Over $158 Million in Solana (SOL) Mysteriously Moved to Coinbase

Massive transfers of Solana (SOL) to Coinbase have crypto community on edge

News Cover image via www.freepik.com

Cover image via www.freepik.com

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Read U.TODAY on

Google News

In an unexpected flurry of activity, over $158 million worth of Solana (SOL) was transferred to Coinbase, one of the most popular cryptocurrency exchanges. The crypto community was alerted to this significant event by Whale Alert, a well-known service that tracks large cryptocurrency transactions. Through a series of tweets, Whale Alert detailed the transfer of large amounts of SOL from unidentified wallets to Coinbase.

The transactions took place in quick succession, with the first involving 201,629 SOL, valued at approximately $39.6 million. This was immediately followed by a second transfer of 201,629 SOL, valued at $39.6 million. The third transaction saw a slightly lesser amount of 201,174 SOL being moved, worth around $39.5 million, while the final tweet reported a transfer of 202,279 SOL, valued at approximately $39.7 million.

Implications for Solana

Some speculate that this could be the action of a major investor or a collective of investors aiming to consolidate their holdings on Coinbase, potentially in preparation for sales. Others see it as a strategic move, possibly leveraging Coinbase’s liquidity for large-scale investment strategies or OTC deals that typically remain off the radar of the general market.

Meanwhile, the implications of these transactions for Solana and the broader market are still unfolding. Should SOL move to Coinbase be sold, it could introduce significant sell pressure on the market, potentially affecting Solana’s price negatively. However, if these movements are part of a larger strategic plan that does not involve selling on the open market, the immediate impact on Solana’s price might be negligible.

The timing of these transactions is particularly noteworthy, given the recent bullish trend in Solana's price. At the time of the transfers, SOL was trading at $196.96, showing a slight increase of 0.22% in the last 24 hours. However, over the last month, SOL has experienced a remarkable surge of 46.92%. Additionally, the 24-hour trading volume of Solana has seen a significant increase, up 51.51%, and currently stands at $3.27 billion.

#Solana News#Solana

About the author

With over three years of immersive experience in the crypto industry, Mushumir is a seasoned crypto writer dedicated to unraveling the complexities of blockchain technology and decentralized finance. From dissecting the latest blockchain innovations to demystifying trading strategies, he brings a unique blend of technical insight and communicative flair to the crypto space. Having penned countless articles, analyses, and market reports, Mushumir has developed a distinctive voice that resonates with both seasoned investors and crypto newcomers alike.

Solana (SOL) Institutional Appeal Skyrockets as Grayscale Solana Trust Surges

Cover image via www.freepik.com

Cover image via www.freepik.com

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Read U.TODAY on

Google News

The Grayscale Solana Trust (GSOL) has seen its value surge to unprecedented levels, signaling bullish sentiment toward Solana (SOL) among institutional investors. The enthusiasm for Solana investment products reached a new peak as Nic Puckrin, CEO and cofounder of The Coin Bureau, highlighted the astonishing premium that GSOL shares are trading at compared to the actual spot price of SOL.

According to a recent tweet by Puckrin, GSOL is trading at a remarkable $433, whereas Grayscale’s February fact sheet reveals that each share of the trust holds approximately 0.377 SOL. This indicates a premium of 5.8 times over the spot price, which was reported at $1,148, showcasing overwhelming institutional demand for Solana.

Institutional demand for $SOL investment products is crazy!

The Grayscale Solana Trust (GSOL) trades at $433.

However, according to their Feb factsheet, each share holds about 0.377 SOL.

This implies a 5.8x premium over spot (price of $1,148) 🤯 pic.twitter.com/A8yzuIu8rU

— Nic (@nicrypto) April 1, 2024

Solana's institutional appeal surges

The phenomenon of GSOL trading at such a high premium is reflective of the broader trend of growing institutional interest in cryptocurrencies as legitimate investment vehicles. Institutions are increasingly looking to digital assets like Solana, which offer not only significant growth potential but also diversification benefits for investment portfolios.

The premium on GSOL shares indicates a willingness among institutional investors to pay more than the current market price for direct exposure to SOL, underscoring their bullish outlook on the asset's future performance. This surge in institutional appeal is not just a flash in the pan but is backed by the solid performance of Solana in the crypto market.

The digital currency has been on a bullish trend, with its current trading price at $197.02, marking a slight increase of 0.15% in the last 24 hours and a significant jump of 45.25% over the past month. Additionally, the trading volume for SOL has spiked by 45.81%, reaching $3,198,145,736, further evidencing growing interest and liquidity on the market for Solana.

Solana, known for its high throughput and fast transaction times, has emerged as a strong contender in the blockchain space, attracting developers and investors alike. Its performance, both in terms of price and technological advancements, has made it a focal point for those looking to invest in the digital asset market.

Whales sent over 806k SOL to Coinbase following drop below $200

Data shows that whales have sent a massive amount of Solana (SOL) to the Coinbase exchange as the asset falls below the $200 mark.

Data shows that whales have sent a massive amount of Solana (SOL) to the Coinbase exchange as the asset falls below the $200 mark.

According to data from Whale Alert, four whale addresses sent a total of 806,711 SOL tokens — worth $158.86 million at the time of writing — to Coinbase at around 09:00 UTC on April 1.

The large whale movements come as the Solana price falls below the $200 mark in the middle of bearish market sentiment.

You might also like::

Dogecoin up by 20% this week ahead of ‘Doge Day’

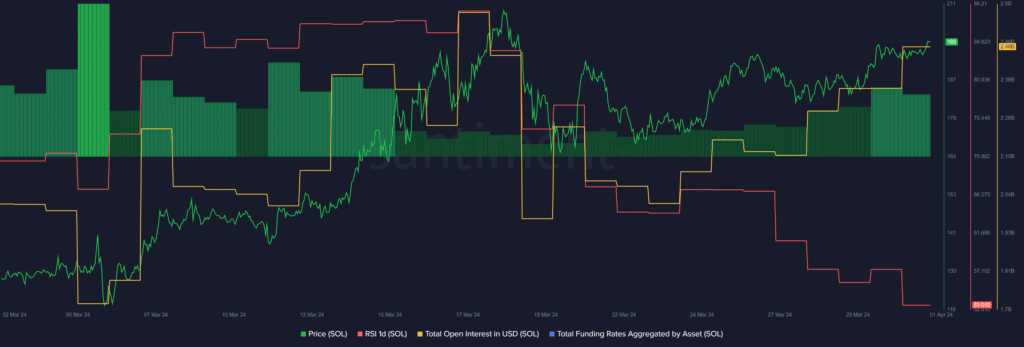

SOL is up by 0.14% in the past 24 hours and is trading at $197 at the time of writing. The asset’s market cap stands at $87.6 billion, slightly above BNB’s $87.4 billion market value. Solana’s daily trading volume recorded a 45% surge, reaching $3.1 billion. SOL price, RSI, open interest and funding rate – April 1 | Source: Santiment

SOL price, RSI, open interest and funding rate – April 1 | Source: Santiment

Notably, SOL briefly touched a local high of $204 at 01:35 UTC on April 1 for the first time in two weeks.

According to data provided by Santiment, Solana’s total open interest (OI) increased by $120 million over the past day — rising from $2.36 billion to $2.48 billion. Higher OI usually leads to higher price volatility since liquidations could happen at any moment.

The amount of traders betting on a further price hike for SOL has also slipped. Per Santiment, the total funding rate aggregated by Solana fell from 0.06% to 0.05% in the past 24 hours.

This shows that the amount of short trading contracts has slightly increased.

On the other hand, Santiment data shows that the SOL Relative Strength Index (RSI) plunged to 53 for the first time since Feb. 28. The indicator shows that the heat around Solana has cooled down, and the asset could potentially enter another accumulation phase.

For Solana to maintain its bullish momentum, its RSI would need to stay below the 60 mark.

Read more:

Top cryptocurrencies to watch this week: BTC, SHIB, ORDI

Best Cryptos For Passive Income: Algotech (ALGT) Profit Share Outshines Solana (SOL) And Curve (CRV) With 1200% Potential

Table Of Contents

- Solana's strong rebound in the crypto markets

- Curve: Revolutionizing decentralized finance (DeFi) with stablecoin trading

- Algotech emerges as top crypto presale of 2024, raises $3 Million in record Time

Algotech (ALGT) has been making waves in the DeFi space recently, with its innovative approach to decentralized finance (DeFi) solutions.

While established players like Solana (SOL) and Curve (CRV) have dominated the market, Algotech appears to be carving its own niche, attracting attention with its unique features and potential for significant growth.

Let's take a closer look at Algotech and how it stacks up against these DeFi giants.

Solana's Strong Rebound In The Crypto Markets

Following a notable downturn last week, the cryptocurrency markets are showing signs of recovery, with Bitcoin (BTC) surpassing the $70,000 mark once again. Among the top 10 digital currencies by market capitalization, Solana (SOL) has emerged as one of the standout performers, recording significant gains over the past 24 hours.

Solana has experienced a noteworthy 4.7% increase from its recent lows during the sell-off. According to CoinMarketCap data, SOL surged from $165 to $190, further bolstering its rebound from the weekend.

Despite these gains, analysts caution that Solana may be approaching a critical zone. Indicators like the average directional index (ADX) and relative strength index (RSI) suggest the possibility of a correction or even a reversal in trend.

Beyond its role as a cryptocurrency, Solana plays a pivotal role as a foundational platform for various sectors including DeFi, NFTs, blockchain gaming, and the metaverse.

Despite short-term uncertainties, future price predictions for Solana remain optimistic, with forecasts suggesting it could reach between $250 to $300 by 2024. This bullish outlook is driven by positive market momentum and sentiment.

Curve: Revolutionizing Decentralized Finance (DeFi) With Stablecoin Trading

CRV is a decentralized exchange designed specifically for stablecoins, employing an automated market maker (AMM) to manage liquidity.

Launched in January 2020, Curve has become synonymous with the DeFi phenomenon, experiencing significant growth.

Since its official launch Curve DAO has steadily gained traction in the crypto market, driven by its innovative network and the Curve.fi concept.

While initially a newcomer to the industry, Curve DAO's rank has risen to #106 among the top virtual currencies. However, the CRV coin has yet to establish a compelling chart for investors and traders.

In March, CRV emerged as a market leader, experiencing significant gains of over 18.4%, driven by increased on-chain developments. The project's focus on reducing slippage for DeFi users and providing access to liquidity pools contributed to its success.

Analysts foresee CRV's bullish momentum to persist, especially given the current trend. With ongoing positive developments, the project could potentially reach $1 by 2024.

Algotech Emerges As Top Crypto Presale Of 2024, Raises $3 Million In Record Time

Algotech (ALGT) has secured its position as the premier presale project of 2024 by raising an impressive $3 million in under three weeks. Traders are flocking to join the platform, enticed by its array of exciting features, including breakout detection, hedging, and mean reversion.

Furthermore, Algotech (ALGT) offers enticing perks to early adopters, such as governance rights and a share of profits from trading fees. Users can also engage in social trading, allowing them to share their gains with their social circles.

Anticipation is high, driving up demand for the ALGT token. Analysts predict a 10x surge in price upon its exchange listing, bolstered by deflationary tokenomics, setting it apart from competitors.

Investors are eager to seize the opportunity to invest in Algotech at its current price of $0.06 before it rises to $0.08 in the next round. Analysts speculate that once Algotech is listed on mainstream exchanges, its price could potentially soar to $1, making it a promising investment opportunity.

For further details about Algotech:

Visit Algotech Presale

Join The Algotech Community

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Solana Stablecoin Usage Surpasses Ethereum – SOL Price Still Rejected at $200

Solana stablecoin usage dominates over Ethereum but its price isn't displaying strength.

Solana stablecoin usage dominates over Ethereum but its price isn't displaying strength.

- Solana stablecoin trading overtakes Ethereum’s significantly.

- SOL struggles at $200, faces potential downturn.

- MEV bots drive Solana’s trading volume surge.

In a remarkable turn of events, Solana‘s network has seen its stablecoin trading volumes soar past Ethereum’s. Despite this monumental achievement, Solana’s native token, SOL, faced a setback, struggling to break through the $200 resistance level.

After attempting to go above $200 today, April 1, we saw a rejection, causing a 5% fall to $194. Should this continue, SOL could go down further.

Stablecoin Trading on Solana Surpassing Ethereum

Recent data from Artemis reveals a significant surge in stablecoin trading on the Solana network, surpassing Ethereum’s activity throughout most of March. Beginning March 9, the disparity in daily trading volumes between the two blockchains widened. Solana’s volume peaked at $97.5 billion on March 30, notably higher than Ethereum’s $9.3 billion.

The gap reached its zenith on March 28, when Solana’s trading volume reached $112.9 billion, over five times Ethereum’s $17.6 billion. This activity positions Solana as the dominant player, accounting for over 80% of the market’s stablecoin trading volume. Artemis attributes this massive volume primarily to the operation of MEV (maximum extractable value) bots and transactions on Phoenix, a decentralized crypto exchange active on Solana. MEV bots, designed to exploit profit-making opportunities by scanning the blockchain for lucrative transactions, have been particularly active on Solana.

Artemis attributes this massive volume primarily to the operation of MEV (maximum extractable value) bots and transactions on Phoenix, a decentralized crypto exchange active on Solana. MEV bots, designed to exploit profit-making opportunities by scanning the blockchain for lucrative transactions, have been particularly active on Solana.

Solana (SOL) Price Analysis

On March 18, the price of SOL reached a high of $210. Shortly after, it fell to $162 on March 20, decreasing by 21%. We saw a recovery from there. The price went on to form an ascending triangle, with April 1’s high of $200 being an interaction with its resistance. As resistance was present, a rejection sent the price of SOL back to the level where the last upward move started. This is an early sign of weakness. The wave structure suggests the completion of an ending diagonal, meaning it could face a more significant downside.

As resistance was present, a rejection sent the price of SOL back to the level where the last upward move started. This is an early sign of weakness. The wave structure suggests the completion of an ending diagonal, meaning it could face a more significant downside.

The ascending triangle is wave five out of a higher degree five-wave impulse. If SOL makes a breakout below the ascending support, that will signal that it is headed for a lower low than on March 20.

Our first target would be the same length as the previous downfall, which is $160. However, if this is the start of a more significant downtrend, the 1.618 Fibonacci extension target at $130 would look more suitable.

Disclaimers

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)