FTX Sues KuCoin After Bybit Controversy Cools Down

The value of these assets was initially only about $28 million, but due to market fluctuations, the current value has increased to over $50 million.

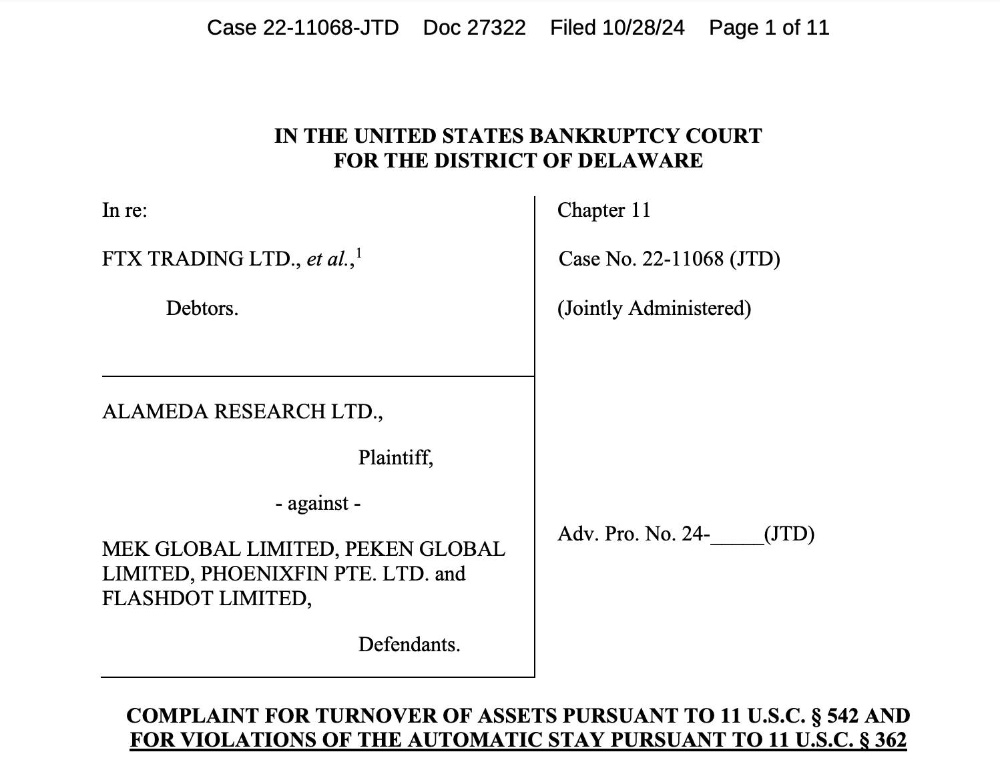

Alameda Research, a sister company of the bankrupt exchange FTX, has just filed a lawsuit against KuCoin, demanding the recovery of more than $50 million in locked assets.

According to the complaint filed in the United States Bankruptcy Court for the District of Delaware, which is also handling the FTX bankruptcy case, Alameda Research said that KuCoin has repeatedly refused to return the assets without providing a valid reason.

Alameda accuses KuCoin of violating the Bankruptcy Code, demanding not only the return of the money but also compensation for these delays. The lawsuit points out that the money belongs to FTX and should be returned to creditors to serve the reorganization process.

KuCoin, the exchange accused of money laundering by the US in March, said the funds were frozen due to suspicious activity. KuCoin attempted to contact the account holders directly to resolve the issue, but these efforts were unfortunately not met with a response. The exchange also pledged to strictly comply with the law and not appropriate user assets in any form.

Just a day earlier, FTX reached a settlement in a similar lawsuit with the Bybit exchange. According to the lawsuit filed on October 24, the settlement included withdrawing $175 million in digital assets held on Bybit and selling nearly $53 million in BIT tokens to Bybit's subsidiary Mirana Corp. The settlement resulted in FTX recovering $228 million.

FTX sued Bybit and its two subsidiaries Mirana Ventures and Time Research in November 2023, seeking to recover $953 million in fiat and crypto that had been withdrawn from the platform. The lawsuit alleges that the entities used their “VIP” status and close relationships with FTX management to withdraw about $327 million in assets before the exchange collapsed.

Under the plan approved by a US judge on October 7, FTX will pay up to 119% of the value claimed to 98% of its creditors. However, the payment will be based on the value of the assets at the time of FTX’s collapse in November 2022, not the current market price.

Earlier this month, former Alameda Research CEO Caroline Ellison agreed to surrender the majority of her remaining assets to compensate FTX creditors and to cooperate with investigations related to FTX. FTX's positive progress in the refund process has many analysts optimistic about the growth of the crypto market in Q4/2024.

FTT price is not affected by today's news.

Once one of the leading cryptocurrency exchanges in the industry, FTX declared bankruptcy in November 2022, after being exposed for liquidity issues, with billions of dollars of customer funds being misused.

![[LIVE] Engage2Earn: Ali CAN beat Dutton in Dickson!](https://cdn.bulbapp.io/frontend/images/a57bb43e-448e-412b-8852-65e281c15419/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)