Hindsight - Saving the Luna coin crash

Do Kwon is the founder of Terra Luna ecosystem of Defi (in the below photo). He must be a smart man to build business with a market cap of $45 billlion at age 31 only.

Hindsight, I guess maybe he is not so smart, I thought he could have saved the blockchain with the following swift actions.

1. Increase the gas fee for selling Luna or UST to 50% during the attack, that is Increase the transaction costs of the attackers. This post a great risk and transaction cost to the attackers who were shorting Luna and UST. And use this gas fees to compensate innocent users who were caught on the cross fire. This has a historical success when the Hong Kong government defended the HKD/USD peg during the Asian Financial crisis 1997 by increasing the interbank rate to 365% pa. This scared off Soros and others; who were shorting the HKD; with that kind of borrowing costs, and successfully defended the HKD/USD peg.

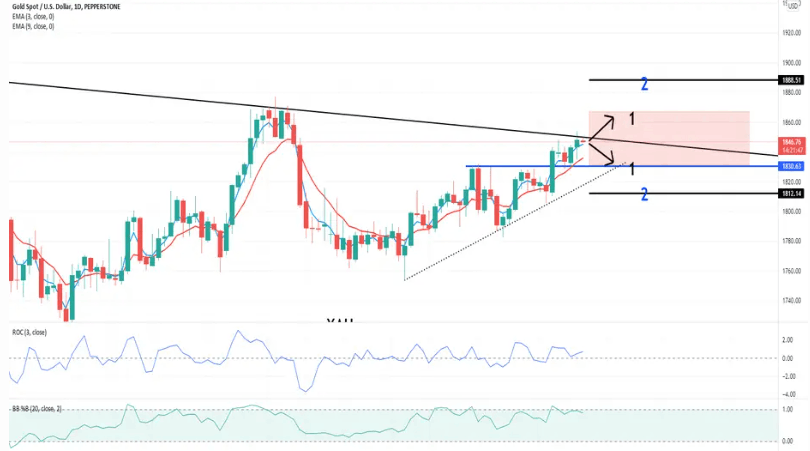

2. Do Kwon spent the entire reserves of Luna Foundation Guard of 80,000 bitcoins on buying back the Luna and UST during the attack, but ofc that all went into the incinerator like a Woofffff, while allow the ALGO Burn/Mint mechanism to mint 6.5 Trillion extra Luna coins, and the hyperinflation caused Luna coin to drop to almost zero at $0.00000112 with market cap of only $7 million. Hindsight, he could have held back the 80,000 bitcoins reserve until Luna was at an absolute bottom price and then start to buy back, this would have created a tsunami wave of buying pressure to push the price back up. The bought back Luna coins by the reserves could be burnt to further stabilize the price.

It may be that he is too smart and has been behind this rug pull. It may be he is too young for this kind of leadership. He has been heavily criticised in social media for not handling the crisis with urgency and transparency. Now he is doing a hard fork of the Luna blockchain and start all over again. Fool me once shame on you...Fool me twice shame on me.

Foot note:

Over 1000 investors in Anchor Protocol lost all their money with the Luna/UTS crash. Many put their life time savings into the UST (supposed to be a stable coin) for 20% APY return. One guy with 4 kids in social media said he put in $US1.5 millions into UST and thought that he had achieved financial freedom with $300k pa income. He exited with only $250K left. Not only that, the entire Crypto market was sold down by the incident and still lingers. And it has ramifications for the Defi industries with possible regulations introduction.