Ripple and the Banks

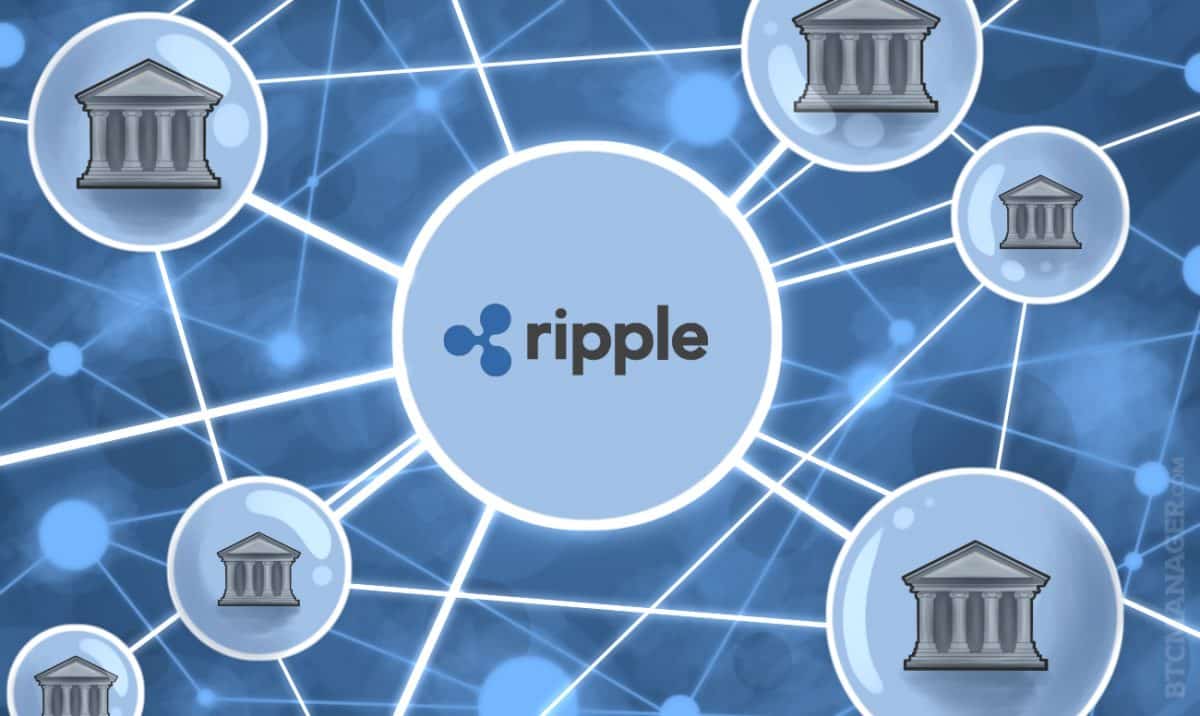

The advent of blockchain technology has fundamentally transformed the financial landscape, presenting both opportunities and challenges for traditional banking institutions. Among the various innovations in this space, Ripple has emerged as a significant player, offering a decentralized payment protocol designed to facilitate rapid cross-border transactions.

This article explores the relationship between Ripple and banks, examining the potential benefits, challenges, and the future of this collaboration.

Understanding Ripple's Technology

Ripple is not merely a cryptocurrency; it is a comprehensive payment platform that utilizes blockchain technology to enable seamless international money transfers. At its core, Ripple operates on a unique consensus algorithm that allows for instant transaction settlements, significantly reducing the time and cost associated with traditional banking methods.

Key Features of Ripple:

Speed: Transactions are confirmed in seconds, compared to the days required by conventional banking systems.

Cost Efficiency: Ripple reduces transaction fees, making it an attractive option for banks, especially for high-value transfers.

Scalability: The network can handle a high volume of transactions, addressing a critical need for banks operating on a global scale.

Ripple's technology is particularly appealing to banks that are looking to enhance their operational efficiency and improve customer service. By integrating Ripple's solutions, banks can streamline their payment processes and offer faster, more reliable services to their clients.

The Benefits of Ripple for Banks

The integration of Ripple's technology into banking systems presents numerous advantages, which can be categorized as follows:

Enhanced Transaction Speed:

Traditional cross-border transactions can take several days to settle due to the involvement of multiple intermediaries. Ripple's protocol allows for instantaneous settlements, enabling banks to provide real-time services to their customers.

Cost Reduction:

Transaction fees associated with international transfers can be exorbitant. Ripple's low-cost framework significantly reduces these fees, allowing banks to offer competitive pricing to their clients.

Increased Transparency:

Ripple's blockchain technology provides a transparent ledger of transactions, enhancing accountability and reducing the risk of fraud. Banks can leverage this transparency to build trust with their clients.

Global Reach:

Ripple's network connects various financial institutions worldwide, facilitating seamless cross-border transactions. This global reach is particularly beneficial for banks looking to expand their international operations.

Challenges and Considerations

Despite the numerous benefits, the adoption of Ripple's technology by banks is not without challenges. Several factors must be considered:

Regulatory Concerns:

The regulatory landscape surrounding cryptocurrencies and blockchain technology remains uncertain. Banks must navigate complex regulations to ensure compliance, which can hinder the swift adoption of Ripple's solutions.

Integration Issues:

Integrating new technologies into existing banking systems can be a daunting task. Banks may face technical challenges and resistance from employees accustomed to traditional methods.

Competition from Other Technologies:

Ripple is not the only player in the blockchain space. Other technologies, such as Stellar and SWIFT's GPI, also offer similar solutions. Banks must carefully evaluate their options to determine the best fit for their needs.

Trust and Security:

While blockchain technology is generally considered secure, banks must ensure that they maintain the highest standards of security to protect their customers' data and funds. Any breach of security could lead to reputational damage and loss of client trust.

The Future of Ripple and Banking Collaboration

As the financial industry continues to evolve, the collaboration between Ripple and banks is likely to deepen. Several trends and developments may shape this relationship in the coming years:

Increased Adoption:

As more banks recognize the benefits of Ripple's technology, adoption rates are expected to rise. This could lead to a more interconnected global banking system that leverages blockchain for efficiency.

Partnerships and Alliances:

The establishment of partnerships between Ripple and various financial institutions will likely expand. These collaborations can foster innovation and create new financial products that cater to the needs of a diverse clientele.

Focus on Financial Inclusion:

Ripple's technology has the potential to enhance financial inclusion by providing access to banking services for underserved populations. Banks may leverage Ripple to offer affordable and accessible financial solutions to individuals and businesses in developing regions.

Evolving Regulatory Framework:

As governments and regulatory bodies become more familiar with blockchain technology, clearer guidelines may emerge. This could pave the way for broader acceptance of Ripple and similar technologies within the banking sector.

The relationship between Ripple and banks represents a transformative shift in the financial industry. By embracing Ripple's innovative solutions, banks can enhance their operational efficiency, reduce costs, and improve customer service. However, they must also navigate the challenges associated with regulatory compliance and technological integration. As the landscape continues to evolve, the collaboration between Ripple and banks holds the promise of a more efficient, transparent, and inclusive financial future.

References

- Ripple: The Future of Cross-Border Payments

- How Ripple Works: A Comprehensive Guide

- The Advantages of Using Ripple for Banks

- Blockchain Technology in Banking: Opportunities and Challenges

- Understanding Ripple and Its Benefits for Banks

- The Role of Blockchain in Modern Banking

- Ripple's Impact on the Global Financial System

- Exploring the Future of Banking with Ripple

- The Regulatory Landscape for Ripple and Other Cryptocurrencies

- The Rise of Ripple: What It Means for Banks and Financial Institutions