Bitcoin, Altcoins Price Decline As Crypto Liquidations Near $900 Million In The Past Day

The crypto market took an unexpected hit on April 12 as a spontaneous decline in the price of Bitcoin and prominent altcoins resulted in massive liquidations. The origin of this widespread price dip remains largely unknown, among a plethora of plausible reasons, including a recent price correction in the US stock markets.

Related Reading: Will The Halving Send Bitcoin Price To $100,000? Analytics Platform Reveals What You Should Expect

Almost $500 Million Liquidated In An Hour Amidst Crypto Flash Crash

According to data from CoinMarketCap, Bitcoin slipped by 4.49% in the last day, falling as low as $66,052. As expected, BTC’s decline reverberated through the market, with prominent altcoins Ethereum and Solana recording daily losses to the tune of 8.12% and 12.16%, respectively

As earlier stated, these losses translated into 277,843 traders losing their leverage positions as total crypto liquidations reached $877.21 million in the last 24 hours based on data from Coinglass. Of these figures, long positions accounted for $782.98 million, with short traders losing only $94.24 million. Notably, $467 million in leverage positions were closed within an hour as a result of a general price decline. The highest amount of liquidations at $369.85 million was recorded on Binance, while the single largest liquidation order valued at $7.19 million occurred in the ETH-USD market on the OKX exchange.

Notably, $467 million in leverage positions were closed within an hour as a result of a general price decline. The highest amount of liquidations at $369.85 million was recorded on Binance, while the single largest liquidation order valued at $7.19 million occurred in the ETH-USD market on the OKX exchange.

Source:

Coinglass

Interestingly, Bitcoin’s price decline correlated with a dip in the US stock market as the S&P 500 index declined by 1.6% to trade as low as $5,108. This market crash was preceded by recent CPI data, which showed that the inflation rate rose to 3.5% year over year in March.

Such reports only indicate that the US Federal Reserve (Fed) could not be implementing any rate cuts soon as it aims to force inflation down to its annual target of 2%. This prediction is quite bearish for the crypto market generally as Fed rate cuts allow investors to comfortably seek risky assets such as BTC with a potential of high yields.

Related Reading: Traders Forecast Massive Rally For Altcoins, But Why Is Sentiment “Down”?

Bitcoin Experiences Network Growth As Halving Approaches

On a more positive note, Bitcoin has recorded a rise in non-empty wallets on its network ahead of the Halving event on April 19. Blockchain analytics platform Santiment reported an increase of 370,000 BTC wallets holding active coins over the last six days. Interestingly, the analytic team is backing investors to maintain this accumulative trend all through the Bitcoin halving event.

At the time of writing, Bitcoin was trading at $66,882, with a 44.80% increase in its daily trading volume, which is currently valued at $43.80 billion. However, Bitcoin’s price has generally been unimpressive in recent times, with a decline of 1.33% and 6.20% in the last seven and 30 days, respectively.

Bitcoin trading at $66,499.00 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from The Independent, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: bitcoinBitcoin HalvingbtcusdBTCUSDTcrypto liquidationsleverage tradin

XRP To Blast Off? Analyst Predicts ‘Realistic’ 5x Surge To $3

XRP, the native token of Ripple, has caught the attention of market analyst Mikybull who is calling for a potential 5x surge in the mid-term. This bullish prediction comes amidst recent struggles for XRP, which is currently grappling to maintain support above the $0.60 level.

Related Reading: Bitcoin Below $70,000: Is $80K Still Possible, Or Is The Rally Over?

Mikybull bases his optimism on two key technical indicators: the two-year moving average (MA) and a symmetrical triangle formation on the two-month chart. XRP recently crossed above the two-year MA, a historical signifier of significant price increases according to the analyst. This pattern held true in late 2017 when XRP skyrocketed to its all-time high of $3.31 after a similar crossover.

XRP Technical Chart Hints At Breakout

The symmetrical triangle on the two-month chart further bolsters Mikybull’s prediction. This pattern often precedes a breakout, and in XRP’s case, a breakout above the triangle’s upper trendline could propel the price towards $3.10, aligning with Mikybull’s 5x surge target. The 2017 price surge also coincided with a breakout from a similar triangle formation, lending historical credence to the analyst’s view.

$XRP

It has climbed above 2-yr MA in this cycle, indicating that an upward explosive move should bring about 5x at least.

It happened in 2017 and 2021 so buckle up. pic.twitter.com/KTIKys2zMy

— Mikybull 🐂Crypto (@MikybullCrypto) April 11, 2024

A Cautious Approach Still Warranted

However, cryptocurrency enthusiasts should approach this prediction with a dose of healthy skepticism. While technical analysis can be a valuable tool, past performance doesn’t guarantee future results. The broader market environment can significantly impact individual cryptocurrency prices. Furthermore, XRP is currently facing resistance at the $0.60 level, highlighting a potential hurdle before any significant upward climb.

Total crypto market cap is currently at $2.39 trillion. Chart: TradingView

Regulatory Landscape And Adoption Remain Key

Beyond technical indicators, the future of XRP hinges on two crucial factors: the ongoing legal battle with the SEC and its adoption within the financial sector. The SEC lawsuit, which accuses Ripple of selling unregistered securities, has cast a shadow over XRP, creating uncertainty for investors. A positive resolution in Ripple’s favor could significantly boost investor confidence and potentially trigger a price increase.

XRP price action in the last week. Source: Coingecko

On the adoption front, Ripple’s core utility lies in facilitating faster and cheaper cross-border payments for financial institutions. Increased adoption of Ripple’s technology by banks and other financial players would translate to a higher demand for XRP, potentially driving its price upwards.

Related Reading: Uniswap Bloodbath: UNI Price Crashes 16% On SEC Lawsuit Fears

A Calculated Optimism For XRP

The coming months will be crucial for XRP as the legal battle with the SEC unfolds and its adoption within the financial sector becomes clearer. With a mix of technical optimism and lingering uncertainties, XRP’s journey towards the $3 target promises to be an exciting, yet potentially volatile, ride.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Tags: altcoinscryptomemecoinsxrp

Crypto Market Crash: Here’s Why Bitcoin, ETH, SOL, XRP, SHIB Fell Sharply

Crypto market crash as Bitcoin tumbled to $65,000 triggering a market-wide correction in altcoins including ETH, XRP, SOL, ADA, SHIB, DOGE.

STORY HIGHLIGHTS

- Crypto market selloff due to options expiry turned into crash on macroeconomic factors and weak sentiment.

- $950 million were liquidated across the crypto market amid profit booking.

- QCP Capital says Bitcoin can further fall below $65K and other experts predicted a massive fall in prices after halving.

- Bitcoin and Ethereum prices are currently under selling pressure.

Crypto market saw a sharp correction, plunging the global crypto market cap by more than 8% to a low of $2.38 trillion. Overall the crypto market saw over $250 billion in market value lost in the recent selloff.

Bitcoin price tumbled to $65,254o from $70,978 due to various reasons including options expiry, historical Bitcoin halving patterns, macroeconomic factors, and technical chart weakness. Bitcoin triggered a selloff in the crypto market, with Ethereum price plunging 12%. This caused altcoins SOL, XRP, ADA, DOGE, SHIB, and others to fall 15-30%. Meme coins are among the most liquidated cryptocurrencies in the last 24 hours.

Crypto Market Selloff Started by Options Expiry and Extended by Other Factors

The crypto market actually started showing signs of weakness ahead of U.S. CPI data earlier this week. Bitcoin price rise to $72k was a range-bound movement in response to rising Bitcoin ETF inflow and demand for long positions due to FOMO surrounding Bitcoin halving, as reported by CoinGape.

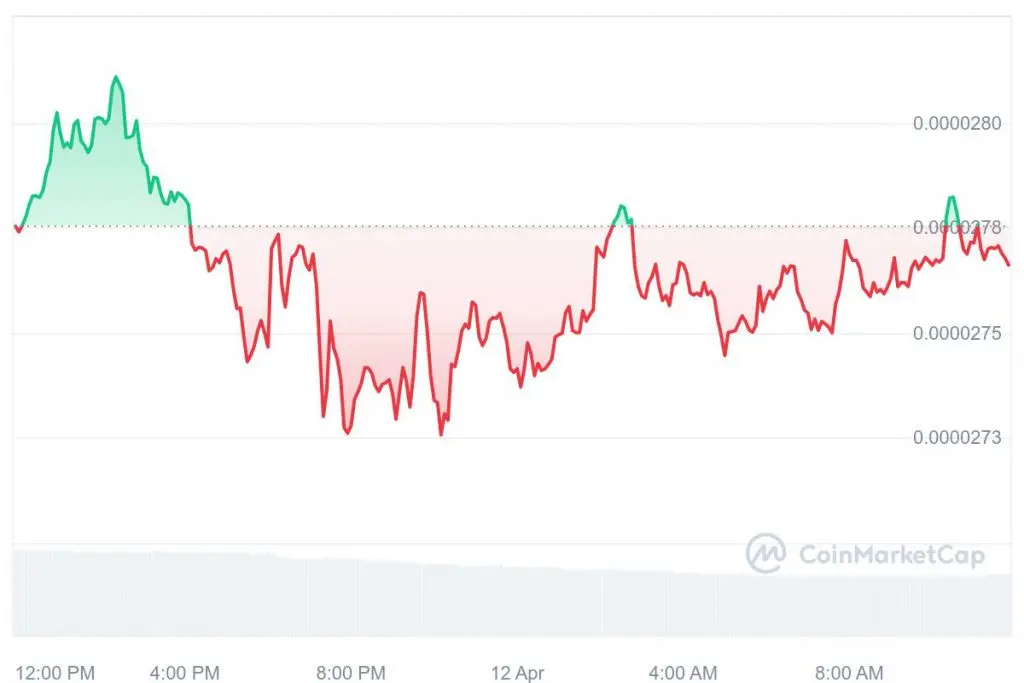

Experts such as Benjamin Cowen, Peter Brandt, and Arthur Hayes predicted a downfall, possibly a market crash, if BTC price repeats a similar chart pattern seen during previous Bitcoin halving events and most recently spot Bitcoin ETFs listing. Cowen predicted BTC price could drop below $60,000 after the halving. CoinGape also predicted a drop in BTC and ETH prices after options expiry. The crypto market selloff started with options expiry at 12 PM UTC, as clearly shown in the above chart. The reasons were lower max pain points than the trading prices, dominant sell trades in the derivatives market amid low volumes, and subdued sentiment after the hotter CPI.

CoinGape also predicted a drop in BTC and ETH prices after options expiry. The crypto market selloff started with options expiry at 12 PM UTC, as clearly shown in the above chart. The reasons were lower max pain points than the trading prices, dominant sell trades in the derivatives market amid low volumes, and subdued sentiment after the hotter CPI.

BTC price broke key support levels at $70,400 and $68,200 and further extended the selloff due to geopolitical tensions in the Middle East and negative sentiment after earnings reports from major banks. JPMorgan Chase shares fell 6.47% on Friday.

The global macroeconomic events caused US dollar index (DXY) to climb above 106, the highest level since early November, and the US 10-year Treasury yield jumped to a 6-month high of 4.585%. As Bitcoin moves opposite to DXY and Treasury yields, a rise in both has caused a downfall in Bitcoin price to $65k, triggering a crypto market crash.

Crypto Price Correction Not Over Yet

Coinglass data shows more than $950 million were liquidated across the crypto market amid this strong correction. Of these, $830 million long positions were liquidated and nearly $120 million short positions were liquidated in the last 24 hours.

Over 297K traders were liquidated and the largest single liquidation order happened on crypto exchange OKX as someone swapped ETH to USD valued at $7.19 million. QCP Capital remains structurally bullish but believes deleveraging dips can go deep, particularly due to the extent of the bull run this year. It suggests that traders looking to hedge short-term downside must consider BTC price at the May 31 expiry.

QCP Capital remains structurally bullish but believes deleveraging dips can go deep, particularly due to the extent of the bull run this year. It suggests that traders looking to hedge short-term downside must consider BTC price at the May 31 expiry.

Markus Thielen, CEO of 10x Research, says Bitcoin miners could sell $5 billion in Bitcoin after the halving event, with whales leading the selloff.

BTC price currently trades at $67,211 and continues to remain under selloff pressure if price stays below support and fails to cross above the 20-simple moving average. ETH price trades at $3,252 at the time of writing. Also Read: GBTC Outflows Surge Past $16 Billion, Defies CEO’s ‘Equilibrium’ Comment

Also Read: GBTC Outflows Surge Past $16 Billion, Defies CEO’s ‘Equilibrium’ Comment

Solana (SOL) Weekend Price Prediction

Solana is the latest cryptocurrency to attract significant market hype and attention this bull season. The crypto has noted a considerable price spike, with its price breaching $200 before slipping back to $173 at press time.

The price of SOL is currently being driven by an extensive meme coin presale frenzy that is injecting heavy volumes of funds into the network. With the Bitcoin halving approaching, Solana is said to undergo notable price sways and downturns before picking up its market pace.

Also Read: Solana’s Retail Surge: Will $250 Be the Next Milestone for SOL?

Solana (SOL) Weekend Price Prediction

Source – Solana

Source – Solana

Per CoinMarketcap, Solana is currently trading at $173, up 0.43% in the last 24 hours. The token has noted a minor downswing this past week, noting a slight price dip by 1.44%. SOL is up 13% this past month, indicating its potential to reclaim some of its lost valuation soon.

Per crypto analytics platform Coincodex, Solana may trade in the $173–$174 price range this weekend. The token is anticipated to encounter a few price bumps before picking up its pace next week.

“SOL is forecast to trade within a price range of $173.17 and $174.66 this week. If it reaches the higher value target, Solana will increase by 0.86% and reach $ 174.66 by April 14, 2024.”

The gradual ascension of SOL might be attributed to the price of Bitcoin, which is also showing signs of volatility and fluctuations these past few days. BTC briefly touched the price level of $72K this week before retracing its step back to trade at $69K.

Also Read: Solana (SOL) Price Prediction: Mid-April 2024

Price Prospects for April

CoinCodex predicts a positive price ascent for Solana in April. SOL is expected to rise post-Bitcoin halving, capitalizing on increased user sentiment and activity.

“ The price of SOL is predicted to rise by 13.61% and reach $196.73 by May 11, 2024. Per our technical indicators, the current sentiment is neutral, while the Fear & Greed Index is showing 76 (extreme greed). Solana recorded 18/30 (60%) green days with 6.19% price volatility over the last 30 days.”

Shiba Inu Teams Up with CDSA to Tackle AI Challenges in Entertainment

Source – Watcher Guru

Source – Watcher Guru

The Shiba Inu [SHIB] ecosystem has been proving to be more than just a meme coin network. The community-driven project has been diving into several other avenues and media and entertainment is the latest. In a recent announcement, the SHIB community revealed that the network has partnered with the Content Delivery and Security Association [CDSA] to explore blockchain technology’s potential in the media and entertainment sector.

By partnering up with Shiba Inu, a network with a market capitalization of a whopping $16.49 billion, CDSA intends to combat malicious activities while trying to bolster content distribution networks. This will be done by leveraging blockchain technology. CDSA has been playing a pivotal role in setting industry standards since 1998. The platform boasts a distinguished membership comprising major studios, tech giants, and industry stakeholders.

Shibarium, Shiba Inu’s layer 2 network has the potential to revolutionize transparency and trust in the media ecosystem. Shytoshi Kusama, the lead developer of the SHIB network expressed excitement about the latest collaboration. Speaking about the same, Kusama said,

“We look forward to providing a unique and blockchain-first perspective to CDSA’s work in helping media and entertainment executives better utilize these innovative technologies, especially as blockchain and artificial intelligence converge.”

Also Read: Shiba Inu [SHIB] Mid-April Price Prediction

Addressing AI-Driven Concerns

Deepfakes have been making rounds lately and pose a prominent threat among other AI-driven challenges. They undermine the integrity of digital content. The Shiba Inu network along with CDSA aims to tackle this while establishing robust defenses by harnessing blockchain solutions. Through this, the authenticity and traceability of media assets are bound to be ensured. Source

Source

Amidst this development, Shiba Inu was trading at $0.00002765 with a dainty drop of 0.39% throughout the last 24 hours. This dip comes after a seven-day rise of 2.94%.

Also Read: Shiba Inu: Here’s When SHIB Could Rally 400% And Hit $0.0001

![[LIVE] Engage2Earn: Let's keep Sam delivering for Hawke](https://cdn.bulbapp.io/frontend/images/2c5d8b18-5618-4a2a-9051-89ceddbcdfd5/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)