Timing the Bull Super Cycle in 2024

Timing the Bull Super Cycle in 2024

YieldNest

In February 2021, I joined Ivan on Tech in an exclusive interview where I highlighted strategies around the optimal crypto exit plan for 2021. This included my price targets for the Bitcoin and Ethereum tops in the previous cycle (along with calculated strategies as to how I arrived at these conclusions), which proved to be accurate as the market reached its peak in April/May 2021, just a few months after the interview.My extensive industry experience, including history in DeFi and blockchain, has provided me with a solid foundation of knowledge to develop these types of intricate frameworks and strategies.I timed the market cycle top in 2021 and I’m ready to do it again with a similar model and strategy — today, I’m going to share my thoughts on this. But first, I’d like to share more background about myself.I’m an entrepreneur, investor and technologist and have been deeply involved in the crypto space since 2012, including roles in writing, development, research, market analysis, and everything in between when it comes to DeFi. I was also Co-Founder of the Curve Llama Risk Team and Fund Manager/partner supervising technical strategies at Cyber Capital and DeFi Capital. I have completed multiple courses and educational initiatives in DeFi. As you can see below, I have previously discussed the origins and future of DeFi. I believe this is fitting, and in this cycle, we will probably see this prediction fully realized through true vision.

Today, I’m Co-Founder of YieldNest, a liquid restaking protocol offering next generation ETH yield with isolated and tailored restaking strategies on EigenLayer. Let’s jump into my thoughts on the crypto market and where I think the next cycle top could be and opportunities you should be looking into to maximize your earning potential.

Where Will The Next Crypto Market Cycle Top Be?

With the Bitcoin halving here, we’ll likely witness a period of sideways movement across the crypto market, with a potential slow upward trajectory interspersed with sharp rises and flash crashes. Historically, the market tends to rally following a halving, typically with a six-month lag: https://charts.bitbo.io/halving-progress/

Many believe this Bitcoin halving will be different from previous events because of the earlier Bitcoin ATH (all-time highs) of around $73,000 from this year’s ETF inflows. However, I would like to make some observations for 2024–2025 when it comes to BTC and ETH.

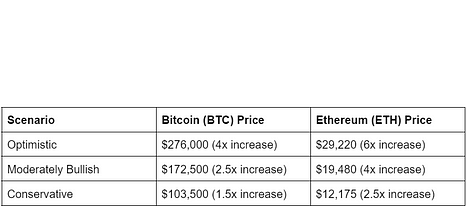

Source: https://charts.bitbo.io/cycle-repeat/When analyzing and overlaying previous data points with historical insights from other market bubbles, it’s completely possible that Bitcoin could reach a price of 4x past its all-time high, while Ethereum could reach a price of 6x past its all-time high:This means a potential cycle top would equate to around $276,000 and $28,000 for BTC and ETH, respectively. I admit that these are very optimistic numbers and this is not financial advice, but rather my opinion (make sure to DYOR) given past historical trends.Here’s a breakdown of my targets in various scenarios for these two tokens (recall that the 2021 ATH’s were $69,000 and $4,870 for BTC and ETH, respectively):

Altcoins And Potential Super Cycle?

Altcoins are expected to pump hard and overperform, but most will be completely wiped out (just as in previous crypto cycles), so it’s important to concentrate on assets that have the highest likelihood of not only surviving but also thriving. This cycle will likely see more mean reversion than before, with many new innovations on the horizon.

While a significant correction could follow these speculative highs, the expansion into new markets increasingly dependent on crypto and the influx of new capital suggests this cycle could very well be a ‘super cycle,’ potentially significantly surpassing previous expectations.In a super cycle, it’s important to understand and plan your exit strategy in order to maximize your yields.The table below outlines parameters around BTC’s market capitalization, which can be an indication that the market is exhausted and overhyped:

As a rule of thumb, for me, if 4 out of 5 of these parameters are achieved at the same time, it could be an optimal time to liquidate positions and take profits out of the market.Retaining liquidity during this potential super cycle will be even more important while keeping market exposure. That’s why Liquid Restaking will play a key role in clarifying value capture and actual revenue models in crypto and its core use cases (I’ll dive deeper into this below).

Follow the Smart Money: Utility-Driven DeFi Plays To Reign Supreme

In my opinion, this cycle won’t be driven by memecoin mania, low utility projects, and the like that we’ve seen in the past. I believe that the market has matured and will better understand the industries and sectors to where assets will flow — and that will be to real revenue generating DeFi projects.

We’re truly witnessing an evolution in the DeFi space and this cycle will be a massive turning point. More mature DeFi infrastructure is being built and will take off in adoption, and restaking will play a significant role in driving this movement.The reality is that the smart money is flowing into ETH. This also directly ties into YieldNest and what we’re building with liquid restaking on EigenLayer.

How YieldNest Can Maximize Returns On Your ETH This Cycle

The YieldNest protocol (after mainnet launch) will allow you to stake ETH to secure the Ethereum network and multiple AVSs (Actively Validated Services), all while earning Ethereum base layer and restaking rewards. Staking ETH with YieldNest also gives you a liquid restaking token (ynETH) to earn additional yield across supported DeFi protocols.

This means you can maximize your yield on ETH, and If ETH can reach any of the new ATH targets I’ve mentioned above, you’ll see your holdings multiply even further in value.Buying, holding, and restaking ETH now could be one of the most straightforward plays to achieve a 5–6x multiple on your investment this cycle and earn maximum yield — just sit back and enjoy the ride.You could also take a riskier path and gamble with other assets (where many could drop to 0). However, ETH will be the key play and most powerful infrastructure hub for DeFi — the smart money is already positioned.In my opinion, this is an opportunity for the ages.

Final Thoughts

Overall, I think there’s still enormous potential in the crypto markets and that Bitcoin and Ethereum will top out at much higher price targets. Focus on the models and strategies I’ve shared and ignore the noise.

Like I said before, keep it simple — stake3 and restake your ETH using YieldNest to multiply your ETH earnings. Then just enjoy the ride and stay vigilant for key sell targets using my strategy.I’m looking forward to the future of Ethereum DeFi, EigenLayer, and what YieldNest is bringing to the table.

READ MORE:

https://www.bulbapp.io/p/f070eae3-b0d5-4a32-ab85-f42b7e8c5113/introducing-ligertron-10-paving-the-way-for-ai-verification-and-ownership-at-scale

https://www.bulbapp.io/p/00606490-4f7e-4785-bab7-a1af99ef66b1/blockchain-and-the-insurance-industry

https://www.bulbapp.io/p/e38b2fe1-9d6d-4397-bbfa-a9855decc494/the-only-guide-you-need-for-real-estate-tokenization-tokenfi-is-already-betting-big-on-it

https://www.bulbapp.io/p/d9356a92-6936-4da0-891a-c7359dbb0fc3/a-beginners-guide-to-web3

https://www.bulbapp.io/p/cd6e55b4-b338-41d3-bb16-7af98c0ed63e/5-coins-to-buy-before-bitcoin-halving-2024

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)