Ethereum Fees Surge: What’s Fueling the Spike in Transaction Costs?

Ethereum fees are once again surging due to increased network activity. Learn what’s behind the rise in transaction costs and its impact on users.

Ethereum, the second-largest cryptocurrency by market capitalization, is experiencing a significant spike in transaction costs. Known as gas fees, these costs are required to process transactions on the Ethereum blockchain, and they have been a topic of concern for years.

As network congestion increases and the demand for decentralized finance (DeFi) and non-fungible tokens (NFTs) continues to grow, Ethereum fees have become a barrier for many users.

This latest surge is not just a byproduct of increased usage but also stems from a variety of other network factors.

The Rise in Ethereum Fees: What’s Behind It?

Ethereum fees have risen steadily in recent months, as the blockchain remains one of the most widely used platforms for smart contracts and decentralized applications. These fees, calculated in "gwei," are essentially the price you pay to miners who validate and confirm transactions on the network. The more congested the network, the higher the fee required to prioritize your transaction.

A key driver behind the recent surge in Ethereum fees is the growing popularity of decentralized finance (DeFi). DeFi applications allow users to trade, lend, and borrow cryptocurrency without intermediaries like banks. However, this surge in activity comes with a cost—higher fees. In particular, complex DeFi transactions often require multiple steps, increasing the gas fee for each action taken on the network.

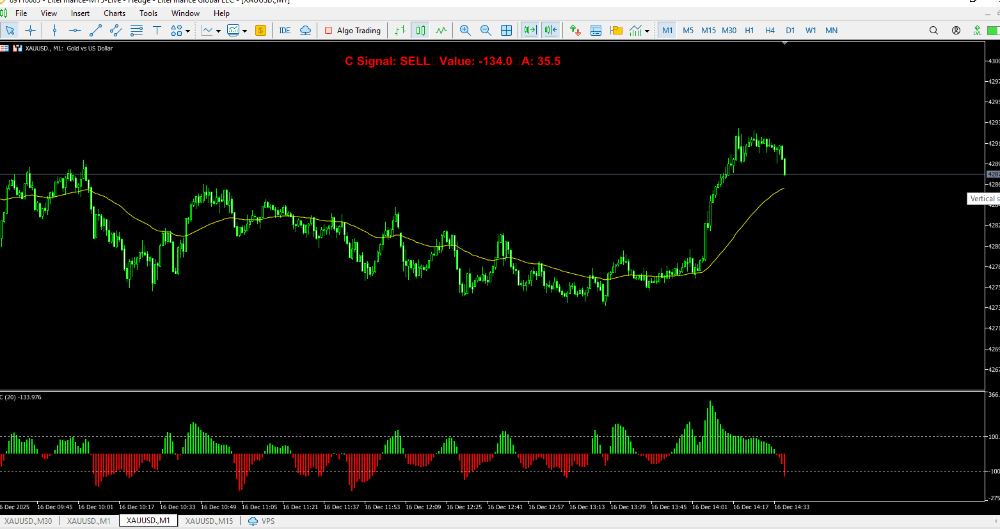

Looks like the value of the metric has been heading up in recent days | Source: Santiment

The rise of non-fungible tokens (NFTs) has also had a significant impact. NFTs, which represent unique digital assets, have exploded in popularity over the last few years. Platforms like OpenSea, which facilitate the minting and trading of NFTs, rely heavily on Ethereum. Minting an NFT or even purchasing one can be costly due to the gas fees associated with each transaction. At the height of the NFT boom in 2021, Ethereum fees spiked dramatically, and this trend has continued as interest in NFTs remains strong.

Another important factor is Ethereum’s transition to Ethereum 2.0, an upgrade designed to improve scalability and lower fees. However, as the network slowly transitions from its current proof-of-work (PoW) mechanism to proof-of-stake (PoS), there has been an increase in speculative activity. Users looking to stake their Ethereum in anticipation of the switch are making more transactions, further congesting the network. This transition, while aimed at eventually reducing fees, is currently adding to the demand for Ethereum transactions.

High Gas Fees: A Double-Edged Sword

The increase in Ethereum fees is both a blessing and a curse for the network. On one hand, it demonstrates the platform's popularity and continued dominance in the DeFi and NFT markets. On the other hand, it raises concerns about the network’s long-term sustainability if fees continue to rise unchecked.

For everyday users, high Ethereum fees present a significant hurdle. Simple token transfers, which once cost a few dollars, now cost significantly more. According to data from Bitinfocharts, the average transaction fee on Ethereum surpassed $30 in recent weeks, and during times of peak congestion, fees can soar even higher. This has led to frustration among smaller investors and users who rely on the network for smaller, routine transactions.

The distribution of the ETH fees over the past week | Source: Santiment

One of the most high-profile events that contributed to the recent surge in Ethereum fees was the Ethereum Name Service (ENS) airdrop. This airdrop, which allowed holders of .ETH domains to claim ENS tokens, created a flurry of activity on the network. Users rushed to claim their tokens, causing a sharp increase in gas fees. The average transaction fee following the airdrop reached nearly $57, one of the highest recorded gas fees in recent months. This event highlights the volatility of Ethereum fees, which can spike quickly in response to specific events or increased network activity.

Increased fees also mean that some users are priced out of the network. For smaller transactions or for those new to cryptocurrency, the high costs of using Ethereum can be a deterrent. While larger investors and institutions may be able to absorb these fees, casual users are often left with few alternatives.

Ethereum 2.0 and Layer 2 Solutions: A Glimpse of Hope?

Despite the current fee challenges, Ethereum is actively working on solutions to address its scalability and cost issues. The most significant development is Ethereum 2.0, a multi-phase upgrade designed to shift the network from its current proof-of-work model to proof-of-stake. This upgrade promises to reduce network congestion, improve scalability, and ultimately lower gas fees.

In the meantime, Layer 2 scaling solutions are gaining traction. These solutions, such as Optimism, Arbitrum, and zk-Rollups, aim to move much of the transaction load off the main Ethereum chain. By processing transactions on these secondary layers and settling them on the Ethereum mainnet, Layer 2 solutions can significantly reduce gas fees while maintaining the security and decentralization of the Ethereum network.

For instance, Arbitrum, one of the most popular Layer 2 solutions, has seen a rapid rise in adoption. According to data from Dune Analytics, Arbitrum processed over a million transactions within a few months of its launch, demonstrating the potential of these solutions to alleviate the fee burden on Ethereum users.

Moreover, with Ethereum’s upcoming sharding upgrade as part of Ethereum 2.0, there is optimism that the network will be able to handle thousands of transactions per second, dramatically reducing the need for high gas fees. Sharding will essentially split the Ethereum network into smaller, more manageable pieces, each capable of processing its own transactions. This should significantly improve the network’s throughput and reduce congestion, making it more accessible to everyday users.

Implications for the Future

The issue of rising Ethereum fees is likely to remain a hot topic as the network continues to evolve. While Ethereum 2.0 promises to alleviate many of the current challenges, the full transition is still several years away. In the meantime, Layer 2 solutions offer a promising alternative, but they are not yet widely adopted by the average user. As these solutions become more user-friendly and integrated into the broader Ethereum ecosystem, they could help reduce the pressure on the mainnet and bring fees back to more manageable levels.

Until then, Ethereum’s high fees will continue to be both a sign of its success and a challenge for its users. As the network grows and more people and applications rely on it, finding ways to balance scalability and cost will be critical to ensuring Ethereum’s long-term viability in the ever-evolving world of blockchain technology.

Ethereum fees are once again on the rise, driven by increased demand for decentralized applications, DeFi, and NFTs. While the network's transition to Ethereum 2.0 offers a long-term solution, current users must navigate high fees in the meantime. The rise of Layer 2 solutions like Arbitrum and Optimism provides some hope for relief, but widespread adoption is still needed to fully address the issue. Until these upgrades are fully implemented, Ethereum’s high fees are likely to remain a contentious issue in the blockchain community.