Money meets Nature - Regenerative Finance

Introduction

Regenerative finance, sometimes called “confluence of crypto and climate”, refers to creating financial incentives in order to regenerate the natural environment, to reverse the impact of climate change, and to curb the negative externalities of carbon emissions. The environmentalist Paul Hawken refers to regeneration as the “means putting life at the center of every action and decision.” Regenerative finance or ReFi is an idea to put care of ecosystems, communities and the environment into the core of our economic system. It can be thought as an important part of the bigger DeFi; unlike DeFi where the goal is to disintermediate thew financial system and build better solutions than traditional finance, ReFi’s primary focus is environmental and social impact.

Carbon markets

One of the most important applications of the current ReFi protocols is tokenization of carbon credits. What is a carbon credit? A carbon credit, also known as a carbon offset, is a transferable certificate that grants its holder the permission to release a predetermined quantity of greenhouse gases. Each carbon credit signifies one metric ton of carbon dioxide (CO2) or an equivalent amount of greenhouse gas emissions. When an organization acquires a carbon credit and asserts that it has been utilized to mitigate emissions, the credit is retired, meaning it is removed from circulation and cannot be traded any further.

Carbon markets operate in two forms: compliance schemes and voluntary programs. Compliance carbon markets function on a compulsory basis, and are typically regulated on a national or global level. The Voluntary Carbon Market (VCM) operates outside the compliance (mandatory) markets; it is a market where entities engage in the voluntary buying and selling of carbon credits. These credits are linked to the reduction or removal of greenhouse gases from the atmosphere. Through purchasing carbon credits on the VCM, corporations or individuals actively support projects that might not be financially viable otherwise. Besides neutralizing carbon footprint, purchasing carbon credits in the voluntary markets can also be motivated for public relations for corporations.

Why are legacy carbon markets broken?

Legacy, or off-chain carbon markets are inefficient and flawed in many ways:

· Lack of price discovery. That most voluntary carbon transactions happen over the counter (OTC) leads to poor transparency of the market. The value of carbon credits depends on multiple factors, such as project type, vintage, or country. This makes it even harder to know the real market price of a voluntary carbon credit.

· Illiquidity. As mentioned above, the voluntary carbon market is done mostly not on exchanges but OTC which results in the highly fragmented and illiquid markets. The heterogeneity of carbon credits implies that different carbon offset types trade in low volumes.

· Poor market transparency. Since the market is voluntary and not regulated by a single entity, it’s hard if not impossible to obtain information on the owners of active carbon credits, on the project details, or on how much each owner spent.

How the blockchain technology can fix it?

Leveraging blockchain technology has the potential to address and resolve several issues in carbon markets. By integrating carbon markets into the blockchain, many, if not all, of these challenges can be mitigated. Blockchain, being a decentralized and immutable public ledger, ensures greater transparency compared to traditional markets. Additionally, the tokenization of carbon credits will enhance market liquidity by attracting a broader user base that might otherwise find these markets inaccessible. Shifting carbon offsets to the blockchain will also enhance price discovery as similar carbon credits are consolidated into a unified pool, facilitating easier comparison.

Toucan Protocol

Toucan’s Carbon Stack consists of three key components: the Carbon Bridge, Carbon Pools, and the Toucan Meta-Registry.

The Carbon Bridge enables users to transfer carbon credits from off-chain sources to on-chain. To accomplish this, individuals must retire their credits in the original source to prevent double counting. Once the bridging process is completed, carbon credits can be fractionalized into tokens known as TCO2.

However, if Toucan’s protocol stopped at this point, it would resemble traditional carbon markets, which often suffer from liquidity issues due to the multitude of project-specific carbon credits. To address this, Toucan introduced Carbon Pools. Carbon trading predominantly occurs over-the-counter rather than on centralized exchanges, leading to limited transparency and price discovery. Carbon Pools aggregate similar carbon offsets into pools, thereby creating more liquid markets and transparent price signals for various carbon categories. After tokenization, standardized carbon reference tokens are generated, facilitating trading on decentralized exchanges with deeper liquidity. Consequently, Carbon Pools enhance liquidity, reduce fragmentation, and increase transparency in carbon markets.

The Toucan Meta-Registry serves as the central repository for all fractionalized carbon credits. It records pertinent details such as project-specific information and the retirement of carbon credits.

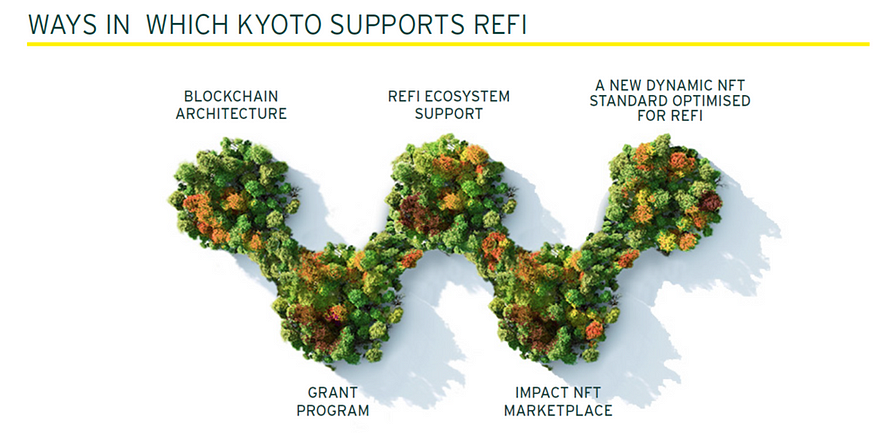

Kyoto

Named after the famous 1997 Kyoto protocol, which by the way introduced the concept of carbon markets among other novelties, is a ReFi ecosystem. The ecosystem has its own blockchain, KYOTO, 25% of transaction fees of which are spent to offset carbon emissions via forestation. Arboretum, the project’s NFT marketplace, goes further by contributing 60% of its fees to positive impact. The mission of KYOTO is to scale the current voluntary carbon markets for which they built the first layer-1 blockchain particularly designed for this aim. Kyoto strives to be the ultimate “Infrastructure-as-a-Service” for carbon markets. Carbon markets lack the single benchmark. What this means can be understood by analogy with other markets. If you want to know AAPL share price, looking at any exchange will give you answer — you can be pretty sure that it’s the market value of AAPL at the moment. Or EURUSD exchange rate. Though there can be negligible differences between different FX brokers — because currency markets are decentralized — you won’t see a significant deviation and the price you see will reflect the market value of that exchange rate. This is diametrically opposite to what is the current state in carbon markets. You cannot confidently assert what is the price of a particular carbon credit, say, one from Amazon rainforests in Brazil.

Carbon markets lack the single benchmark. What this means can be understood by analogy with other markets. If you want to know AAPL share price, looking at any exchange will give you answer — you can be pretty sure that it’s the market value of AAPL at the moment. Or EURUSD exchange rate. Though there can be negligible differences between different FX brokers — because currency markets are decentralized — you won’t see a significant deviation and the price you see will reflect the market value of that exchange rate. This is diametrically opposite to what is the current state in carbon markets. You cannot confidently assert what is the price of a particular carbon credit, say, one from Amazon rainforests in Brazil.

Kyoto Carbon Standard is the carbon benchmark designed by Kyoto to increase efficiency of the carbon markets. An integral part of this standard, Kyoto Credit will be traded on a decentralized carbon trading exchange. We already noted that the bulk of carbon trades are executed in OTC which doesn’t help the transparency of the market. Kyoto aims to disrupt this as well by launching Kyoto Carbon Exchange (KCE) which will link buyers with high quality carbon offsetting projects.

Ecosapiens

Ecosapiens is a VC-backed company focused on climate which issues digital collectibles financed by carbon sequestration projects. The first product of Ecosapiens is Ecogenesis Collection, an NFT collection backed by real world 16 metric tons of tokenized CO2. This is equal to the quantity of an average American’s yearly carbon emissions. So, when you mint one of these collectibles, an Ecosapien, a full year’s worth of carbon is offset as a result.

The source of carbon credits for the Ecogenesis Collection is Northern Kenya Rangelands Project, claiming to be the world’s largest soil carbon removal project. The project’s mission is to improve the local grassland health. As grass cover grows, it captures carbon from atmosphere; it is predicted that the project will remove more than half million metric tons of greenhouse gas (CO2 and its equivalents) and about 50 million tons during a 30-year period. Inspired by the success of its first collection, Ecosapiens released other serises of digital collectibles, such as Celosapiens which offsets about 290 metric tons of CO2 among others. On 7th February a new NFT collection called Elesapien RWA will be minted on Opensea.

Inspired by the success of its first collection, Ecosapiens released other serises of digital collectibles, such as Celosapiens which offsets about 290 metric tons of CO2 among others. On 7th February a new NFT collection called Elesapien RWA will be minted on Opensea.

Regen Network

Regen Network is one of the first players in the field whose whitepaper was written in 2017. It enables creating carbon credits and other ecological assets. You can also trade digital ecocredits on the Regen Marketplace. When I say trade, I don’t mean only buy or sell; one of the best features of any carbon marketplace I think is to allow to retire carbon credits which is what Regen does. An environmentally conscious individual can purchase and then retire a credit on the platform thus offsetting his carbon impact on the planet.

Though Regen Network was originally built on its own domain-specific layer-1 blockchain, to increase liquidity of carbon credit it started to cooperate with other blockchain networks. It has become the first protocol bringing carbon assets to Cosmos. NCT (Nature Carbon Ton) token, which is backed 1:1 by carbon credits released by Verra, the leading carbon standard, is the first ICB-compatible digital carbon token. There are two liquidity pools on Osmosis DEX where one can trade NCT — REGEN / NCT and NCT / OSMO.

Menthol Protocol

Irrespective of the fact that blockchains are a very useful technology, they consume a lot of energy. Some blockchains, those operating on Proof of Stake (PoS) consensus algorithm, require much less energy than Proof of Work (PoW) blockchains per transactions. But if there are millions or even billions of transactions required to be validated and executed — which there are — then this still takes a huge quantity of energy. To be sure, we here at Flagship.fyi don’t condemn the blockchain technology at all. On the opposite, we love it. The point of this article is pay attention to the negative externalities of carbon and energy footprint and to reduce them.

This is what Menthol Protocol aims to do as well. The protocol’s mission, as its whitepaper (which is called CoolPaper, by the way) states, is to empower Web3 users, dApps and blockchain networks to make the world a better, cooler place by enabling them to offset the impact of their actions. In a nutshell, it is a sustainability protocol which calculates the ecological footprint for any Web3 entity, be it a user, a dApp or a blockchain network who chooses to do so, and then in order to offset this footprint buys an equal amount of tokenized carbon and renewable energy credits. To gauge the dirty energy usage and carbon footprint Menthol uses both blockchain network-specific parameters such as data indexers and external variables such as grid emission factors.

To use Menthol Protocol to offset their ecological footprint, an entity should deposit funds into CoolPool. Depending on the depositor type, there are three kinds of CoolPools:

- User pools. Individuals deposit into these pools to compensate their transactions.

- Protocol pools. Protocols or dApps provide funds to this pool to offset the impact of transactions made on them. For example, an NFT marketplace can choose to provide liquidity to a Protocol CoolPool to fully or partially compensate the transactions executed on that marketplace. These transactions include but are not limited to buying or selling an NFT, placing a bid or an offer. Until the protocol withdraws its funds, the offsetting module of Menthol Protocol will go through that protocol to compute emissions and to offset them.

- Network pools. The same as the protocol pools with the only difference that in these pools the shareholder or depositor is a blockchain network which provides funds to the pool to offset transactions executed on that network.

If I want to compensate the footprint of my transactions on any dApp or blockchain network, I have to deposit funds to a user pool. If it is a dApp, say, Magic Eden, an NFT marketplace, to offset its transactions, then it will go to a protocol pool. Finally, if a blockchain network, say, Solana, aims to compensate the transactions executed on it, then it will provide liquidity to a network pool. Another important of the system, CoolSave directs pooled funds to lending dApps to generate interest. CoolBot will track entity’s activities and offset their footprint based on user preferences.

Conclusion

Regenerative finance (ReFi) is a new movement towards reversing the negative consequences of climate change and regenerate our planet through the financial system. As such I want to believe that it isn’t just another hype but a real force with a positive societal and natural impact. There are already actively building actors in ReFi, and some of them such as Toucan and Kyoto attempt to build infrastructure for other protocols to work upon them. ReFi is one of the currently less known categories of DeFi but increasing focus on global warming which results in growth of environmental awareness will bring more builders to regenerative finance.

My ebooks:

https://fmiren.gumroad.com/l/zwnkt

fmiren.gumroad.com/l/eixemq

Please support my writing activity if you like it.