One year on, El Salvador’s Bitcoin experiment has proven a spectacular failure

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders. El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

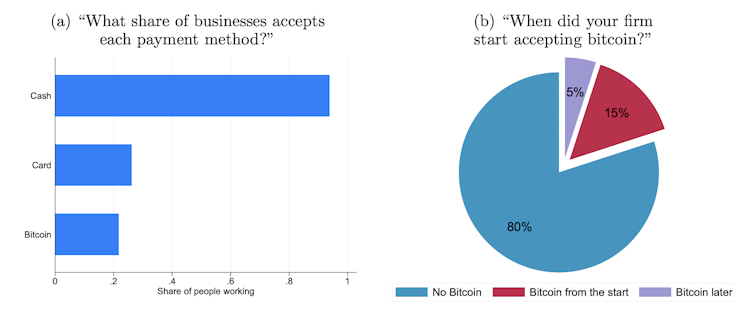

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador NBER Working Paper 29968, CC BY

NBER Working Paper 29968, CC BY

A survey for the El Salvador Chambers year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefits.

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction”.

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholders.

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 2021.

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/AP

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing.

This bold financial experiment has proven to be an almost complete failure.

Making Bitcoin legal tender

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries.

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they could.

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service”.

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's plan

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360).

Yet despite the law and these incentives, Bitcoin has not been embraced.

Greeted with little enthusiasm

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30.

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size).

Business acceptance of Bitcoin in El Salvador

NBER Working Paper 29968, CC BY

A survey for the El Salvador ChamberA survey for the El Salvador ChamberA survey for the El Salvador ChamberA survey for the El Salvador ChamberA survey for the El Salvador ChamberA survey for the El Salvador ChamberA survey for the El Salvador year ago, El Salvador became the first country to make Bitcoin legal tender – alongside the US dollar, which the Central American country adopted in 2001 to replace its own currency, the colón.

President Nayib Bukele, a cryptocurrency enthusiast, promoted the initiative as one that would deliver multiple economic benefit

Making Bitcoin legal tender, he said, would attract foreign investment, generate jobs and help “push humanity at least a tiny bit into the right direction

His ambitions extended to building an entire “Bitcoin city” – a tax-free haven funded by issuing US$1 billion in government bonds. The plan was to spend half the bond revenue on the city, and the other half on buying Bitcoin, with assumed profits then being used to repay the bondholder

El Salvador's President Nayib Bukele announced his plan for 'Bitcoin City' at a conference for cryptocurrency speculators in November 202

El Salvador’s President Nayib Bukele announced his plan for ‘Bitcoin City’ at a conference for cryptocurrency speculators in November 2021. Salvador Melendez/A

Now, a year on, there’s more than enough evidence to conclude Bukele – who has also called himself “the world’s coolest dictator” in response to criticisms of his creeping authoritarianism – had no idea what he was doing

This bold financial experiment has proven to be an almost complete failur

Making Bitcoin legal tend

Making Bitcoin legal tender meant much more than allowing Bitcoin to be used for transactions. That was already possible, as it is in most (but far from all) countries

If a Salvadoran wanted to pay for something in bitcoins, and the recipient was willing to accept them, they coul

But Bukele wanted more. Making bitcoins legal tender meant a payee had to accept them. As the 2021 legislation stated, “every economic agent must accept Bitcoin as payment when offered to him by whoever acquires a good or service

Read more: Can Bitcoin be a real currency? What's wrong with El Salvador's pl

To encourage Bitcoin uptake, the government created an app called “Chivo Wallet” (“chivo” is slang for “cool”) to trade bitcoins for dollars without transaction fees. It also came preloaded with US$30 as a bonus (the median weekly income is about US$360

Yet despite the law and these incentives, Bitcoin has not been embrace

Greeted with little enthusia

A nationally representative survey of 1,800 Salvadoran households in February indicated just 20% of the population was using Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the US$30

Among respondents who identified as business owners, just 20% said they were accepting bitcoins as payment. These were typically large companies (among the top 10% of companies by size

Business acceptance of Bitcoin in El Salvad

NBER Working Paper 29968, CC

A survey for the El Salvador Chamber BYor)..smd.).an”.d..ere..P1.s.”.s.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)