Tokenomics Unveiled: Understanding Its Impact on Token Pricing, Importance in the Crypto Market, and

Tokenomics, a portmanteau of "token" and "economics," plays a pivotal role in shaping the dynamics of the crypto market, influencing token pricing, and paving the way for a project's success. In this blog post, we'll delve into the essence of tokenomics, its significance in the cryptocurrency space, and essential considerations for evaluating the future valuation of a token.

Defining Tokenomics:

- Holistic Ecosystem Design:

Tokenomics refers to the economic system and principles governing a cryptocurrency or token. It encompasses the distribution, creation, and utilization of tokens within a blockchain ecosystem, reflecting the project's goals and values.

- Incentive Structures:

Tokenomics involves the design of incentive structures to align the interests of various stakeholders, including developers, investors, and users. Well-crafted tokenomics aims to create a self-sustaining and vibrant ecosystem.

Tokenomics and Token Pricing:

- Supply and Demand Dynamics:

The laws of supply and demand heavily influence token pricing. Tokenomics defines the total supply of tokens and their distribution mechanisms, impacting scarcity and, consequently, value.

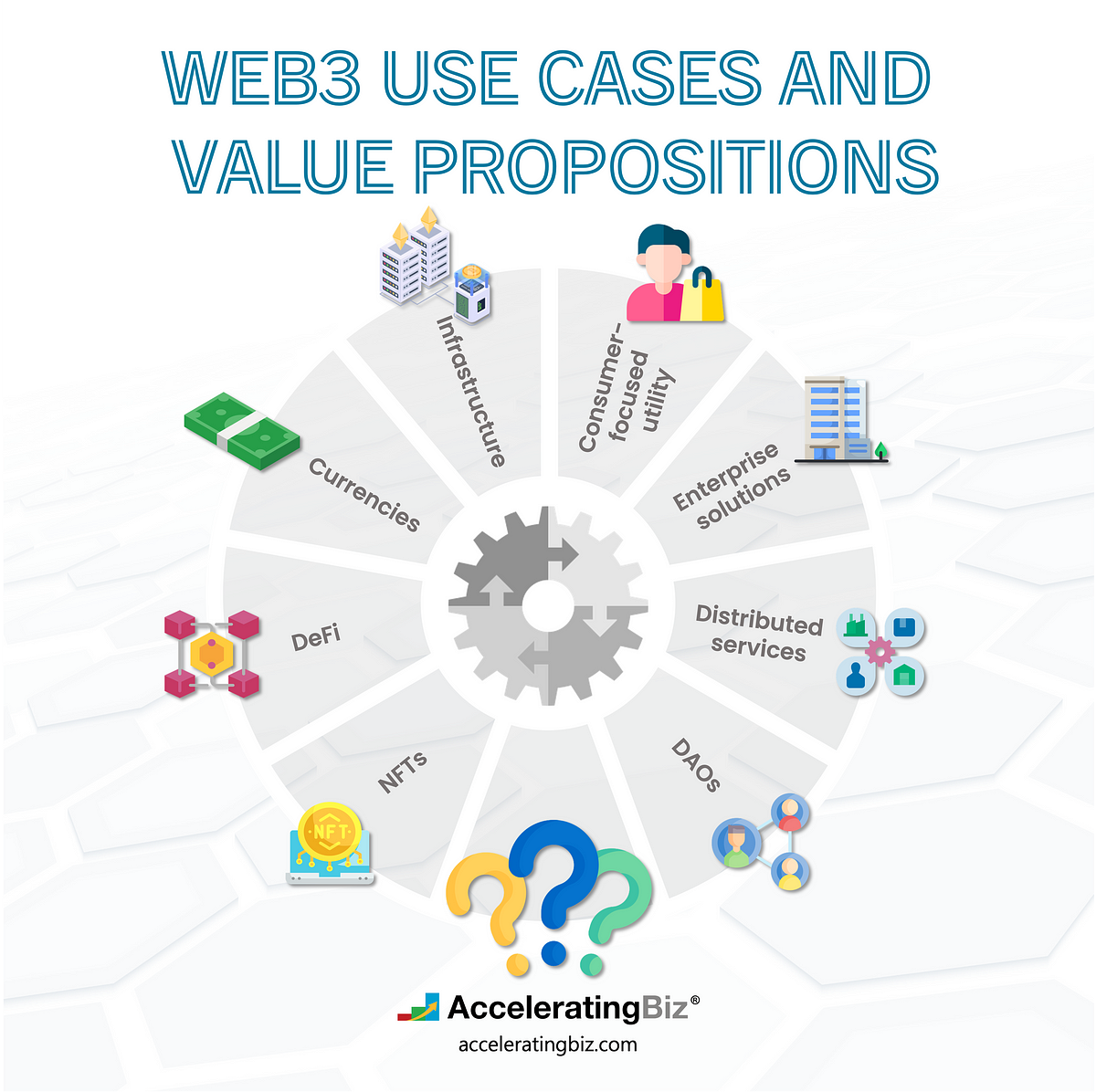

- Utility and Use Cases:

Tokenomics outlines the utility and use cases of a token within its ecosystem. The more integral a token is to the functioning of the platform or the more diverse its use cases, the higher its perceived value.

Importance of Tokenomics in the Crypto Market:

- Community Engagement:

Well-designed tokenomics can foster community engagement and participation. Token holders are more likely to actively contribute to the ecosystem if they see the token as a valuable and integral part of the project.

- Project Funding and Sustainability:

Tokenomics is often intertwined with initial coin offerings (ICOs) or token sales, providing a means for project funding. A sustainable tokenomics model ensures ongoing development and maintenance of the project.

- Governance and Decision-Making:

Tokenomics can define the governance structure of a blockchain project. Some tokens grant voting rights to holders, allowing them to participate in decision-making processes and shape the project's future.

Considerations for Future Token Valuation:

- Ecosystem Growth and Adoption:

A growing and active ecosystem indicates positive tokenomics. Projects with increasing adoption rates and expanding use cases are likely to experience upward pressure on token valuations.

- Token Burn Mechanisms:

Token burn mechanisms, where a portion of tokens is intentionally removed from circulation, can impact scarcity positively. However, the implementation and transparency of such mechanisms should be considered for their effectiveness.

- Regulatory Compliance:

The regulatory landscape can significantly influence token valuations. Projects adhering to regulatory guidelines and maintaining compliance are more likely to attract institutional investors and foster trust among the broader community.

Conclusion:

Tokenomics serves as the backbone of blockchain projects, influencing everything from token pricing to community engagement. As the crypto market continues to evolve, understanding the intricacies of tokenomics and paying attention to the factors that shape future valuations are essential for both investors and project developers. A well-designed tokenomics model can contribute not only to the success of a project but also to the sustainability and vibrancy of the broader cryptocurrency ecosystem.

![[LIVE] Engage2Earn: Veterans Affairs Labor repairs](https://cdn.bulbapp.io/frontend/images/1cbacfad-83d7-45aa-8b66-bde121dd44af/1)