As stablecoins gain greater traction, what's next for crypto's 'killer use case?

In recent years, stablecoins have emerged as one of the most successful applications of blockchain technology, gaining significant traction across both the public and private sectors. With a total market size of $177 billion and global transactions surpassing $5.1 trillion in just the first half of the year, stablecoins have solidified their position as the “killer use case” for crypto, according to analysts.

The increasing stablecoins growth is set to impact industries, governments, and investors alike, as they become a critical player in the financial ecosystem.

Stablecoins: From Niche Product to Global Use Case

Stablecoins are digital assets designed to maintain a consistent value, typically pegged to a stable currency such as the U.S. dollar. Unlike volatile cryptocurrencies like Bitcoin and Ethereum, stablecoins provide a safe medium for users looking for the benefits of blockchain without exposure to the dramatic price fluctuations that plague most crypto assets.

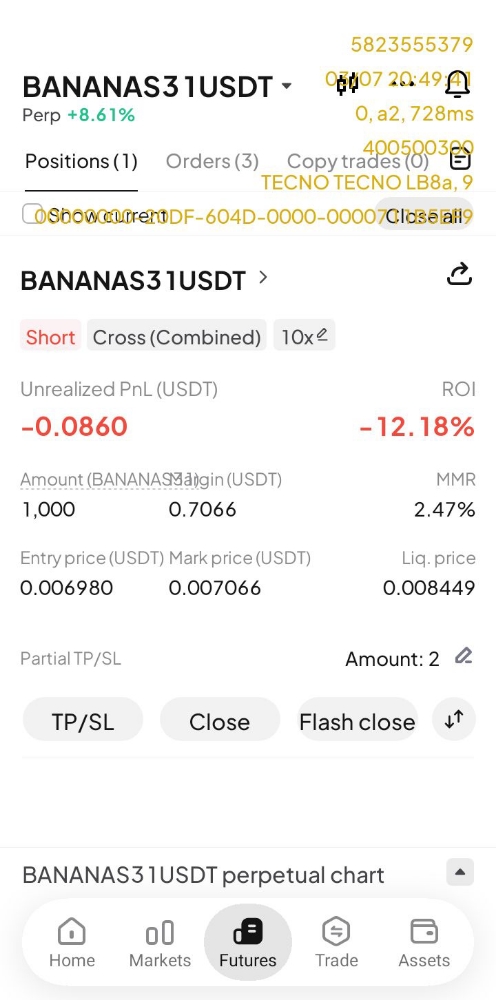

Analysts at Bitwise, a crypto asset management firm, highlighted that stablecoins have now reached a level of adoption comparable to major payment networks. “Stablecoins generated more than $5.1 trillion worth of global transactions in the first half of this year alone,” said Juan Leon and Ari Bookman from Bitwise, “That's nearly on par with Visa’s $6.5 trillion over the same period.” These figures demonstrate that stablecoins have found product-market fit, offering advantages in cross-border payments, liquidity, and integration with global

businesses. Stablecoin transactions. Image: Bitwise.

Stablecoin transactions. Image: Bitwise.

Companies like PayPal, Ripple, and Robinhood have already launched their own stablecoins, marking a significant shift toward mainstream acceptance. Just recently, Stripe made waves by acquiring stablecoin API firm Bridge for $1.1 billion. This acquisition, the largest in crypto history, underlines the legitimacy of stablecoins and their critical role in integrating blockchain into traditional payment systems.

Stablecoins and U.S. Treasuries: A New Financial Powerhouse

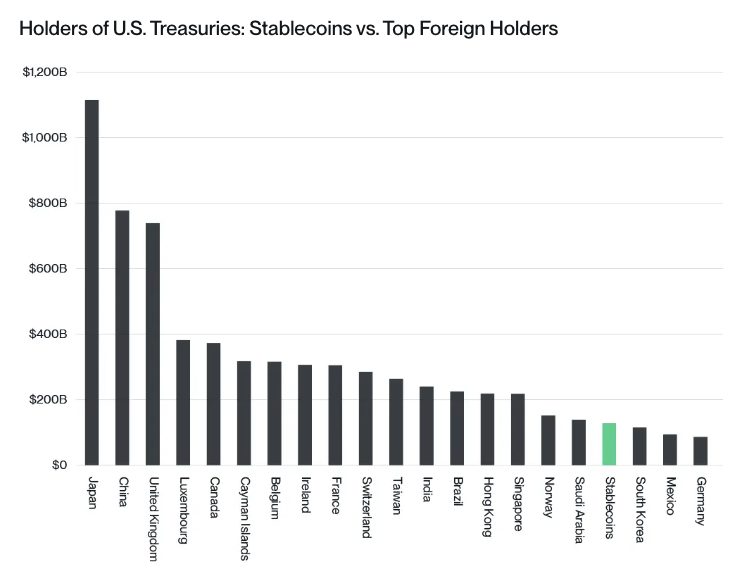

Stablecoins are no longer just an innovation for the crypto sector—they are becoming important players in the global financial system. In fact, the largest stablecoins have become one of the top holders of U.S. Treasuries, surpassing even some G20 nations. “The top five stablecoins now hold more U.S. Treasuries than countries like South Korea and Germany,” noted Bitwise’s report. This is significant for several reasons, not least of which is the liquidity they provide to the U.S. Treasury market, a key pillar of the global financial system. Holders of U.S. Treasuries: Stablecoins vs. top foreign holders. Image: Bitwise.

Holders of U.S. Treasuries: Stablecoins vs. top foreign holders. Image: Bitwise.

The business model for stablecoin issuers, like Tether and Circle, is simple yet highly profitable. These issuers take in fiat currency from users in exchange for stablecoins, and then use those reserves to purchase U.S. Treasuries or other high-yield assets. This strategy allows issuers to earn significant interest, with some like Tether even reporting higher profits than established asset management giants like BlackRock.

Gautam Chhugani, Bernstein’s digital asset lead, emphasized the broader implications: “Stablecoins provide U.S. dollar savings access to international users, and they are the cheapest cross-border payment rails. They’re becoming systemically important.” As stablecoins become more integrated into global businesses, the demand for U.S. debt will likely continue to rise, further entrenching stablecoins in the global financial ecosystem.

Investment Opportunities and Future Growth

Despite their appeal as a financial instrument, stablecoins are not designed to generate direct returns for investors. Their value is pegged to fiat currencies, meaning that they don’t inherently appreciate in value. However, there are still ample investment opportunities linked to the growth of stablecoins.

For instance, companies like Circle, which issues USD Coin (USDC), are positioning themselves for public listings. Circle confidentially filed for an IPO in January, signaling that investors may soon have direct exposure to the stablecoin market through public stock offerings. Likewise, Visa and PayPal are rapidly integrating stablecoins into their operations, making them potential beneficiaries of the stablecoins growth.

The Bitwise report suggests that stablecoins could even rival money market funds in the future if issuers decide to distribute interest from their Treasury reserves to users. “If interest-bearing stablecoins were approved at scale, they could challenge money market funds, which represent a $6.3 trillion industry,” the analysts noted. This would open up a new frontier of competition in traditional finance, attracting financial advisors and institutional investors to stablecoins as part of diversified portfolios.

Additionally, stablecoins are heavily tied to the Ethereum network, where much of their transaction activity takes place. As the use of stablecoins increases, so does the demand for Ethereum, indirectly boosting the price of ether (ETH). This symbiotic relationship could prove to be another investment opportunity for those looking to capitalize on the continued growth of both stablecoins and blockchain infrastructure.

Regulatory Framework and the Road Ahead

As the stablecoin market expands, discussions around regulation are becoming more frequent. Governments are starting to recognize the potential and the risks associated with widespread adoption of stablecoins, prompting debates at the highest levels. In the U.S., Congress has been actively working on legislation that would bring greater clarity and oversight to the market.

While stablecoins are still a relatively small portion of the overall liquid deposits in the U.S. (approximately 1% of an $18 trillion market), their rapid growth has caught the attention of lawmakers. The approval of interest-bearing stablecoins or a comprehensive regulatory framework could unlock even greater potential, further accelerating the stablecoins growth.

As global corporations and financial institutions increasingly adopt stablecoins for cross-border payments and other financial services, the technology is poised for continued expansion. The business model is too compelling to ignore, and as more companies integrate stablecoins into their operations, the market will likely see new innovations that enhance usability and accessibility.

Conclusion

Stablecoins have successfully found their place as one of the most dominant applications of blockchain technology. With global transactions exceeding $5 trillion and major corporations integrating stablecoins into their operations, they are on track to become a cornerstone of the financial system. The stablecoins growth story is far from over, with new investment opportunities, regulatory developments, and innovations on the horizon. As stablecoins evolve and expand, their influence on global finance will continue to grow, offering exciting possibilities for businesses, investors, and consumers alike.

Reference Link To Original Source Article

https://www.theblock.co/post/322421/stablecoins-crypto-killer-use-case