Token Valuation

Introduction

Many protocols adopt a dual structure of company and DAO, where the company acts as the developer and operator of the underlying protocol of the DAO. This article focuses on the valuation of DAO tokens, presenting a framework that is independent of the developer companies behind the DAOs. We believe DAO token valuation can primarily be approached through two methods: fundamental valuation and comparative analysis.

Understanding DAO Token Valuation

In this article, we discuss a valuation framework for decentralized autonomous organizations (DAOs). Although the framework is based on corporate finance theory, it introduces native DAO valuation concepts. This framework aims to help the community assess how well DAOs create value for token stakeholders and to promote greater accountability among the development teams behind the DAOs. It is important to note that the proposed DAO valuation framework is preliminary, as we are still learning about the characteristics of DAOs and how market participants value them.

Key Valuation Methods

- Fundamental Valuation Method: This method attempts to value DAO tokens based on fundamental factors, such as utility and expected growth in token value.

- Comparative Analysis Method: This method involves comparing DAO tokens using various metrics to derive their value. This is a market-based approach that infers value from comparable DAOs.

Defining DAO Tokens and Their Structures

A DAO is considered an organization that operates autonomously on smart contracts and is managed by a stakeholder community. Many protocols have a dual structure where a company acts as the developer and operator of the underlying protocol for the DAO. The developer company often predates the DAO and retains ownership of relevant IP and assets. For example, Uniswap can be seen as a DAO with its governance token (UNI), where development is handled by Uniswap Labs.

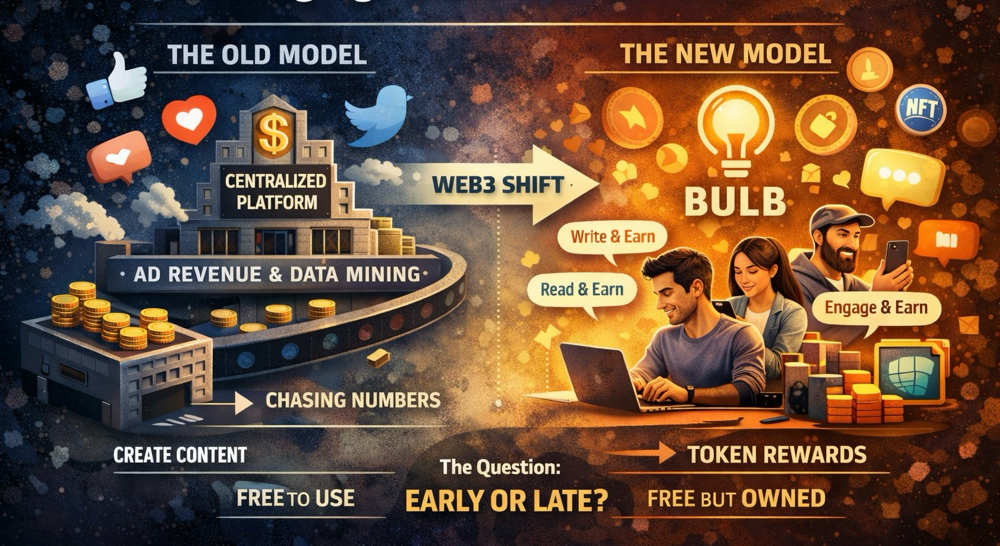

Web3 and Token Economics

Web3 uses token economics for stakeholder incentives, creating proper decentralization and alignment. Tokens are used to solve cold start problems by incentivizing user participation and rewarding appropriate behavior. Fundamentally, a token’s value is derived from community membership, utility within the ecosystem, and associated governance rights. Unlike traditional securities, DAOs are cautious about directly distributing value to token holders to avoid being classified as securities. Instead, value created by a DAO can flow indirectly to token holders through mechanisms like staking, community benefits, and overall growth.

Valuation Models

A) Discount Factor

The discount rate can be estimated using the Weighted Average Cost of Capital (WACC), which accounts for the cost of both debt and equity (tokens). However, most DAOs do not have leverage, so WACC is primarily the cost of token capital. The expected return can be estimated using a factor model tailored to DAOs, considering market factors, ecosystem factors, size, value, liquidity, and momentum.

B) Future Token Flow Valuation

Similar to the Discounted Cash Flow (DCF) model used for traditional companies, the Discounted Token Flow (DTF) model evaluates future token flows generated by the DAO. This involves estimating the free token flow (FTF), including net income, asset depreciation, changes in working capital, and capital expenditures.

C) Value of DAO Benefits

DAO tokens offer various benefits like community membership, governance rights, and more. The value of these benefits can be estimated using measures such as community interaction, governance participation, and the value of holding tokens.

D) Expected Staking Rewards

Many Web3 projects offer token staking rewards, which can be considered passive income. These rewards can be discounted using the appropriate discount rate, with adjustments for liquidity costs and risk premiums.

Comparative Analysis Method

The comparative analysis method uses ratios and metrics to determine valuation estimates based on similar entities. Relevant metrics for DAOs include protocol users, token holder participation in governance, transaction volume, and more. Specific metrics may vary based on the type of DAO, such as social DAOs versus DeFi protocol DAOs.

Conclusion

The valuation of DAO tokens is a complex process that involves both fundamental analysis and comparative methods. The framework outlined here provides a starting point for evaluating DAOs, but further research and community input are necessary to refine these methods and develop a comprehensive approach to DAO token valuation.

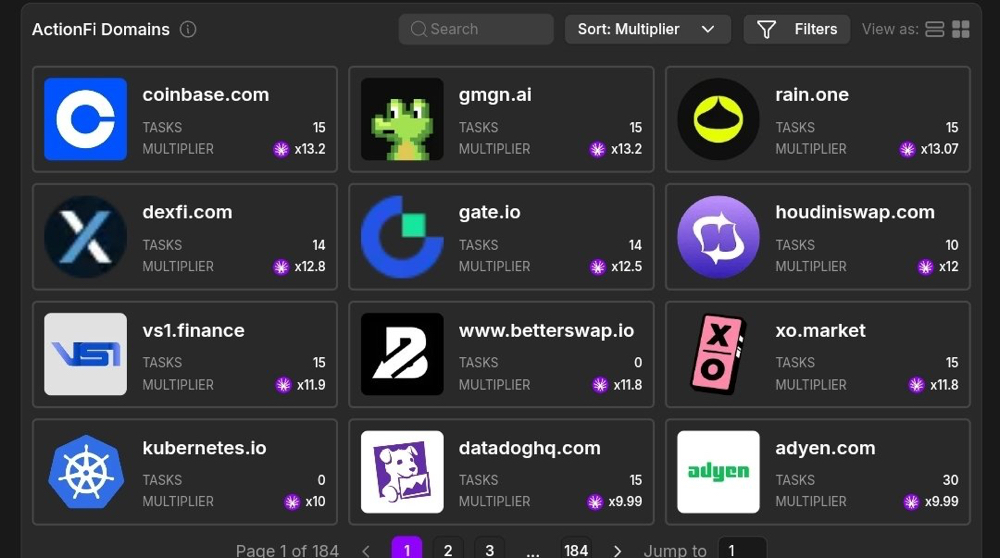

Enjoy exclusive trading discount by using : Binance, Gate.io, Bybit and OKX.