The Rise of Decentralized Finance (DeFi): How it’s Transforming Traditional Banking"**

**Introduction:**

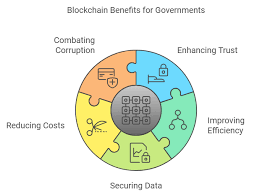

In recent years, decentralized finance (DeFi) has emerged as a groundbreaking innovation in the financial sector. By leveraging blockchain technology, DeFi aims to recreate traditional financial systems—such as lending, borrowing, and trading—in a decentralized manner. This shift has the potential to democratize financial services, making them more accessible and transparent.

**The Concept of DeFi:**

DeFi refers to a range of financial applications built on blockchain networks, primarily Ethereum. Unlike traditional banks and financial institutions, DeFi platforms operate without intermediaries, allowing users to engage directly with financial services. Smart contracts—self-executing contracts with terms written into code—enable these transactions, ensuring security and reducing the need for trust.

**Key DeFi Innovations:**

1. **Decentralized Exchanges (DEXs):** Platforms like Uniswap and SushiSwap allow users to trade cryptocurrencies directly with one another without a central authority, enhancing liquidity and reducing trading fees.

2. **Lending and Borrowing Platforms:** Services such as Aave and Compound enable users to lend their assets and earn interest or borrow against their holdings, all facilitated through smart contracts.

3. **Yield Farming and Staking:** Investors can earn rewards by providing liquidity or staking their assets, participating in protocols like Yearn.finance and Curve Finance.

**Impact on Traditional Banking:**

DeFi is challenging traditional banking by offering lower fees, greater transparency, and increased accessibility. Users from around the world can access financial services without the need for a traditional bank account or credit history. Additionally, the decentralized nature of DeFi reduces the risk of single points of failure and potential fraud associated with centralized systems.

**Challenges and Risks:**

Despite its potential, DeFi faces challenges such as regulatory uncertainty, smart contract vulnerabilities, and scalability issues. The technology is still in its early stages, and navigating these risks will be crucial for its long-term success.

**Future Outlook:**

As DeFi continues to evolve, it may drive significant changes in the financial landscape. The integration of decentralized finance with traditional systems could lead to a hybrid model, combining the best of both worlds. Innovations in blockchain technology and increased regulatory clarity will play key roles in shaping the future of DeFi.

**Conclusion:**

Decentralized finance is poised to revolutionize the financial industry, offering new opportunities and challenges. By understanding its potential and staying informed about developments, investors and users can better navigate the evolving landscape of DeFi.

---

Feel free to adjust or expand on any section based on your audience and the focus of your blog!