I Gave An AI Trading Bot $3,000 To Trade Crypto

A 4-Day Crypto Trading Bot Experiment: Insights on Profit Potential and Challenges

Trading bots have become an increasingly popular tool for crypto traders looking to automate their strategies and generate passive income. As someone new to algorithmic trading, I was curious to see if these bots could really deliver consistent profits with minimal effort. So I decided to put them to the test using real money and real time.

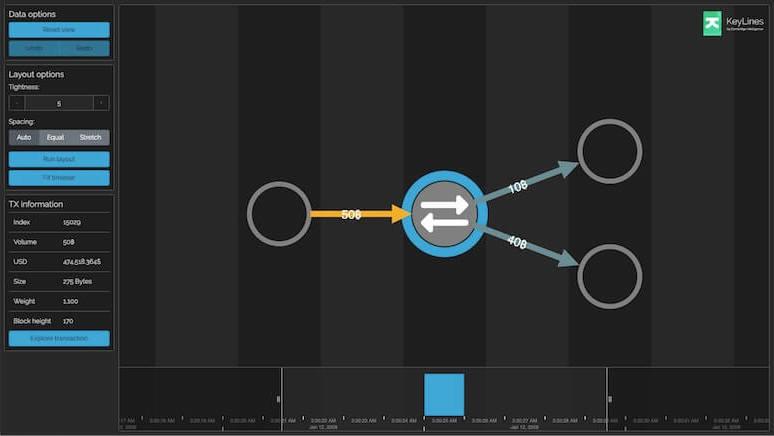

Over the course of 4 days, I opened up two crypto trading bots with a total starting capital of $3,000. One bot traded Bitcoin futures using a grid strategy while the other used an AI model to trade Solana.

Day 1 — Minor Losses But Still Optimistic

Checking in on day 1, my Solana bot was down about 2% or $21. Not a great start, but expected given the downward drift in Solana’s price. The key is that we’re still within the bot’s range.

As long as we get some volatility to trigger the grid sales, I’m confident this bot can bounce back into profitability. Just needs some sideways chop or consolidation around these levels.

My Bitcoin bot fared slightly better and was actually up a bit. About 0.5% or $10 in profit so far. Again, the choppy price action within Bitcoin’s range has given the grid strategy plenty of opportunities to buy low and sell high.

So while it wasn’t a hugely profitable first day, the bots were performing as expected. The sideways and volatile conditions that led me to deploy these strategies still held. I remained optimistic about their profit potential over the coming days.

Day 2 — Swings In Both Directions

Logging in to check my bots on day 2, I was met with a bit of a surprise. My Solana bot had actually swung into profit, up over 5% or $51!

Reviewing the trade history, I saw Solana made a solid move upward which allowed the bot to trigger several of its pending sell grids. Exactly the price action it needed.

Meanwhile, my Bitcoin bot dipped into negative territory, down about $2 overall. Not a huge loss but seemed Bitcoin’s surge outside of the range left some open shorts that hadn’t been offset yet.

The good news is both coins appeared ready for a pullback after these impulsive moves. And if they stay within my bots’ ranges, I remain confident they can turn these floating profits and losses into realized gains very soon.

So even with the wilder price swings, the grid bots were doing their job exploiting the volatility. My experiment was going well so far.

Day 3 — Consistent Gains

On day 3 the markets remained volatile, with my Solana bot continuing its strong performance. It had extended its gains to over $100 in total profit so far.

Bitcoin also swung positive again after its brief dip into the red. The price action was playing out exactly as I hoped when I set up these grid strategies.

Even though prediction is difficult in these markets over shorter timeframes, the bots make it possible to turn choppy price action into consistent gains. Their pre-programmed logic filters out the noise and exposes opportunities.

Overall my experiment was proving successful. $100 profit across the bots after just 3 days on a $3,000 account is over 3% returns. Compounded daily that can add up to very strong returns over time. My interest in algorithmic crypto trading was clearly well-founded.

Day 4 — A Pleasant Surprise

I was ready to close out my experiment and record the final results on day 4. But while I was out, I got a notification that the market was pumping hard across the board.

I rushed back to my computer to find my Solana bot had surged over $200 in profit! A huge swing in just a few hours. The coin’s massive run up triggered a cascade of selling grids for big gains.

Meanwhile Bitcoin held relatively steady around break even. But combined with my other closed bots, I ended the experiment with over $100 total profit across just 4 days of trading.

....

Overall I’m extremely happy with the results of my experiment. In just 4 days I gained firsthand experience of the potential profits algorithmic trading offers. I plan to expand my use of crypto bots going forward as a key part of my investment strategy.