How to make more money in the crypto market

While I can provide some general information about cryptocurrency investing, I want to emphasize that the crypto market is highly volatile and risky. Any investment advice should come from qualified financial professionals. That said, here are some general principles that crypto investors often discuss:

- Research and education: Thoroughly understand blockchain technology, different cryptocurrencies, and market trends before investing.

- Diversification: Don't put all your funds into a single cryptocurrency. Spread investments across different assets to manage risk.

- Long-term perspective: Many investors advocate for a "hold" strategy rather than frequent trading, especially for beginners.

- Stay informed: Keep up with news and developments in the crypto space, as the market can be influenced by various factors.

- Use reputable exchanges: Ensure you're using secure and well-established platforms for buying, selling, and storing cryptocurrencies.

- Consider dollar-cost averaging: Investing fixed amounts at regular intervals can help mitigate the impact of market volatility.

- Set realistic goals: Avoid chasing get-rich-quick schemes or falling for hype around new coins without proper research.

- Risk management: Only invest what you can afford to lose, given the high volatility of crypto markets.

- Be wary of scams: The crypto space is unfortunately rife with fraudulent schemes. Be cautious of offers that seem too good to be true.

I'll expand on some key aspects of cryptocurrency investing:

Research and education:

- Study blockchain technology fundamentals

- Analyze whitepapers of promising projects

- Understand different consensus mechanisms (e.g. Proof of Work vs Proof of Stake)

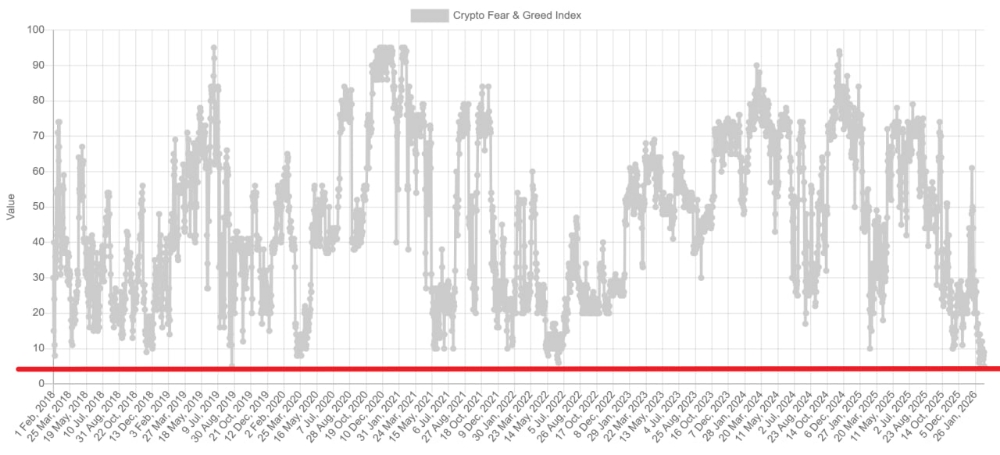

- Learn about market cycles and historical trends

Diversification strategies:

- Invest in a mix of established (e.g. Bitcoin, Ethereum) and emerging cryptocurrencies

- Consider different sectors within crypto (DeFi, NFTs, Layer 2 solutions)

- Potentially include some blockchain-related stocks or ETFs for broader exposure

Long-term perspective:

- "HODLing" (holding on for dear life) through market volatility

- Focus on projects with strong fundamentals and long-term potential

- Be prepared for extended bear markets and resist panic selling

Staying informed:

- Follow reputable crypto news sources and analysts

- Join communities (e.g. Reddit, Discord) for project-specific updates

- Watch for regulatory changes that could impact the market

Using reputable exchanges:

- Research exchange security measures and insurance policies

- Consider using both centralized (e.g. Coinbase, Binance) and decentralized exchanges

- Use hardware wallets for long-term storage of significant holdings

Dollar-cost averaging (DCA):

- Set up recurring purchases to buy a fixed amount regularly

- This strategy can help smooth out price volatility over time

- Adjust your DCA amount based on your risk tolerance and market conditions

Setting realistic goals:

- Define clear investment objectives (e.g. long-term growth, short-term gains)

- Understand the risk-reward profile of different cryptocurrencies

- Regularly reassess and adjust your portfolio based on performance and changing goals

Risk management:

- Only invest funds you can afford to lose entirely

- Consider setting stop-loss orders to limit potential losses

- Regularly take profits on successful investments to reduce overall portfolio risk

Avoiding scams:

- Be skeptical of unsolicited investment advice or offers

- Research team backgrounds for new projects

- Watch for red flags like promises of guaranteed returns or pressure to invest quickly

Additional considerations:

Technical analysis:

- Learn to read charts and identify trends

- Understand key indicators like moving averages, RSI, and trading volumes

- Use these tools to inform entry and exit points for trades

Fundamental analysis:

- Evaluate the technology, team, and adoption metrics of cryptocurrencies

- Consider factors like network effects, scalability, and real-world use cases

- Look for projects solving actual problems or improving existing systems

Tax implications:

- Understand your local tax laws regarding cryptocurrency transactions

- Keep detailed records of all trades and investments

- Consider using crypto tax software to help with reporting

Yield farming and staking:

- Explore opportunities to earn passive income through DeFi protocols

- Understand the risks associated with these strategies, including smart contract vulnerabilities and impermanent loss

Remember, there's no guaranteed way to "make more money" in crypto markets. All investments carry risk, and past performance doesn't guarantee future results. It's crucial to make informed decisions based on your financial situation and risk tolerance.

Risk management is paramount in cryptocurrency investing due to the market's extreme volatility and speculative nature. Here's a comprehensive guide to managing risk effectively:

1. Only Invest What You Can Afford to Lose

- Determine your risk tolerance based on your financial situation

- Never invest money needed for essential expenses or emergency funds

- Consider crypto investments as high-risk, speculative assets

2. Diversification

- Spread investments across different cryptocurrencies and blockchain projects

- Include a mix of established (e.g., Bitcoin, Ethereum) and emerging cryptocurrencies

- Consider diversifying across different sectors within crypto (DeFi, NFTs, Layer 2 solutions)

- Potentially include traditional assets (stocks, bonds) to balance overall portfolio risk

3. Position Sizing

- Limit the size of any single investment to a small percentage of your total portfolio

- Use the 1% rule: Never risk more than 1% of your total portfolio on a single trade

4. Use Stop-Loss Orders

- Set automatic sell orders at predetermined price levels to limit potential losses

- Regularly adjust stop-loss levels as the market moves

5. Take Profits

- Set target prices for taking profits

- Consider selling a portion of successful investments to lock in gains

6. Dollar-Cost Averaging (DCA)

- Invest fixed amounts at regular intervals rather than large lump sums

- This strategy can help mitigate the impact of market volatility

7. Stay Informed

- Keep up with market news, regulatory changes, and technological developments

- Understand how external factors can impact your investments

8. Use Reputable Exchanges and Secure Storage

- Only use well-established, secure cryptocurrency exchanges

- Store significant holdings in hardware wallets or other secure offline storage methods

9. Understand and Manage Leverage Risk

- If using leverage, understand the increased risk of liquidation

- Only use leverage if you're an experienced trader and fully understand the risks

10. Regular Portfolio Review

- Periodically reassess your portfolio allocation

- Rebalance as needed to maintain your desired risk profile

11. Have an Exit Strategy

- Define clear conditions under which you'll exit positions

- This could be based on price targets, time horizons, or changes in fundamental factors

12. Psychological Preparation

- Be prepared for extreme price swings

- Develop strategies to manage emotions and avoid panic selling or FOMO buying

By implementing these risk management strategies, you can potentially minimize losses and protect your capital in the volatile cryptocurrency market. Remember, no investment strategy can eliminate risk entirely, and past performance doesn't guarantee future results.