Real World Assets: Blockchain's Gateway to Tangible Value

Introduction:

The rapidly evolving technology in the crypto world is now extending beyond digital assets to focus on real-world assets. In this context, "Real World Assets" (RWA) signifies the unique opportunities blockchain technology provides for tokenizing physical assets. This article explores what RWA is, how it works, and its potential future impact.

1. What is RWA?

Real World Assets (RWA) are digital tokens representing physical assets such as real estate, industrial machinery, and artworks. The reliability and transparency of blockchain enable the secure digitization and trade of these assets. 2. Tokenization and RWA:

2. Tokenization and RWA:

RWA refers to the process of tokenizing assets. This process involves creating a digital representation of an asset and trading that representation via a token on the blockchain. This provides the potential for liquidity not seen in traditional financial systems.

3. Impacts on the Financial World:

The impact of RWA on the financial world could be substantial, particularly in creating a more global and accessible investment environment beyond the limitations of traditional finance. This could mean more opportunities for small investors and a broader range of assets for large investors.

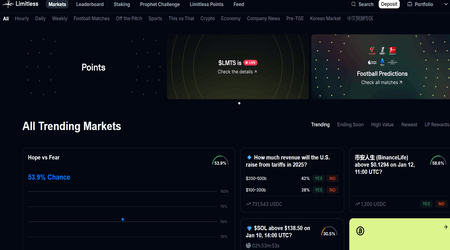

Real World Assets are often associated with DeFi (Decentralized Finance) projects. Asset tokenization allows DeFi to introduce new and innovative products based on real assets, potentially accelerating the expansion and diversification of DeFi.

5. Legal and Regulatory Challenges:

The adoption of RWA may face legal and regulatory challenges. Differences in regulations across countries and uncertainties regarding the tokenization of physical assets could limit growth in this field.

6. Example Use Cases:

This section will focus on practical applications of RWA, spanning from the real estate sector to the art market, industrial assets, and agriculture, showcasing how RWA is implemented across various industries.

The future potential of Real World Assets is substantial. As more assets get tokenized, further research and development are expected on how this technology could change economic balances worldwide and integrate with financial systems.

8. Sustainability and RWA:

RWA can contribute to sustainability efforts. Tokenizing assets like green energy projects, organic farming areas, or environmentally friendly industrial assets can provide investors with opportunities to engage in sustainability-focused projects.

9. Technological Challenges and Progress:

Alongside the development of blockchain technology, RWA must overcome technological challenges. Progress in areas such as scalability, security, and user-friendly interfaces could enable RWA to reach broader audiences.

10. Education and Awareness:

Education and awareness are crucial for the adoption of RWA. Both investors and traditional financial actors need to understand the opportunities and potential risks brought by RWA. This could enhance collaboration with regulatory bodies and increase trust in the sector.

11. RWA and Industry Collaborations:

Tokenizing real-world assets might encourage collaborations within industries. This could offer more opportunities for how blockchain technology and RWA can integrate with traditional industrial sectors. 12. Evolution of Digital Ecosystems:

12. Evolution of Digital Ecosystems:

Real World Assets can play a significant role in the evolution of digital ecosystems. With the adoption of RWA, digital asset portfolios may become more diverse and complex, shaping future trends in the financial world.

Conclusion:

Real World Assets emerge as a revolutionary concept brought by blockchain technology, impacting physical assets in the real world. However, to fully realize this potential, many obstacles and challenges need to be overcome. In the coming years, increased adoption of RWA and developments in this field could become crucial factors in shaping the future of financial systems and investment.