The Future of DeFi: How Decentralized Finance is Reshaping Traditional Banking

Decentralized Finance (DeFi) represents a paradigm shift in the financial industry, promising to revolutionize the way we engage with money and banking services. By leveraging blockchain technology, DeFi creates a more open, transparent, and accessible financial ecosystem.

This article explores the impact of DeFi on traditional banking, its key components, advantages, challenges, and the future prospects of this transformative movement.

Understanding DeFi: Core Components and Principles

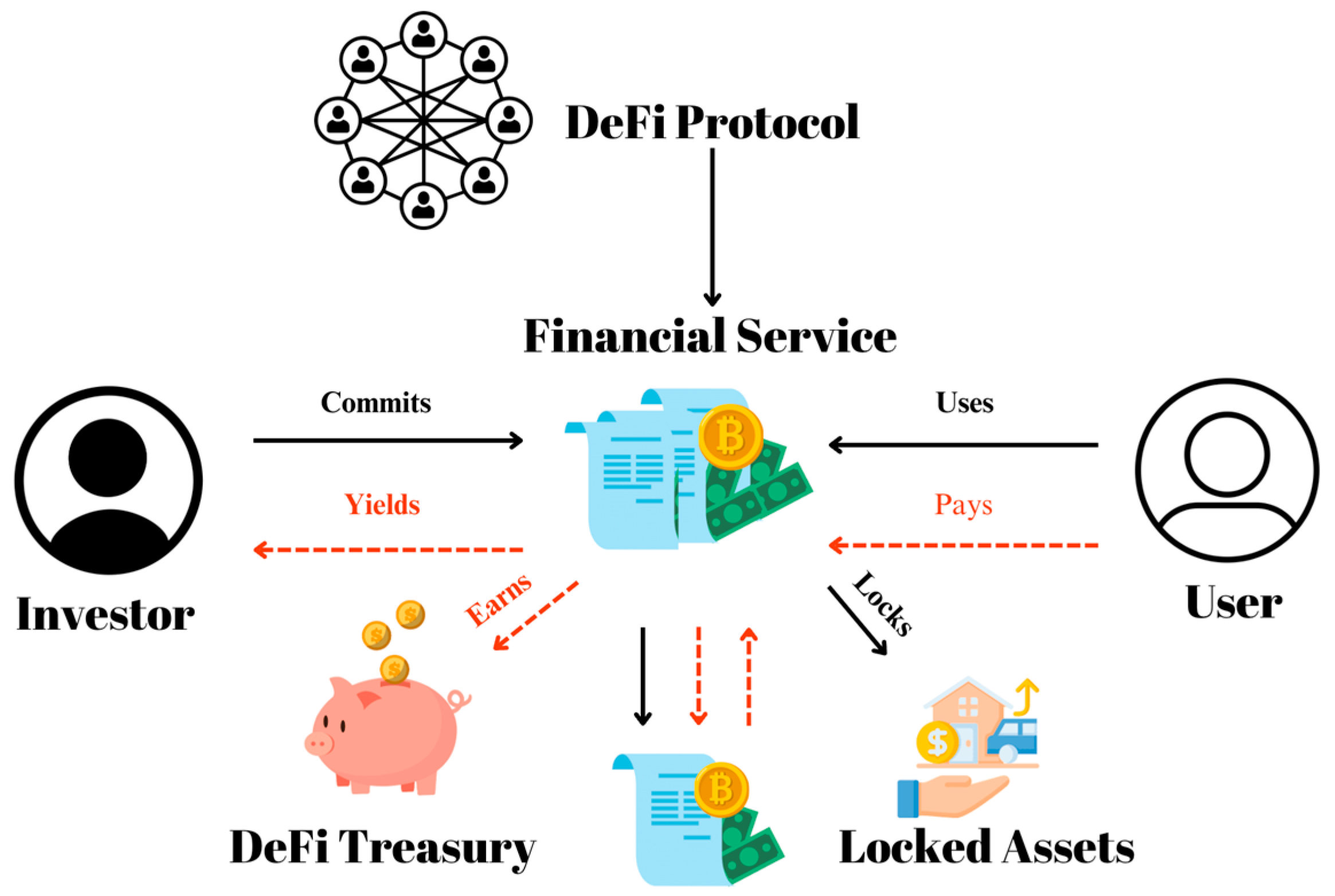

Decentralized Finance, or DeFi, refers to a broad category of financial services and applications that are built on blockchain networks, particularly Ethereum. Unlike traditional financial systems, DeFi operates without central intermediaries, relying instead on smart contracts and decentralized protocols. Here are the core components and principles that underpin DeFi:

Decentralized Finance, or DeFi, refers to a broad category of financial services and applications that are built on blockchain networks, particularly Ethereum. Unlike traditional financial systems, DeFi operates without central intermediaries, relying instead on smart contracts and decentralized protocols. Here are the core components and principles that underpin DeFi:

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce and execute transactions when predefined conditions are met. In DeFi, smart contracts enable trustless and transparent financial services, eliminating the need for intermediaries such as banks and brokers.

Decentralized Applications (dApps)

Decentralized applications, or dApps, are applications that run on blockchain networks. They interact with smart contracts to provide various financial services, such as lending, borrowing, trading, and investing. dApps are open-source, meaning anyone can inspect their code, ensuring transparency and reducing the risk of fraud.

Tokenization

Tokenization involves converting real-world assets into digital tokens on a blockchain. These tokens can represent anything from currencies and stocks to real estate and art. In DeFi, tokenization facilitates the creation of new financial instruments and markets, making it easier to trade and manage assets digitally.

Liquidity Pools

Liquidity pools are a fundamental concept in DeFi, enabling decentralized trading and lending. Users contribute their assets to these pools, providing liquidity for decentralized exchanges (DEXs) and lending platforms. In return, they earn fees or interest, creating a passive income stream.

Advantages of DeFi Over Traditional Banking

DeFi offers several advantages over traditional banking, making it an attractive alternative for consumers and businesses alike.

Accessibility and Financial Inclusion

One of the most significant advantages of DeFi is its potential to enhance financial inclusion. Traditional banking systems often exclude individuals and businesses in developing regions due to high costs and stringent requirements. DeFi, on the other hand, is accessible to anyone with an internet connection and a digital wallet. This democratization of financial services empowers underserved populations, providing them with access to banking, credit, and investment opportunities.

Transparency and Trust

DeFi operates on public blockchains, where all transactions are recorded on an immutable ledger. This transparency ensures that all participants can verify and audit transactions, reducing the risk of fraud and corruption. Additionally, smart contracts automate processes without human intervention, minimizing errors and enhancing trust in the system.

Cost Efficiency

Traditional banking systems involve numerous intermediaries, each taking a fee for their services. DeFi eliminates these intermediaries, significantly reducing transaction costs. For example, cross-border payments in DeFi can be completed quickly and cheaply compared to traditional methods, which often involve high fees and lengthy processing times.

Innovation and Customization

DeFi fosters innovation by allowing developers to create new financial products and services quickly. The open-source nature of DeFi protocols encourages collaboration and experimentation, leading to the rapid development of novel solutions. Users can also customize their financial strategies, tailoring them to their specific needs and risk profiles.

Challenges and Risks in DeFi

Despite its advantages, DeFi also faces several challenges and risks that need to be addressed for it to achieve mainstream adoption.

Security Vulnerabilities

Security remains a significant concern in the DeFi space. Smart contracts, while powerful, are not immune to bugs and vulnerabilities. Hackers can exploit these weaknesses to steal funds or manipulate protocols. High-profile attacks, such as the DAO hack in 2016 and more recent DeFi exploits, highlight the need for rigorous security audits and improved coding practices.

Regulatory Uncertainty

The regulatory landscape for DeFi is still evolving, with many jurisdictions grappling with how to classify and regulate decentralized financial services. This uncertainty creates risks for both developers and users, as regulatory actions could impact the legality and functionality of DeFi platforms. Establishing clear and consistent regulations is crucial for fostering innovation while protecting consumers.

Scalability Issues

As DeFi grows in popularity, scalability becomes a pressing issue. Most DeFi applications currently run on the Ethereum blockchain, which has faced congestion and high transaction fees. These limitations hinder the scalability and user experience of DeFi platforms. Layer 2 solutions, such as Optimistic Rollups and sidechains, are being developed to address these challenges, but widespread adoption is still in progress.

User Experience and Education

For many users, DeFi platforms can be complex and challenging to navigate. The lack of user-friendly interfaces and the need for technical knowledge can deter potential users from participating in DeFi. Improving the user experience and providing educational resources are essential for onboarding new users and fostering widespread adoption.

The Future of DeFi: Trends and Predictions

The future of DeFi is promising, with several trends and developments poised to shape the industry in the coming years.

Integration with Traditional Finance

As DeFi matures, we can expect greater integration with traditional financial systems. Banks and financial institutions are beginning to explore DeFi partnerships and collaborations to enhance their service offerings. This convergence of DeFi and traditional finance, often referred to as CeFi (Centralized Finance), could create hybrid models that leverage the strengths of both systems.

Expansion of DeFi Ecosystem

The DeFi ecosystem is continually expanding, with new protocols and platforms emerging to address various financial needs. Decentralized insurance, asset management, and prediction markets are just a few areas where DeFi is making inroads. This diversification will attract a broader range of users and use cases, driving further growth and adoption.

Enhanced Security and Compliance

Improving security and compliance will be paramount for the future success of DeFi. Advances in smart contract auditing, formal verification, and decentralized security protocols will help mitigate risks. Additionally, the development of regulatory frameworks that accommodate the unique aspects of DeFi will provide clarity and confidence for users and developers.

Cross-Chain Interoperability

Interoperability between different blockchain networks is a critical factor for the growth of DeFi. Cross-chain solutions, such as Polkadot and Cosmos, are being developed to enable seamless interactions between multiple blockchains. This interoperability will enhance liquidity, enable asset transfers, and foster collaboration across the DeFi ecosystem.

Mass Adoption and Financial Inclusion

As DeFi continues to evolve, it has the potential to achieve mass adoption and significantly enhance financial inclusion. User-friendly interfaces, mobile accessibility, and educational initiatives will play a crucial role in onboarding new users. DeFi's ability to provide financial services to underserved populations can drive economic empowerment and reduce inequality.

Conclusion

Decentralized Finance is reshaping the traditional banking landscape by offering innovative, transparent, and accessible financial services. While challenges such as security, regulation, and scalability remain, the future of DeFi is bright, with ongoing developments promising to overcome these hurdles. As DeFi continues to evolve, it will play a pivotal role in creating a more inclusive and efficient global financial system.

References

DeFi Pulse - DeFi Analytics

Uniswap - Decentralized Exchange

Aave - DeFi Lending Protocol

Compound - DeFi Lending and Borrowing

DeFi Safety - Security and Audits