Restaking in Eigen Layer: The Unmissable 2024 Crypto Investment Revolution!

According to Louround's tweets on X (Twitter) 2024 is predicted to be a big year for Eigen Layer with a big restaking narrative. If you've missed LSDfi, L1, and L2, now is the time to tune in to the big opportunities in the Eigen Layer remake!

Ethereum: From PoW to PoS

Ethereum's change from Proof of Work (PoW) to Proof of Stake (PoS) opens up a new dynamic in the crypto market. As pointed out by @LidoFinance on Twitter, this created a $30 billion Liquid Staking Derivatives (LSDfi) market. @LidoFinance is leading the market by offering the possibility to deposit ETH and get its liquid version, namely $stETH.

According to @SteakCapital's tweet, LSDfi became DeFi's largest sector with a capitalization of more than $31 billion. This marks a new era where investors can gain strategic positions in the LSDfi sector.

Eigen Layer and AVS

eigenlayer uses Liquid Staking Tokens to introduce Restaking for Active Validation Services (AVS). According to Louround on Twitter, AVS ensures infrastructure like bridges and oracles are secure and decentralized. By depositing LST in the Eigen Layer, users earn additional yield and points (potential airdrop). AVS also ensures that essential infrastructure in the crypto ecosystem remains secure and decentralized. This adds an additional layer of security that is much needed in a growing ecosystem.

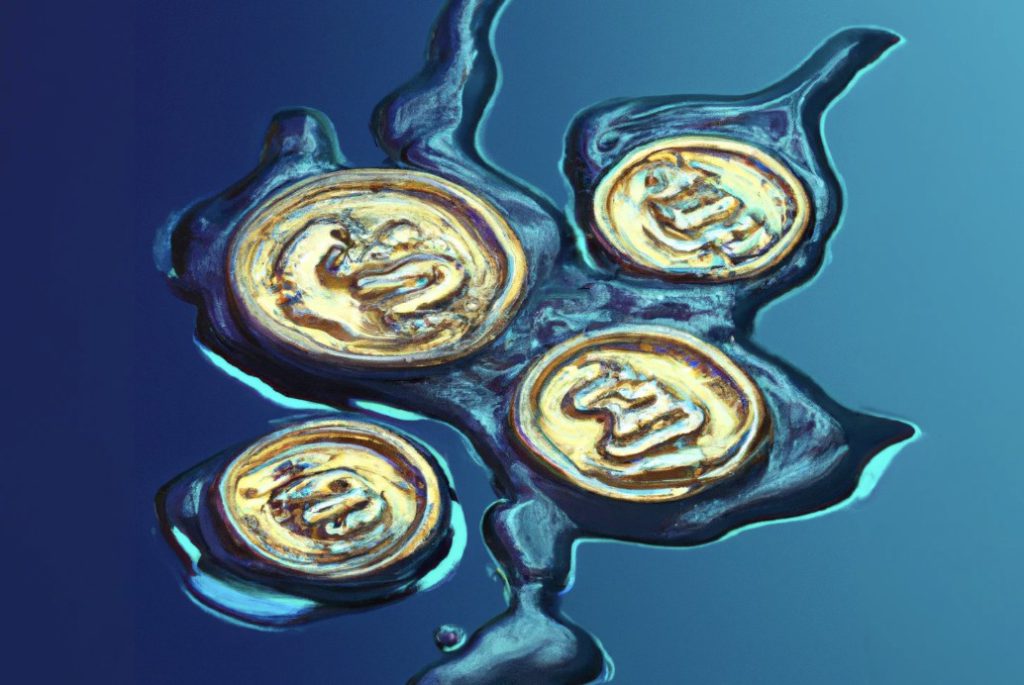

LRT Concept: Liquid Restaking Token

Source: Minke

Source: Minke

Louround also revealed a new concept in restaking: Liquid Restaking Tokens (LRT). LRT provides liquidity and capital efficiency for restakers in the Eigen Layer. It allows users to earn rewards from LST (4%) plus rewards from Eigen Layer and its potential airdrops. The existence of LRT provides additional flexibility and liquidity for users involved in restaking. It shows an evolution in the way crypto assets are managed and capitalized.

Important Restaking Projects

Some notable projects have started to build on the LRT narrative. @restakefi, for example, just launched $RSTK and is showing impressive price performance. In addition, @KelpDAO from @staderlabs has attracted over $140 million TVL. According to a tweet from @DeFi_Made_Here, @KelpDAO promises more Eigen points than any other LST. This shows how important LRTs are in the restaking ecosystem.

Risk and Potential

While restaking and Eigen Layer offer great potential, it is important to consider the risks. As @DefiIgnas points out, contract risk and heightened systemic risk need to be considered. Most LRTs are not yet fully live, so capital remains locked up. It is important to understand that technologies like LRT are new and may face contractual risks. Investors should exercise caution and inform themselves before jumping into these investments. Overall, restaking in the Eigen Layer may be one of the biggest narratives in 2024. Despite the huge potential, it is important for investors to fully understand the dynamics and risks involved. This is an opportunity to get ahead of the new crypto investment trend.

*Disclaimer

This content aims to enrich readers' information. Always do independent research and use cold money before investing. All crypto asset trading and investment activities are the responsibility of the reader.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)