Can Bitcoin Reach $50,000 Ahead of Spot ETF Decision?

Can Bitcoin Reach $50,000 Ahead of Spot ETF Decision?

The crypto markets experienced volatile hours throughout the week. After starting the year with an upward trend, Bitcoin made a move to break its sideways movement upward. However, negative speculation spread mid-week, somewhat denting the bullish sentiment.

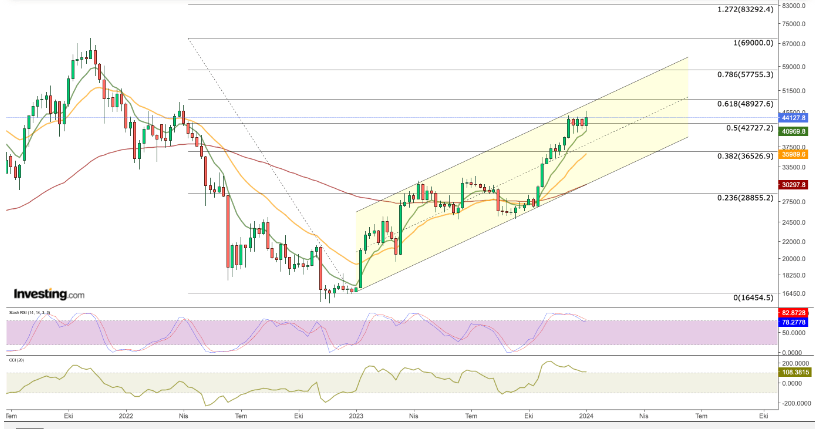

Bitcoin entered a rapid upward trend towards the end of 2023 with soaring expectations for ETFs. Throughout December, we observed the largest cryptocurrency starting to consolidate. As we entered 2024, just as a new upward surge seemed imminent, a report suggesting the SEC could reject spot ETFs postponed the upward trend.

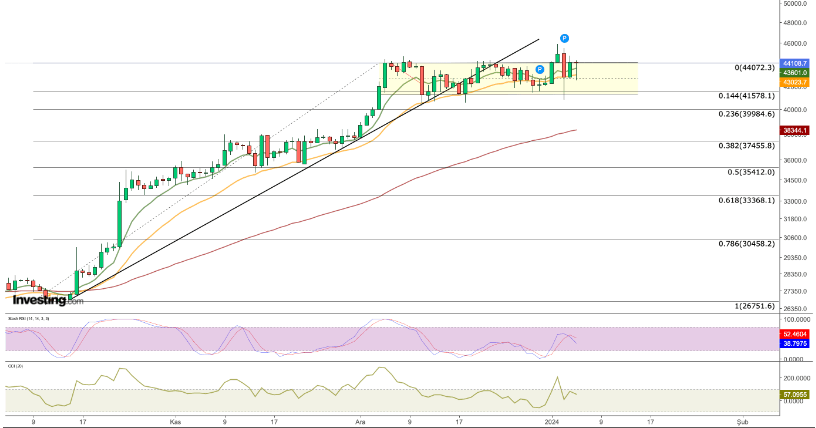

When we look at the daily chart, following Wednesday's drop, we witnessed a continuation towards the lower band of the sideways channel we've been tracking since December, which was met with buying interest at this point. This region, perceived as a buying opportunity, also acted as a significant support area in the latter half of December. Moreover, the short duration of the decline and the day's closure above the dynamic support of EMA-21, which has been supporting the recent uptrend, emerged as a significant sign for recovery.

The rebound movement after Wednesday's drop encouraged investors, prompting BTC to move towards the upper band of the horizontal channel. Today, in the early hours, while a retracement towards the middle band of the channel took place, demand remained lively in the lower zone.

For Bitcoin, the $44,100 level stands as the nearest resistance today, and if the cryptocurrency manages to break above this level by the weekend, it might reignite the upward movement paused earlier this week. While the short-term EMA value supports an upward trend in Bitcoin, the recent downward momentum has created a negative aspect in the Stochastic RSI. However, a move above $45,000, beyond the $44,100 resistance, could trigger a bullish signal in this indicator.

On the other hand, today's release of the Non-Farm Payrolls data could lead to volatile movements in Bitcoin's price. While the ADP Employment data released yesterday came in higher than expected, an NFP figure exceeding the estimated 170,000 jobs could exert pressure on risky markets. Employment surpassing expectations can be considered a significant indicator of the ongoing vitality of the US economy. Consequently, the Fed might signal a further delay in abandoning its tight monetary policy during this month's meeting, reducing expectations for an early 2024 interest rate cut. This might lead to a potential decrease in risk appetite, resulting in weakened demand for the cryptocurrency markets.

Nevertheless, crypto investors, particularly institutional players, are more focused on the SEC's decision regarding the ETF. Any potential delay or rejection could disrupt the bullish setup in Bitcoin. In such a scenario, breaking the support zone around $41,000 seems likely, potentially causing a drop to the range of $37,500 - $38,000 as the initial reaction.

The general market sentiment leans toward expecting a decision on the ETF approval window by January 10. Until this period, positive speculations could serve as catalysts for Bitcoin's upward movement. If employment data meets expectations, and no negative developments occur until the decision date, Bitcoin, after consolidating, might test the $50,000 region with a jump exceeding 10%.

However, it's crucial to note that on the weekly chart, the Stochastic RSI, which has been indicating overbought conditions for a prolonged period, shows a loss of momentum. This suggests a potential correction towards $38,000 before the cryptocurrency reaches its $50,000 target. This is indicated by the slowdown in momentum in the Stochastic RSI, which dipped below the overbought zone in the 2023 uptrend, aligning with a retracement movement towards the middle band of the rising channel. Hence, we can discuss the continued significance of the support zone at $41,000. However, depending on developments in the coming hours and days, we might witness an upward surge as long as buyers maintain Bitcoin above $44,000.

Thank you for reading.

If you liked my article, please don't hesitate to like and comment.

Additionally, you can check out my other articles:

https://www.bulbapp.io/p/392c0974-ff72-433c-9643-f26a1b6ce7b1/how-to-perform-the-cheapest-transactions-tx-on-zksync

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)