Bitcoin Price Performance After Spot ETF Approval, Fails to Break $50,000

Several days after the approval of the Bitcoin spot ETF on Wednesday (11/1/24), the price of BTC appears to be correcting, even though it briefly touched $49,000. It is highly likely that the "sell the news" factor caused BTC to fail to continue its upward trend to reach the $50,000 price level.

Bitcoin Correction Post ETF Approval

After the approval of the Bitcoin spot ETF in the early hours of Wednesday (11/1/24) WIB, the BTC price experienced an increase, reaching $49,000. Four days after the approval, as of the writing of this article (15/1/24), BTC is trading at $42,710, reflecting a correction of -12.8%.

The correction is likely caused by the "sell the news" effect, where those who had accumulated BTC before the ETF approval took profit.

It should be noted that when BlackRock first filed the application for the Bitcoin spot ETF in June 2023, the BTC price had risen by approximately +70% since then.

Another metric supporting the occurrence of the correction is the BTC dominance rate, which has decreased to 51.1%, having previously touched 54.5%.

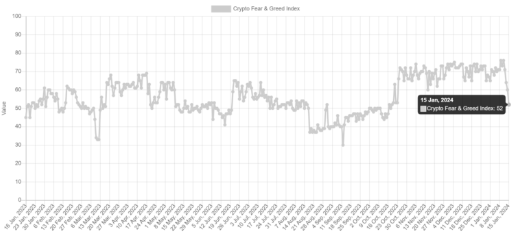

Additionally, the fear and greed index have also experienced a drastic decline since the ETF approval, reaching the neutral category at 52. This level was last seen at the end of October 2023.

This indicates that crypto market euphoria decreased right after the ETF was approved, strengthening the "sell the news" hypothesis.

Bitcoin Price Increase Takes Time

The increase in BTC price may not happen immediately upon ETF approval. Large investors and institutions also need time to allocate funds to specific investment instruments, including the first approved Bitcoin spot ETF in the U.S.

For example, the gold ETF approved on November 18, 2004, did not cause a significant increase in gold prices on the day it was approved. However, within a year and a half, the gold price increased by 67%. From the approval of the gold ETF, the gold price has increased by +368% as of the writing of this article (15/1/24).

Considering the much lower volatility of gold compared to Bitcoin, BTC has the potential to reap extraordinary returns after the ETF is approved if it follows the gold's upward trend.

Furthermore, the four-year cycle and halving increase the chances of BTC experiencing significant gains a year after ETF approval.

Read Too : Publisher of USDC, Circle, Files for IPO in the US

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)