Enhance your chances of success in the stock market with these 5 essential rules

Every person has a financial goal to earn more in a short period. With a small amount of money he/she possesses, a person wants to get rich quickly. The dream of earning huge amounts of money overnight has enticed most people into the stock market. Several investors have made a killing in the stock market. Due to this, every investor involved in the stock market has a dream to make it big someday. However, Investing in the stock market is not an easy task. More investors have lost their wealth in the stock market than those who have been successful.

To remain involved and be successful in the stock market, it is essential to follow certain rules. The five major Golden Rules to become successful in the stock market are:

1. Know Yourself

This might look silly, but not every person knows him/herself. People have a biased or prejudiced view of their abilities and limitations. They believe themselves to be more noble, intelligent, talented, active, social, and strong than they may be. On the other hand, they tend to underestimate their limitations or weaknesses. Due to this reason, people do not have an appropriate evaluation of themselves.

To know yourself means to understand your nature. It means to have a fair evaluation of your capabilities and your imperfections. If you know your strengths and weaknesses, you will know what you can expect from your decisions and actions. A person involved in the stock market can be a trader or a long-term investor, based on their nature.

A highly active person who wants results quickly is more suitable to be a trader. Likewise, a more passive person will benefit more if he accepts himself as a long-term investor. It is when a passive person tries to be a trader, or an active or impatient person tries to be a long-term investor, that things go wrong. You need to understand your nature, accept it, and make your investing strategies that fit your nature, not the other way around.

2. Know Your Investments

To be successful in the stock market, you should know about your investments. Before making an investment decision, investors should have a thorough understanding of their possible investment. You need to do enough homework or research before investing your money. Whether you are a fundamentalist or a technical analyst, doing your research is essential to investment success. The style of research may differ among investors, but it is a must if you want to put the money into the stock market.

Do you buy your clothes without looking at it? The answer is probably no. You choose the proper color, style, and fabrics. You try it on and decide whether it suits you or not. You look into other alternative clothes. If you like any of them, then you bargain for the price. Finally, if you get the clothes that you like the most at the price you think is appropriate, then only you make the purchasing decision.

You spend so much time shopping for clothes which costs so little as compared to the stocks you buy. Then how is it reasonable that you buy the stocks of a company without doing any research on it? You should at least follow the guidelines while purchasing any stocks like you do when you purchase your clothes.

3. Do not Follow the Crowd

Stock prices move due to the movement of crowd psychology. When the crowd feels secure and intoxicated, the stock market climbs to a new high every day. On the other hand, when the crowd feels afraid and depressed, the market tumbles. Although, the crowd moves the market, following the crowd may be dangerous to your investment success. You need to be one step ahead of the crowd if you want to be ahead in the game.

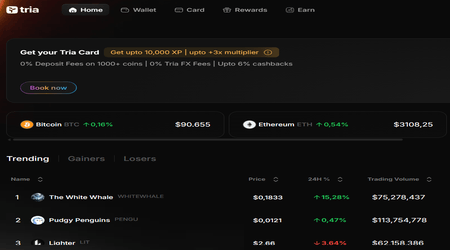

The movement of the price of Bitcoin can be taken as an example. When the price of Bitcoin was trading at $17000 - $18000, investor's sentiment was negative towards Bitcoin. Investors were passing negative comments on social media and urged others to sell. Due to this, the price was continuously declining. However, when the price of Bitcoin started to rise and reached An all-time high - $70000, there was a huge transaction of Bitcoin with positive feedback in social media.

If you follow the crowd, you are likely to fall behind since the crowd reacts late as we can see in the example of Bitcoin. When Bitcoin was worth buying, there was a general sentiment to sell. Likewise, when the price has climbed 6-7 times within a month, the general sentiment seems to be aggressive buying. This can lead investors into a trap. So, to be successful in the market, one has to have a contrarian bend and act sensibly (most of the time in opposition to the crowd).

4. Do not Invest Your Money From Others’ Tips and Rumors

The money is yours. Why should you invest by listening to others’ rumors and useless tips? This is as plain as it can be. The decision to invest should be your own based on your homework or research. How can you be sure that the tips you get from others at a free cost can be profitable? If the tip giver knew something that could make a fortune, would he share it with you easily? If he was so sure of the tip, wouldn’t he invest as much as he could? So, stop listening to others and do your homework. Otherwise, find the most reliable or trustworthy person to handle your investments. You don’t need to involve yourself in every aspect of your life. If you are a doctor, be a doctor. You don’t need to be a stock market wizard. Let a reliable and smart financial planner handle your investments and finances.

5. If Possible, Invest for the Long Term

For an average investor, having a long-term view of the stock market can be quite rewarding. An average person cannot spend the bulk of his time following market prices every second. Buying and selling shares constantly may not be ideal for him/her. Every decision to buy or sell should have sufficient reason behind them. Making a huge number of decisions requires extensive research and study, which may not be possible for an average investor. Finding a good company in which he can put his savings for a long period, can be an ideal strategy. He may not be distracted by the endless volatility of the market. This may prevent him from making mistakes from market timing.