Why Solana was Called 'The Ethereum Killer'

Solana has quickly risen to prominence in the blockchain and cryptocurrency world, earning the moniker "The Ethereum Killer." This nickname reflects its rapid adoption and technological advancements, positioning it as a formidable competitor to Ethereum, the leading smart contract platform.

Solana has quickly risen to prominence in the blockchain and cryptocurrency world, earning the moniker "The Ethereum Killer." This nickname reflects its rapid adoption and technological advancements, positioning it as a formidable competitor to Ethereum, the leading smart contract platform.

This article delves into the reasons behind Solana's rise, examining its technological innovations, performance metrics, ecosystem growth, and the ongoing challenges it faces.

Technological Innovations

Proof of History (PoH)

One of Solana's most significant innovations is its Proof of History (PoH) consensus mechanism. This cryptographic clock creates a historical record that proves events have occurred at a specific moment in time.

By doing so, PoH allows the network to achieve high throughput and low latency without compromising security.

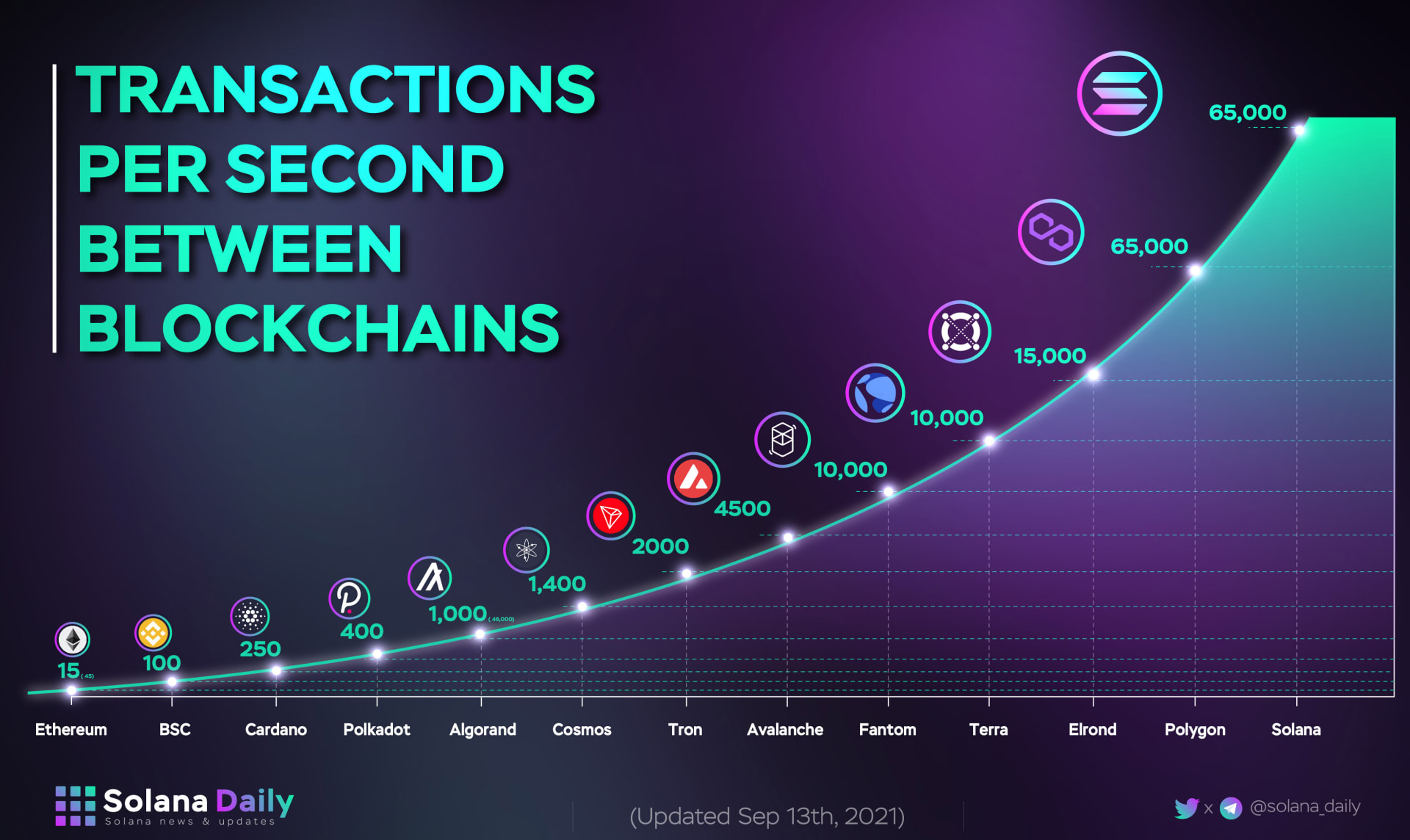

Efficiency and Speed: PoH enables Solana to process transactions at a rate of up to 65,000 transactions per second (TPS), far exceeding Ethereum's 15-30 TPS. This high throughput is crucial for supporting decentralized applications (dApps) and large-scale blockchain projects.

Reduced Latency: With PoH, Solana minimizes the time it takes to verify and process transactions, leading to near-instant finality. This is a stark contrast to Ethereum, where transaction confirmations can take several minutes during peak usage .

Scalability

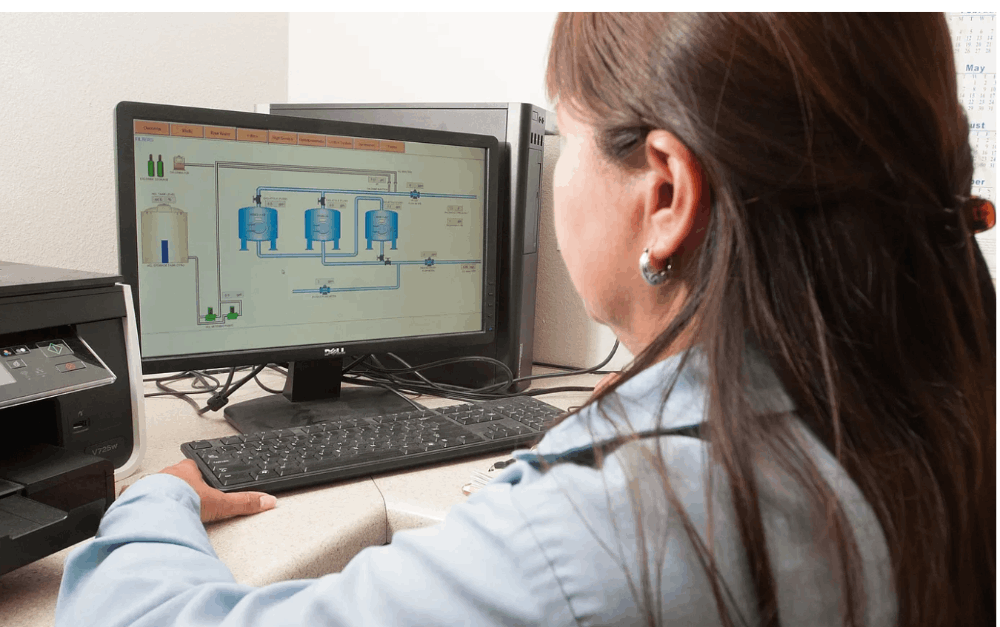

Scalability has been a persistent challenge for blockchain networks. Solana addresses this issue through its unique architecture, which includes features like Sealevel, a parallel smart contracts execution engine, and Gulf Stream, a transaction forwarding protocol.

Sealevel: This innovation allows Solana to execute thousands of smart contracts in parallel, significantly enhancing its scalability and efficiency. In contrast, Ethereum’s current architecture processes transactions sequentially, limiting its scalability.

Gulf Stream: By reducing the memory pool (mempool) of unconfirmed transactions, Gulf Stream optimizes transaction processing, enabling validators to execute transactions ahead of time. This reduces the workload and increases the network’s overall efficiency .

Performance Metrics

Transaction Speed and Costs

One of the critical differentiators for Solana is its ability to maintain low transaction fees while delivering high-speed performance.

One of the critical differentiators for Solana is its ability to maintain low transaction fees while delivering high-speed performance.

This capability makes it an attractive platform for developers and users alike.

Transaction Costs: Solana's transaction fees are a fraction of those on Ethereum, often costing less than a cent per transaction. Ethereum, on the other hand, has faced criticism for its high gas fees, especially during network congestion .

Speed: The average block time on Solana is around 400 milliseconds, significantly faster than Ethereum's 13-15 seconds. This speed ensures a smoother and more responsive user experience .

Network Reliability

Network reliability is crucial for the success of any blockchain platform. Solana has demonstrated robustness and resilience, with a track record of maintaining uptime and handling significant network activity without major disruptions.

Uptime: Solana has maintained a high level of network uptime, ensuring that dApps and services built on its platform are consistently available to users .

Handling Network Activity: During periods of high activity, such as the launch of popular NFT projects, Solana has successfully managed increased traffic without significant slowdowns or crashes .

Ecosystem Growth

Developer Adoption

The growth of Solana’s ecosystem can be attributed to its robust support for developers. Solana has cultivated a vibrant community of developers by offering comprehensive resources, grants, and incentives.

Developer Tools: Solana provides an array of tools and frameworks that simplify the development process, making it easier for developers to build and deploy dApps on its platform .

Grants and Incentives: Through initiatives like the Solana Foundation and Solana Ventures, the platform offers grants, funding, and technical support to promising projects, fostering innovation and growth within its ecosystem .

DeFi and NFT Expansion

Solana has made significant strides in the decentralized finance (DeFi) and non-fungible token (NFT) sectors, attracting numerous projects and substantial capital.

DeFi Projects: Solana hosts a wide range of DeFi applications, including decentralized exchanges (DEXs), lending platforms, and stablecoins. These projects benefit from Solana’s high throughput and low fees, providing a competitive edge over Ethereum-based counterparts .

NFT Marketplaces: The platform has also seen a surge in NFT activity, with several high-profile NFT marketplaces and projects choosing Solana for its efficiency and cost-effectiveness. This has further enhanced Solana's appeal to artists, collectors, and developers alike .

Challenges and Future Prospects

Centralization Concerns

Despite its advantages, Solana faces criticism regarding its level of decentralization. Some argue that its reliance on fewer validators compared to Ethereum compromises its decentralization and security.

Validator Distribution: Solana’s network, while robust, is maintained by a smaller number of validators, raising concerns about potential centralization. This is in contrast to Ethereum’s more extensive validator network, which enhances its decentralization .

Security Implications: A less decentralized network can be more vulnerable to attacks and manipulation, making decentralization a critical aspect of blockchain security .

Competition and Market Dynamics

As the blockchain industry evolves, Solana must continuously innovate to stay ahead of its competitors, including Ethereum and emerging blockchain platforms.

Ethereum 2.0: Ethereum's transition to Ethereum 2.0 aims to address its scalability and fee issues through the implementation of Proof of Stake (PoS) and sharding. This upgrade could mitigate some of Solana’s current advantages .

New Entrants: The blockchain space is highly dynamic, with new platforms emerging that may offer even more advanced features and capabilities. Solana will need to maintain its pace of innovation to retain its competitive edge .

Conclusion

Solana’s designation as "The Ethereum Killer" is a testament to its remarkable technological advancements, high performance, and growing ecosystem. Its innovations, such as Proof of History and parallel transaction processing, have set new benchmarks for blockchain efficiency and scalability. However, Solana must address centralization concerns and navigate an increasingly competitive market to sustain its position.

By continuing to foster developer engagement, expanding its DeFi and NFT offerings, and addressing its decentralization challenges, Solana has the potential to remain a leading force in the blockchain industry. As the landscape evolves, Solana's ability to adapt and innovate will determine its long-term success and influence.