What is Polynomial Protocol? Information about the Polynomial project

One of the derivatives DEX projects similar to Zeta Markets that is receiving attention recently is supported by the Synthetix protocol. What is polynomial?

What is Polynomial Protocol?

Polynomial Trade is a derivatives DEX , powered by the Synthetix protocol on Optimism. This exchange allows leverage trading up to 50x. With a simple interface and functions like a normal derivatives DEX.

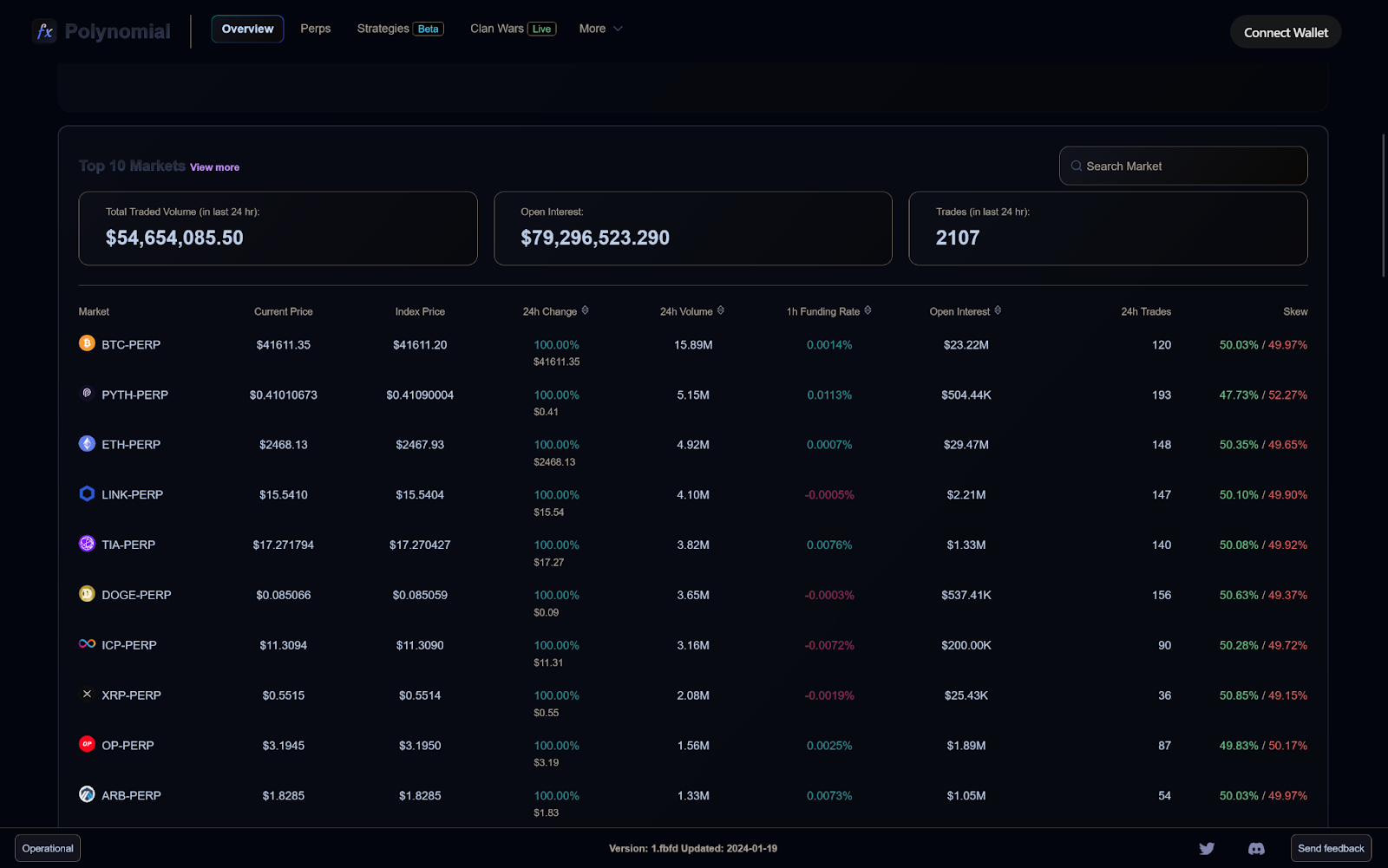

Polynomial Protocol interface.

Polynomial Protocol interface.

Polynomial Protocol's main product

Polynomial Swaps

Polynomial Swap is a platform that allows users to trade tokens on the Optimism platform , including synthetic assets such as sETH, sUSD, sBTC provided by Synthetix Protocol. For other asset types that are not synthetic assets, such as USDT, USDC, DAI, ETH, Polynomial Swap will use liquidity aggregation services from 1Inch, helping users to make transactions conveniently and quickly. effective. This ensures that users have access to a wide range of different assets and trade with flexibility on the Polynomial Swap platform.

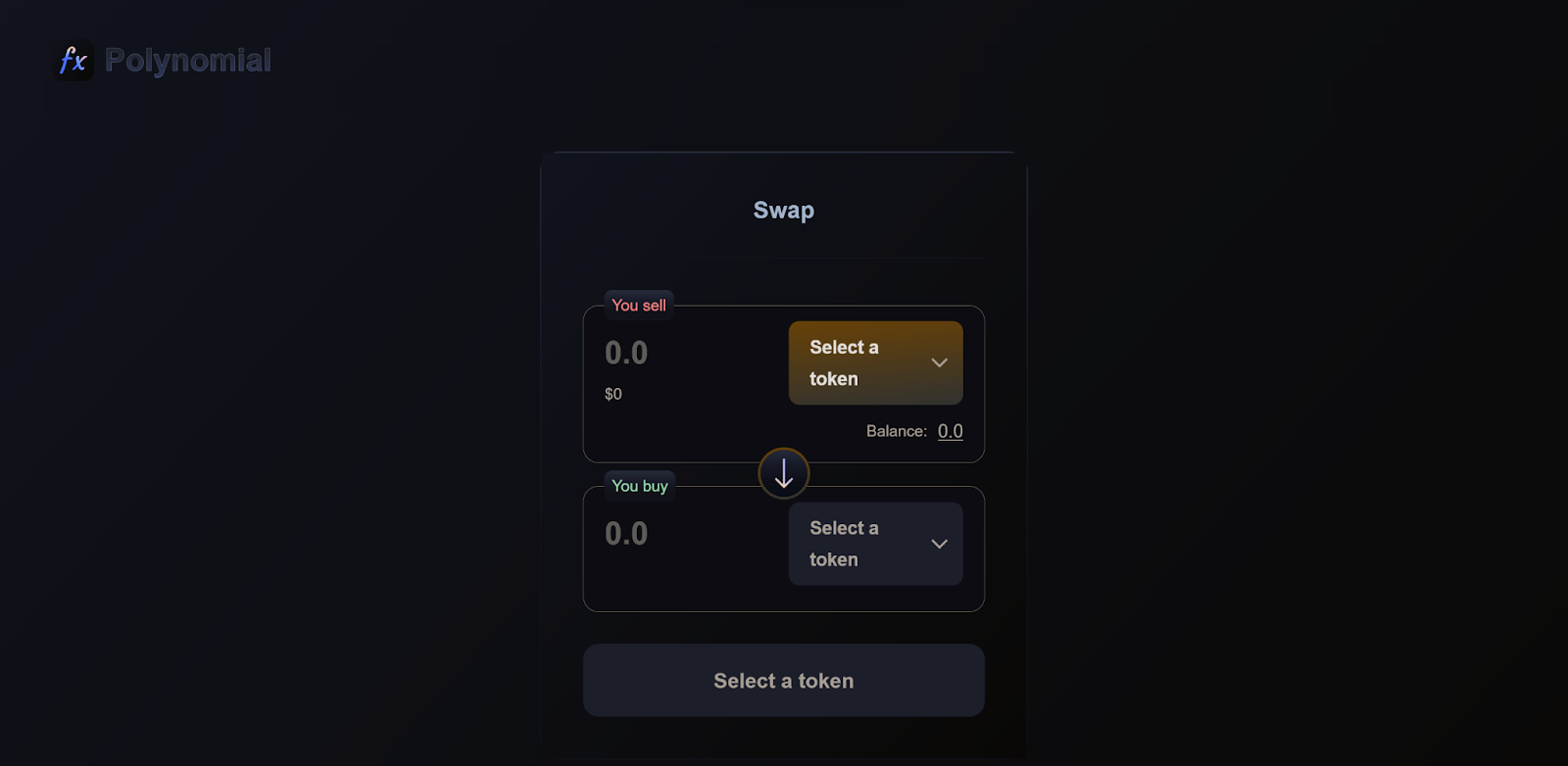

Polynomial Swap interface.

Polynomial Swap interface.

Polynomial Trade

Polynomial Trade is a decentralized derivatives exchange that offers the ability to trade both spot and perpetual contracts. On this exchange, users can trade with up to 25x leverage, taking advantage of abundant liquidity from many different trading pairs.

When performing derivatives transactions on Polynomial Trade, this exchange operates based on Synthetix Protocol. This means that each trade order on Polynomial Trade will use reciprocal liquidity from investors staking SNX (SNX stakers). These SNX stakers not only provide liquidity to the exchange, but they also receive rewards in the form of trading fees from trading activities on the exchange.

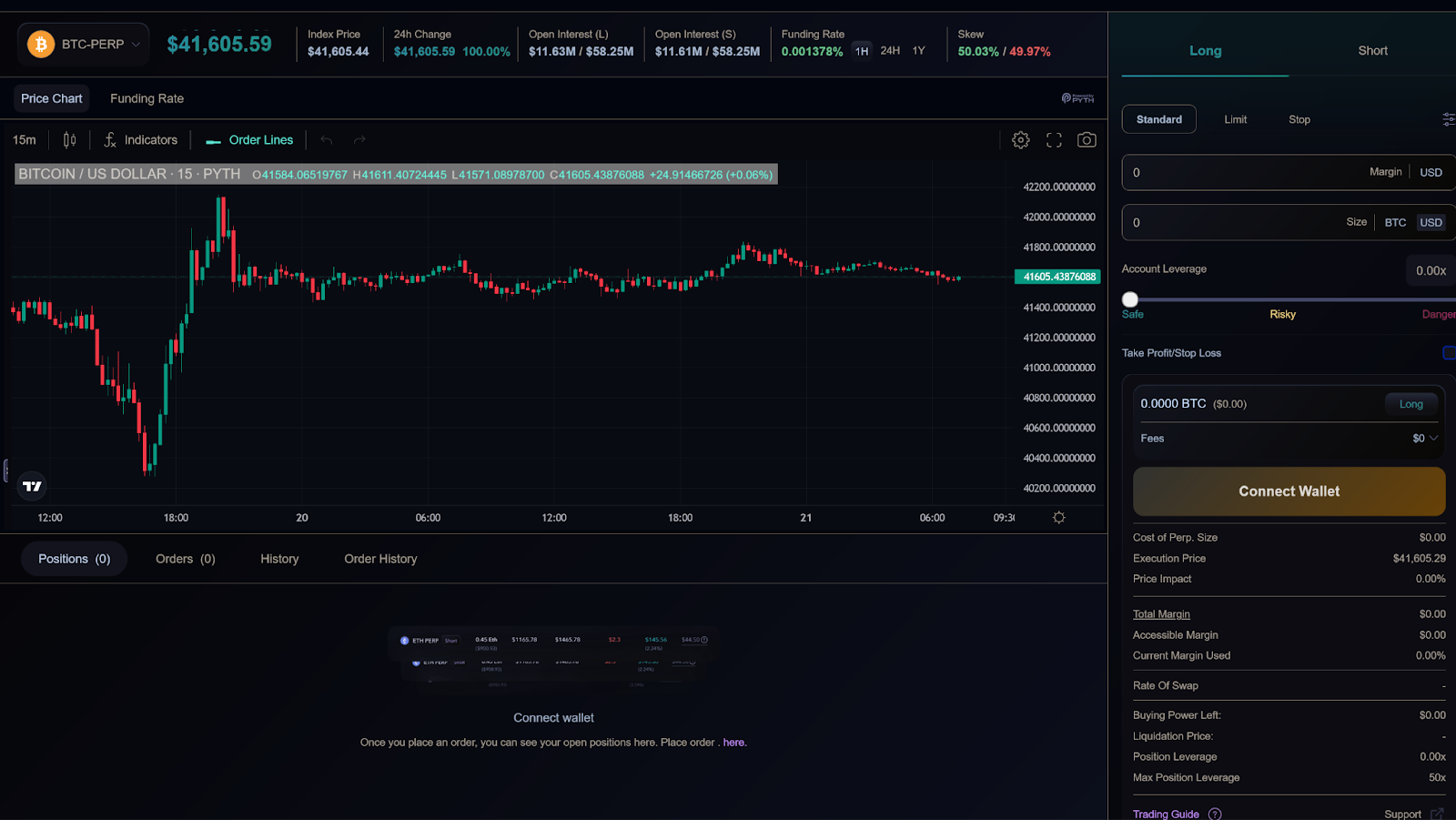

Trading interface.

Trading interface.

In other words, this model facilitates profit sharing from trading fees between Polynomial Trade and SNX stakers, and helps ensure the necessary liquidity for the exchange. This system helps create a balanced exchange where each party has its own benefits and contributes to the maintenance and development of the project.

Polynomial Earn Vaults

Polynomial Earn Vaults offers a unique approach to investing in the cryptocurrency market through options contracts, also known as options. To better understand how it works, let's look at a specific example.

Imagine you have 1,000 USD and want to invest in cryptocurrency. Instead of buying Bitcoin or another altcoin directly, you decide to deposit the coins into a Polynomial Vault. This is the first step in your investing process.

Once your funds are deposited into the Vault, Polynomial will use the funds to create a Bitcoin call option contract. Let's say this contract has a target price of $20,000 for Bitcoin and an expiry of 3 months. This means Polynomial is selling options to buy Bitcoin for $20,000 within the next 3 months to someone else.

When the contract is sold, the majority of the premium - the money the contract buyer pays for the right to buy Bitcoin at a set price - will be divided among the investors in the Vault, including you. Here's how you profit from investing in options without having to buy or sell cryptocurrency.

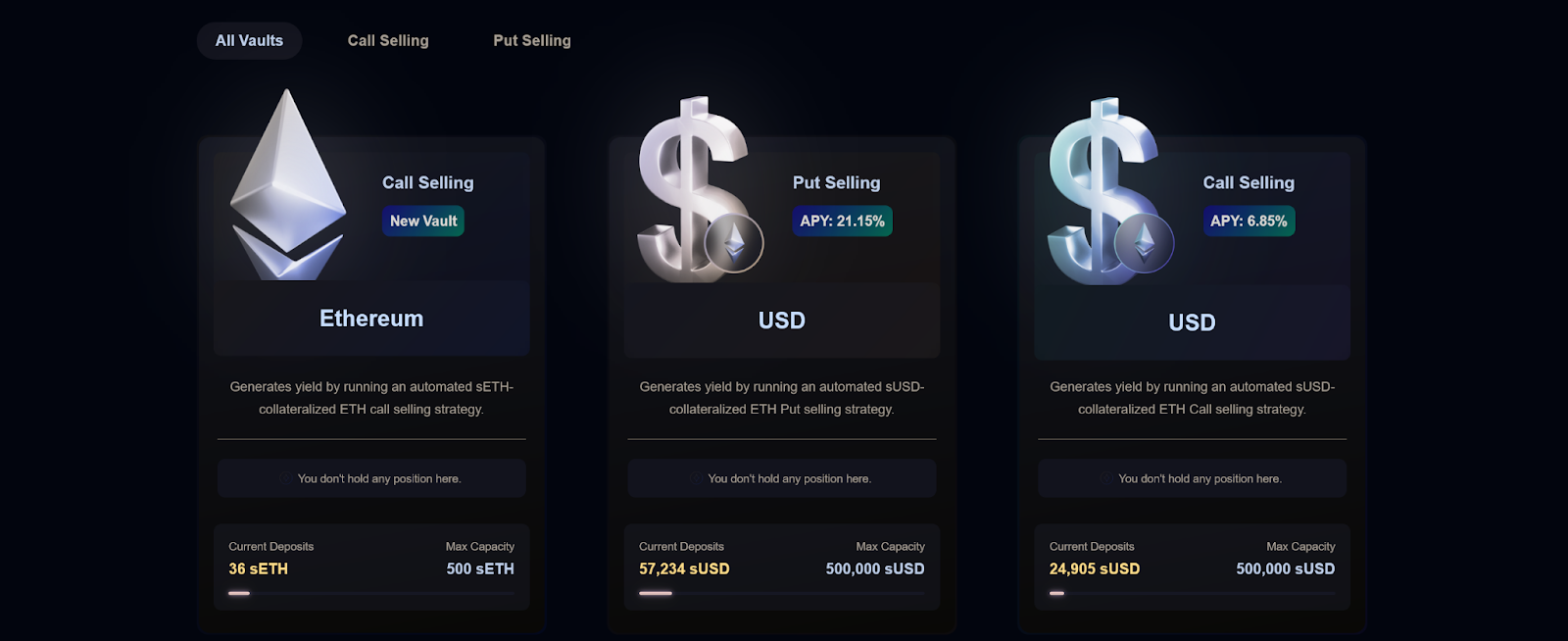

Earn Vaults interface.

Earn Vaults interface.

When the contract expires in 3 months, there are two possible outcomes. If the price of Bitcoin passes $20,000, the contract buyer can use his option to buy Bitcoin at a price below the market price. In this case, you and other investors in the Vault may suffer losses due to having to sell Bitcoin at a price below the market price. Conversely, if the price of Bitcoin does not surpass 20,000 USD, the contract becomes worthless and the buyer does not use his options. In this case, you and the other investors in the Vault keep the Bitcoins and all premiums collected.

Finally, the premium collected from selling options contracts is reinvested in Vault to generate additional profits for participants, including you. Thus, by depositing money into Polynomial Vault, you become part of the process of creating and selling options contracts, and have the opportunity to profit from premiums along with other investment opportunities.

Clan Wars event

Clan Wars in Polynomial Trade is a unique trading competition event where traders are organized into groups, or "clans", to participate in a trading competition. Each clan has its own name and symbol, creating a vibrant and attractive competitive space.

In Clan Wars, participating traders will be randomly classified into clans such as Pi-Rates, Fibonacci Fighters, Calculus Crusaders, or Quadratic Questers. The goal of each clan is to achieve the highest total Profit and Loss (PnL), thereby competing to win the event. This encourages collaboration and trading strategy development within the group.

To participate, traders need to pay a small fee, usually 10 USD, and must achieve a certain minimum trading volume. The total amount of fees collected from all participating traders will be added to the prize fund. For example, if there are 25 traders participating and the total amount of fees collected is 250 USD, then the prize fund will be the sum of this amount plus a base amount from the organization, usually at least 10,000 USD.

In the end, the clan with the highest total PnL will win and the prize will be divided among the members of that clan. Prize distribution is based on a certain ratio, with a portion based on the individual PnL contribution of each member of the winning clan.

Clans that you can choose from.

Clans that you can choose from.

Information about Polynomial Protocol tokens

Currently, Polynomial Protocol does not have its own project token.

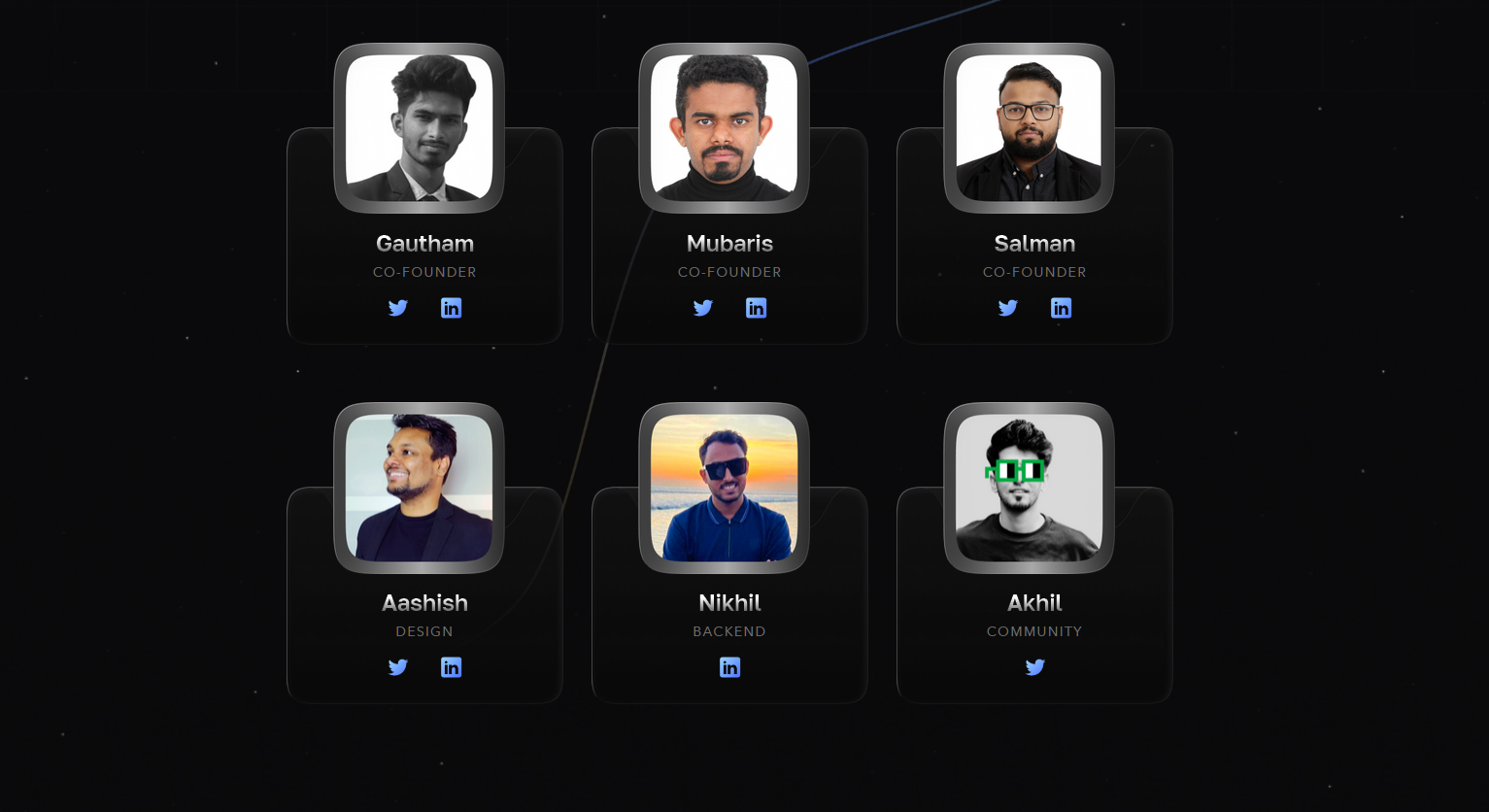

Team & Investors Polynomial

Team

Mubaris NK and Salman Naseer are the two founders of Polynomial, a company operating in the field of technology and decentralized finance (DeFi) .

Mubaris NK graduated in Information Technology from Indian Institute Of Information Technology Allahabad in 2019. He started his career as a Software Analyst at Citi, where he worked for almost 2 years before leaving to look for another opportunity. new association. After that, he joined Instadapp as a Software Engineer, working remotely for 3 months. Mubaris later left Instadapp and founded Polynomial with his colleagues.

Salman Naseer also graduated in Information Technology from Indian Institute Of Information Technology Allahabad in 2019. He started his career at CodeAsylums as a Fullstack Developer. After that, Salman moved to work at Tekion Corp, where he held the positions of Associate Software Engineer and Software Engineer. Like Mubaris, Salman also left his job to found Polynomial with his colleagues.

Both of them have a strong background in the information technology field and used their experience to develop Polynomial.

Project team.

Project team.

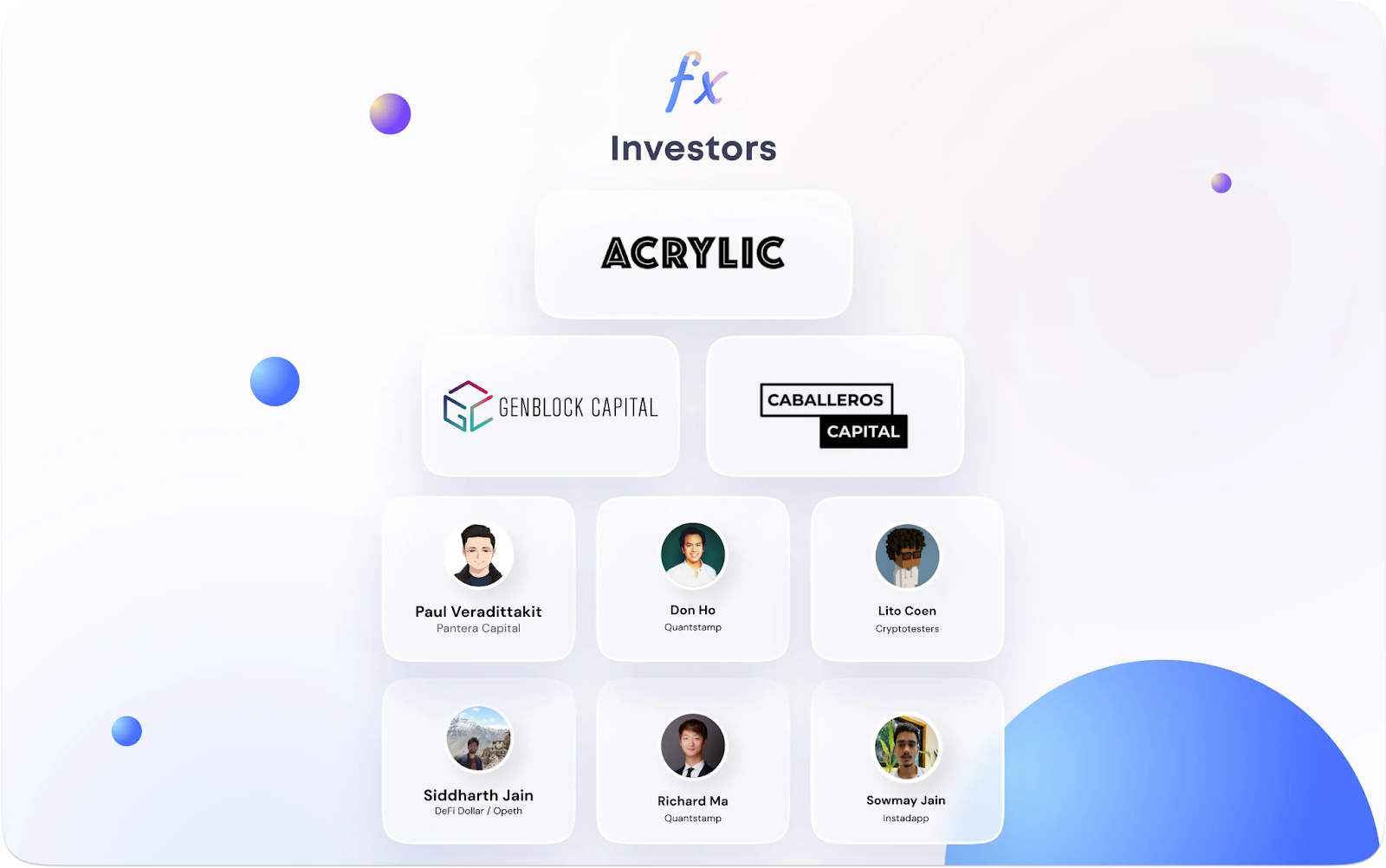

Investors

On October 20, 2021, Polynomial Protocol successfully raised capital for the Pre-Seed Round with an amount of 1.1 million USD. This funding round was led by Archetype fund and had participation from Genblock Capital and Caballeros Capital. In addition, the funding round also witnessed the participation of angel investors from famous organizations and projects such as Pantera Capital, Quantstamp and InstaDapp.

Investors Polynomial.

Investors Polynomial.

summary

Polynomial Protocol is a simple project with the basic functions of a derivatives DEX, similar to Zeta Markets on Solana. This project can also be one of the new alternatives for those who like to try trading on many different exchanges. Please follow MarginATM to follow the next information of Polynomial Protocol.

Read more: What is Gomble? Information about the Gomble game project and airdrops

**Not financial advice.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)