Ripple & Sam-Bankman’s Legal Saga Takes New Turn, Solana Meme Coins Echo Frenzy

In a thrilling plot twist, the cryptocurrency realm witnessed Sam Bankman Fried's imprisonment, a Solana meme coin frenzy, and the US SEC's call for final judgment on Ripple this week.

STORY HIGHLIGHTS

- Sam Bankman Fried finally faces 25 years of imprisonment.

- The SEC urges Judge Analisa Torres for a final call against Ripple in the XRP lawsuit.

- Solana meme coins continue to nab investor attention.

Another week ends with a riveting turn of events witnessed within the global crypto realm. Among these eye-catching events, Ripple, Sam-Bankman Fried, and Solana meme coins appear to have magnetized substantial attention among crypto market participants.

Some of the top headlines that echoed a sense of frenzy this week are-

Sam Bankman Fried’s Legal Battle Ends With Prison

The epic fall of FTX, a bankrupt cryptocurrency exchange, has finally received its validation, as the founder of the firm, Sam-Bankman Fried, was finally sentenced to 25 years in prison. The 32-year-old was sentenced to prison in a Manhattan federal court under the authority of Judge Lewis A. Kaplan after being convicted on multiple charges, including fraud and money laundering, which caused the notable downfall of FTX.

Following a series of legal battles ever since FTX collapsed, this decision finally offered investors immense relief. With various legal sagas such as impact statements presented in court, the DOJ’s constant push to ensure the convicted is behind bars, and the Sam Coins’ chronicle weighing in this week, the founder of FTX finally faces a decision.

Final Call on Ripple vs SEC Looms?

Meanwhile, another legal chronicle that appears to have endured since historic times, Ripple vs. the US SEC, took an exciting turn this week. The SEC reportedly asked Judge Analisa Torres for a final judgment against Ripple in the XRP lawsuit, eyeing a nearly $2 billion penalty.

This week, the US SEC recalled Ripple’s violations in a federal court, asking Judge Torres to rule a final judgment. It includes permanent injunctions, disgorgement, and prejudgment interest, and nearly $2 billion in civil penalties.

Also Read: Sam Bankman News: 15 Things You Should Know About Sam Bankman, Ex-FTX CEO

Solana Meme Coins Curate Buzz

On the other hand, Solana meme coins appear to be emerging as the hot topic this week, defying broader downtrends by meme coins. Although Dogecoin was another meme coin that defied this downtrend, Solana meme coins, in particular, stood out.

Aligning with SOL’s broader uptrend, meme coins Dogwifhat (WIF) and the newly launched Cat in a Dogs World (MEW) nabbed substantial investor attention. On one hand, WIF noted a weekly surge of roughly 100%, continuing its upward trajectory, whereas MEW sparked speculations with an approximate 140% rally as of press time.

This garnered noteworthy attention among crypto market traders and investors globally, as even Solana whales appear to have been noted shifting focus to MEW. With a whale accumulating over 10% of MEW’s supply, switching its position from BOME to MEW, the Cat in a Dogs World token birthed bullish sentiments across the global crypto horizon, followed by other similar accumulations.

MicroStrategy Overvalued: Is Bitcoin Behind The Higher MSTR Price?

MicroStrategy's MSTR stock price faces scrutiny for overvaluation amid its substantial Bitcoin investments, raising concerns about reliance on cryptocurrency.

STORY HIGHLIGHTS

- MicroStrategy's stock surge is attributed to its significant Bitcoin acquisitions and bullish stance on cryptocurrency.

- Recent analysts have raised concerns over MicroStrategy's (MSTR) stock price overvaluation.

- Analysts discuss if MicroStrategy's stock reflects its intrinsic value or is inflated by Bitcoin hype.

MicroStrategy, under the leadership of CEO Michael Saylor, has been making waves in the investment world with its significant Bitcoin acquisitions. The company’s recent purchase of massive Bitcoins has further intensified speculation about the correlation between its Bitcoin holdings and the soaring MSTR stock price.

Meanwhile, as Bitcoin continues to garner institutional interest, questions arise about whether MicroStrategy’s bullish stance on the cryptocurrency is driving its stock valuation or leading to overvaluation.

Bitcoin Boom Aid In Stock Price Rally

MicroStrategy, led by CEO Michael Saylor, has become synonymous with Bitcoin investment, amassing an impressive stash of the cryptocurrency. Notably, the company’s recent acquisition of an additional 9,245 BTC further solidifies its position as a major Bitcoin holder in the corporate world.

In addition, with MicroStrategy’s total Bitcoin holdings now surpassing 214,000 BTC, equivalent to 1% of the maximum Bitcoin supply, attention has turned to the impact of this accumulation on the firm’s stock, and MSTR performance.

Meanwhile, as Bitcoin gains mainstream acceptance, MicroStrategy’s unwavering commitment to the digital asset has propelled its stock price to new heights. In 2024 alone, the MSTR stock surged by approximately 170%, fueled by growing optimism surrounding Bitcoin and MicroStrategy’s strategic Bitcoin acquisitions. Moreover, over the past month, the stock witnessed a remarkable increase of over 65%, reflecting the fervor surrounding the cryptocurrency market.

Is MicroStrategy Overvalued Amid Bitcoin Hype?

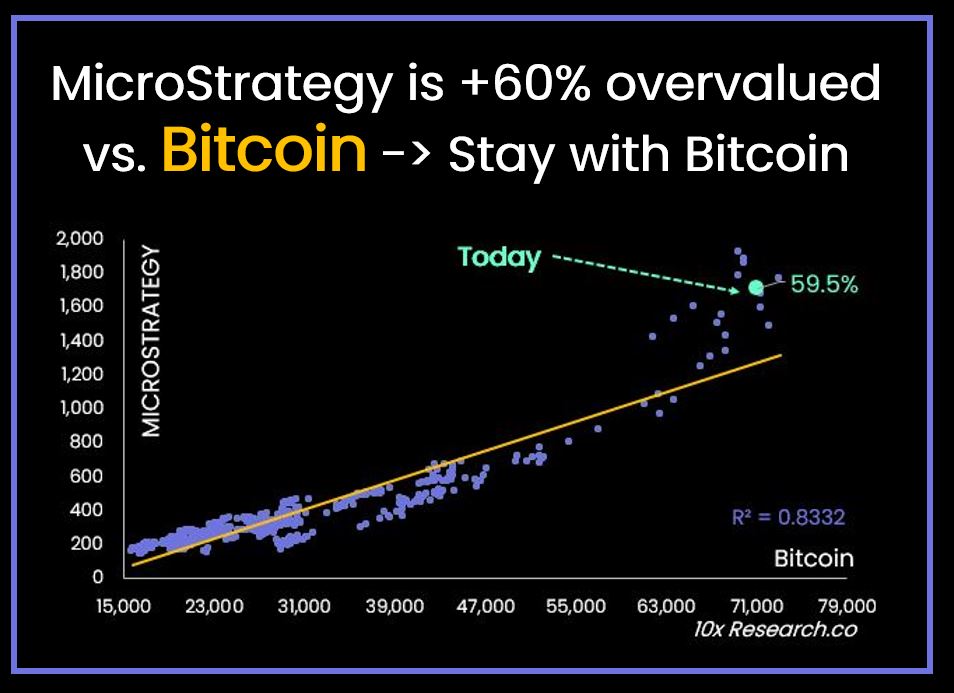

Despite MicroStrategy’s bullish outlook and its impressive Bitcoin holdings, concerns about the stock’s valuation have emerged. According to Markus Thielen’s 10X Research, a prominent crypto research firm, MicroStrategy shares are deemed overvalued by as much as 60% based on regression with Bitcoin. On the other hand, when evaluated against the company’s actual Bitcoin holdings, the overvaluation jumps to nearly 100%.

Meanwhile, Thielen’s analysis suggests that MicroStrategy’s stock price may not accurately reflect its intrinsic value, considering its heavy reliance on Bitcoin performance. While MicroStrategy has emerged as a flagbearer for Bitcoin enthusiasts in the corporate sector, questions linger about whether the stock’s meteoric rise aligns with fundamental market principles.

With Thielen’s research pointing towards a more modest valuation range for MicroStrategy, investors are urged to exercise caution amidst the Bitcoin-fueled euphoria. Meanwhile, the MSTR stock price closed at $1,704.56 on March 28, down 11.18% from its previous session.

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)