Top Personal Finance Apps to Help You Save and Invest

Managing personal finances can be a daunting task, but technology has made it easier than ever to take control of your money. Personal finance apps are powerful tools that help you save, invest, and track your financial progress. With countless options available, choosing the right app can be overwhelming.

This article highlights the top personal finance apps that can help you streamline your savings and investment goals, offering insights into their features and benefits.

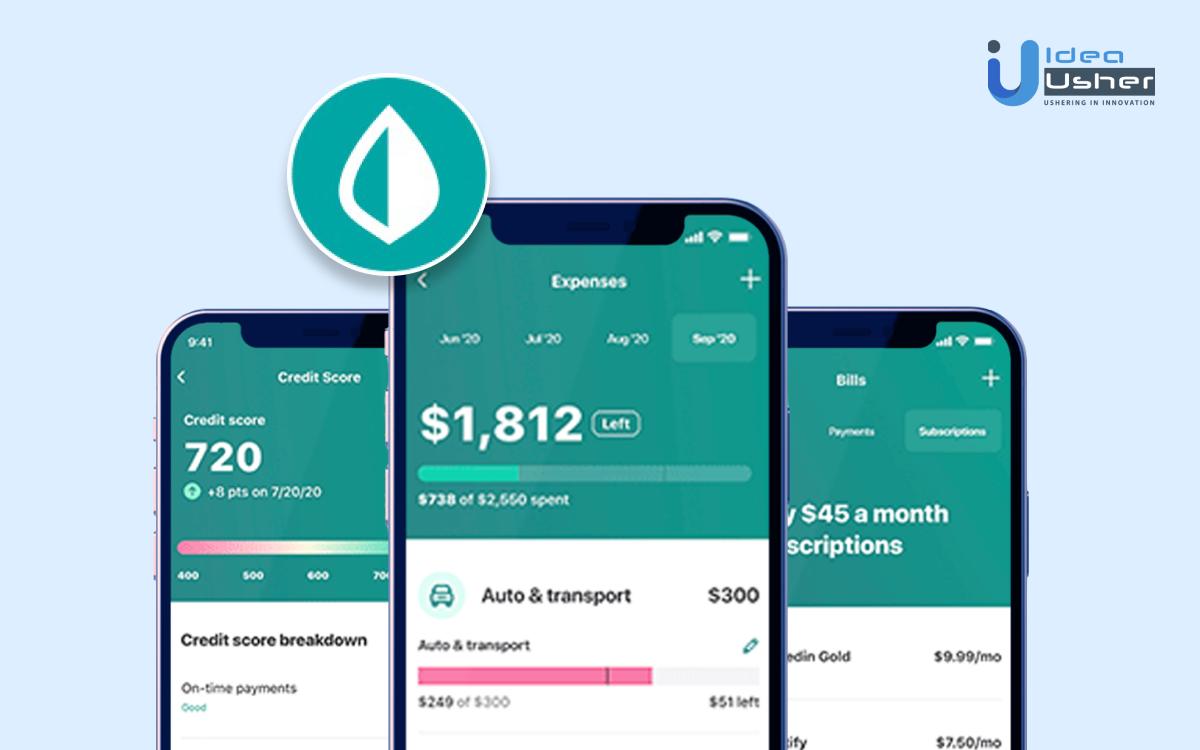

Mint: Comprehensive Financial Management

Mint is a highly popular personal finance app that provides a holistic view of your financial situation. Developed by Intuit, the makers of TurboTax and QuickBooks, Mint is designed to help you manage your money more efficiently.

Mint is a highly popular personal finance app that provides a holistic view of your financial situation. Developed by Intuit, the makers of TurboTax and QuickBooks, Mint is designed to help you manage your money more efficiently.

Key Features:

- Account Aggregation: Mint allows you to link all your bank accounts, credit cards, investments, and bills in one place. This feature provides a comprehensive overview of your finances, making it easier to track spending and manage budgets.

- Budgeting Tools: The app offers customizable budgeting tools that help you allocate funds to different categories. It tracks your spending in real-time and alerts you when you are nearing your budget limits.

- Bill Reminders: Mint sends reminders for upcoming bills, ensuring you never miss a payment. This feature helps you avoid late fees and maintain a good credit score.

- Credit Monitoring: Mint offers free credit score monitoring and provides tips on how to improve your score. It also alerts you to any significant changes in your credit report.

Pros:

- Free to use

- User-friendly interface

- Comprehensive financial tracking and budgeting tools

Cons:

- Advertisements and product promotions within the app

- Some users may have concerns about data privacy

YNAB (You Need A Budget): Proactive Budgeting

YNAB, short for You Need A Budget, is a personal finance app that focuses on proactive budgeting. It encourages users to assign every dollar a job, promoting intentional spending and saving.

YNAB, short for You Need A Budget, is a personal finance app that focuses on proactive budgeting. It encourages users to assign every dollar a job, promoting intentional spending and saving.

Key Features:

- Zero-Based Budgeting: YNAB uses a zero-based budgeting system, where every dollar you earn is allocated to a specific purpose. This method helps you plan for expenses, savings, and investments proactively.

- Goal Tracking: The app allows you to set and track financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. Progress bars help you visualize your progress towards these goals.

- Educational Resources: YNAB offers a wealth of educational resources, including webinars, workshops, and a supportive community. These resources help users improve their financial literacy and budgeting skills.

- Real-Time Syncing: The app syncs your budget in real-time across multiple devices, ensuring that you always have up-to-date information about your finances.

Pros:

- Focuses on proactive budgeting and goal setting

- Excellent educational resources and community support

- Real-time syncing across devices

Cons:

- Requires a subscription fee after a 34-day free trial

- May have a learning curve for new users

Acorns: Automated Investing

Acorns is an innovative app that simplifies investing by rounding up your everyday purchases and investing the spare change. It is ideal for beginners who want to start investing without the need for extensive financial knowledge.

Acorns is an innovative app that simplifies investing by rounding up your everyday purchases and investing the spare change. It is ideal for beginners who want to start investing without the need for extensive financial knowledge.

Key Features:

- Round-Ups: Acorns links to your bank account and rounds up your purchases to the nearest dollar, investing the spare change into a diversified portfolio. This automated approach makes investing effortless and accessible.

- Recurring Investments: The app allows you to set up recurring investments, enabling you to invest a fixed amount of money regularly. This feature helps you build a habit of investing and grow your portfolio over time.

- Found Money: Acorns partners with various brands that offer cash-back rewards when you shop with them. The rewards are automatically invested into your Acorns account.

- Educational Content: Acorns provides educational content through its Grow magazine, which offers articles and videos on personal finance and investing.

Pros:

- Easy and automated investing

- Low initial investment requirement

- Educational resources for novice investors

Cons:

- Charges a monthly fee, which may be high relative to small account balances

- Limited investment options and control over portfolio customization

Personal Capital: Wealth Management and Investment Tracking

Personal Capital is a robust financial app that combines budgeting and investment tracking. It is designed for individuals who want to manage their finances comprehensively and optimize their investment portfolios.

Key Features:

- Investment Tracking: Personal Capital offers detailed insights into your investment accounts, including asset allocation, portfolio performance, and investment fees. It helps you analyze your investments and make informed decisions.

- Net Worth Calculation: The app calculates your net worth by aggregating all your financial accounts, including bank accounts, credit cards, investments, and loans. This feature provides a clear picture of your financial health.

- Retirement Planner: Personal Capital includes a retirement planning tool that projects your future retirement income and expenses. It helps you assess whether you are on track to meet your retirement goals.

- Cash Flow Management: The app tracks your income and expenses, providing a comprehensive view of your cash flow. It categorizes your spending and helps you identify areas where you can save.

Pros:

- Comprehensive investment tracking and analysis

- Retirement planning tools

- Free to use for basic features

Cons:

- Some advanced features require a higher account balance

- Users may receive calls from financial advisors offering paid services

Conclusion

Choosing the right personal finance app can significantly enhance your ability to save and invest effectively. Mint, YNAB, Acorns, and Personal Capital each offer unique features tailored to different financial needs and goals. By leveraging these tools, you can gain better control over your finances, make informed investment decisions, and achieve your financial objectives.

Sources

Mint by Intuit

YNAB - You Need A Budget

Acorns

Personal Capital