ALTCOINS, STABLECOINS, MEMECOINS AND SHITCOINS

ALTCOINS, STABLECOINS, MEMECOINS AND SHITCOINS

2 Apr 2024

56

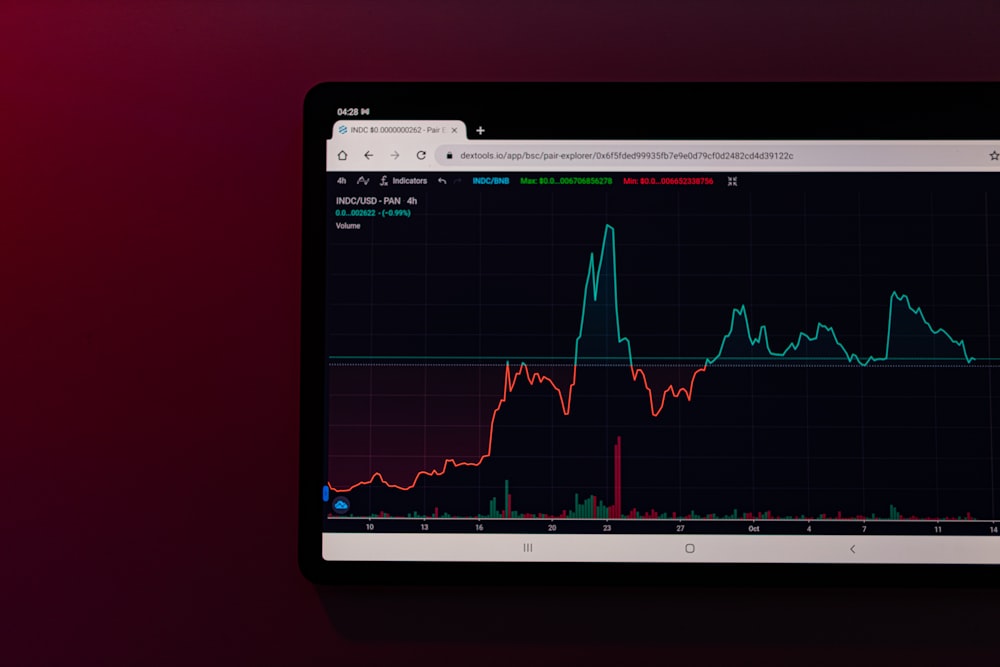

Image Source: Unsplash

Introduction

Looking to navigate the world of cryptocurrencies but feeling overwhelmed by the jargon? You're not alone. With so many different terms floating around, it can be difficult to keep up. From altcoins to stablecoins, memecoins to shitcoins, the crypto sphere is filled with an array of catchy and sometimes confusing names.

In this comprehensive guide, we will explore the various types of cryptocurrencies and shed light on altcoins, stablecoins, memecoins, and shitcoins. By understanding the characteristics, risks, and potential benefits associated with these cryptocurrencies, you'll be better equipped to make informed investment decisions in the ever-evolving crypto market.

Understanding different types of cryptocurrencies

Cryptocurrencies have revolutionized the financial landscape, offering decentralized and secure digital assets. While Bitcoin remains the dominant player, there are numerous alternative coins, or altcoins, that have emerged. These altcoins serve different purposes and cater to various market demands.

What is an altcoin?

Altcoins, short for alternative coins, refer to any cryptocurrency that is not Bitcoin. While Bitcoin remains the most well-known and valuable, altcoins offer investors a chance to diversify their portfolios and potentially find the next big thing.

Altcoins can be categorized into different groups based on their functionalities. Some altcoins aim to improve upon Bitcoin's technology, offering faster transaction speeds or enhanced privacy features. Others focus on specific use cases, such as facilitating smart contracts or powering decentralized applications (DApps). Examples of popular altcoins include Ethereum (ETH), Ripple (XRP), and Litecoin (LTC).

Exploring stablecoins and their purpose

Price volatility has long been a concern in the cryptocurrency market, deterring some investors from fully embracing digital assets. This is where stablecoins come into play. Stablecoins are designed to minimize price volatility by being pegged to a stable asset, such as a fiat currency or a commodity.

The main purpose of stablecoins is to provide stability in a market known for its volatility, making them a popular choice for those seeking a more predictable investment. These coins are typically backed by reserves or collateral, ensuring their value remains relatively stable. While stablecoins may not offer the same potential for astronomical growth as other cryptocurrencies, they provide a sense of security and can be used as a medium of exchange or a store of value.

Memecoins: The rise of viral cryptocurrencies

In recent years, the cryptocurrency market has witnessed the emergence of memecoins – cryptocurrencies that gain traction for their humorous and often meme-inspired branding. Memecoins have captured the attention of a younger demographic who appreciate the fun and irreverent nature of these coins.

Unlike traditional cryptocurrencies that focus on technology and utility, memecoins prioritize community-driven engagement and entertainment. Dogecoin (DOGE) is perhaps the most well-known memecoin, initially created as a joke but gaining significant popularity due to its online meme culture. Memecoins often experience wild price fluctuations driven by social media trends and online communities, making them a highly speculative investment.

The concept and controversy of shitcoins

While altcoins, stablecoins, and memecoins serve specific purposes within the cryptocurrency ecosystem, there is another category that deserves attention – shitcoins. Shitcoins are cryptocurrencies with little to no value or utility, often associated with fraudulent schemes or pump-and-dump scams.

The term "shitcoin" is derogatory and used to describe cryptocurrencies that have no legitimate purpose or technology behind them. These coins are often created to take advantage of unsuspecting investors, promising high returns without any substance. It's important to exercise caution and do thorough research when considering any investment in these highly risky assets.

Factors to consider when investing in altcoins, stablecoins, memecoins, and shitcoins

Investing in cryptocurrencies requires careful consideration of various factors. Here are some key points to keep in mind when evaluating altcoins, stablecoins, memecoins, and shitcoins:

1. Purpose and Utility

Before investing in any cryptocurrency, it's crucial to understand its purpose and utility. Altcoins should offer something unique or improve upon existing technologies. Stablecoins should provide stability and serve as a reliable medium of exchange. Memecoins should have an engaged community and a clear value proposition. Shitcoins should be avoided altogether due to their lack of value or utility.

2. Team and Development

The team behind a cryptocurrency project plays a vital role in its success. Research the developers, advisors, and contributors involved in the project. Look for transparency, expertise, and a track record of delivering on promises. Regular updates and ongoing development are also positive signs of a healthy project.

3. Market Capitalization and Liquidity

Market capitalization and liquidity are important indicators of a cryptocurrency's stability and potential for growth. Higher market capitalization signifies a larger user base and a more established presence in the market. Liquidity ensures that you can easily buy or sell the cryptocurrency without significant price slippage.

4. Security and Regulation

Security is paramount in the world of cryptocurrencies, given the potential for hacking and theft. Look for cryptocurrencies that prioritize security measures, such as robust encryption and secure storage solutions. Additionally, consider the regulatory environment surrounding the cryptocurrency. Compliance with regulations can provide a level of trust and legitimacy.

Risks and benefits of investing in these types of cryptocurrencies

As with any investment, there are risks and benefits associated with investing in altcoins, stablecoins, memecoins, and shitcoins. Understanding these factors can help you make informed decisions and manage your investment portfolio effectively.

Risks

- Price Volatility: Cryptocurrencies, especially altcoins, memecoins, and shitcoins, are known for their extreme price volatility. Rapid price fluctuations can lead to significant losses if proper risk management strategies are not in place.

- Lack of Regulation: The cryptocurrency market operates in a relatively unregulated environment, exposing investors to potential scams, fraudulent activities, and market manipulation.

- Liquidity Risks: Some cryptocurrencies may suffer from low liquidity, making it difficult to buy or sell large amounts without impacting the market price.

- Technological Risks: Altcoins, memecoins, and even stablecoins may face technological challenges or vulnerabilities that could impact their functionality and security.

Benefits

- Diversification: Investing in different types of cryptocurrencies can help diversify your investment portfolio, reducing the risk of relying solely on one asset.

- Potential for High Returns: Altcoins, memecoins, and even some stablecoins have the potential to generate significant returns, especially during bull markets.

- Innovation and Disruption: Cryptocurrencies have the potential to disrupt traditional financial systems and offer innovative solutions to various industries.

- Financial Inclusion: The use of cryptocurrencies, particularly stablecoins, can provide financial services to the unbanked population in countries with limited banking infrastructure.

Popular altcoins, stablecoins, memecoins, and shitcoins in the market

The cryptocurrency market is vast and constantly evolving. Here are some popular examples of altcoins, stablecoins, memecoins, and shitcoins that have gained traction:

Altcoins

- Ethereum (ETH): A blockchain platform enabling the creation of decentralized applications (DApps) and smart contracts.

- Ripple (XRP): A digital payment protocol designed for fast, low-cost international money transfers.

- Litecoin (LTC): Often referred to as the silver to Bitcoin's gold, Litecoin aims to offer faster transaction confirmations and a different mining algorithm.

Stablecoins

- Tether (USDT): A stablecoin pegged to the value of the US dollar, providing stability and liquidity in the crypto market.

- USD Coin (USDC): Another stablecoin backed by the US dollar, offering transparency and regulatory compliance.

- Dai (DAI): A stablecoin pegged to the value of the US dollar but maintained through smart contracts on the Ethereum blockchain.

Memecoins

- Dogecoin (DOGE): Initially created as a joke, Dogecoin gained a massive following due to its meme-based branding and active community.

- Shiba Inu (SHIB): Inspired by Dogecoin, Shiba Inu gained popularity as a meme-driven cryptocurrency with a focus on community development.

- SafeMoon (SAFEMOON): A memecoin that aims to reward long-term holders through a redistribution mechanism and anti-whale measures.

Shitcoins

- Bitconnect (BCC): Infamous for its involvement in a Ponzi scheme, Bitconnect promised high returns through a lending platform but ultimately collapsed.

- Prodeum (PDE): A short-lived project that aimed to revolutionize the fruit and vegetable industry but turned out to be a scam, disappearing overnight.

- OneCoin: OneCoin gained notoriety as one of the largest cryptocurrency Ponzi schemes, defrauding investors of billions of dollars.

How to spot potential scams in the altcoin, stablecoin, memecoin, and shitcoin space

With the rising popularity of cryptocurrencies, scams have become more prevalent. Here are some red flags to watch out for when evaluating potential scams:

- Lack of Transparency: If a cryptocurrency project lacks transparency regarding its team, technology, or roadmap, it could be a warning sign of a potential scam.

- Unrealistic Promises: Be skeptical of projects that promise guaranteed high returns or make claims that seem too good to be true.

- Poorly Designed Whitepapers: Whitepapers should provide detailed information about the project's technology, use cases, and future plans. If the whitepaper is poorly written or lacks substance, it could indicate a scam.

- Unregulated Exchanges: Be cautious when trading on unregulated exchanges, as they may facilitate the trading of fraudulent or low-quality cryptocurrencies.

Conclusion: The future of altcoins, stablecoins, memecoins, and shitcoins

As the cryptocurrency market continues to evolve, altcoins, stablecoins, memecoins, and shitcoins will play significant roles in shaping the industry's future. Altcoins offer opportunities for innovation and diversification, stablecoins provide stability in the volatile market, memecoins cater to a younger demographic seeking entertainment, and shitcoins serve as cautionary tales of fraudulent schemes.

It's crucial to approach investing in these types of cryptocurrencies with caution, conducting thorough research, and understanding the risks involved. As the crypto landscape evolves, staying informed and adapting to changing market dynamics will be key to navigating this exciting and ever-changing space.Blockchain

Cryptocurrencies

Finance

3 Read

2 Wow

0 Meh

Tip

2 Apr 2024

19

2 Apr 2024

48

2 Apr 2024

43

2 Apr 2024

- Here’s When Bitcoin and Altcoin Prices Could Truly Go Parabolic, According to Coin Bureau’s Guy Turn

22

2 Apr 2024

46

2 Apr 2024

32

2 Apr 2024

39

2 Apr 2024

71

2 Apr 2024

39

2 Apr 2024

19

2 Apr 2024

47

2 Apr 2024

26

2 Apr 2024

47

2 Apr 2024

78

2 Apr 2024

51

2 Apr 2024

43

2 Apr 2024

40

2 Apr 2024

31

2 Apr 2024

45

2 Apr 2024

56

2 Apr 2024

25

2 Apr 2024

25

2 Apr 2024

24

2 Apr 2024

31

2 Apr 2024

14

2 Apr 2024

31

2 Apr 2024

25

2 Apr 2024

29

2 Apr 2024

17

2 Apr 2024

54

2 Apr 2024

29

2 Apr 2024

59

2 Apr 2024

69

2 Apr 2024

29

Enjoy this blog? Subscribe to ovmint

Subscribe

3 Comments

All comments

2h

Well if luck has it for you investing some tossing couple of dollars in a memecoin can be heaven for someone when the prices go up.

Have invested in Catwifhat and it's looking promising.Read more

1

REPLY

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)