Savings vs. Investments: Timing the Market or Time in the Market?

Savings vs. Investments: Timing the Market or Time in the Market?

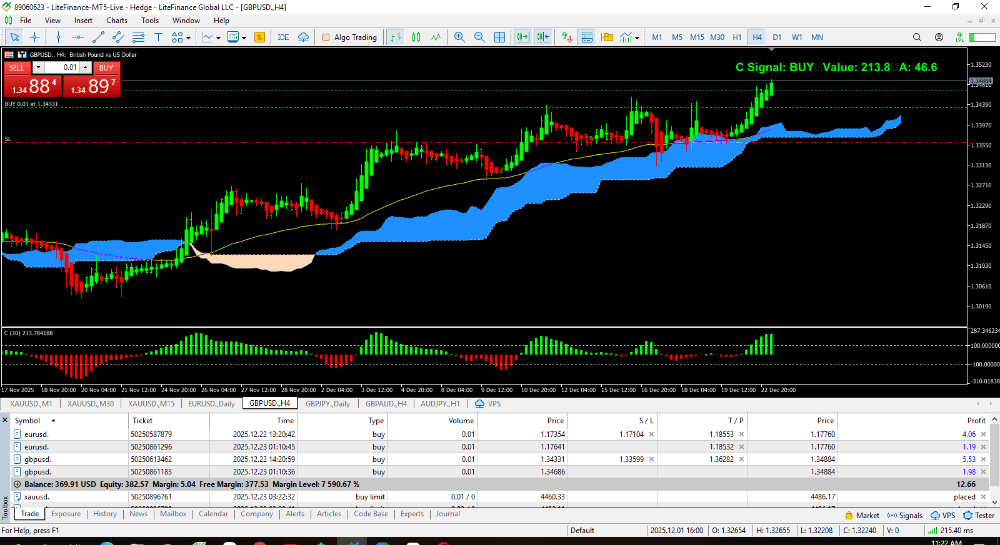

Ah, the age-old question: when is the right time to invest? Market fluctuations can be nerve-wracking, leading many to wonder if there's a magic formula to time the market and buy low, sell high.

This article explores the concept of market timing versus time in the market, providing insights to help you develop a sound savings and investment strategy regardless of current market conditions.

Savings vs. Investments: Setting the Stage

Before diving into market timing, let's establish the fundamental difference between saving and investing. Saving involves setting aside money for short-term goals, typically within a few years. Savings accounts, certificates of deposit (CDs), and money market accounts are common savings vehicles offering low risk and minimal return.

Investing, on the other hand, is about putting your money to work for the long term, aiming to grow your wealth over a period of several years, often decades. Stocks, bonds, mutual funds, and real estate are examples of investment options,each with varying risk-reward profiles.

The Allure (and Illusion) of Market Timing

The idea of market timing is undeniably appealing. Imagine perfectly navigating market highs and lows, buying when prices are depressed and selling at peaks.

However, the reality is far more complex. Some reasons why market timing is generally considered a fool's errand:

- Market Volatility is Inherent: Stock markets will naturally experience ups and downs. Predicting these swings consistently is incredibly difficult, even for seasoned professionals.

- Missing Out on Gains: Trying to time the market often leads to missing out on crucial periods of growth. Even a short absence during a significant upswing can significantly impact your returns.

- Emotional Investing: Fear and greed are powerful emotions that can cloud judgment when attempting to time the market. Panic selling during downturns or chasing hot trends can lead to costly investment decisions.

Time in the Market: The Power of Consistency.

Instead of market timing, focusing on time in the market is a more reliable approach for long-term wealth creation. Here's why:

- Compounding Interest: Albert Einstein famously called compound interest the "eighth wonder of the world." Over time, your investments earn returns, and those returns themselves earn returns (compound interest). The longer your money stays invested, the more compounding can work its magic.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals,regardless of the market's current state. This approach averages out the cost per share over time, mitigating the risk of buying at a peak.

- Focus on Long-Term Goals: Investing for long-term objectives like retirement allows you to ride out market fluctuations. Temporary downturns smooth out over time, allowing your investments to recover and potentially reach new highs.

Developing a Sound Savings and Investment Strategy

Now that you understand the limitations of market timing and the benefits of time in the market, let's explore how to develop a solid savings and investment strategy:

- Emergency Fund: Before focusing heavily on investments, build a healthy emergency fund to cover unexpected expenses. Aim for 3-6 months of living expenses to weather financial emergencies without dipping into your investments.

- Risk Tolerance: Assess your risk tolerance. Are you comfortable with the volatility of the stock market, or do you prefer more stability? This will influence your investment choices.

- Investment Horizon: Define your investment goals and the timeframe for achieving them. Short-term goals might be better suited for savings vehicles, while long-term goals can benefit more from investments with higher growth potential.

- Asset Allocation: Diversify your portfolio across different asset classes like stocks, bonds, and real estate. This helps mitigate risk and provides a balance between growth and stability.

Resources for Building Your Savings and Investment Strategy

- The National Endowment for Financial Education (NEFE): https://www.nefe.org/ offers resources and tools to improve your financial literacy.

- The Securities and Exchange Commission (SEC): https://www.sec.gov/ provides investor education materials to help you make informed investment decisions.

- Financial Advisors: Consider consulting a qualified financial advisor for personalized guidance tailored to your specific financial situation and goals.

Remember: There's no one-size-fits-all approach to savings and investments. By understanding the limitations of market timing, focusing on time in the market, and developing a sound strategy, you can position yourself for long-term financial success.