How To Achieve Financial Freedom

How To Achieve Financial Freedom

One goal that we all have in common is that we all want to make more money in order to achieve financial freedom.

However, only a small percentage of us actually achieve the financial freedom we long for.

We all want to have enough money so that we never have to worry about money again. The only question is, “Are you ready to do it or not?”

The good news is that there are more people achieving financial freedom faster today than ever before.

Through proper financial planning and making it a goal to improve your personal finances, you can become one of them too.

The Formula For Financial Freedom

Financial freedom means you have the ability to live your life without worrying about being tied down by monetary limitations, relying on an emergency fund, or worrying about money in general.

If you’re ready to achieve financial independence and freedom, here is a seven-point formula that you can use to help accumulate wealth, become happier, and achieve financial freedom in the years ahead.

Begin To Think Positively About Money

Part of becoming rich and achieving financial freedom involves thinking positively about money.

Thinking negatively about money is an emotional obstacle that you must eliminate in order to achieve financial freedom.

You must eliminate the thoughts that having more money leads to evil or that money can’t buy you happiness.

When you begin thinking positively about money, you will attract opportunities and open up more doors than you ever thought possible.

Rewrite Your Major Goals For Financial Freedom

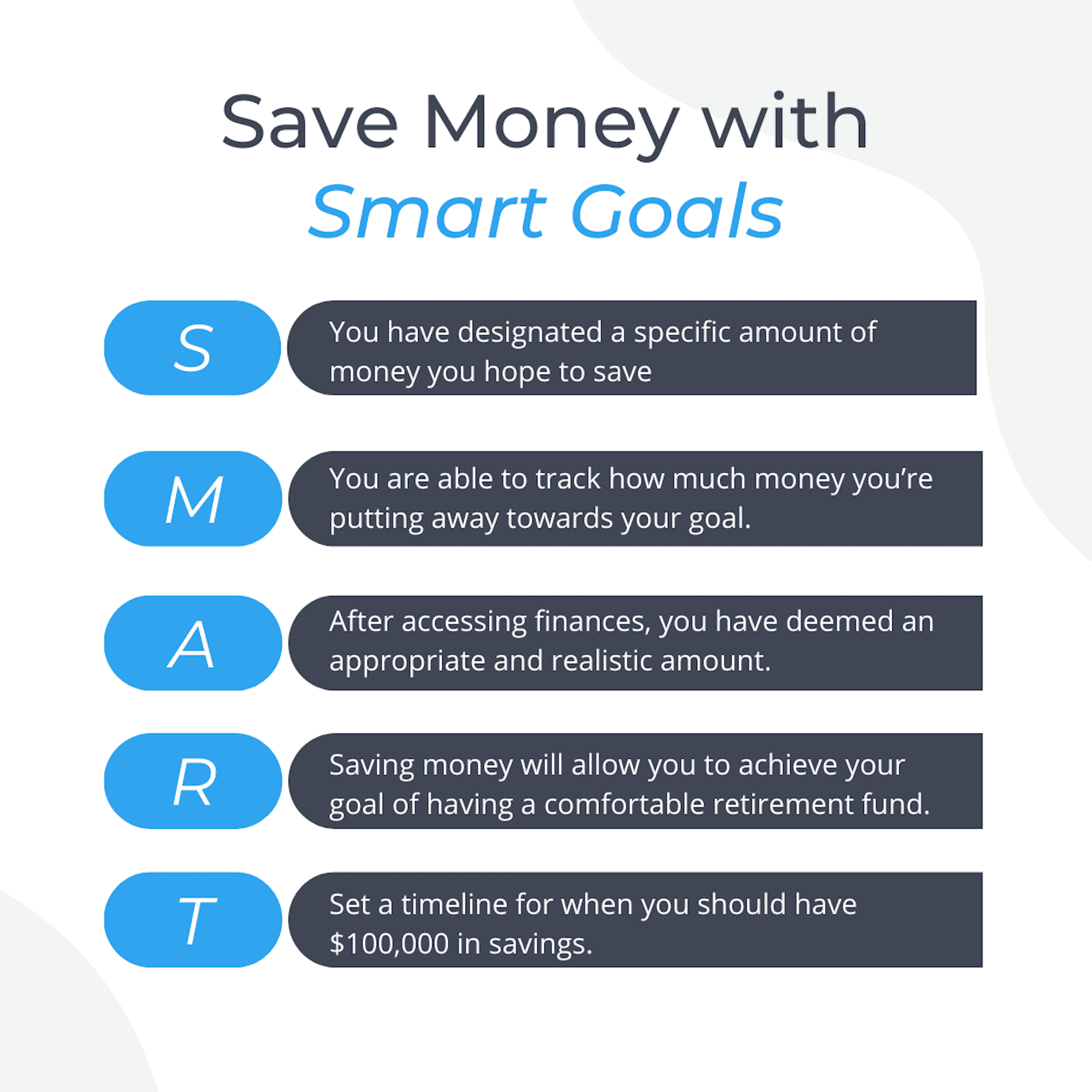

Set financial goals for yourself.

Rewrite and review your goals on paper every day and think of how you could accomplish them. This will take you between five and ten minutes.

The very act of writing and rewriting your goals, and thinking about them each morning before you start off, will increase your chances of accomplishing them.

Plan Every Day In Advance

Plan every day in advance. The best time to do this is the night before.

The very act of planning each day, each week, and each month in advance will make you far sharper and more precise at everything you do.

You will find yourself with better focus and a greater sense of self-control and personal power when you work from a list.

When you plan every day in advance you will be better able to control and track your spending habits as well.

Plan how much you have to spend for the week, month, or year and decide where you will be able to save.

From there, put as much as you’ve allocated into a savings account, some into an emergency fund, some aside for normal bills and paying off any student loan debt you may have, and maybe even consider budgeting for investing money in the stock market.

The Principle Of Concentration

Concentrate single-mindedly, every hour of every day, on the most valuable use of your time.

The principle of concentration is absolutely essential to achieving financial freedom.

Virtually everything you do in terms of goal setting and financial planning is aimed at enabling you to determine the one or two things that you should concentrate on more than anything else.

Your ability to develop the habit of concentration will do more to ensure your personal finance success than perhaps any other skill or habit you can acquire.

The things you focus the most on and spend the most time doing should be in direct alignment with your financial goals.

Spend your time focused on what will make you the most money.

Invest In Yourself

Listen to audio programs in your car. The average person spends 500 to 1,000 hours per year behind the wheel.

By turning your car into a university on wheels, you can become one of the most knowledgeable and skilled people in your profession.

Purchase courses on money management, read books on personal finance, and find articles online about money. You may even invest in yourself by investing in the advice of a financial advisor.

Very soon you will have so much knowledge in the area of money that people will come to you for advice.

Ask Yourself These Magic Questions

Ask yourself the two “Magic Questions” after every meeting and every event of importance in your life.

The first question is, “What did I do right?” And the second question is, “What would I do differently, next time?”

By reviewing your performance immediately after every meeting, sales call, and presentation, you will become better and better, faster than you can imagine.

The answers to both of these questions are positive.

By reviewing what you did right and what you would do differently next time, you program into your mind a predisposition to be even better the next time out.

If you take a few minutes and write down everything you did right and everything you would do differently immediately after a call or presentation, you can double and triple the speed at which you learn, grow, and improve your work.

Improving yourself and your quality of work will, in effect, improve the money you make.

Be Generous To Others

The final point is to treat everyone you meet like a million-dollar customer.

Treat every single person, at home and at work, as if they were the most important person in the world.

Since everybody believes that he or she is the most important person in the world, when you treat them as if they were, they appreciate your recognition and acknowledgment more than you can imagine.

It is a proven fact that being a more generous person will help you attract more wealth and become a happier person.

We’ve often heard it said, “money doesn’t buy happiness”.

But, the truth is that:

- Money is essential to happiness.

- Material prosperity predicts life satisfaction,

- And the more economic status we achieve, the more we’ll feel satisfied with our life.

Not only do our measurements of happiness rise as our income rises, but so does our sense of well-being and life satisfaction.

So, by choosing to focus on money goals that motivate you, while also embedding a positive mindset towards money, towards yourself, and life in general, you will help to achieve both increased wealth and happiness.

And when you get there – evidence clearly shows us that being generous with our money makes us happier – and richer!

How To Save Money And Achieve Financial Freedom

Did you know that the decisive factor in the achievement of financial freedom is the development of specific habits?

Well, it is.

In fact, most self-made millionaires have already learned these habits and as the result of practice and repetition, have reached financial freedom.

This is great news!

Why?

Because you can learn to save money and think like self-made millionaires to become financially independent yourself.

Some Tips To Save Money

In this case, which is quite common, I recommend a gradual process of learning to save money where you begin by saving 1% of your income and living on the other 99%.

For example, if you are earning $2000 per month, make a decision today to save $20 per month or $.67 cents per day.

You can then live on the other $1,980. Save money in the long run by opening up a separate bank account, your “financial freedom” account. Money that goes into this account only flows only one way- inward.

Money that goes into this account only flows only one way- inward.

Once you put money into this savings/investment account, you never, ever take it out or spend it for any reason.

It has only one purpose:

To enable you to achieve financial freedom as soon as possible.

Once you have become comfortable living on 99% of your income, increase your monthly savings rate to 2% off the top.

Within one year, you will find yourself living quite comfortably on 10% of your current income.

Continue this process until you are saving 15% and then 20% of your income, off the top.

You will not even notice the difference in your standard of living because it will be so gradual.

But the difference in your financial life will be absolutely extraordinary.

There is an especially special habit that financially successful people learn or develop over time.

It is the habit of responding to incoming money in a particular way.

When we are growing up, we are encouraged to save money from our allowances.

However, as children, we look upon money as a tool with which to buy candy, toys, and other things that make us happy.

As a result, we naturally begin to look upon saving as a punishment, something that hurts us and deprives us of the candy, toys, and enjoyable things we desire.

At an early age, most people begin to associate savings with pain, sacrifice, with loss of pleasure, satisfaction, and happiness.

As adults, this negative habit is manifested in our desire to spend money as soon as we make it.

Many people in their late teens and twenties look upon every paycheck as an opportunity to go out and spend as much money as they can.

This is why it is generally known in the restaurant business that they will be the fullest at the middle and at the end of the month, on paydays.

People very early begin to associate spending with happiness and saving with pain.

Since the basic human motivation is to move away from pain toward pleasure, from discomfort toward comfort, and from dissatisfaction toward satisfaction, most people develop the habit of associating spending with enjoyment and saving with unhappiness.

Using The Law Of Attraction For Financial Freedom

When you begin to save money, and you feel positive and happy about your growing account, these positive emotions imbue that money with a form of energy that begins to attract more money into your life, and into that account.

Old friends will pay you back debts that you had forgotten a long time ago.

You will have opportunities to earn additional amounts of money that had not occurred to you.

You will sell things that you had had for a long time that you thought had no value.

And as you add these amounts to your account, your account will develop even more positive energy, and attract even larger amounts of money.

This is an extraordinary discovery…

I had heard about this concept for many years, but I was always broke and there was never anything I could do about it.

Then, about two years after I got married and started my own business, I ran out of money.

I had been able to buy a house with my lifetime of savings, but now I had to sell the house to get the cash, and then move to a rented house.

At this point, my wife Barbara demanded that I turn over to her $10,000 from the proceeds from the sale of the house.

After some arguing, I gave in. She took the money and deposited it in another bank account which I could not access.

No matter how many financial problems we had in the months ahead, she refused to even consider the possibility of spending that money.

This was her security blanket. The most remarkable thing happened.

From that day forward, we were never broke again. Even though it was the middle of a recession and businesses were going bankrupt all around us, we were never again out of money.

Every week, every month, business came in, the bills were paid, and opportunities opened up and exciting possibilities seemed to be attracted into our lives.

Within a couple of years, we were able to move out of the rented house and buy a beautiful new home in a lovely neighborhood.

Two years later, we were able to buy a home that cost five times as much on a beautiful golf course, overlooking two lakes with the ocean in the distance.

Rewire Your Thinking And Gain Financial Freedom

Your job is to reverse the wiring on this habit.

It is to detach the wires from one set of attitudes and reattach them with a different set of attitudes.

Your job is to begin thinking in terms of pleasure whenever you think of saving and accumulation, and pain whenever you think of spending and getting rid of your money.

The Major Obstacles To Financial Freedom & How To Overcome Them

There are many major mental obstacles that deter financial success.

The most common reason is that some people believe, for whatever reason, that they don’t deserve to be rich.

Now, I know some of you may be asking, why is that?

Some people, including myself, have been raised with a steady drumbeat of destructive criticism.

This has led them to conclude, at an unconscious level, that they don’t deserve to be successful and happy.

Of course, this is untrue.

Yet, this negative way of thinking can lead to destructive financial habits.

These habits can be hard to break.

Change Your Attitude Toward Money

Negative experiences in childhood, which are all too common, can have terrible effects.

For example, when people actually do succeed as a result of hard work, they feel guilty.

These guilt feelings then cause them to do things to get rid of the money, to throw it away.

- They spend it or invest it foolishly.

- They lend it, lose it or give it away.

- They engage in self-sabotage.

It can come in the form of overeating, excessive drinking, drug usage, marital infidelity, and often dramatic personality changes.

To change your results with money, you have to change your attitude toward it.

You have to make a habit of seeing money as something positive.

The fact is that money is very much like a lover. It must be courted and coaxed and flattered and treated with care and attention.

It gravitates toward people who respect it, value it and are capable of doing worthwhile things with it.

It flows through the fingers and flees from people who do not understand it, or who do not take proper care of it.

See Yourself As Deserving Of Money

Sometimes people say that they are not very good with money.

But being good with money is a skill that anyone can learn through practice.

Usually, saying that one is not very good with money is merely an excuse or a rationalization.

The fact is that the person is not very successful or disciplined with money.

The person has not learned how to acquire it or to hold on to it.

The starting point of accumulating money is for you to believe in yourself.

You have an unlimited capacity to obtain all the money that you will ever need.

Look at yourself as a financial success waiting for a place to happen. And see yourself as deserving of all you can acquire.

Money Is Essential To Our Lives

Money is good. Money gives you choices and enables you to live your life the way you want to live it.

Money opens doors for you that would have been closed in its absence.

But just like anything, an obsession can be hurtful.

If a person becomes so preoccupied with money, he may lose sight of the fact that money is merely a tool.

If money becomes something used to acquire happiness, then it becomes a harmful thing.

Money is essential to our lives in society. It is also neutral. It is neither good nor bad.

It is only the way that it is acquired and the uses to which it is put that determines whether it is helpful or hurtful.

Take Action!

Here are two things you can do immediately to put all of these ideas into action:

First, recognize and accept that virtually everyone who has money today at one time was broke and probably broke for a long time.

Then they learned the skills of accumulating money and they are now financially independent.

Whatever they have done, you can probably do as well.

Second, become a student of money from this day forward.

Study it, learn about it and apply the lessons you discover toward your own financial life until you begin to attract more and more money in your direction.