The World’s Biggest Stock Markets, by Country

The World’s Biggest Stock Markets, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

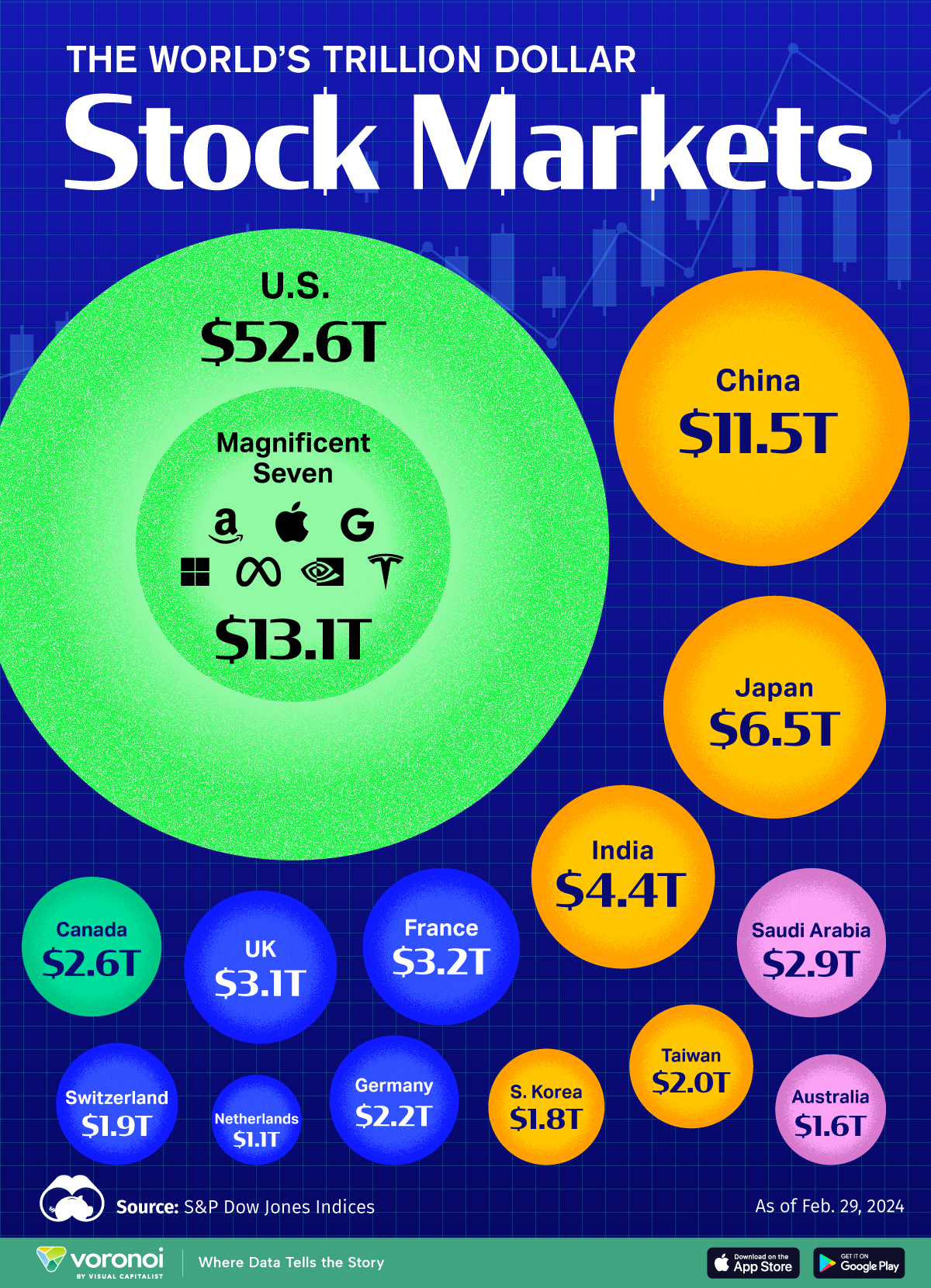

In this graphic, we’ve visualized the global market capitalization of stock markets by country, based on figures from S&P Dow Jones Indices. More specifically, this is based on the methodology of the S&P Global Broad Market Index (BMI), which captures over 14,000 stocks from developed and emerging markets.

As a point of reference, we’ve also illustrated the size of the “Magnificent Seven” stocks within the U.S. total.

The numbers we used to create this graphic are as of Feb. 29, 2024, and are listed in the table below. Only countries with stock markets of at least $1 trillion in capitalization were included.

Country (or group)Market Cap🇺🇸 U.S.$52.6TMagnificent Seven$13.1T🇨🇳 China$11.5T🇯🇵 Japan$6.5T🇮🇳 India$4.4T🇫🇷 France$3.2T🇬🇧 UK$3.1T🇸🇦 Saudi Arabia$2.9T🇨🇦 Canada$2.6T🇩🇪 Germany$2.2T🇹🇼 Taiwan$2.0T🇨🇭 Switzerland$1.9T🇰🇷 South Korea$1.8T🇦🇺 Australia$1.6T🇳🇱 Netherlands$1.1T

After the U.S., we can see that the three largest stock markets are all located in Asia.

India Climbs the Ranks

India’s total market capitalization rose above $4 trillion for the first time ever in early 2024, cementing the country as the world’s fourth largest equity market.

According to reporting from Bloomberg, the market capitalization of companies listed on Indian exchanges has grown by $1 trillion in under three years, making the country one of the best performing emerging markets.

Meanwhile, stock markets in China and Hong Kong have moved in the opposite direction, wiping out an estimated $6 trillion in valuation since their 2021 peak. The Hang Seng Index, Hong Kong’s primary stock index, has shrunk by more than 40% over the past five years.

Might of the Magnificent Seven

Although Tesla is down 28% YTD in 2024, the Magnificent Seven continues to dominate thanks to Nvidia’s rapid ascension into a $2 trillion company. Overall, the group accounts for roughly a quarter of the overall U.S. stock market.

MARKETS

The Top Performing Investment Themes of 2023

In 2023, several investment themes outperformed the S&P 500 by a wide margin. Here are the top performers—from blockchain to AI.Published 10 hours ago on March 14, 2024

By

Dorothy Neufeld

The Top Performing Investment Themes of 2023

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

While the S&P 500 rebounded over 24% in 2023, many investment themes soared even higher.

In many ways, the year was defined by breakthrough announcements in AI and the resurgence of Bitcoin. At the same time, investors looked to nuclear energy ETFs thanks to nuclear’s growing role as a low carbon energy source and the war in Ukraine.

This graphic shows the best performing investment themes last year, based on data from Trackinsight.

Blockchain ETFs Lead the Pack

With 82% returns, blockchain ETFs outperformed all other themes in the U.S. due to the sharp rise in the bitcoin price over the year.

These ETFs hold mainly bitcoin mining firms, since ETFs investing directly in bitcoin were not yet approved by regulators in 2023. However, as of January 2024, U.S. regulators have approved 11 spot bitcoin ETFs for trading, which drew in $10 billion in assets in their first 20 days alone.

Below, we show the top performing themes across U.S. ETFs in 2023:

Theme2023 PerformanceBlockchain82%Next Generation Internet80%Metaverse59%FinTech54%Nuclear Energy50%Cloud Computing49%AI/Big Data49%Gig Economy48%Digital Infrastructure & Connectivity43%As we can see, next generation internet ETFs—which include companies focused on the internet of things and new payment methods—also boomed.

Meanwhile, nuclear energy ETFs had a banner year as uranium prices hit 15-year highs. Investor optimism for nuclear power is part of a wider trend of reactivating nuclear power plants globally in the push towards decarbonizing the energy supply. In fact, 63 new reactors across countries including Japan, Türkiye, and China are planned for construction amid higher global demand.

With 49% returns, AI and big data ETFs were another top performing investment theme. Driving these returns were companies like chipmaker Nvidia, whose share price jumped by 239% in 2023 thanks to its technology being fundamental to powering AI models.

Top Investment Themes, by Net Flows

Here are the the investment themes that saw the highest net flows over the year:

Theme2023 Net FlowsRobotics & Automation$1,303MNuclear Energy$997MAI/Big Data$987MGlobal Infrastructure$734MNet Zero 2050$716MBlockchain$357MCannabis & Psychedelics$270MEmerging Markets Consumer Growth$203MOverall, ETFs focused on robotics and automation saw the greatest net flows amid wider deployment of these technologies across factories, healthcare, and transportation actvities.

The success of AI large language models over the year is another key factor in powering robotics capabilities. For instance, Microsoft is planning to build a robot powered by ChatGPT that provides it with higher context awareness of certain tasks.

Like robotics and automation, AI and big data, along with blockchain ETFs attracted high inflows.

Interestingly, ETFs surrounding emerging markets consumer growth saw strong inflows thanks to an expanding middle class across countries like India and China spurring potential growth opportunities. In 2024, 113 million people are projected to join the global middle class, seen mainly across countries in Asia.

Will Current Trends Continue in 2024?

So far, many of these investment themes have continued to see positive momentum including blockchain and next generation internet ETFs.

In many cases, these investment themes cover broad, underlying trends that have the potential to reshape sectors and industries. Going further, select investment themes have often defined each decade thanks to factors like technological disruption, geopolitics, and the economic environment.

While several factors could impact their performance—such as a global downturn or a second wave of inflation—it remains to be seen if investor demand will carry through the year and beyond.

SUBSCRIBE

Join the 375,000+ subscribers who receive our daily email

Sign Up

POPULAR

- TECHNOLOGY

- 5 days ago

- Visualizing iPhone 15 Production by Manufacturer in 2023

- CULTURE

- 2 weeks ago

- The World’s Most Popular Religions

- POPULATION

- 2 weeks ago

- Mapped: North America Population Patterns by Density

- MONEY

- 2 weeks ago

- Mapping Credit Card Delinquency Rates in the U.S. by State

- AUTOMOTIVE

- 1 week ago

- What are America’s Most Disappointing Cars in 2024?

- AFRICA

- 1 week ago

- Mapped: Breaking Down the $3 Trillion African Economy by Country

- MONEY

- 1 week ago

- Wealth Needed to Join the Top 1%, by Country

- STOCKS

- 1 week ago

- Ranked: South Korea’s Largest Companies by Market Capitalization

- ABOUT

- SUBSCRIBE

- VC+

- MASTHEAD

- PRESS CENTER

- CAREERS

- CONTACT US

- FREQUENTLY ASKED QUESTIONS

- STORE

- USE OUR VISUALIZATIONS

- LICENSING

- ADVERTISE

Copyright © 2024 Visual Capitalist

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)