Manta Soars To $3.7B Valuation Ten Days After Launching Token

Manta Soars To $3.7B Valuation Ten Days After Launching Token

Manta Pacific is currently the third-largest Ethereum Layer 2 network by total value locked. As crypto markets bounce back from yearly lows, Manta Network’s recently launched eponymous token is leading the charge.

As crypto markets bounce back from yearly lows, Manta Network’s recently launched eponymous token is leading the charge.

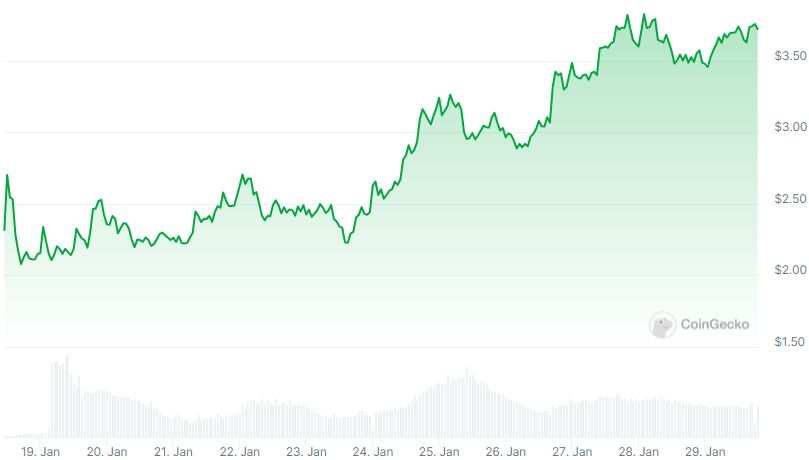

MANTA is up 51% in the past week, making it the top gainer among the 100 most valuable digital assets, according to CoinGecko. MANTA Price

MANTA Price

Launched on Jan. 18 with an airdrop for early adopters, MANTA is the governance token of the Manta Network, which is composed of two separate networks. The flagship chain is Manta Pacific, an Ethereum Layer 2 that uses Celestia for data availability. The other, called Manta Atlantic, is a Layer 1 chain built on Polkadot.

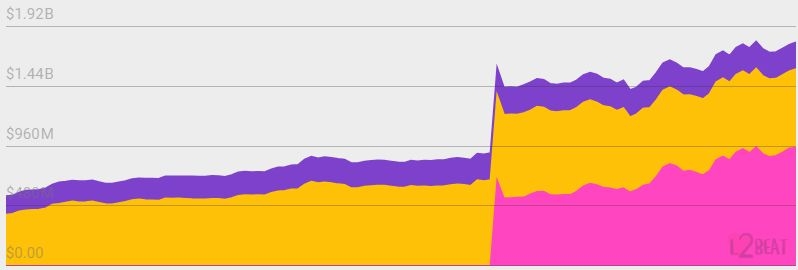

With over $1.7B in total value locked (TVL), Manta Pacific is the third largest Layer 2. However, it’s worth noting that MANTA tokens account for over half that figure. Since the airdrop, externally bridged TVL has dropped by $55M, according to L2beat. Manta Pacific TVL (Externally Bridged in Yellow)

Manta Pacific TVL (Externally Bridged in Yellow)

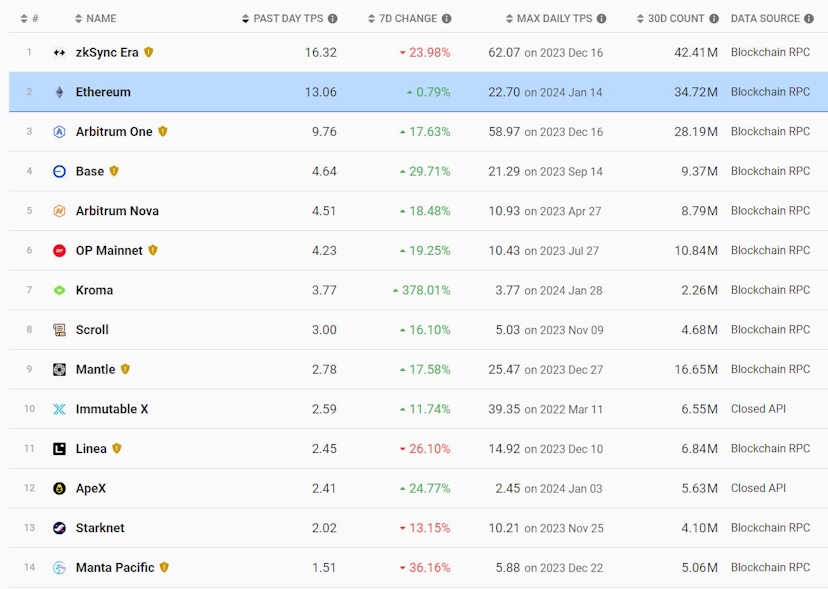

This indicates that opportunistic traders may be moving assets off the network in pursuit of the next airdrop opportunity. In addition, the blockchain is processing just 1.5 transactions per second (TPS) – far fewer than leading L2s like Arbitrum and Optimism. Layer 2 TPS

Layer 2 TPS

Manta recently completed an integration with Moonbeam to enable interoperability with the Polkadot ecosystem. It also plans to migrate Manta Pacific to a Polygon-based zkEVM solution in the near future.

JUP Token Rockets to Top 10 DEX by Market Cap Minutes After Launch

Solana-based Jupiter has airdropped its JUP token, immediately becoming the sixth-largest decentralized exchange by market capitalization, according to CoinGecko.

Solana-based Jupiter has airdropped its JUP token, immediately becoming the sixth-largest decentralized exchange by market capitalization, according to CoinGecko.

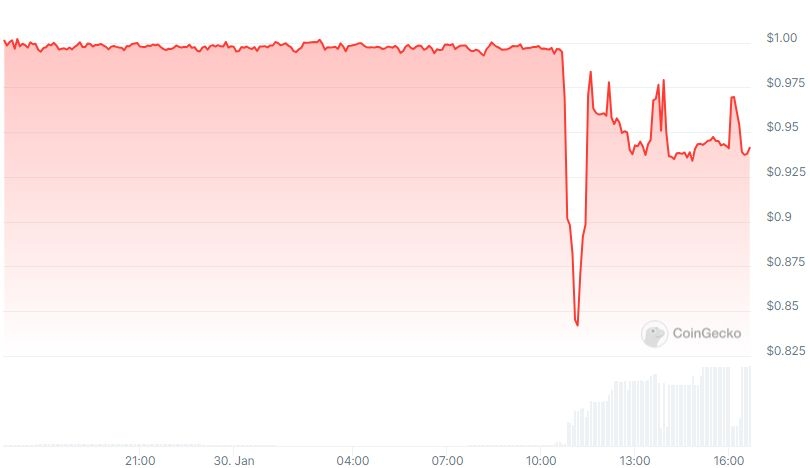

JUP’s market cap was at $905 million within 30 minutes of its 10am EST launch, according to Coingecko. That would make it the sixth largest decentralized exchange. Jupiter is a Solana-based DEX aggregator.

JUP has bounced between an initial $0.86 and a low of $0.5, according to CoinGecko. It was hovering near $0.6 at the time of writing. JUP Price - GeckoTerminal

JUP Price - GeckoTerminal

The airdrop of 1 billion tokens went to roughly 955,000 different wallet addresses. The total circulating supply is 1.35 billion with 250 million going to a launchpool, a Jupiter-developed product for releasing tokens, 50 million going to loans to market makers on centralized exchanges and 50 million for liquidity provision, according to a post from meow, the project’s founder.

JUP tokens will be split 50-50 between the team and the broader community, according to meow’s post introducing the token.

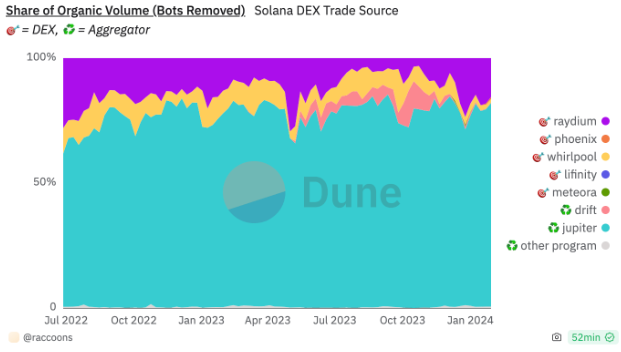

At $661 million in volume the last 24 hours, Jupiter is the largest aggregator in crypto, according to DeFi Llama. The project also facilitated over 80% of decentralized exchange (DEX) volume on Solana, according to a Dune Analytics dashboard. DEX Agg Volume - Dune Analytics

DEX Agg Volume - Dune Analytics

Jupiter features other products outside its aggregator — it offers perpetuals, limit orders, and dollar-cost-averaging functionality. Meow’s post calls JUP a “full-stack ecosystem play.”

Zeta Markets launched perpetuals for Solana today.

Solana Revival

JUP’s launch comes amidst a revival of Solana in terms of SOL price, active addresses, and major partnerships. The founder has framed the token as a “symbol for DeFi 2.0” —a phrase which momentarily gained popularity in 2021— and is focused on pushing usage in crypto.

“Decentralized adoption is not when people buy crypto, it is when people use crypto,” he said on X in December.

JUP Utility

Meow has expressed an unconventional view on the airdropped token’s value.

“The initial value of JUP will be [a] symbol for Jupiter and DeFi 2.0, much as the value for UNI is a symbol for Uniswap DeFi 1.0, not from any utility,” he said in a response to an Ask-Me-Anything (AMA) on Reddit last month.

Meow is a colorful character — his personal site features original poems among his musings on cryptocurrency.

Moving forward, meow is open to the JUP token gaining utility.

“Things start changing in a few years tho, if we/solana/meta experiences 10x-100x growth, and the platform and the community scales along accordingly,” he said in the Reddit AMA. “Because then, JUP will have the chance to be the token for the entire Jupiter economy.”

Community Ownership

Tristan Frizza, CEO at Zeta Markets, the Solana based derivatives platform, is supportive of meow’s approach.

“JUP is a bold step towards full community ownership where value is accrued to the protocol by building a wide and committed community and strong ecosystem partners,” he told The Defiant. “By first growing the pie, Meow and team will create a strong base of distribution for their token and protocol, into which future utility can easily be layered."

For now, meow isn’t willing to change his stance on utility behind a token being a myth. “That's it, i refuse to overthink it, since cat brains are smol,” he said on Reddit.

[ With reporting help from Pedro Solimano.]

Lending Protocol Abracadabra Hit By $6.5M Exploit

DeFi lending protocol Abracadabra has been exploited to the tune of $6.5M.

DeFi lending protocol Abracadabra has been exploited to the tune of $6.5M.

According to the team, the attacker targeted specific V3 and V4 cauldrons on Ethereum to take out unauthorized MIM loans. The borrowed MIM was then swapped for ETH, according to security firm Peckshield, which first flagged the exploit.

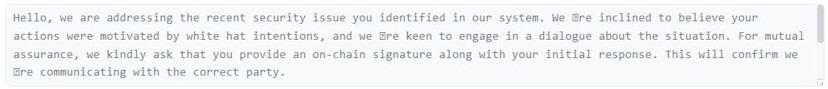

Borrowing limits on the affected cauldrons have been set to zero to prevent further losses. The Abracadabra team has sent an onchain message to the exploiter’s address in the hope of recovering the stolen assets in exchange for a bounty. Message sent to the exploiter

Message sent to the exploiter

Abracadabra is a collateralized debt protocol that allows users to borrow MIM, its native stablecoin, against various crypto assets. Its cauldrons operate similarly to Maker’s vaults. MIM Price

MIM Price

With MIM trading well under its $1 peg, the team has committed to deploying the protocol’s treasury to buy and burn the stablecoin in a bid to restore its peg. MIM has a market capitalization of around $55M.

Abracadabra is working with blockchain analytics firm Chainalysis to track the flow of the stolen assets.

This is a developing story.

Swell Launches Liquid Restaking Token As LRTs Boom

The burgeoning liquid restaking sector continues to grow, with Swell becoming the latest project to launch a token offering yields via EigenLayer.

The burgeoning liquid restaking sector continues to grow, with Swell becoming the latest project to launch a token offering yields via EigenLayer.

On Jan. 29, Swell announced the launch of rswETH, a liquid restaking token (LRT). The token allows users to earn Ethereum staking rewards and native restaking yield from EigenLayer without locking up their liquidity, meaning users can also use their tokens in third-party DeFi protocols.

Tokenholders also earn EigenLayer’s Restaked Points alongside Pearls — which represent a future claim to Swell’s forthcoming SWELL token. Swell will accumulate 10% of users’ staking rewards after taking zero fees for the first 30 days after rswETH’s launch.

Swell currently boasts $455.6M in total value locked, according to DeFi Llama, with its liquid staking token (LST) accounting for 97% of the TVL.

Liquid restaking

Swell’s entrance into the LRT segment follows liquid restaking recently emerging as a hot new narrative within DeFi.

EigenLayer pioneered restaking, allowing users to earn Ethereum staking rewards in addition to restaking yields for securing third-party services via the protocol. EigenLayer users generate yields either by natively restaking ETH via the protocol without limit or by depositing LSTs to the protocol’s capped pools. More than $2B worth of ETH is now deposited in EigenLayer.

LRT providers offer the benefits of uncapped access to EigenLayer restaking rewards without users having to spin up a node to validate Ethereum, in addition to allowing tokenholders to remain liquid rather than lock their assets.

The surging rise of LRTs

EtherFi is currently the leading liquid staking protocol, with its eETH token surging to a $507M TVL after growing 400% since the start of January.

EtherFi’s TVL is up 47% since launching a vampire attack intended to siphon liquidity from EigenLayer on Jan. 24. The campaign allows EigenLayer restakers to swap their ETH or LST deposits for eETH while sidestepping the seven-day delay on withdrawals. Participants also earn loyalty points ahead of EtherFi’s token generation event in April.

KelpDAO has emerged as the second-largest LRT with a $256M TVL after launching in December. KelpDAO boasts integrations with LSTs from Frax and Stader.

Renzo is also a prominent LRT protocol with a $155M TVL. The project announced the completion of a $3.2M seed round.