Bitcoin Futures Open Interest Skyrockets Amid Rising Market Enthusiasm and ETF Anticipation

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

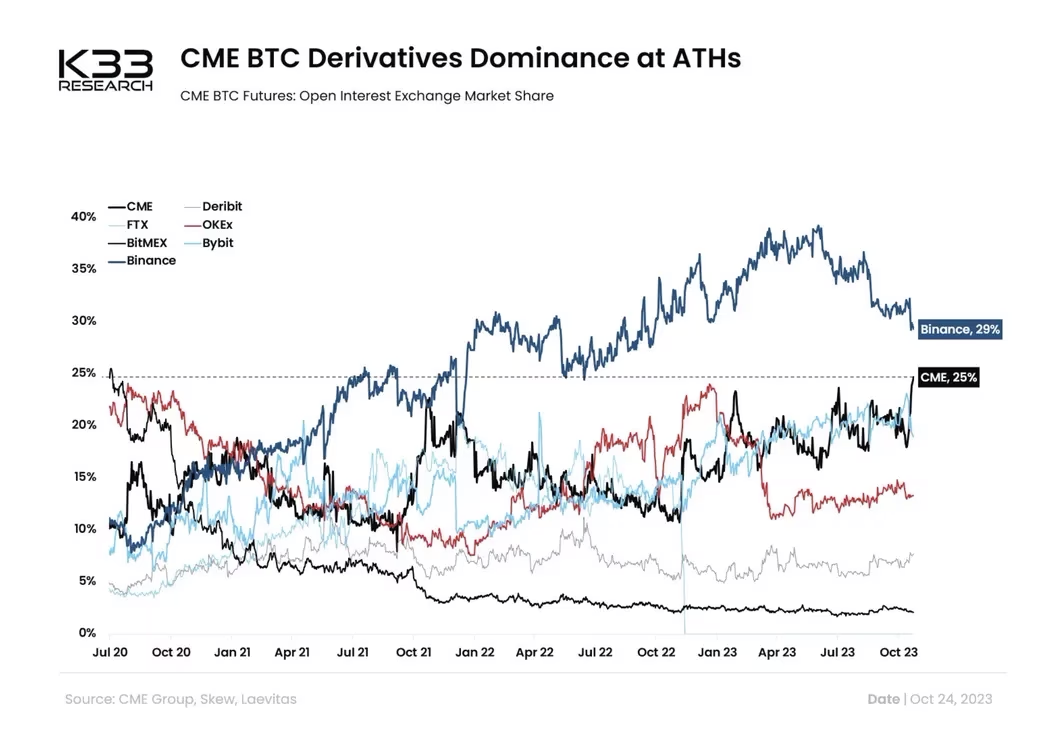

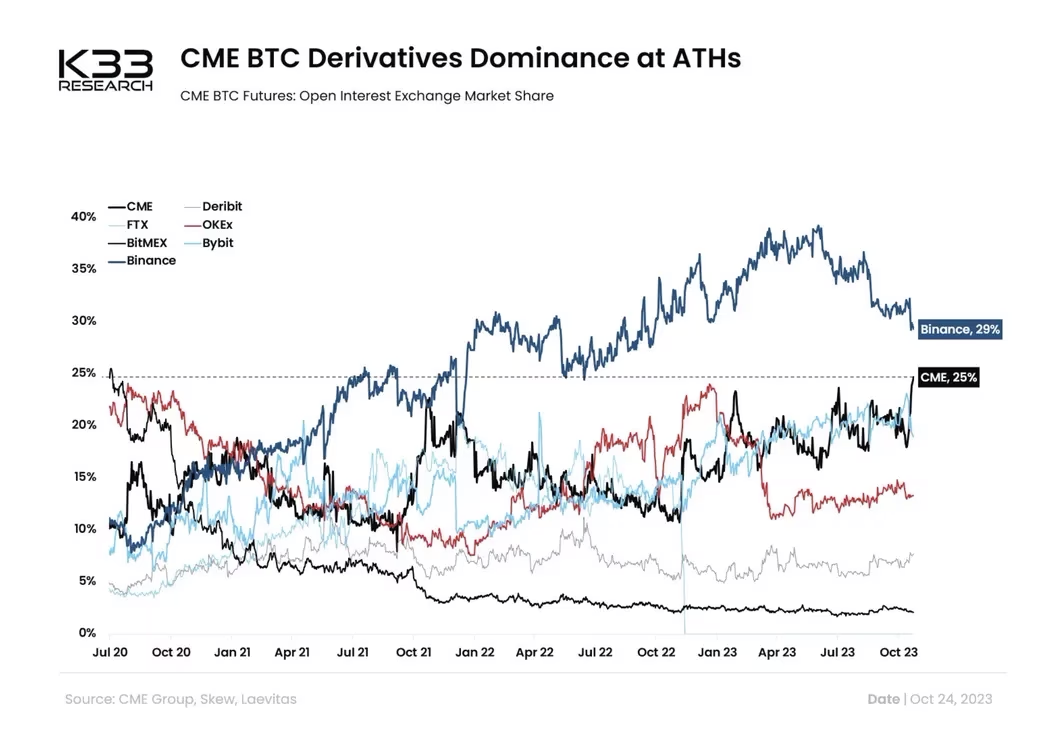

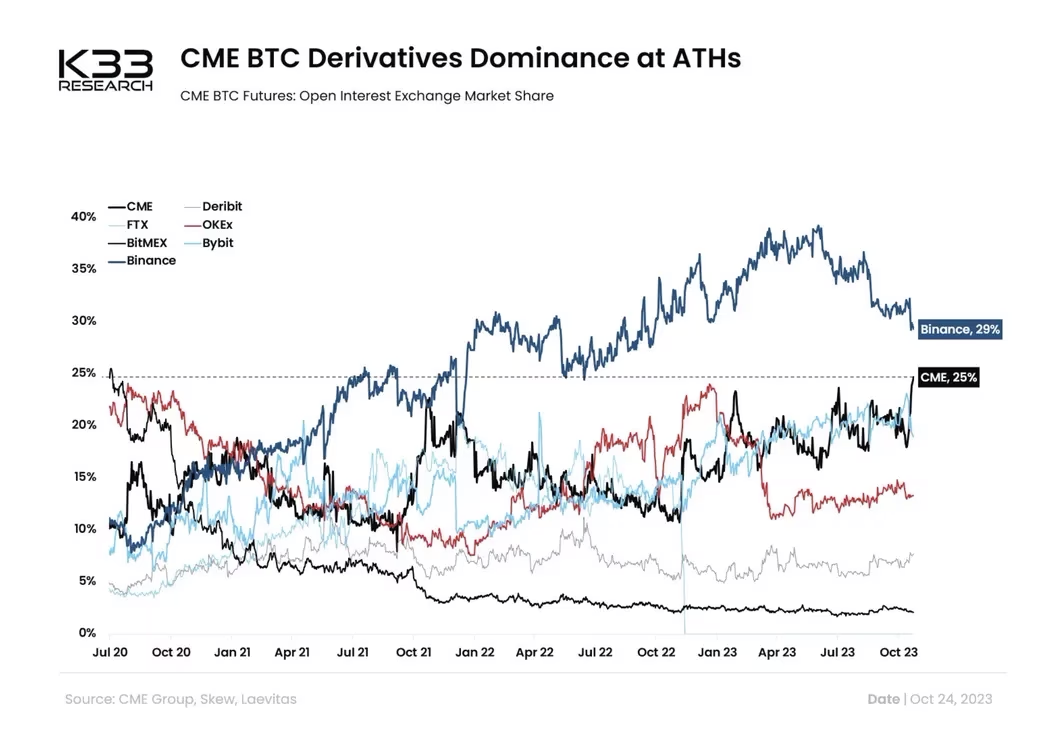

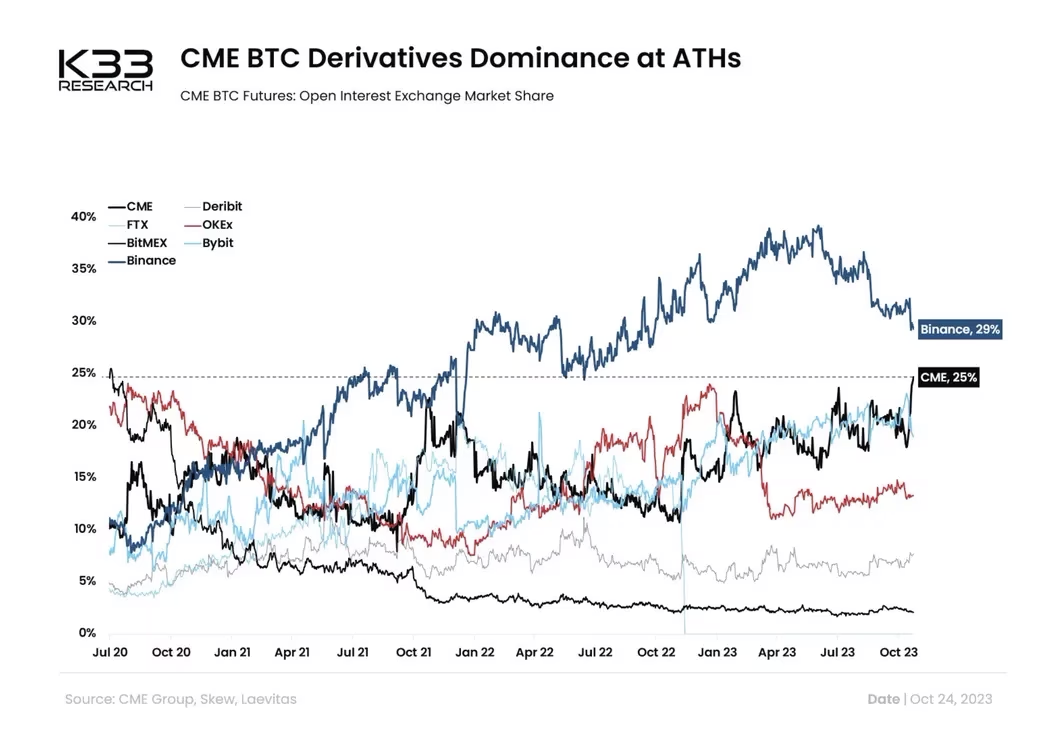

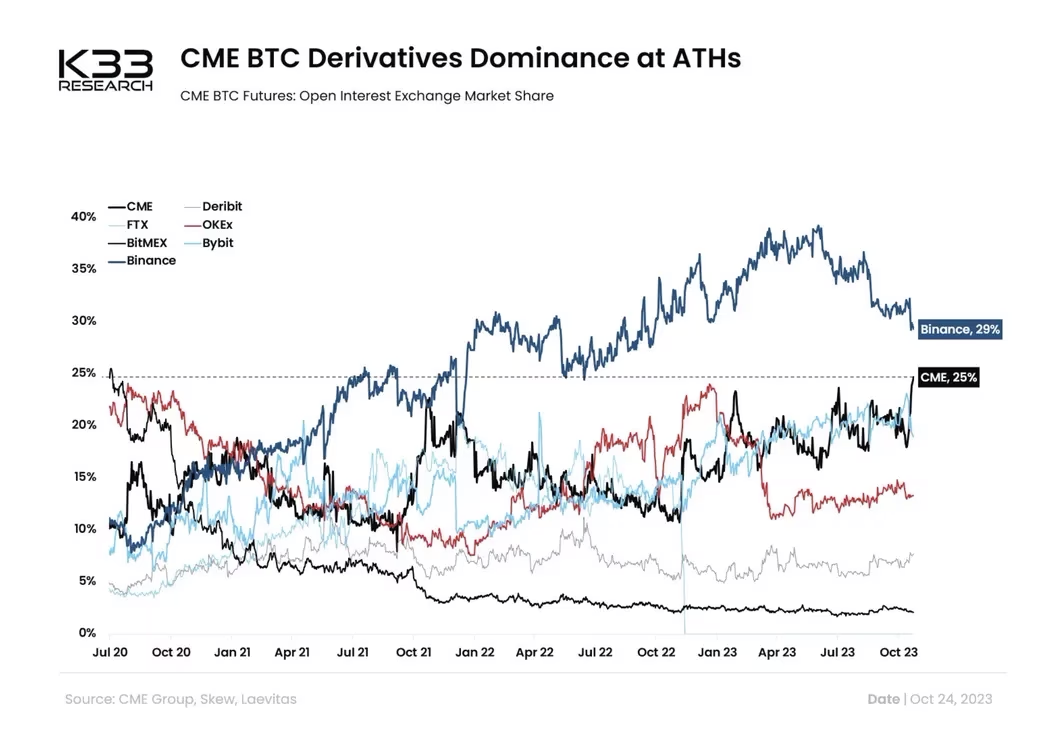

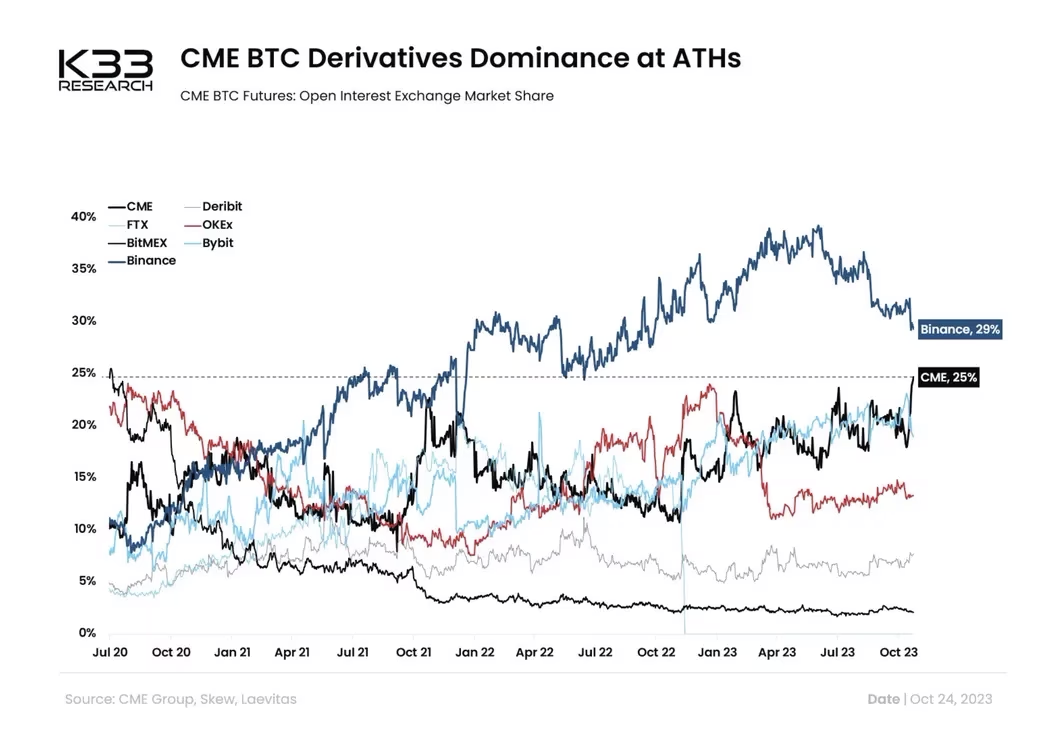

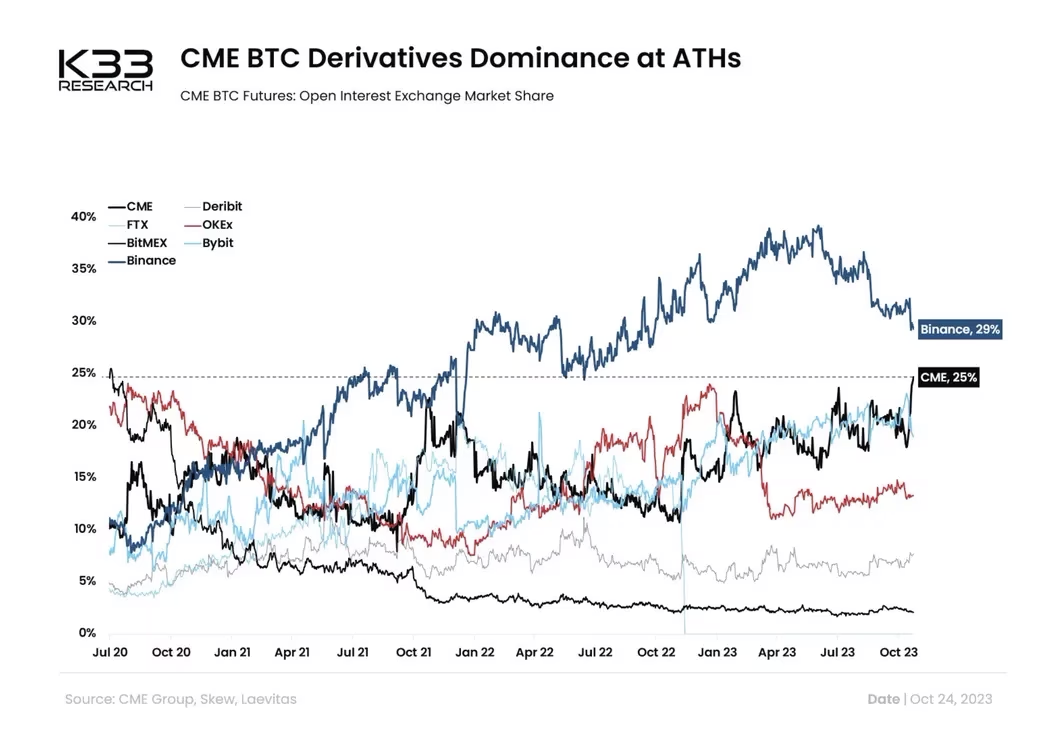

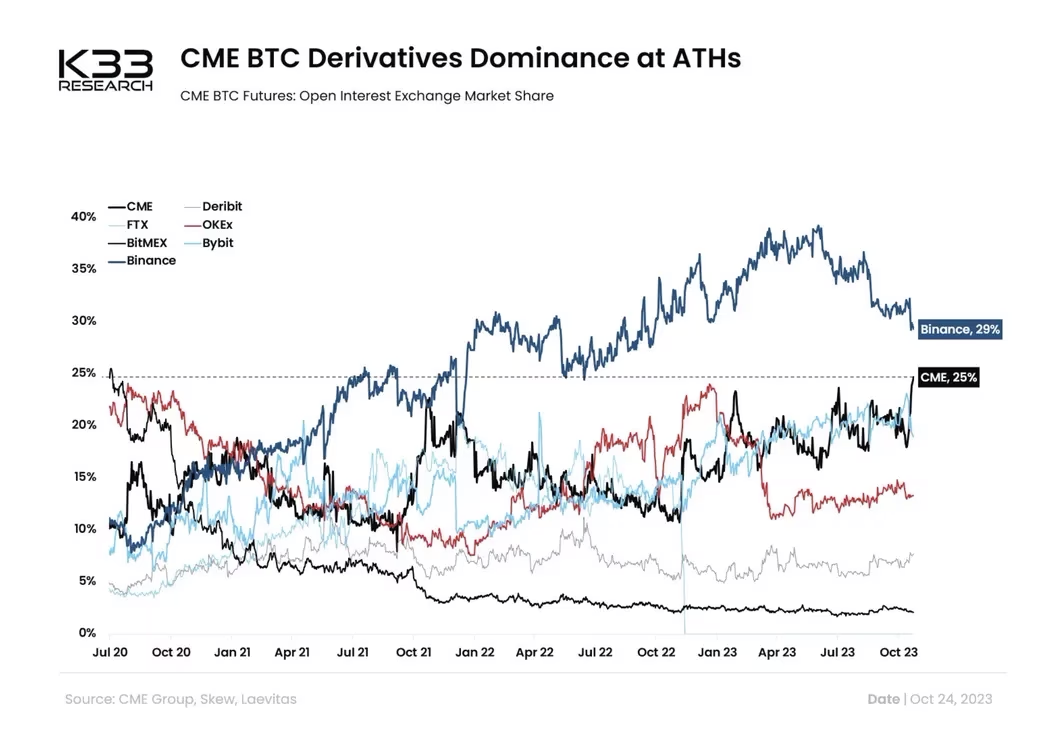

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.Bitcoin futures open interest (OI) has surged dramatically within the last day, with CME Group’s OI reaching an impressive 100,000 bitcoin, equivalent to $3.4 billion. This isn’t an isolated event; platforms such as Binance, Deribit, Bitget, and Okx are also experiencing significant upticks.

Bitcoin’s Futures Landscape Heats Up

For those new to the term, in bitcoin futures, open interest (OI) represents market engagement and the volume of money or contracts actively circulating. In layman’s terms, it’s the sum of unsettled futures contracts — those not yet cleared by a counter-trade or delivery. Recent data shows a noteworthy increase in bitcoin futures OI in just 48 hours.

K33 Research‘s latest findings highlight CME BTC futures OI’s rise beyond 100,000 BTC, setting a new record. With this leap, CME now commands a 25% market slice, narrowing the gap with Binance’s lead in the futures sector to a mere 4%. On October 23, there was also a notable rise in CME’s options volume and OI related to BTC futures. Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

Deribit isn’t far behind, with both its futures and options showing significant growth. The platform’s bitcoin options OI soared past the $12 billion benchmark, with its bitcoin futures OI inching close to a billion. At its core, OI provides insights into the overall activity and capital flow in the futures market. When OI climbs, it typically signals heightened market enthusiasm, whereas a decline might hint at waning interest.

As of October 23, Binance reported a whopping $12.08 billion in bitcoin futures OI. Other significant players in the futures domain encompass Bitget, Okx, Gate.io, Kucoin, and Bitmex. Meanwhile, Dydx and Crypto.com have also witnessed OI spikes recently. This newfound interest is largely attributed to the potential approval of a spot bitcoin exchange-traded fund.

The recent legal victory by Grayscale and Blackrock’s ETF preparations are interpreted by many as auspicious signs for the future.

What do you think about the latest surge in bitcoin futures open interest? Share your thoughts and opinions about this subject in the comments section below.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)