What is a Vampire Attack in Crypto?

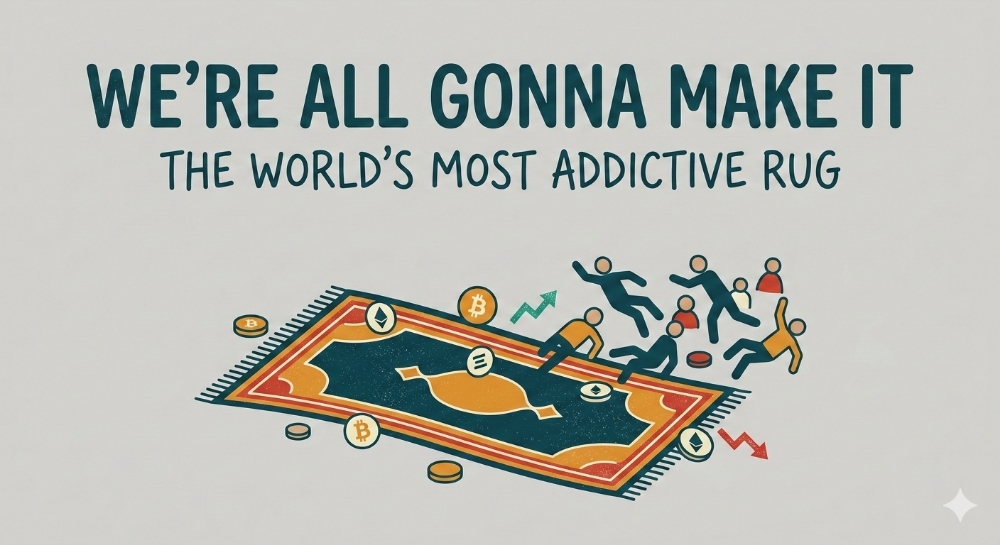

With Halloween on the horizon, the term "Vampire Attack" takes on a unique meaning in the realm of decentralized finance (DeFi). A vampire attack in DeFi refers to a strategic maneuver where one protocol attempts to lure users, especially liquidity providers (LPs), away from an established platform by offering more lucrative incentives. This aggressive strategy aims to drain the liquidity of the original platform, effectively “siphoning” its resources, much like a vampire.

Common targets for vampire attacks include decentralized exchanges (DEXs), automated market makers (AMMs), non-fungible token (NFT) marketplaces, and yield farming platforms.

The goal is to attract LPs by promising better rewards, such as higher returns through native tokens or more favorable staking conditions. In essence, a vampire attack is designed to weaken a rival while strengthening the attacking platform’s liquidity.

How Does a Vampire Attack Work?

A vampire attack in DeFi typically relies on three key mechanisms: liquidity migration, token incentives, and aggressive marketing. These tactics, when combined, can effectively shift large amounts of liquidity from one platform to another.

Liquidity Migration

Liquidity migration is at the core of a vampire attack. In DeFi, users supply liquidity to DEXs to earn trading fees. When a vampire attack occurs, a new platform incentivizes LPs to migrate their liquidity, effectively draining the original platform’s liquidity pool. This shift causes a “drain” on the original platform, leading to lower liquidity, higher trading costs, and reduced efficiency.

Token Incentives

To entice liquidity providers, the attacking platform often offers high-yielding native tokens. This method is crucial for attracting LPs who are seeking better returns. For example, in 2020, SushiSwap launched a vampire attack against Uniswap by offering its SUSHI token as an additional incentive to LPs who migrated their assets. This resulted in a significant migration of liquidity from Uniswap to SushiSwap, enabling the latter to grow rapidly.

Aggressive Marketing

Marketing plays a critical role in the success of a vampire attack. The new platform often emphasizes its higher rewards and better returns to create excitement and attract liquidity providers. This includes promotions on social media, community engagement, and the use of influencers to spread the word about the new platform's benefits. By creating a buzz, the attacking platform can persuade users to switch over, further exacerbating the drain on the victim platform.

The SushiSwap vs. Uniswap Example

One of the most well-known instances of a vampire attack occurred in 2020 between two DEXs: SushiSwap and Uniswap. SushiSwap, a fork of Uniswap, implemented a vampire attack to lure liquidity away from its predecessor. By offering SUSHI tokens as additional rewards to liquidity providers who migrated their assets from Uniswap, SushiSwap successfully attracted a significant amount of liquidity in a short period.

This move allowed SushiSwap to gain rapid prominence in the DeFi ecosystem. As a result, Uniswap faced a substantial reduction in its total value locked (TVL). However, Uniswap responded by launching its own governance token, UNI, which helped the platform regain some of its lost liquidity and re-establish its competitive position.

Impact of a Vampire Attack on DeFi Platforms

Vampire attacks can have profound impacts on both the victim and the attacking platform. Understanding these effects is crucial for assessing the long-term implications of such strategies in the DeFi market.

Impact on the Victim Platform

Loss of Liquidity: The most immediate effect of a vampire attack on the victim platform is a sharp decline in liquidity. As LPs migrate their funds to the competing platform, the victim loses the liquidity needed to facilitate efficient trading. This can result in increased slippage, higher trading costs, and reduced trading activity, making the platform less attractive to users.

Reduced Competitiveness: A decline in liquidity can severely affect a platform’s competitiveness. With less liquidity available, the platform may struggle to maintain low trading fees and competitive rates. As a result, it could lose market share to other platforms offering better conditions. Additionally, a diminished user base can tarnish the platform's reputation, making it more challenging to attract new users and regain liquidity.

Potential Downward Spiral: If the victim platform fails to respond effectively, it may enter a downward spiral. As liquidity and user activity decline, the platform’s value proposition weakens, leading to further withdrawals and reduced interest from the DeFi community. This cycle can be difficult to reverse without substantial changes to incentives and community engagement.

Impact on the Attacking Platform

Initial Liquidity Surge: For the attacking platform, a successful vampire attack often results in a significant initial boost in liquidity. This influx can improve trading volume, increase the platform’s visibility, and help it gain traction among DeFi users. The surge in liquidity can position the platform as a formidable competitor, especially if it can sustain its momentum.

Challenges in Sustainability

However, the long-term success of a vampire attack depends on the attacking platform’s ability to retain liquidity. If the platform’s reward structure becomes unsustainable or if it fails to provide long-term value to users, the influx of liquidity may be short-lived. Liquidity providers may choose to move their assets back to more stable options, leaving the attacking platform vulnerable to the same fate it inflicted on its predecessor.

Reputational Risks

Engaging in a vampire attack can also carry reputational risks. Some DeFi users view such strategies as overly aggressive and unethical, which can impact the platform’s image. Building trust with the community is essential for long-term growth, and a negative perception could hinder the attacking platform's ability to attract loyal users in the future.

How DeFi Platforms Defend Against Vampire Attacks

Given the potential risks posed by vampire attacks, many DeFi platforms have developed strategies to defend against them and maintain their user base. Here are some of the most effective methods:

Enhanced Incentives for Loyalty

Platforms can counter vampire attacks by offering their own competitive rewards and loyalty programs. This may include boosting native token rewards, creating exclusive staking opportunities, or offering airdrops to long-term liquidity providers. By adjusting incentives based on market conditions, platforms can retain their liquidity providers and reduce the appeal of migrating to a new competitor.

Community-Driven Governance

Strong community engagement is a key defense mechanism against vampire attacks. By fostering a sense of ownership and involving users in governance decisions, platforms can build a loyal user base that is less likely to switch to another platform. Platforms that prioritize transparency and user engagement are often better equipped to weather liquidity challenges.

Innovative Features

Differentiating a platform through unique features and offerings can also help defend against liquidity drain. For instance, platforms might integrate with new blockchains, introduce innovative yield farming options, or offer more sophisticated trading tools. By providing a richer ecosystem, platforms can become more than just venues for liquidity provision, making them harder to replace.

Ethical and Legal Considerations

Vampire attacks raise important ethical questions within the DeFi community. While competition can drive innovation, some argue that vampire attacks undermine the collaborative spirit that DeFi aims to foster. The act of draining liquidity from an established platform can be perceived as a zero-sum game that harms the ecosystem's overall stability.

Moreover, there are potential legal concerns related to unfair competition and market manipulation, though these are often difficult to address due to the decentralized nature of the industry. As DeFi continues to grow, the balance between fostering innovation and maintaining fair competition will be a critical consideration for the community.

Vampire attacks highlight the competitive and fast-paced nature of the DeFi ecosystem. While these strategies can help new platforms gain traction, they also pose challenges to market stability and ethical considerations. Platforms that adapt with better incentives, community engagement, and innovative features are more likely to thrive in this dynamic environment.