İndigo protocol

1. Introduction: Rethinking Fee Dynamics

The Indigo Protocol operates in a complex environment with diverse user roles and economic incentives, making the balancing of interests very important. While robust in collateralization, the Protocol faces issues like potential depegging events and inefficiencies in CDP-related transactions. The reliance on CDP liquidations as a primary revenue source for INDY stakers leads to inconsistencies, especially in fluctuating market conditions. Recognizing and fulfilling the need for a DAO revenue generation solution, a stable and predictable DAO and user revenue model is vital for maintaining the Protocol’s innovation and reliability in the DeFi space.

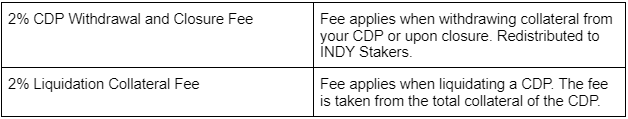

V1 Fees

2. Addressing the Core Issues

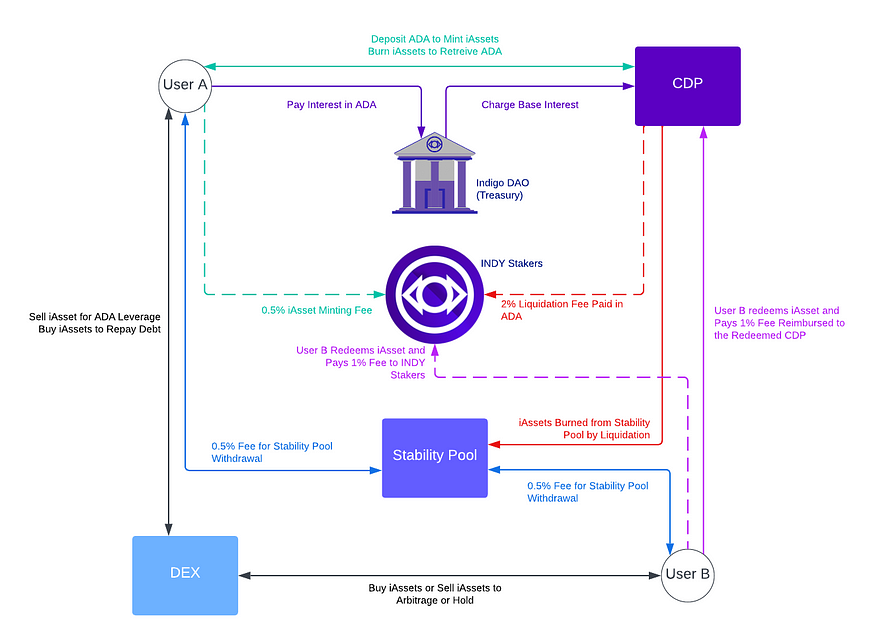

Indigo Protocol V2 sees the elimination of the 2% collateral fee that existed in V1. This change in fee structure enhances the economic incentives for being an INDY Staker. In the new model, revenue is generated more consistently through various activities within the protocol, such as redemptions, liquidations, and iAsset minting. This shift ensures a more stable and predictable income stream for INDY Stakers, aligning their interests more closely with the protocol’s overall financial health and performance. As a result, INDY Stakers are better positioned to benefit from the protocol’s growth and success through a more robust and sustainable economic model.

The introduction of the Interest Mechanism in Indigo Protocol V2 marks a significant advancement in the protocol’s economic structure. This mechanism serves a dual purpose: it generates consistent revenue for the Indigo DAO and plays a crucial role in maintaining the peg of iAssets. The generated ADA revenue through this mechanism opens up new avenues for the DAO, such as funding future development initiatives or exploring potential strategies like an INDY buyback program.

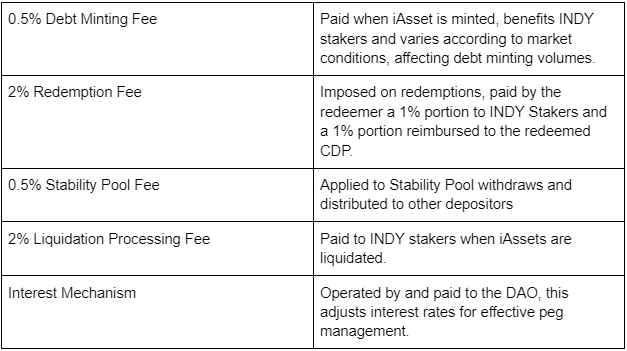

V2 Fees

V2 Fees

V2 Fees

3. Proposed Fee Structure Overhaul

3.1 Implement a Debt Minting FeeIn periods of upward market trends, there’s a tendency for increased debt minting, correlating with the rising value of collateral. As the fees are set up currently in Indigo Protocol V1, INDY stakers would not receive any ADA from an increase in iAsset minting. To address this, the Protocol could implement a debt-minting fee. This fee would be a percentage of the total amount minted, automatically deducted from the user’s wallet, and transferred to the Collector.

For example, consider a scenario where a user mints 1000 iUSD (equivalent to 4000 ADA) at an oracle price of 0.25 USD/ADA. With a debt minting fee of 0.5%, the user would pay a fee of 20 ADA which would be sent to the Collector at the time of minting and then distributed to INDY stakers.

The calculation formula would be:

0.5% * Amount Minted * Oracle Price = Fee Charged

This fee structure means the user’s wallet would be responsible for an output of an additional 20 ADA (e.g., in addition to the 4000 ADA for the mint) to cover the fee during the minting process. Such a fee structure would be adjustable by a vote of the DAO, providing the flexibility to maintain market competitiveness while discouraging excessive minting. Importantly, this fee is extracted from the user’s wallet, distinct from the collateral held in the CDP.

Who Benefits?

INDY Stakers: The fee directly supports INDY stakers. This fee would either replace or supplement the existing CDP Liquidation fee.

3.2 Implement a Redemption FeeRedemption plays a crucial role in maintaining the hard peg in a Protocol like Indigo. To balance the costs and incentives between the redeemer and the protocol effectively, it’s proposed to introduce a 2% fee on redemptions. This fee is particularly significant in the context of the additional recommendation below to eliminate the collateral fee. It would be calculated based on the total redemption amount and could be directed either back toward the redeemed CDPs or to INDY stakers, or a combination of both. This structure for the fee provides maximum flexibility to the DAO in managing the Protocol’s hard peg targets.

As an illustrative example, suppose a user redeems 1000 iUSD, which is equivalent to 4000 ADA, at an oracle-reported price of 0.25 USD/ADA. With a redemption fee set at 2%, an 80 ADA fee would be levied.

The calculation would follow this formula: 2% * Amount Redeemed * Oracle Price = Fee Charged

The application of this fee offers two positive benefits: If directed to the CDPs, it can mitigate the impact on the redeemed CDP by channeling the fee back into the CDP’s UTXO; and if directed to INDY stakers, it can provide another stream of ADA revenue. This dual-option approach allows for strategic flexibility in enhancing the Protocol’s stability and incentivizing participation.

Who Benefits? (Adjustable by DAO)

Redeemed CDP: A 1% portion of the fee will return to the CDP UTXO which benefits the CDP by increasing its Collateral Ratio.

INDY Stakers: As redemptions take place, a 1% portion of the fee will be distributed to INDY stakers.

3.2.1 Implement a Partial Redemption Fee

A further refinement to the fee structure involves the introduction of a global parameter within the Protocol Parameters. This parameter would define a flat ADA fee specifically for partial redemptions. It’s important to note that this fee would be exclusive to partial redemptions; users opting for a full redemption would not incur this charge. The introduction of this fee serves as a means to fine-tune the protocol’s security model, ensuring that partial redemptions don’t overload the system.

3.3 Implement Stability Pool Withdrawal Fee

An additional strategy under consideration is the implementation of a withdrawal fee for the Stability Pool. This fee aims to deter potential gaming of the system and to streamline the efficiency of liquidation processes. The proposed fee is 0.5% of the withdrawal amount. This fee will be redistributed among Stability Pool depositors as a loyalty bonus.

The structure of this proposed fee is designed to be directly proportional to the amount withdrawn in iAssets. The fee would be retained within the Stability Pool.

This fee would provide a tangible benefit to Stability Pool depositors, rewarding their participation and contribution to the protocol’s liquidity and stability. By implementing such a fee, the Protocol not only discourages opportunistic behaviors but also fosters a more loyal and engaged community of participants.

Who Benefits?

Stability Pool Depositors: This fee directly benefits those who contribute to the pool, aligning their interests with the long-term health of the Protocol.

3.4 Implement a Liquidation Processing FeeIn a declining market scenario, where liquidations of positions are more frequent, the introduction of a 2% liquidation processing fee could be a strategic move. This fee, designated for INDY stakers, has the potential to replace the existing collateral fee, thereby streamlining the Protocol’s fee structure. The primary goal is to ensure a more stable and consistent revenue stream for INDY stakers, enhancing their utility within the Protocol.

If the Collateral Fee is removed, a new mechanism is needed to handle the division of the liquidated ADA amounts during liquidations. As a solution, a 2% processing fee on the value of the liquidated iAssets could be instituted. This fee would be extracted from the iAssets at the time of liquidation and then transferred to the Collector, from where it would be distributed to INDY stakers.

The calculation would follow this formula: 2% * Liquidated Debt * Oracle Price = Fee Charged

For example, if 1100 ADA (worth of iAssets at 110% Minimum Collateral Ratio (MCR)) is liquidated, a 2% fee on the standard 1000 ADA would amount to 20 ADA, differing from having the fee on the full collateral.

This restructuring of the fee system not only simplifies the calculation but also provides a clearer and more logical framework for understanding the fees: an 8% premium plus a 2% fee on the iAsset value. This is a more straightforward approach compared to the previous system of a 2% fee on collateral coupled with a 7.8% premium.

Who Benefits?

INDY Stakers: This revised fee structure directly benefits INDY stakers, aligning their interests with the Protocol’s efficiency and financial health.

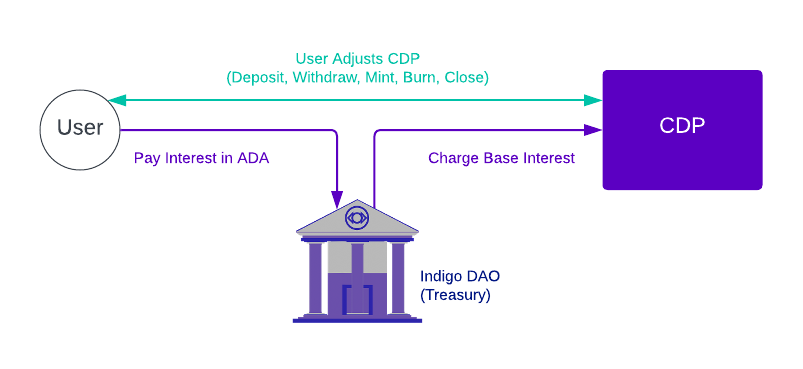

3.5 Introduce an Interest Rate Pegging Mechanism and DAO Revenue Stream Introducing an interest rate for Collateralized Debt Positions (CDPs) establishes a vital stability factor within the protocol. This mechanism is designed to promote responsible borrowing behavior and ensure timely debt repayment. CDPs from V1 will not accrue interest but will begin accruing interest if the CDP Owner modifies the position in V2.

Introducing an interest rate for Collateralized Debt Positions (CDPs) establishes a vital stability factor within the protocol. This mechanism is designed to promote responsible borrowing behavior and ensure timely debt repayment. CDPs from V1 will not accrue interest but will begin accruing interest if the CDP Owner modifies the position in V2.

The mechanism functions by adjusting the base interest rate in response to the frequency of oscillations around the redemption rate. Essentially, the Indigo DAO has the discretion to either raise or lower interest rates, effectively influencing the extent to which minting or spot purchasing of $iUSD is incentivized or discouraged.

In scenarios where depegging occurs, as indicated by heightened redemption activities, the interest rate would be increased. This increment in interest rates serves as a regulatory measure, discouraging excessive borrowing and encouraging debtors to settle their debts promptly.

Who Benefits?

The DAO Treasury: The implementation of this interest-pegging mechanism directly contributes ADA revenue to the DAO treasury. This ADA revenue can potentially be used for future development or for an INDY buyback program if proposed by the DAO.

4. Implementing New Limits

Indigo Protocol V1 relied on a single parameter to determine the ratio of collateral to debt that could be minted and the ratio at which the CDP could be liquidated, the Minimum Collateralization Ratio (MCR). In V2, this parameter is being split into a Maintenance Ratio (MR) which determines the collateral ratio a user can have when adjusting or minting a CDP, and a Liquidation Ratio (LR), the ratio at which the CDP will be liquidated.

4.1 Maintenance Ratio (MR)

The proposed Maintenance Ratio (MR), similar in function to the Reference Margin Ratio (RMR), sets a cap on the maximum debt that can be secured against a specified amount of collateral when adjusting a position. This MR can be aligned with the Liquidation Ratio (LR) to temporarily deactivate it, thus preventing excessive minting when necessary. This strategic measure is akin to adjusting minting fees but is specifically tailored to address positions with lower levels of collateralization.

It’s noteworthy that typical brokerage accounts often maintain an initial margin 10–20% above the liquidation threshold. In scenarios where an upward depegging occurs, aligning the MR with the LR offers a straightforward solution. This alignment not only manages depeg situations effectively but also aids in steering the iUSD back to a stable 110% LR.

4.2 Liquidation Ratio (LR)

Adjusting the Liquidation Ratio (LR) directly affects the proportion of the liquidation fee allocated to the stability pool. However, excessively increasing the LR can lead to unfair outcomes for CDP owners facing liquidation. To address this, the LR adjustments should be considered after first considering adjustment of the MR. This concurrent approach ensures a balanced and equitable distribution of fees, safeguarding the interests of both the stability pool and the CDP owners.

5. Summary: A Comprehensive Approach

This proposed restructuring introduces five new fees and two specific ratios, providing the DAO with an enhanced toolkit for managing the Protocol and helping ensure that hard pegs are maintained. These changes aim to improve the stability and predictability of the Indigo Protocol, ensuring its continued success and growth in the DeFi landscape while also improving the economic incentive for INDY Stakers and generating ADA revenue for the Indigo DAO Treasury.