Diary of a Brand: HokaHow Hoka sneakers went from obscurity to $1Bn in revenue

“Ugly.” “Weird.” “Clown shoe look.”

These are some of the ways Redditors on a 2014 Reddit/running post describe Hoka, the sneaker brand that Ugg parent company Deckers bought for a reported $1.1M in 2012.

Flash forward 10 years and Hoka generates over $1 billion in sales for Deckers. Last weekend when I went to a fitness class in New York, approximately half the class at came suited up in Hoka sneakers. Hoka takeover at Barry’s Bootcamp Tribeca. Source: Author

Hoka takeover at Barry’s Bootcamp Tribeca. Source: Author

How did Hoka get here?

“Ugly” is only part of the story. Almost all of the 2014 Reddit comments are accompanied by a positive:

- In all honesty I’m hooked and I can’t wait to run when I lace them up.

- Yes it’s like angels licking your feet on every run.

- I’ll spare you all the details, but run after run, I felt great. I’d switch back to my old shoes and they felt like rocks…Yes, they’re ugly and weird and expensive. Get over it.

Hoka is not just an ugly running shoe; it’s a killer product. And ugly might be part of the strategy. Per Deckers CEO Dave Powers in 2022: “I don’t mind the ugly moniker…it basically says you’re different. You’re owning something distinct.”

“I don’t mind the ugly moniker…it basically says you’re different. You’re owning something distinct.”

— Deckers CEO Dave Powers

To be ‘distinct’ takes authenticity, a clear understanding of who you are, and frankly, guts, to attempt to sell a product that doesn’t fit the category mold. But, in a branding catch-22, distinctiveness is one of the tenets of companies that go on to be category-leading. Hoka’s colorful, maximalist look. Source: Hoka

Hoka’s colorful, maximalist look. Source: Hoka

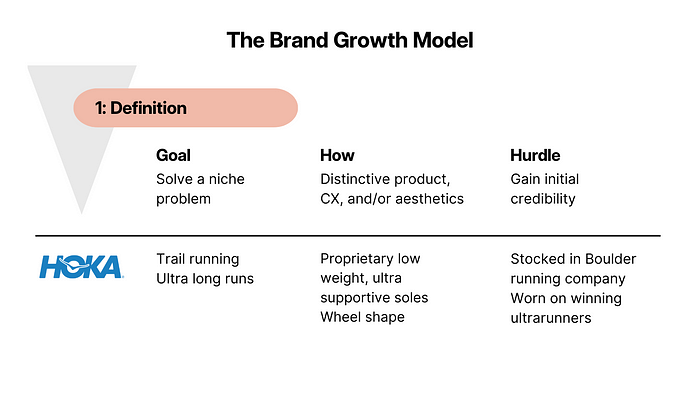

In this Diary of a Brand, I am introducing a new framework: the Brand Growth model — to explain how the Deckers and Hoka team took Hoka from obscurity to main street.

It’s purposely simple, and breaks up brand-building into two phases: definition and scaling. Definition is about distinctiveness — solving a problem for a specific niche. Scaling is about expanding from that niche — to new customers, new use cases, or both — while holding onto the distinctive elements which eventually create a moat around a brand. Source: Michelle Wiles

Source: Michelle Wiles

Phase 1: Definition

Hoka started as a solution to a problem. French mountain runners Nicolas Mermoud and Jean-Luc Diard aimed to create a shoe cover that would help them run downhill faster. The idea was that runners would carry the covers up mountains and slip them on for steep downhill runs. However, per Podium Runner, once Mermoud and Diard began developing their prototype, “they knew they weren’t making a technical accessory but a real running shoe.”Hoka V1: A cover on top of a Salomon sneaker, where Mermoud and Diard worked before Hoka. Source: Youtube

The resulting shoe took inspiration from technology used in powder skis, mountain bike wheels, and tennis rackets, featuring a thick, oversized sole that offered a combination of higher stability and more cushion than other running shoes, while still being lightweight and fast.

“Mountain bikes addressed tough terrain with big tires and shocks, and oversize skis allowed you to float…We wanted to make a shoe that worked the same way.” -Jean-Luc Diard

The original Hoka prototype, circa 2009. Source: Facebook

To keep the shoe light, Diard and Mermoud worked with a chemist to develop a proprietary sole material that offered 29 millimeters of cushion (in comparison to 10 millimeters for traditional sneakers) with no added weight (Source: Outside Online).

As for name, Mermoud and Diard called the innovation Hoka One One [pronounced o-nay o-nay], which loosely translates to “fly over the earth” in Māori, the language of New Zealand’s indigenous population.

Initial traction via influencers

Influencer marketing might seem like a recent phenomenon, but the sportswear category is littered with brands who gained early buzz and credibility via influential people in sports. Nike’s earliest marketing included endorsing athletes, while Gymshark was a pioneer of social media influencer marketing after sending free product to YouTubers in 2012.

Hoka caught a similar wave in December 2009, when Mermoud brought his Hoka prototype to a tradeshow. Mermoud asked Mark Plaatjes, co-founder of Boulder Running Company and 1993 world marathon champion, to do a brief test run in the Hoka prototype. Per Outside Online, “Plaatjes immediately liked the concept… [and] said BRC would buy as many as the store could get, which wound up being 770 pairs — the majority of Hoka’s initial production run.”

Mermoud continued this strategy, approaching ultra-runner Karl Meltzer with his oversized Hoka sneaker in 2010. Meltzer agreed to try the shoes on a run around his neighborhood. Less than 3 months later, Meltzer dropped his sneaker sponsor, La Sportiva, and began competing in Hokas.

“People thought they looked like clown shoes, but I didn’t care…I could float over rocks and not feel anything.”

— Karl Meltzer

Hoka Mofates circa 2010. Source: Grailed

Hoka Mofates circa 2010. Source: Grailed

Meltzer’s racing performance started to improve as well, and in 2011, he won his first race in a year, followed by victories in two 100-mile races. The combination of unique look and clear product performance helped Hoka gain notice among the ultra-running community. More running stores began to stock Hoka’s maximalist sneakers.

With a foundation of distinctive product, clear use case, and credibility, Hoka had the foundation of a niche brand. Source: Michelle Wiles

Source: Michelle Wiles

Phase 2: Scaling

By 2012, Hoka sales were just under $3 million. Or, roughly one ten thousandth of Nike’s 2012 sales. But industry insiders were already picking up on the shoe’s potential. Johnny Halberstadt of Boulder Running Company (Hoka’s original stockist) called Jim Van Dyne, a brand president at Deckers, to recommend that Deckers acquire the brand.

After some research, Van Dyne came to a confident conclusion:

There was a 95% chance we can get this business over $100 million in five years.

— Jim Van Dyne, 2013, Footwearplus Magazine

What did Van Dyne see in the obscure running shoe?

It’s important to note that Van Dyne was no stranger to the shoe industry. He had cut his teeth scaling two of the fastest growing brands of all time, Reebok and Keen, before joining Deckers. He was also a runner himself. He pitched Hoka to Deckers, which purchased the brand outright in 2012.

Van Dyne’s pitch was predicated partially on Hoka’s differentiated product:

“Hoka represents a technology breakthrough.. That is a critical aspect, as Hoka has entered the largest and most competitive category of footwear in the world.”

— Jim Van Dyne, 2014, Footwear Plus Magazine

Differentiation went beyond the technical benefits and to the distinctive aesthetic of the shoe:

“The fact is brands that have experienced explosive growth have, almost without exception, had some type of visually arresting quality to them. Reebok’s aerobic shoes didn’t look like any other shoe. Teva, Keen, Ugg, Dr. Martens, Vibram FiveFingers — these were all shoes that when they hit the market consumers said, “Wow, that’s different.”

- Jim Van Dyne, 2014, Footwear Plus Magazine

Hoka sneaker circa 2013. Source: Outdoor Online

Hoka sneaker circa 2013. Source: Outdoor Online

Scaling hoka: Balancing authenticity with expansion

Van Dyne’s challenge with Hoka was twofold: He needed to expand the brand to new customers who were skeptical of Hoka’s non-traditional approach to sneakers. But just as important, he had to keep the brand grounded in the distinctive features that justified his acquisition of Hoka in the first place.

Van Dyne and team followed a strategy of expansion across product, distribution, and marketing, while maintaining Hoka’s core ‘maximalist’ aesthetic and continuing to invest in performance driven innovation. Hoka’s expansion strategy. Source: Michelle Wiles

Hoka’s expansion strategy. Source: Michelle Wiles

3 levers of Hoka expansion

1. Distribution — Van Dyne and team quadrupled the number of stores carrying HOKA between 2013 and 2014, and have only continued to broaden Hoka’s reach with entry into sporting goods retailers, department stores and owned retail. Today, Hoka sees its omni-channel approach as a core strength:

Consumers interact with both our retail stores and our websites before making purchasing decisions. … our DTC online and retail sales channels interact with each other and largely overlap to provide a fluid purchasing experience which engenders brand loyalty while improving inventory productivity — Deckers 2022 Annual Report

(A quick aside: If you’re enjoying this article, consider subscribing to my free newsletter, Branding in 4-D, by clicking here!)

2. Product range — Van Dyne began introducing new lower profile Hokas in 2014 to attract new customers. The shorter versions still fit Hoka’s maximalist look, with the new versions classified as ‘oversize,’ in comparison to the original ‘ultrasize’ line.

“The business is trending to be 55 percent oversized and 45 percent ultrasized… [Oversized are] still larger than conventional shoe dimensions, but they’re a little closer to what has been normal…that’s the shoe we think will sway the naysayers.” — Jim Van Dyne, 2014, Footwear News

Hoka’s lower profile Clifton sneaker, released summer 2014. Source: Runblogger

Hoka’s lower profile Clifton sneaker, released summer 2014. Source: Runblogger

3. Marketing — Deckers complemented Hoka’s expanded range with marketing focused on attracting new customers. They started by expanding their sponsorship program from ultra-marathoners into elite track and field runners with a 2014 sponsorship of 2012 Olympic 1,500 silver medallist Leo Manzano.

“We wanted to sign some elite track athletes as a demonstration that this isn’t just for old broken runners and ultramarathoners”

— Jim Van Dyne, 2014, Footwear News

Hoka’s sponsorship of Leo Manzano signaled the brand’s expansion to a broader running community. Source: LetsRun.com

Since then, Hoka has only continued to bring in new audiences. Wendy Yang, who took over as Hoka brand president in 2015, made a concerted effort to draw in women:

“We have very conscientiously focused on women over the last five years, in a sector that was predominantly very white and very male, shifting the fanbase from 60% male to 50%+ female and into a far more racially diverse space.”

— Wendy Yang, 2018, Forbes

Yang’s approach has been to broaden the appeal of Hoka to all runners, whether your style is elite performance or casual running. Some of her campaigns include sponsoring Julie Moss, a 61-year-old triathlete, and Latoya Shauntay Snell, an ultramarathon runner and self-proclaimed “Running Fat Chef,” a ‘fit, fat, athlete’.Latoya Shauntay Snell runs for Hoka. Source: Forbes

Hoka has also found credible influencers in podiatrists, who regularly recommend the brand to runners with Plantar fascilitis, a painful foot inflammation that affects many runners. Plantar fascilitis is forecast to affect 1 in 10 in their lifetime. With that, Hoka has a potential 33M customers in the US alone.

Hoka might not pay podiatrists directly, but they make it easy to make the medical connection between their shoes and running injuries. Hoka’s ecommerce website features a page with podiatrist testimonials, and, like its running shoe competitors Brooks and Altra, Hoka sponsors the American Academy of Podiatric Sports Medicine (AAPSM). However, unlike Brooks and Altra, Hoka shows up on the AAPSM website with marketing materials and clear visuals of its technical product benefits:Hoka speaks directly to the podiatrist community. Source: AAPSM

Maintaining brand DNA: aesthetics

Despite Hoka’s mega expansion over the past 10 years, management has stayed true to the DNA of what makes Hoka, Hoka. Their latest line, Transport, debuted in 2023 and is designed for walking instead of running. Nevertheless, Transport sneakers still feature Hoka’s distinctive thick sole and wheel-inspired shape.“Adventure everywhere” presents an evolution of Diard’s and Mermoud’s vision of a shoe made for adventure. Source: Hoka 2023

Hoka is currently also toying with ‘minimal’ tones for its new Clifton 9 and Bondi lines. Nevertheless, the distinctive sole features prominently. Source: Hoka 2023

Source: Hoka 2023

Maintaining brand DNA: technical performance

Hoka has also continued to invest in its leadership as the performance- shoe for ultra-long distance runners. Case in point, Hoka held time-trial events in 2019 and 2021 to promote the launches of its Carbon X and Carbon X2 ultra racing shoes. In the 2019 race, ultrarunner Jim Walmsley set a new 50-mile world best of 4 hours, 50 minutes, 8 seconds, in Hoka Carbon X, beating the record last set in 1983 (Source: Runner’s World). Jim Walmsley’s record beating 2019 run in Hoka. Source: Youtube

Jim Walmsley’s record beating 2019 run in Hoka. Source: Youtube

Scaling ‘ugly’

Much has been written about how easy it is to start a brand today (thanks to a combination of Facebook/Meta advertising, third party logistics, and Shopify‘s ecommerce platform). But scaling a brand is another challenge entirely (as evidenced by profitability struggles at Allbirds, Warby Parker, Glossier, and other direct-to-consumer innovators).

What did Hoka do differently?

Ideally this article and the ‘Brand Growth Model’ serve as a guide to what marketers can do to scale brands. A fewtakeaways stick in my head:

One, don’t avoid distribution. Glossier is in the news this week for its turnaround strategy, much of which centers on its distribution into 600 Sephora stores. This is seen as a rejection of Glossier’s original direct to consumer strategy. Founders of one-time unicorn Away also mentioned in 2019 that they turned down distribution from Amazon and other retailers. Distribution should not be seen as a bad thing. Apple is known for its very profitable stores. But you can also buy Apple products at Best Buy. Omni-channel is a good thing — for awareness, for segmenting audiences, for inventory management.

But the other tenet of Hoka is its insistence on maintaining what makes it distinctive. Or even, ugly. Hoka is not trying to be anyone else. They did not hire the same branding firm that did the same pastel coated design as every other brand on the market. Instead, the brand has stayed true to who they are — giant soles and all. The soles do serve a purpose for runners. But now, giant soles also serve as a moat that other running brands cannot imitate without ‘copying Hoka.’ It’s a good place to be.

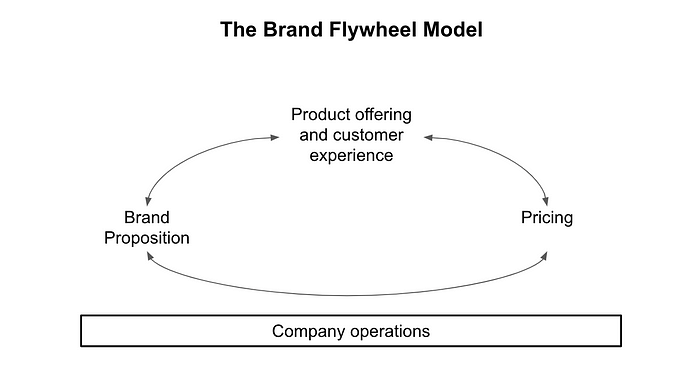

Finally: Hoka and the brand flywheel model

In the first Diary of a Brand piece, I posited that great brands are not just the result of strong marketing, but a company operating model that connects brand and product to underlying operations. For example, IKEA’s flat pack furniture, out of city locations, and reliance on customers to assemble goods allow IKEA to save costs and invest in a killer offering of good design at low prices. Great brands are supported by strong operations. Source: Michelle Wiles

Great brands are supported by strong operations. Source: Michelle Wiles

How does Hoka stack up?

Hoka’s model is self-reinforcing — a good sign — and no surprise given their consistent growth.

Brand <> Product: Hoka’s brand proposition is to empower all athletes to feel like they can fly. This is supported by Hoka’s product — an exceptionally supportive shoe that allows ultramarathoners and walkers to feel like they’re gliding across the Earth.

Product <> Price: Hoka’s credible product benefits and noticeable product (the thick heel is tough to ignore) justify a premium price. Source: Michelle Wiles

Source: Michelle Wiles

Brand, Product, Price <> Operations: Most importantly — Hoka supports its offering with smart operations. Deckers kept the original founders onboard as product leads, maintaining technical innovation as the brand scaled. To encourage risk taking in design, Decker’s has a test store to try out new models. And, the company itself has a culture of promoting ‘ugly’ (er, distinctive) shoes.

Every season [Deckers] designers are given permission to go wild, a portion of each collection reserved for riskier attempts in search of the next big breakout. The company uses one of its 145 stores to test items so they don’t have to persuade retailers to get on board without proving that some new zany shoe has staying power. — Bloomberg, 2022

Shoe businesses can be tough operationally— they require inventory of many sizes, as well as quality assurance for products that can handle regular beatings on city roads and trails. Hoka sources its products externally in China and Vietnam, which allow Hoka to offload some inventory risk. However, Hoka keeps a presence nearby, allowing managers to keep a tight eye on product quality:

[Our] on-site supervisory offices in China and Vietnam, collectively serve as a strong link to our independent manufacturers … Our strong regional presence enhances … adherence to quality control standards and final design specifications. -Deckers Financial Statements, 2022

Hoka’s newest shoe: the Clifton 9. Source: Hoka

Hoka’s newest shoe: the Clifton 9. Source: Hoka

The future of Hoka

As stated at the beginning of this article, distinctiveness is a core tenet of brands that go on to be category leading. Hoka’s unique sole has gone from a hurdle (Why would I wear those clown shoes?) to key brand asset (Oh, are those Hokas?). By leaning into its distinctive brand assets, Hoka now has a base (or sole?) on which to take on industry giants like Nike. Their operations are also designed to keep producing standout products. I wouldn’t bet against them.

Don’t miss out on brand insights — Sign up for monthly emails on brand marketing.