KNOW ABOUT CBDC (BANK DIGITAL CURRENCY)

EVERYTHING YOU NEED TO KNOW ABOUT CBDC (CENTRAL BANK DIGITAL CURRENCY)

Ever since their birth in 2009, cryptocurrencies have continuously gained public interest. Due to their potential impact on the finance sector, individual investors and like-minded corporations have included this unconventional asset into their portfolios. As of December 2020, high activity among traders has caused BTCs price to surge to a staggering $53,219.33.

With COVID-19 forcing digital transformation across industries, digital payments are becoming the new standard. The world is transitioning from physical cash to digital currencies, and this places the spotlight on cryptocurrencies. However, the mass-adoption of crypto will still take some time since various technical concerns need to be addressed first.

But as more technologies and innovations in the finance sector are becoming available, cryptocurrency is finding ways to eventually be implemented across industries. One of the many things crypto enthusiasts look forward to is the introduction of Central Bank Digital Currencies (CBDC). Take a look at the guide below to learn more about CBDC’s core features.

Central Bank Digital Currencies – An Early State of Play and an Inevitability

Central Bank Digital Currencies (CBDCs) have the potential to be the most pervasive innovation in the digital and payments space which will fundamentally impact all participants in the global financial services industry. A Central Bank Digital Currency is an innovation in the form of money issued as well as the underlying infrastructure on which payments can be transacted.

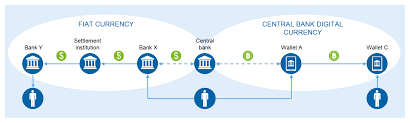

A CBDC is a digital payment instrument, denominated in the national unit of account, that is a direct liability of the Central Bank (BIS 2020, 3). It is the legal tender issued by the Central Bank in a digital form as a medium of exchange, store of value and unit of account. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency.

Currently, only commercial banks and certain permitted financial institutions can hold Central Bank money in the form of ‘reserves’ while the retail public can hold money issued by the Central Bank only in form of physical bank notes. In its electronic form, CBDCs have the potential to be widely used by wholesale financial institutions, households and businesses to store value and make payments in a more secure way.

With cash usage declining over most economies, CBDCs can play a role in maintaining and streamlining the Central Bank’s function of providing money, financial stability and ensuring continued access in a purely digital economy.

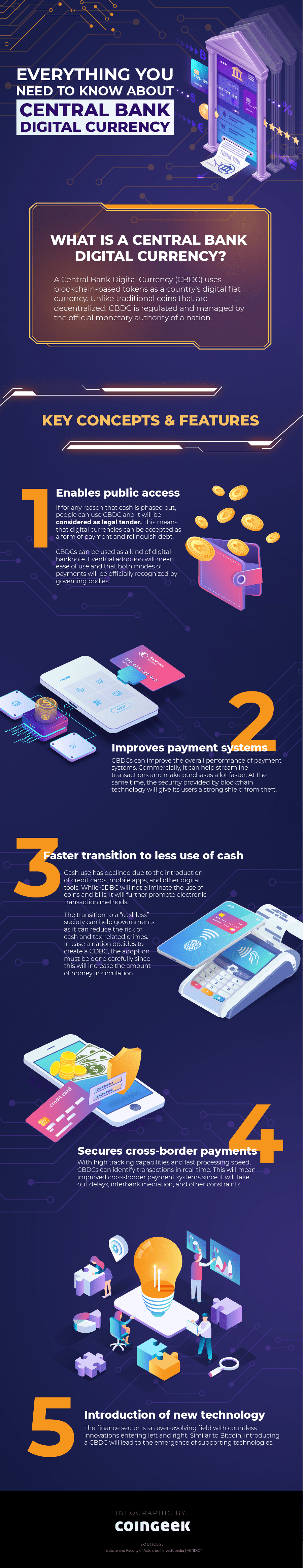

What is a Central Bank Digital Currency?

Over the past few years, cryptocurrencies have gained immense popularity. Since they’re free from the intervention of third-parties, it’s no surprise that they’ve garnered the attention of many. In turn, the public’s interest has caused crypto prices to surge, giving authorities a difficult time controlling its growth.

While cryptocurrency is showing a lot of potential, it’s not posing a real threat to traditional banking or financial systems. It can be used to underpin and improve the technologies which would make things transparent, traceable, and hold banks or governments accountable. On the other hand, technical issues and the constant launch of new coins also put the public at higher risk of scams and cyberattacks. To counter this dilemma, financial institutions from around the world have come together to discuss the idea of their own digital currencies.

Unlike traditional coins that are decentralized, a central bank digital currency (CBDC) is managed by the official monetary authority of a country. Like fiat, it has stored value and carries a unique serial number to prevent offenders from imitating them.

While governments have flirted with the idea of issuing a CBDC, no country has released it just yet. Full implementation would take some time, but it’s good to know what Central Bank Digital Currencies can bring to the table and to understand the potential impact of CBDCs.

Key Concepts and Features;

1. Enables public access

In case cash access is limited or suddenly phased out, it’s good to know that the public can easily access a CBDC. While it’s unlikely that cash use will be abolished entirely, CBDCs can also be used as a kind of digital banknote. Eventual adoption will mean ease of use and that both modes of payments are officially recognized by governing bodies.

2. Improves payment systems

CBDCs can improve the overall performance of payment systems. Streamlining to a digital platform will make transactions faster, guarantee user security, and cut money production costs.

Exchanging through a digital platform can also allow governments to remove low-denomination coins, like the penny in the United States. In April 2017, the Bank of Korea initiated a coinless society trial, allowing customers to receive change in prepaid cards instead of coins. This experiment has proved beneficial for the country, allowing it to save up to 53.7 billion Won on coin production.

While nothing is set in stone, the mainstream use of CBDCs can have a similar effect on a nation’s economy.

3. Faster transition to less use of cash

Cash use has significantly declined due to the introduction of credit cards, financial applications, and other digital tools. While a CBDC may not completely end the use of coins and bills, it will further promote electronic transactions. Both businesses and consumers can significantly benefit from this because digital exchanges provide increased convenience and security.

4. Secures cross-border payments

International transactions can be costly since manual data entry, interbank mediation, and other constraints can expose users to unwanted fees and settlement risk. Fortunately, a CBDC can eliminate time lags and other limitations thanks to its ability to identify transactions in real-time.

By reducing processing time and cutting costs, CBDCs can make cross-border payments more efficient.

5. Introduction of new technology

Now that we live in a fast-paced and technologically-advanced age, new technologies are constantly emerging. Similar to how Bitcoin and cryptocurrency have paved the way for advancements in the finance sector, the introduction of CBDC will inevitably bring about other innovations.

With the world gearing towards digitization, relevant agencies will need to find ways to support its use.

Why have central banks become interested in CBDCs?

Four trends have likely spurred central banks’ interest in CBDCs:

- Plummeting cash usage. In Europe, cash usage declined by one-third between 2014 and 2021. In Norway, only 3 percent of payment transactions are made with cash. This trend has forced central banks to reexamine their role in the monetary system.

- Growing interest in privately issued digital assets. In the United Kingdom, 10 percent of adults report holding or having held a digital asset, like cryptocurrency. The European Central Bank says that as many as 10 percent of households in six large EU countries own digital assets. Consumer use of digital assets can be viewed as a potential challenge to fiat currency as a unit of measurement for value.

- Decreasing sense of central banks as payments innovators. CBDCs offer central banks a new opportunity to lead strategic conversations on cash use cases in a public forum.

- Rising global payment systems. Many central banks seek to establish greater local governance over increasingly global payment systems. Central banks see CBDC as a potential stabilizing anchor of local digital payment systems.

There are potential benefits to establishing CBDCs, but they aren’t without risk. Read on to learn more.

How can various stakeholders prepare for the future of CBDCs?

It’s still too early to predict what the future holds for CBDCs. But despite the uncertainty, central banks can consider the following five questions:

- What’s the end game in adoption compared with traditional money? Business cases and scenarios should be based on assessments of the current and future payment landscape and realistic adoption goals.

- Which constituencies does the CBDC aim to address? Design choices should be based on the user segment: private citizens, commercial banks, or corporations. Decisions should be informed by expertise outside the traditional central-bank organizations.

- What role will the central bank play? Whether or not the central bank envisions itself as deeply involved, existing relationships with commercial banks and corporations should be used to achieve adoption goals.

- What resources and capabilities will be required? Central banks are likely to need new decision-making processes, new change management practices, and talent experienced in forging partnerships.

- What changes beyond payments will central banks need to enforce? Hurdles in regulation, commerce enablement, and fiscal rights will need to be overcome to achieve central banks’ adoption goals.

Final Takeaways

So far, no country has officially launched a CBDC. There are still various issues within the cryptocurrency industry that need to be addressed, and more research is required to predict its impact on the finance and banking sector.

The idea of CBDCs has gained traction, and many financial institutions have conducted studies to determine their overall usability. With the features mentioned above, consumers, brands, and authoritative agencies have a lot to be excited about. However, only time will determine what its economic and societal implications will be.

Are you relatively new to the cryptocurrency industry? We’ll help you find your way! If you’re looking for a comprehensive guide about Bitcoin for beginners, head over to our blog to get started!