Embracing the New Age of Money

Money's New Age: Crypto

From Cash to Cryptocurrencies:

In the fast-evolving landscape of the 21st century, technology has profoundly impacted nearly every aspect of our lives, and the world of finance is no exception. The way we handle money and conduct transactions has undergone a significant transformation, giving rise to what many refer to as the "New Age of Money." This new paradigm includes innovative financial instruments and systems, most notably cryptocurrencies, which have captured the imagination of millions and are poised to redefine the future of money.

A cryptocurrency is a digital or virtual currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

- A cryptocurrency is a form of digital asset based on a network that is distributed across a large number of computers. This decentralized structure allows them to exist outside the control of governments and central authorities.

- Some experts believe blockchain and related technologies will disrupt many industries, including finance and law.

- The advantages of cryptocurrencies include cheaper and faster money transfers and decentralized systems that do not collapse at a single point of failure.

- The disadvantages of cryptocurrencies include their price volatility, high energy consumption for mining activities, and use in criminal activities.

The Decline of Cash:

Traditional paper currency has been the primary medium of exchange for centuries, but its grip on our financial interactions is loosening. With the advent of digital payment systems, mobile wallets, and contactless cards, we are witnessing a gradual decline in the use of cash. Electronic payment methods offer speed, convenience, and enhanced security, reducing the need to carry physical currency.

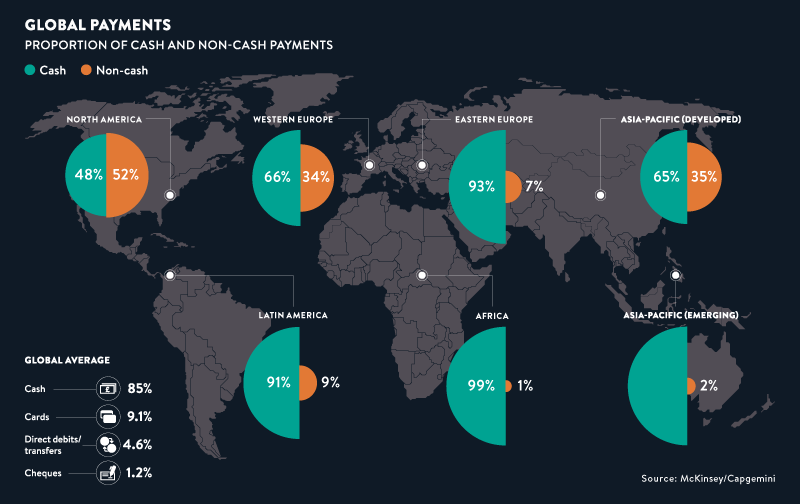

All of this makes for an interesting picture worldwide. As the following charts show, we are well on the way to a cashless world. But we are not there yet. Over half of North American transactions (52 per cent) were cashless in 2015, a higher proportion than any other global region. Asia-Pacific’s developed economies, with a 35 per cent cashless rate, and Western Europe at 34 per cent, are second and third on the list.

Over half of North American transactions (52 per cent) were cashless in 2015, a higher proportion than any other global region. Asia-Pacific’s developed economies, with a 35 per cent cashless rate, and Western Europe at 34 per cent, are second and third on the list.

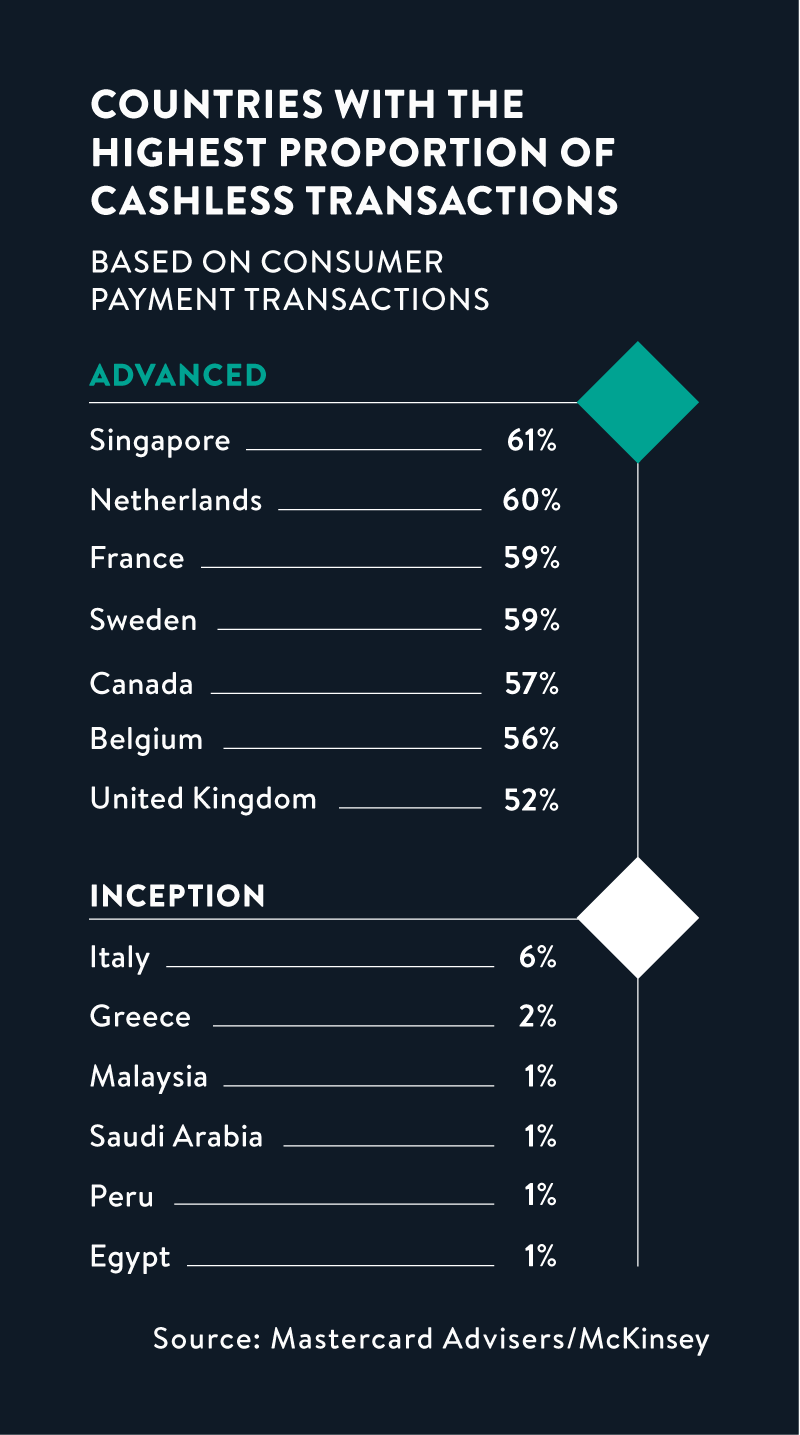

Across the rest of the world the picture is very different. There is not a single other region where more than one in 10 transactions is cash free. In Africa, the region most dependent on hard currency, only 1 per cent of transactions are cashless. Big differences exist between nations, too. Singapore boasts the highest cashless transaction rate of any country in the world (61 per cent), followed by the Netherlands (60 per cent), France and Sweden (both 59 per cent). The UK, where 52 per cent of transactions are cashless, is in 7th place.

Big differences exist between nations, too. Singapore boasts the highest cashless transaction rate of any country in the world (61 per cent), followed by the Netherlands (60 per cent), France and Sweden (both 59 per cent). The UK, where 52 per cent of transactions are cashless, is in 7th place.

The contrast with countries at the other end of the scale is a stark one. In Egypt, Peru, Saudi Arabia and Malaysia only around 1 per cent of all transactions do not involve cash.

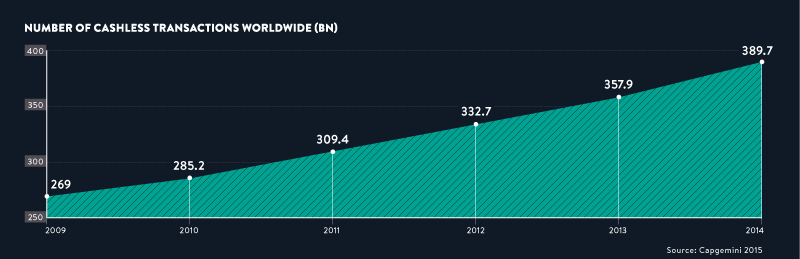

There are some notable European inclusions towards the bottom of the chart. Greece and Italy both remain heavily dependent on cash, with only 2 per cent and 6 per cent of consumer transactions in these countries cashless respectively. Between 2009 and 2014 the total value of cash-free transactions worldwide increased by almost half, from £269bn to £389.7bn, according to research by Capgemini.

Between 2009 and 2014 the total value of cash-free transactions worldwide increased by almost half, from £269bn to £389.7bn, according to research by Capgemini.

Increasing financial inclusion rates globally, widespread adoption of contactless cards and the spread of cashless mobile payment systems in developing and emerging economies mean this trend is predicted to accelerate.

For the moment, though, cash continues to be used in around 85 per cent of global consumer transactions. It may be on the decline, but it remains the most commonly used payment mechanism in the world.

The Rise of Cryptocurrencies:

At the forefront of the New Age of Money are cryptocurrencies. Bitcoin, introduced in 2009, paved the way for a decentralized, peer-to-peer electronic cash system. Since then, thousands of other cryptocurrencies have emerged, each with unique features and use cases. Cryptocurrencies operate on blockchain technology, a distributed and immutable ledger, which ensures transparency and security.

The last several years are characterized by the rapid rise of Bitcoin. Its rates achieved the highest ranks and provoked a powerful reaction in the market of virtual currencies (Andrianto & Diputra, 2018). Investors and coins owners acquired a potent tool to perform financial operations and guarantee particular stability. The given shift of priorities from traditional to innovative currencies also preconditioned the emergence of multiple debates regarding the future of this payment method and its use in deals. At the same time, the popularity and power of precious metals were doubted (Grier, 2014). However, the rise of Bitcoin was followed by its downfall as its price quickly became lower and created the ground for a new wave of discussions about the reliability of the coin and its ability to be used at the international level (Andrianto & Diputra, 2018). For this reason, there is the need for in-depth research of the given aspect with the primary aim to determine its potency, nature, and correlation with alternatives such as precious metals:

- Nevertheless, bitcoin is not the only virtual currency that is used in the modern world. There are also Ethereum, Dash, Litecoin, and Monero that are characterized by the ability to accumulate money and serve as the promising investment to monitor the state of the market and play on forex rates (Andrianto & Diputra, 2018).

- Therefore, at the moment, it is one of the most well-known coins because of the recent rise and shock caused by its blistering growth.

- However, precious metals trading has always been an alternative to innovative methods because of their traditionally high reliability and understandable character (Grier, 2014).

- Cogitating about the forces impacting both these options, researchers assume that they are vulnerable to similar processes happening within the market and stock (Andrianto & Diputra, 2018; Grier, 2014).

- For this reason, the need for an in-depth investigation of the current situation along with the analysis of the perspectives and problems associated with these cryptocurrencies becomes obvious.

Financial Inclusion and Accessibility:

One of the most promising aspects of the New Age of Money is its potential to foster financial inclusion. Traditional banking systems have left billions of people unbanked or underbanked, especially in developing countries. However, with the rise of digital wallets and cryptocurrency applications, individuals can access financial services with just a smartphone and an internet connection, bypassing the need for a brick-and-mortar bank.

Between 2011 and 2017 gender gap in account ownership remained stuck at 9 percentage points in developing countries, hindering women from being able to effectively control their financial lives. Countries with high mobile money account ownership had less gender inequality. The impact of the COVID-19 on this gender gap remains to be seen.

Since 2010, more than 55 countries have made commitments to financial inclusion, and more than 60 have either launched or are developing a national strategy. Countries that have achieved the most progress toward financial inclusion have:

- Policies delivered at scale, such as universal digital ID - India and Aadhaar / JDY accounts - more than 1.2 billion residents covered

- Leveraged government payments. (For example, 35% of adults in low income countries receiving a government payment opened their first financial account for this purpose.)

- Allowed mobile financial services to thrive. (For example, in Sub-Saharan Africa, mobile money account ownership rose from 12% to 21%.)

- Welcomed new business models, such as leveraging e-commerce data for financial inclusion

- Taking a strategic approach by developing a national financial inclusion strategy (NFIS) which bring together diverse stakeholders including financial regulators, telecommunications, competition and education ministries

- Paying attention to consumer protection and financial capability to promote responsible, sustainable financial services

When countries take a strategic approach and develop national financial inclusion strategies which bring together financial regulators, telecommunications, competition and education ministries, our research indicates that when countries institute a national financial inclusion strategy, they increase the pace and impact of reforms.

Borderless Transactions:

Cross-border transactions have long been associated with high fees and time-consuming processes. Cryptocurrencies offer a solution by enabling near-instantaneous, low-cost transactions across borders. This development has significant implications for businesses and individuals involved in international trade and remittances, reducing overhead costs and increasing the speed of settlements.

Cross-border payments have played a major role in keeping the world economy moving at a time of unprecedented turmoil. The first Borderless Payments Report from Mastercard helps us understand why consumers and small businesses send and receive money around the world, and how digital cross-border payment solutions have been a financial lifeline to many.

At a global level, key findings include:

- 38% of consumers are sending or receiving more cross-border payments than a year ago

- 62% are more reliant on online transfers

- 73% have sent money to support friends and family abroad

More than a quarter (26%) of respondents, including 57 percent of those in India and 43 percent of those in the U.S., said they regularly send more than half of their monthly income to another country, and 46% send more than a fifth of their salary abroad. The high value and importance of these transactions mean people need the cross-border payment services they use to be dependable and efficient, as well as secure.

- 38% of small businesses are sending or receiving more cross-border payments than a year ago

- 74% say cross-border payments have helped their business to survive

- 81% say using online cross-border payments had helped the business to grow

It has never been more important to help small businesses pay and get paid to help them weather the economic storm of COVID-19 and come out stronger on the other side. More than three quarters (76%) of small business respondents agreed the pandemic had forced them to look at new opportunities for the business globally, with 68% reportedly planning to do more international business than they had before.

Maintaining a safe, efficient and inclusive global economy will be essential for economic recovery and growth from the pandemic and beyond.

Financial Sovereignty and Control:

Centralized financial systems give governments and banks considerable control over individuals' funds. In contrast, cryptocurrencies empower users by providing financial sovereignty and ownership over their money. With private keys and wallets, individuals can manage their assets without relying on intermediaries, giving rise to the notion of self-custody.

Changing patterns in practices have also prompted some companies to position themselves between customers and traditional service providers in very specific segments in order to offer value-added services. This "re-intermediation" has given rise in Europe to a continuous adaptation of regulations in order to regulate and secure data sharing, which is the driving force behind open banking. This trend benefits both relatively small players (FinTechs) and technology giants whose business model is based on the monetisation of data (Gafams and BATX, whose entry into the European market is more recent).

These changes are the natural result of a process of creative iteration, and promise to simplify practices by diversifying them. Nevertheless, they have significant consequences for the structure of markets, with a substantial impact on our ability to impose and control our public policy choices regarding financial services, in particular in terms of legal, technological and operational certainty. For instance,

- which law is applicable, when the provision of services involves players established in different jurisdictions with sometimes contradictory legal requirements? The United States in particular is characterised by a broad definition of extraterritoriality. Besides the identification of the legal framework, there is also the question of the ability of a judicial authority to enforce the law, given the size of financial groups, the large number of intermediaries, or the location of their various activities.

- The digitisation of financial services also introduces a new form of dependence on physical (mobile phones and connected objects) as well as digital (search engines, mobile applications) entry points and on the non-European technology companies that control and dominate them. Yet, competition law, created in the 19th century in a period when the State took a stand on monopolies, is proving to be ill-equipped to deal with these technology companies.

- Lastly, the dematerialisation of activities, by increasing the number of interconnections and system entry points, makes them more vulnerable to potential "cyber-attacks" and to their use for money laundering and terrorist financing purposes, and makes them more dependent, to counter this, on non-European players who also operate outside the regulated financial sectors.

Challenges and Concerns:

Despite the excitement surrounding the New Age of Money, it is not without its challenges and concerns. Cryptocurrencies' volatility and the lack of regulatory clarity have raised eyebrows among traditional investors and policymakers. Additionally, the pseudonymous nature of some cryptocurrencies has led to concerns about their potential use in illicit activities.

In life, we all go through challenges and it’s either we face them or walk away from it. Growing up, people will always have different ways of handling things that happens in their life. We can’t know what could happen and how we handle it because life is unexpected. As I see it is that if you tend to keep making the same mistakes, you’ll never get passed your past and if you learn from all of your mistakes, you can move forward with your life. Everyone has faced their challenges in their own way and not everything in life will be easy because I can tell you right now that no one’s life is perfect. Everyone has their flaws, but they're perfect in their own way possible.

- The challenges I have gone through has made me the person I am today and has made me a stronger person mentally and physically.

- I’m more of an independent type of person because I’m not one to express my feelings to people I don’t trust or don’t know. I can tell my friends certain things, but when it comes to adults asking me about what’s going on in my life, I can’t open up to them.

- I feel anxiety every time an adult wants to talk to me because I don’t like to say what I’m going through or how I’m feeling.

- I’ll just tell them that everything is fine because I don’t want to be asked more or been told more about talking to someone about my problems.

The Evolution of Traditional Finance:

As cryptocurrencies gain traction, traditional financial institutions are taking notice. Major banks and investment firms are exploring ways to integrate digital assets into their offerings, recognizing the potential benefits of blockchain technology in streamlining processes and increasing efficiency.

There was a time when theoretical and empirical evidence seemed to suggest that conventional financial theories were reasonably successful at predicting and explaining certain types of economic events. Nonetheless, as time went on, academics in the financial and economic realms detected anomalies and behaviors which occurred in the real world but could not be explained by any available theories.

It became increasingly clear that conventional theories could explain certain “idealized” events—but that the real world was, in fact, a great deal more messy and disorganized, and that market participants frequently behave in ways that are irrational and thus difficult to predict according to those models.

Auditor: An auditor is someone tasked with ensuring accuracy in financial records. They may be employed by a company to analyze finances, or they may work for the government.

Banker: A commercial banker works with businesses to provide banking services such as accounts and loans. An investment banker is someone who focuses on companies looking to raise capital or conduct a sale or merger.

Capital manager: A capital management professional helps a company allocate its capital resources and balance them against its debts.

Lender: Someone who works in lending, such as a loan officer, manages the issuance of loans. For example, a mortgage lender works up contracts that secure a real estate loan.

Market analyst: Market analysts evaluate trends and make forecasts that account for changing market conditions, preparing recommendations that can guide a company's financial decisions.

Environmental Impact:

The energy-intensive nature of certain cryptocurrency mining processes has sparked debates about their environmental impact. As the world becomes more conscious of climate change, there is a growing demand for sustainable and eco-friendly blockchain solutions.

The New Age of Money represents a seismic shift in the way we perceive and utilize financial resources. While cryptocurrencies have captured the imagination of enthusiasts and early adopters, widespread adoption and regulatory clarity remain essential for their continued growth and integration into mainstream finance. As technology continues to advance, the financial landscape will undoubtedly undergo further transformations, opening up new possibilities for financial empowerment and inclusivity. Embracing this evolution responsibly will be the key to shaping a more equitable and efficient financial future for all.

- We live in a God-gifted world, but humans are the reason behind the deterioration of the environment. Everything that surrounds us constitutes the environment. The earth is made up of various environments in which all living and non-living things coexist. Nature’s biological, physical and natural forces interact to generate conditions that allow creatures to survive.

- The environment is a term used to describe such circumstances. A derivative of the word environment is the French word ‘environ,’ which means ‘to surround.’ The environment is made up of all biotic (living) and abiotic (non-living) things. Plants, animals, human beings, and insects are examples of biotic components. They are classified as biological environmental components.

- Every living thing has a predetermined life cycle. The human being, for example, is the most powerful living entity on the planet. To meet his needs, he requires plants and animals. Without these components, the life of human beings will be disordered. The atmosphere, lithosphere, hydrosphere, and biosphere are all examples of abiotic/physical components.

- The atmosphere is a gaseous layer containing nitrogen, oxygen, and other gases. The hydrosphere is made up of all the water bodies, such as rivers and oceans. The lithosphere is the earth’s solid outer shell. It is composed of the crust, covering the earth’s mantle, rocks, and soil.

- The biosphere, where life exists, is the most essential layer. There are ecosystems in the water, on land, and in the air.