𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 - Part 4 - From No Money To Mo Money

These last couple of weeks I have been making time to give some of you the best financial advice ever.

Best Financial Advice Ever (Improving Health & Wealth) - Part 1

BitcoinBaby - The Best Financial Advice You Ever Get Part 2

𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 (in under 5 minutes) - Part 3

This chapter I want to focus on that glorious moment when your bad debt is dead. When you are dead free after denying yourself so much for so long.

Celebration Time Invest!

Yes, you read it correctly celebration time! You now only have good debt left meaning a debt that has no crazy high interest and is used to pay for something useful. Mainly a mortgage, or a bank loan to pay off your debt. Lending money for a car is a big no-no as it´s a bad investment. Unless you really need a car to make money and public transport is not an option. In that scenario, I assume you bought the best-suited car at the most affordable price and not as many; the best-looking car that will end up being just another money pit.

⚠️The Debt Is Dwindeling⚠️

Now comes the hard part, your debt is shrinking. You have no more payment plans to pay and you are getting those spending urges again. For many that buying itch will appear as soon as you have some money left at the end of the month.

The solution, make sure there is no money to spend! Include that money in next month's budget and invest it, give it a spending purpose.

Include that money in next month's budget and invest it, give it a spending purpose.

The new steps should be:

- Money arrives

- Bills get paid

- Debts get paid

- Cashbook gets updated

- The leftover money gets a spending purpose.

This way you don´t spend it all on blow and cheap hookers.

Instead, you can start setting financial goals:

- Holiday

- House

- 25K emergency fund

- Investment Fund

It does not really matter what your goal is, but make them clear in your cashbook, and make sure that redeeming that money will take multiple actions. This way you are less likely to touch it.

Investing your hard-earned money, the fun part?

Once you are done with paying too much for your mistakes the money you used monthly for getting rid of your sins can now be used to your advantage without you even noticing it.

And if you want to keep a bit for having more fun, that´s okay. But remember it´s never too early to start investing.

Investing is not only for old angry white rich boomers. Anyone can start doing it, doing it will make you wealthier, and wealthier means healthier.

It does not take much, just use what you used each month to pay off your debt. You will not even notice the difference till you check out your investments in a couple of years. You can start with $50 a month while learning more about finance.

That brings us to the hard part, why and what to invest in?

From No Money To Mo Money

The first bit of non-financial advice you get is: Diversify

Diversifying only works if you buy good assets, otherwise, it's just deWORSification.

Just an example of how you easily deworsify:

Buying meme coins is already a huge risk, but by buying 5 different meme coins to diversify is the perfect example of deWORSification.

What To Buy?

So what would I suggest? Nothing!

This is where my financial advice ends and I only explain what makes sense in my little mind.

Now the first rule is:

Only invest what you are willing to lose.

Second rule:

You probably lose more than you win but if you win it makes up for the losses and over time you will improve in choosing a winning investment.

Risk/Reward

Investing is all about rewards, but rewards are only there for those that invest, If you get too scared because you lost once, you better not invest at all.

Meme coins are one of the most risky investments because the chance that you make money on a meme coin is nihil but if you do it will be booming.

Hence: High Risk/ High Reward.

Investing in gold, is the opposite. Gold is a very solid market mainly used to hedge against inflation and not to make huge gains....although, with the current inflation, there is quite a bit to gain.

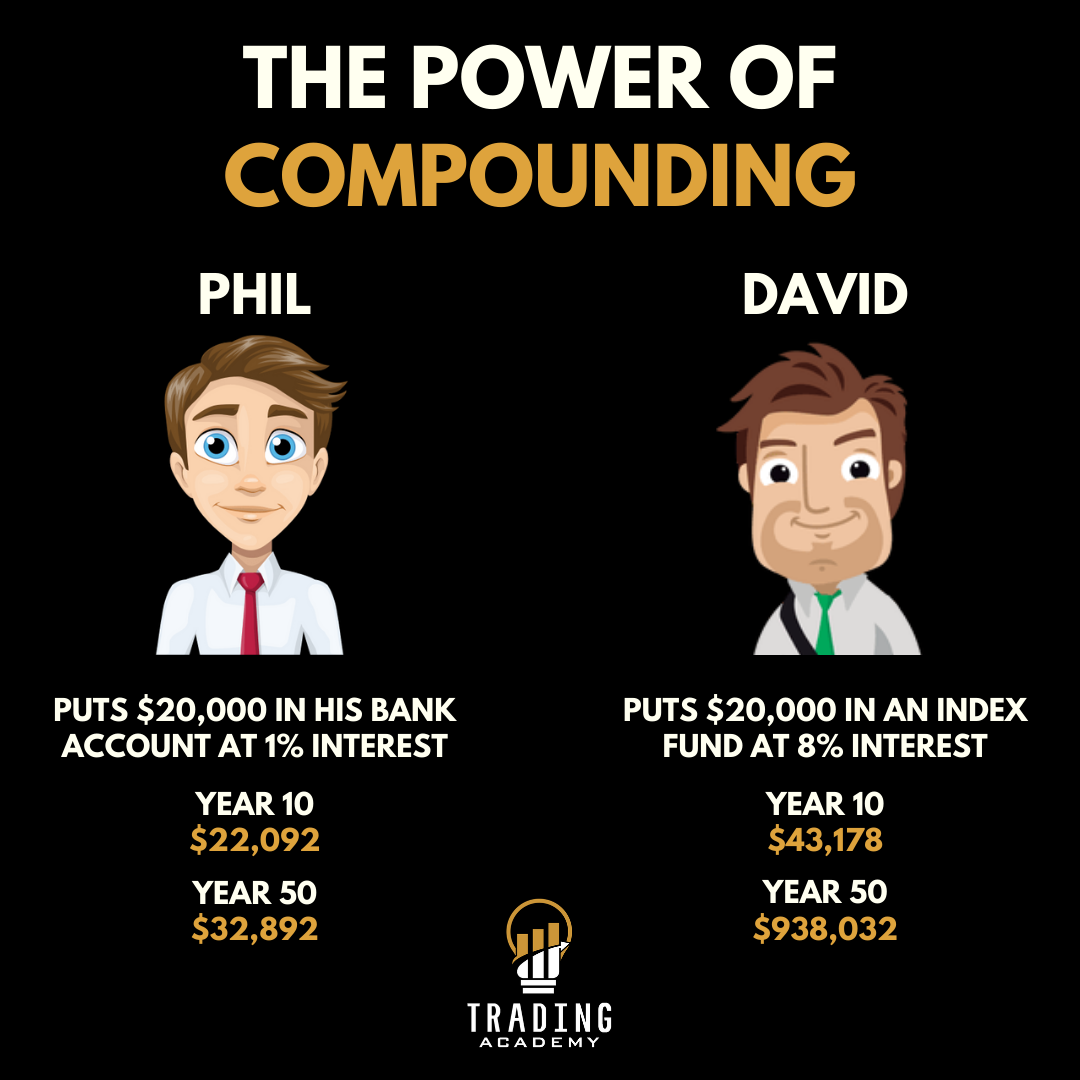

Now you´re worst investment is probably leaving it in your bank account against 1% interest. While you get a very nice 1% from your bank, inflation will eat 8% of your money a year. So if your appetite is low risk/Low rewards keep that money in silver or gold. And spread it on actual gold and in gold funds to spread the risk. But don´t keep it in the bank.

So if your appetite is low risk/Low rewards keep that money in silver or gold. And spread it on actual gold and in gold funds to spread the risk. But don´t keep it in the bank.

My Holdings

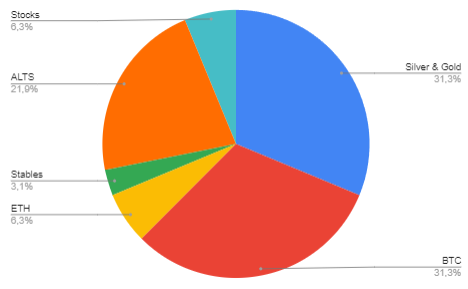

At this moment I probably have 5K in Silver and Gold hedged against inflation but not making me much money.

A Bit Of Stocks

Next, I wanted to play around with stocks. I was already in Silver and crypto, but I kept hearing diversify and so I did. Fortunately, the company I work for got bought by a bigger fish that went live on the New York Stock Exchange.

Buying shares in your company often gives a nice discount, but it only makes sense if you work for a company that has a future of course.

If that is the case, and you can get a 15% discount on each buy you can suffer a loss without even noticing it. Especially because you have to DCA and it´s taken from your wages before they hit your bank account, so it´s like it never happened.

Stocks and Stock Funds should be a long-term investment. Just keep dropping money into that well and do not look back for a couple of years.

Stock Funds spread the risk for you, and although I think it´s not the best time to go big on stocks atm, starting with DCAing into stocks is something I should have done years ago. You can´t start investing too early.

It´s not all about the money. If you start investing now with a little, you will learn a lot. When you learn a bit you get in the investing mindset and can apply those learnings to be a better investor with more to invest.

Now it all is up to your risk appetite and what you are willing to lose because: crypto is next.

And keep in mind we are talking about investing, not trading so no longs or shorts. But actually, doing research and finding a project that has the right development team behind it and fits in an upcoming narrative.

Or you can just invest in BTC and ETH if your risk appetite is not that big.

Now let me think how I am doing it?

I got 60% of my crypto in BTC & ETH and 5% in stables. That leaves 35% in riskier poo coins aka ALTS.

For Crypto the rules are well known I think but here we go:

1. DYOR

Don´t listen to anyone listen to everyone. The web is full of shillers so get to the bottom of a project. Use multiple sources, and keep your eye on the prize.

You can always get out, but getting out in time if the cookie starts to crumble means actively following your investment.

2. Bear markets are for buying

Bear markets are where you get rich, they are the time to invest. You can get the best deals, new all-time lows on ALTs every week.

3. Sell on the way Up

Two things, in bear markets you will have the occasional 30% out-of-the-blue pump. If that hits your holdings sell, and buy back when it drops 20% over the next couple of weeks.

But this might not work in the bull market, you still sell on your way up but differently.

In a bull market, you need to plan your selling a bit better and keep an eye on your investment.

When Bull Market?

The start of the bull market probably has already happened, but a bull takes a long time to get moving. I am looking at a 40K BTC to switch my mindset and start planning my ALT sales.

Planning because BTC and ETH will run faster than those ALTs at the start of the Bull market, but the ALTS will catch up at some point. At this point, people take their money out of the big 2 and start buying the riskier stuff. That is when we sell.

4. Sell In Batches

"I sold at the Top!"

Well lucky you, because selling at the top is like hitting blackjack in the casino, you can estimate that the chance is high, that you are near 21, but you´re never sure.

Anything can and will happen, so once you start selling in a bull run sell in batches and set those with the margin you planned.

Simple example spread 75% of a token in 5 Batches: A 2X, 4X, 6X, 8X, 10X batch. That last 25%, let it ride.

This is just an example, because if your holding went down 90% since you bought it, your batch would look more like 10X, 20X, 40X.

What to Buy pt2

Last but not least, don´t be a bag holder. If you hold bags from the last run that are currently down 90% they might never get back to the price you paid. They probably will not set a new ATH. If a coin has a previous ATH, lots of people are holding it hoping it will go back to what they paid for it.

Therefore it´s better to refresh your bags with coins that never really had an ATH. Coins that are Hip, Upcoming, and fit the 2025 narrative.

Those coins will have the biggest chance at a 1000X because they did not have a ceiling, they can go through the roof because there is no roof. Nobody bought them at the top, so less sell pressure.

So if you want to invest in crypto DYOR, Buy in Bear Markets and Sell on the way up.

One A Personal Note

My portfolio looks like this atm. Now for full disclosure that is about 40% of my holdings, meaning 60% right now is in Freaking Fiat. Something I do not like at all but at the same time have a good reason for. Well, two good reasons, but I will save you from reading even more and talk about that next week.

Now for full disclosure that is about 40% of my holdings, meaning 60% right now is in Freaking Fiat. Something I do not like at all but at the same time have a good reason for. Well, two good reasons, but I will save you from reading even more and talk about that next week.

Bottom Line

Start investing as early as possible it does not matter how much. But learn about finance, money, investing, compounding, risk/reward, diversifying. This way you risk a small investment, you learn a lot before you have the money to make a bigger more educated investment.

Thank goodness you made it till the end Pees, Love, and I am out of here!

Mystery Box

And for those that made it till here if you like a ZKSync Mystery Box use this link: https://grvt.io/exchange/sign-up?ref=CYORLP0

Or code: CYORLP0

[Source Pic](All pictures are by Meme, MyI & AI unless source is listed)

![[LIVE] Engage2Earn: Doubling down on Dickson](https://cdn.bulbapp.io/frontend/images/0dea4715-4791-404e-acff-82013adb11e1/1)