Decoding Cryptocurrency: A Comprehensive Guide to Essential Terms

Introduction:

The world of cryptocurrencies is a labyrinth of innovative concepts and terms that can be overwhelming for newcomers. To help you navigate this dynamic landscape, we've compiled a comprehensive guide to 50 essential crypto terms. Whether you're a seasoned investor or just dipping your toes into the crypto waters, understanding these terms will empower you on your crypto journey.

- Cryptocurrency: Digital Currency for a Digital Era

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for security. Bitcoin, introduced in 2009, was the trailblazer, inspiring a multitude of other digital currencies.

- Blockchain: The Immutable Digital Ledger

Blockchain is a decentralized and transparent ledger that records transactions across a network of computers. It forms an unalterable chain of blocks, ensuring transparency and security.

- Wallet: Your Digital Fort Knox

A cryptocurrency wallet is a secure digital tool for storing, sending, and receiving cryptocurrencies. It includes a public key (for receiving funds) and a private key (for access and security).

- Altcoin: Beyond Bitcoin

Altcoins are any cryptocurrencies other than Bitcoin. Examples include Ethereum, Ripple, and Litecoin. Altcoins often offer unique features and use cases.

- ICO: The Birth of Cryptocurrencies

An Initial Coin Offering is a fundraising method where new projects sell tokens to investors for established cryptocurrencies. It's a way for projects to secure funding in their early stages.

- Mining: Unearthing New Coins

Mining is the process of validating transactions and adding them to the blockchain. Miners use powerful computers to solve complex mathematical problems, earning new cryptocurrency as a reward.

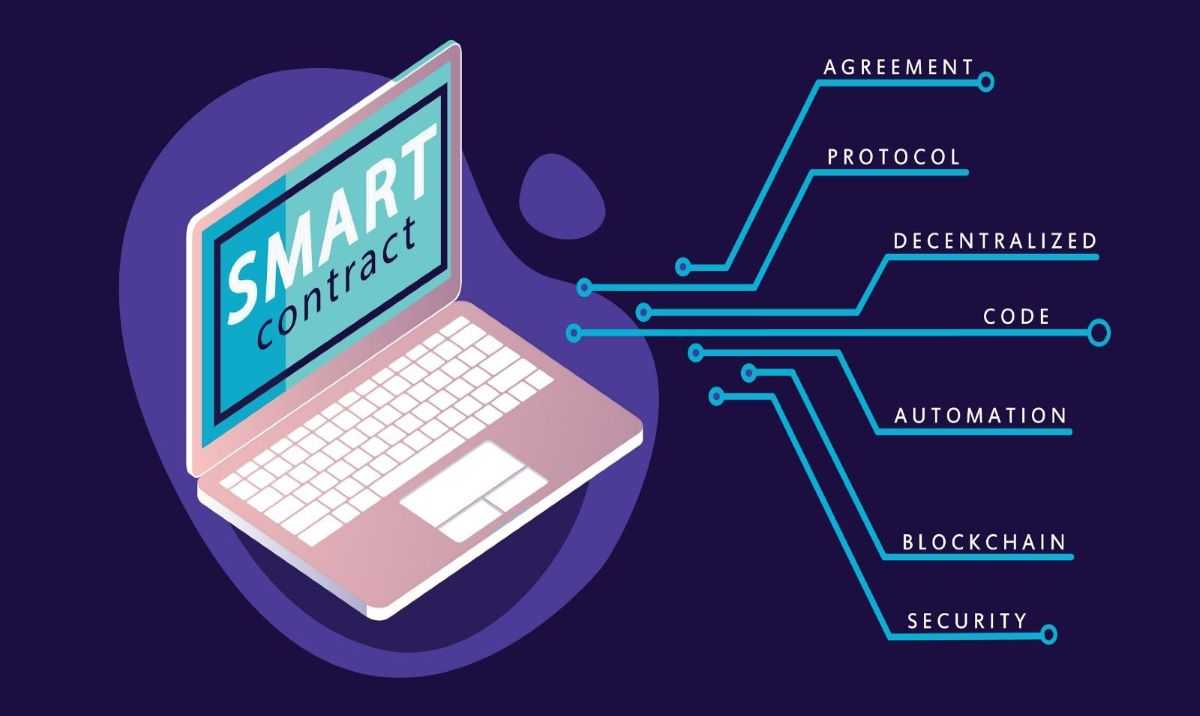

- Smart Contracts: Code-Based Agreements

Smart contracts are self-executing contracts with terms written into code. They automatically execute when predefined conditions are met, reducing the need for intermediaries.

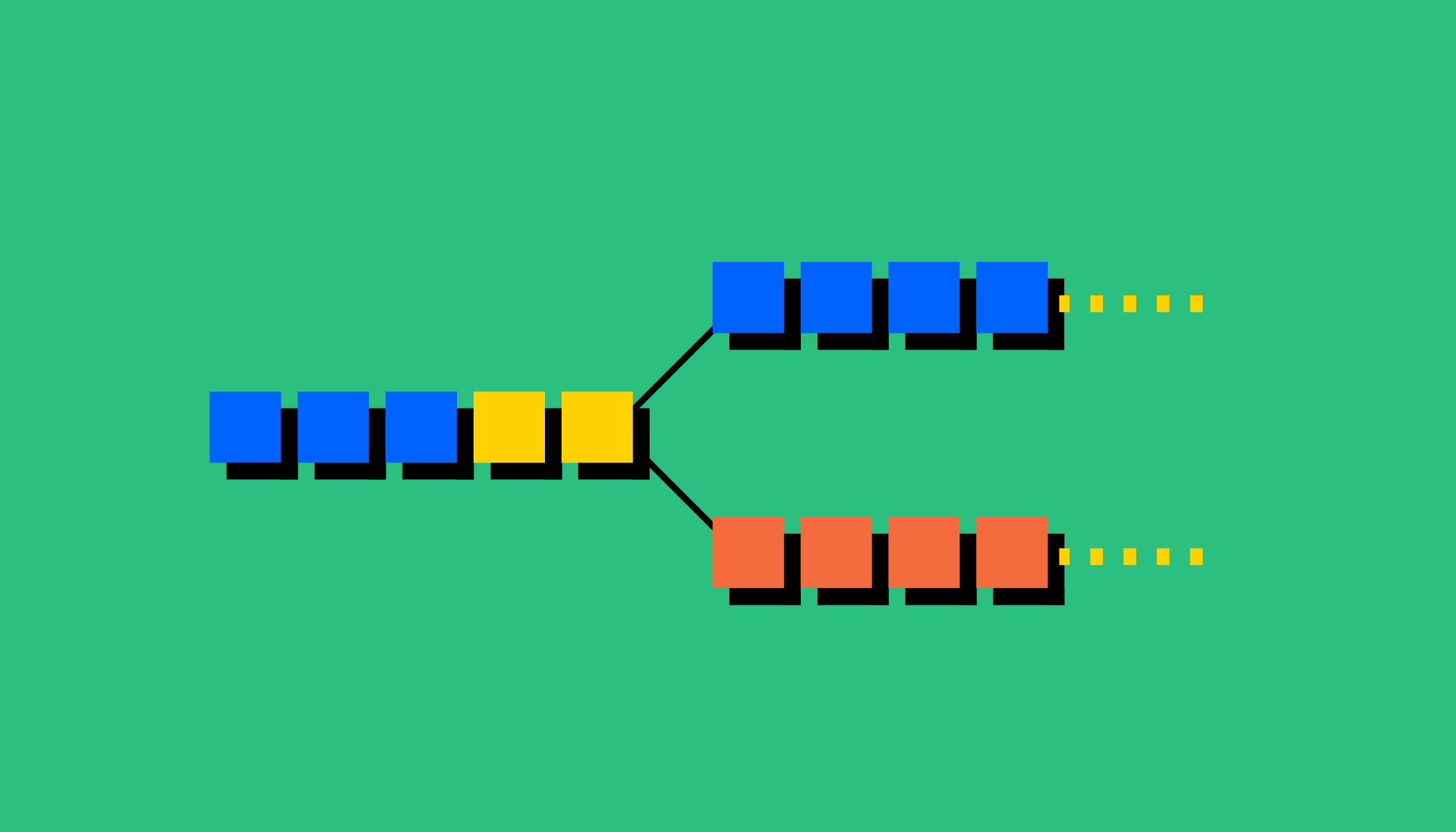

- Fork: A Divergence in the Blockchain

A fork occurs when a blockchain splits into two paths, creating two versions of the ledger. Forks can be planned upgrades or contentious, resulting in a new cryptocurrency.

- DeFi: Finance on the Blockchain

Decentralized Finance (DeFi) seeks to recreate traditional financial systems on the blockchain. It offers decentralized alternatives to banking, lending, and other financial services.

- HODL: The Art of Holding Strong

HODL originated from a misspelling of "hold" and represents the strategy of holding onto cryptocurrencies for the long term, irrespective of market fluctuations.

- Token: Digital Representation of Value

Tokens are units of value issued by projects on a blockchain. They can represent various assets such as utility, security, or real-world assets.

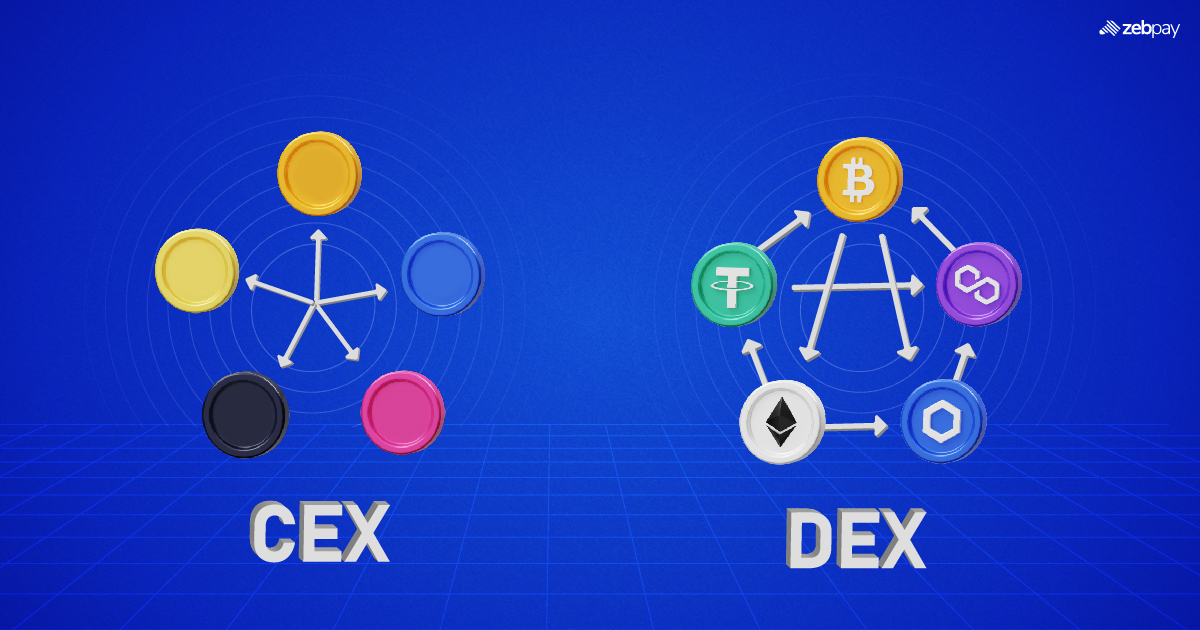

- Exchange: The Crypto Marketplace

Cryptocurrency exchanges are online platforms for buying, selling, or trading digital assets. Popular examples include Coinbase, Binance, and Kraken.

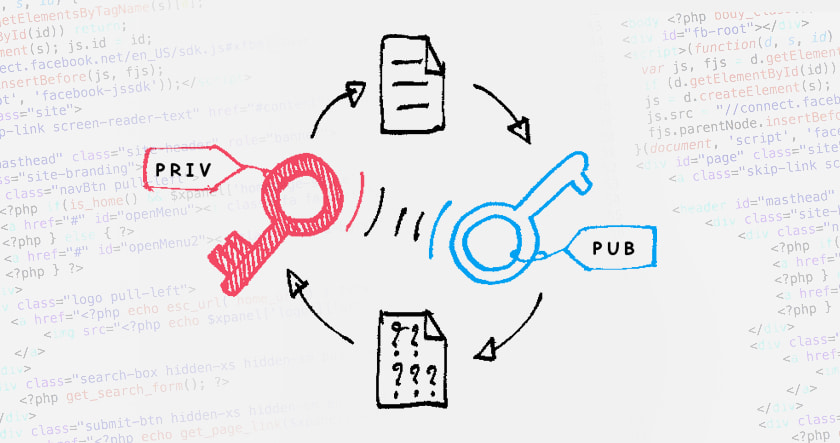

- Private Key: Your Cryptographic Identity

A private key is a secret code that allows access and management of cryptocurrencies. It must be kept secure, as losing it can lead to the permanent loss of funds.

- Public Key: Your Crypto Address

The public key is an address derived from the private key, visible to others. It's used to receive cryptocurrencies, allowing others to send funds to your wallet.

- Staking: Participating for Rewards

Staking involves holding and "staking" your cryptocurrency to participate in a blockchain network's operations. In return, you often receive additional coins as a reward.

- Wallet Seed Phrase: Your Recovery Key

A wallet seed phrase is a series of words serving as a backup for your wallet. It enables recovery in case your device is lost or damaged.

- Gas Fee: The Cost of Transactions

Gas fees represent the cost of processing transactions or executing smart contracts on a blockchain. Users pay these fees to compensate miners for their work.

- Hot Wallet vs. Cold Wallet: Striking a Balance

A cold wallet is offline and more secure, while a hot wallet is online for easier accessibility. Balancing the use of both depends on individual security preferences.

- NFT: Ownership of Unique Digital Assets

Non-Fungible Tokens (NFTs) are unique digital assets representing ownership or proof of authenticity. They find applications in digital art, collectibles, and in-game items.

- Hash Rate: Powering the Blockchain Network

Hash rate measures the processing power of a blockchain network. A higher hash rate generally indicates a more secure and efficient network.

- Whitepaper: Blueprint of Cryptocurrency Projects

A whitepaper is a comprehensive document outlining the details of a cryptocurrency project, including its purpose, technology, and goals.

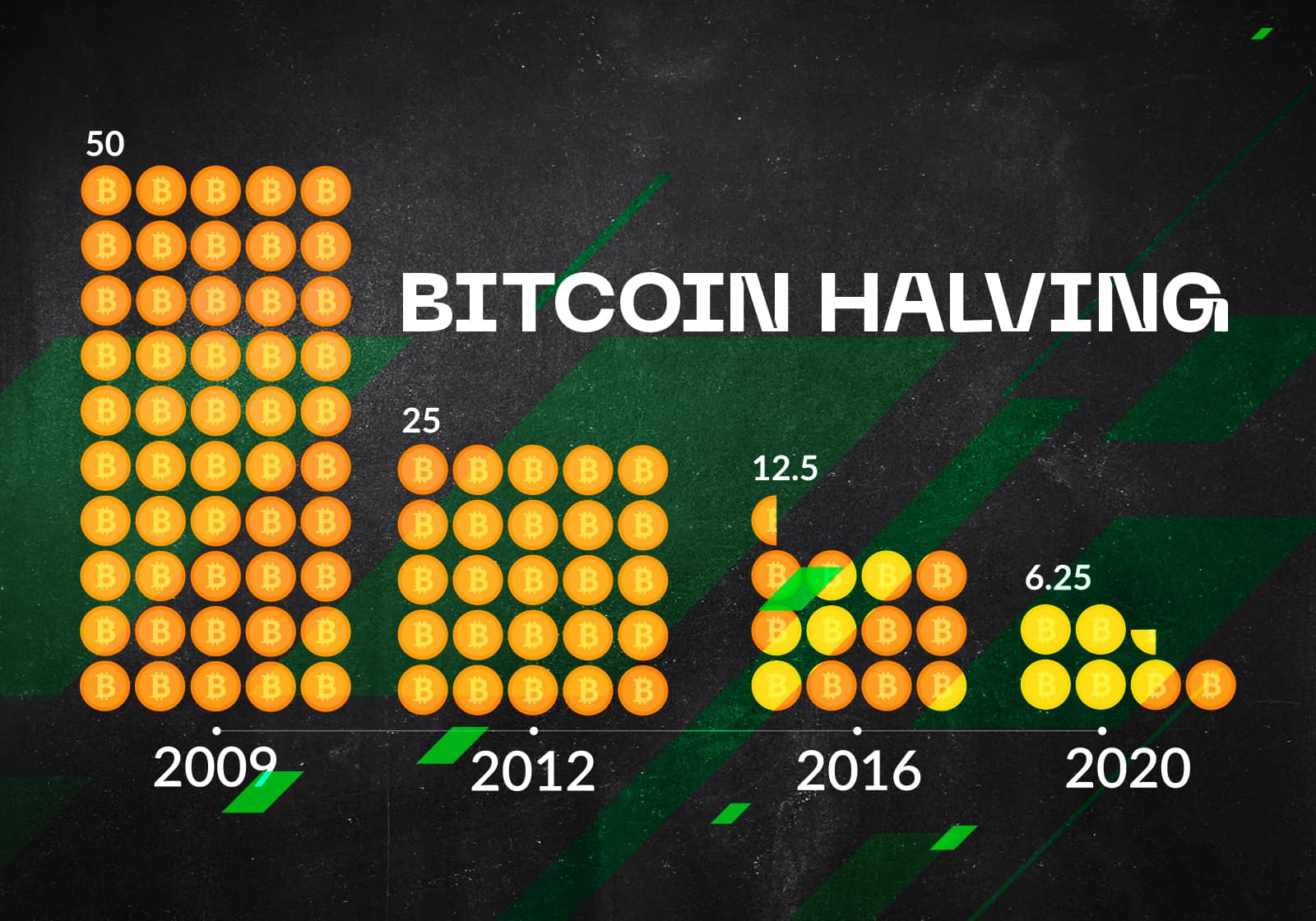

- Halving: Controlled Reduction in Mining Rewards

Halving is an event programmed into certain cryptocurrencies, like Bitcoin, where mining rewards are halved at regular intervals.

- FOMO and FUD: Emotions in the Crypto Market

FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt) are emotional reactions that influence market behavior.

- Whale: Large Holders with Significant Influence

Whales are individuals or entities holding a large amount of cryptocurrency, capable of influencing market prices.

- DEX: Decentralized Exchange

A decentralized exchange operates without a central authority, allowing users to trade cryptocurrencies directly with one another.

- Bear Market vs. Bull Market: Market Trends

A bear market is characterized by falling prices and pessimism, while a bull market is marked by rising prices and optimism.

- Liquidity: Ease of Buying or Selling

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price.

- Market Cap: Valuing Cryptocurrencies

Market capitalization is the total value of a cryptocurrency in circulation, calculated by multiplying its current price by its total supply.

- ATH and ATL: Peaks and Lows

ATH (All-Time High) refers to the highest price a cryptocurrency has ever reached, while ATL (All-Time Low) is the lowest.

- DYOR: Do Your Own Research

DYOR is an acronym emphasizing the importance of conducting thorough research before making investment decisions.

- Rekt: Slang for Heavy Losses

Rekt is slang for significant losses in the crypto market, often used humorously to describe unsuccessful trades.

- DAO: Decentralized Autonomous Organization

A DAO is an organization represented by rules encoded as a computer program, enabling decentralized decision-making.

- Leverage: Borrowing for Trading

Leverage allows traders to borrow funds to increase their position size, potentially amplifying both gains and losses.

- AML/KYC: Regulatory Compliance

AML (Anti-Money Laundering) and KYC (Know Your Customer) are regulatory measures to prevent illegal activities and verify user identities.

- Wrapped Token: Bringing Real-World Assets to Blockchain

Wrapped tokens are blockchain tokens pegged to the value of real-world assets, enabling their representation on the blockchain.

Conclusion:

Congratulations! You've now navigated through 50 essential crypto terms that will serve as your compass in the vast and ever-evolving world of cryptocurrencies. Armed with this knowledge, you're better equipped to explore, invest, and participate in the exciting innovations shaping the future of finance. Remember, the crypto space is dynamic, so stay curious, stay informed, and enjoy your journey! Happy crypto exploring!

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)