Top Sui Projects: Sui DApps, Games, NFTs & Wallets Explored!

There’s no denying that Sui is one of the most exciting Layer 1 blockchain projects to emerge in recent history, a new challenger in the highly competitive scalable blockchain race currently led by Solana.

One of the “Holy Grail” narratives in crypto is that it would be a real game-changer to have a blockchain that can overcome the blockchain trilemma at the protocol level, meaning that scalability, security, and decentralization could all be achieved without having to rely on layer 2s, which contribute to fragmentation issues as we currently see on Ethereum.

Many projects are working towards this utopian blockchain oasis such as NEAR protocol, Algorand, Cardano, Avalanche, and many others, but the truth is that no layer one has definitively claimed the crown here as it remains to be seen how these protocols will perform and how scalable they will truly be once they reach mass adoption and are “battle-tested”.

Solana, one of the current favourites in this race, experienced multiple outages in 2022, totalling over 150 hours of downtime and then experienced another 5-hour outage in 2024, so it is safe to say the crown is still up for grabs and there is ample opportunity for altcoin projects to stand upon the podium.

This is where Sui enters the fray. By leveraging the Move programming language, its unique consensus engine and Parallel Execution capabilities, the Sui brainchild was born from the best and brightest minds from Facebook’s Diem project among others.

There has been a lot of excitement around Sui and its DApp ecosystem, which i will be covering in this article, but before we get into the top Sui projects & DApps, it helps to provide a bit of background.

What is Sui?

Drawing inspiration from the Japanese term for water, Sui sets out to imbue the Web3 landscape with the fluidity and adaptability reminiscent of its namesake. Sui endeavours to streamline development across diverse applications.

Fundamentally, Sui strives to diminish smart contract execution time and prioritize scalability for decentralized applications (DApps). To distinguish itself from other established blockchains, Sui introduces a suite of architectural innovations to boost its speed and scalability while upholding security. Standout features encompass the Sui consensus engine, parallel transaction execution, and the Sui Move smart contract programming language. These innovations, along with Sui's delegated proof of stake (dPoS) consensus mechanism have led many crypto enthusiasts to feel that Sui may be a real contender in the race for blockchain optimization.

These innovations, along with Sui's delegated proof of stake (dPoS) consensus mechanism have led many crypto enthusiasts to feel that Sui may be a real contender in the race for blockchain optimization.

As for the Sui cryptocurrency, validators stake SUI to authenticate transactions and the coin functions as a medium of exchange, an investible asset for those bullish on the long-term value of the network, executes custom programs, and rewards users contributing to the platform's advancement.

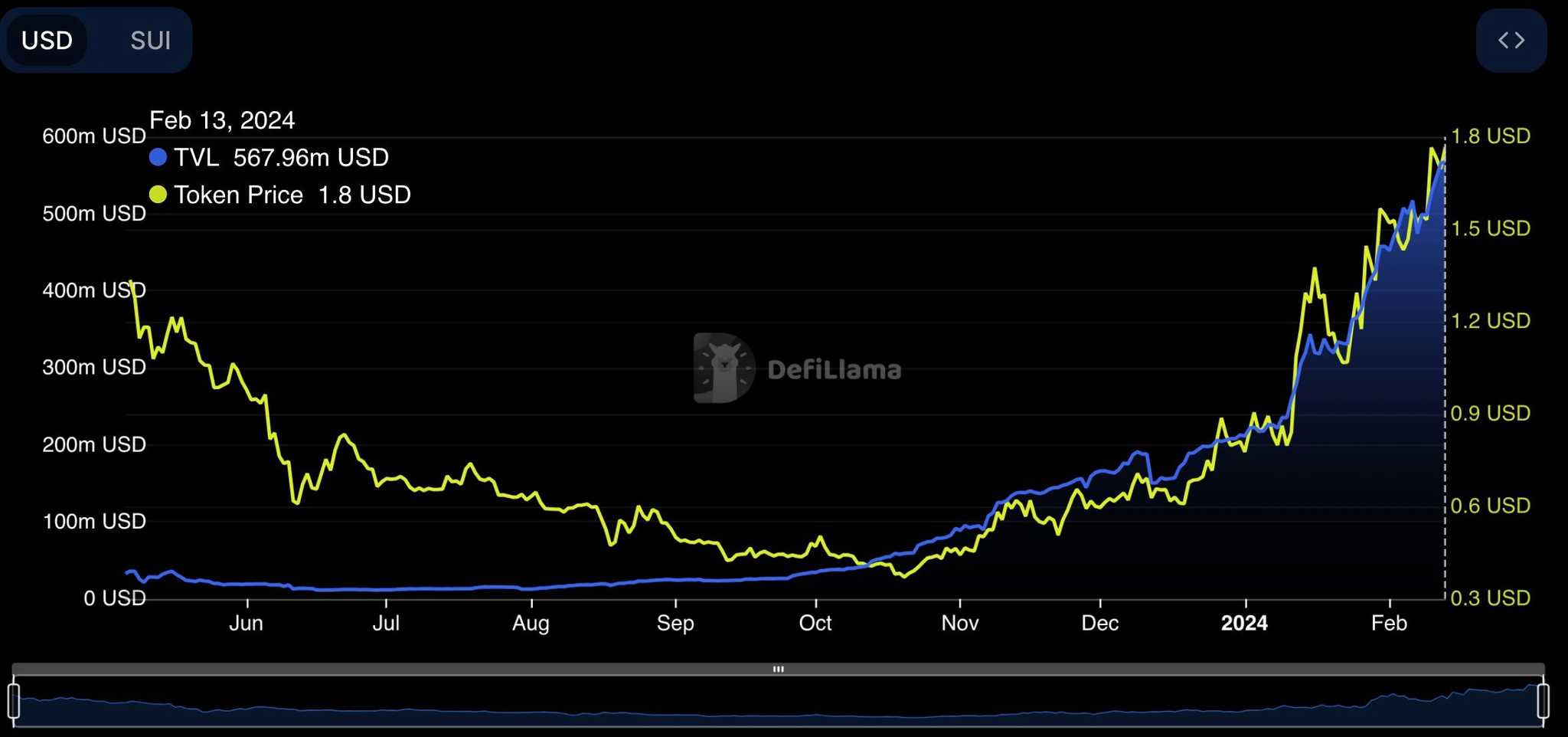

Sui’s trajectory has been nothing short of astonishing in its short history. The network temporarily broke into the top ten for DeFi ecosystem TVL at one point, which is no simple feat, and taking a look at the TVL growth and price on DeFiLlama…Well, the chart below speaks for itself:

Sui History

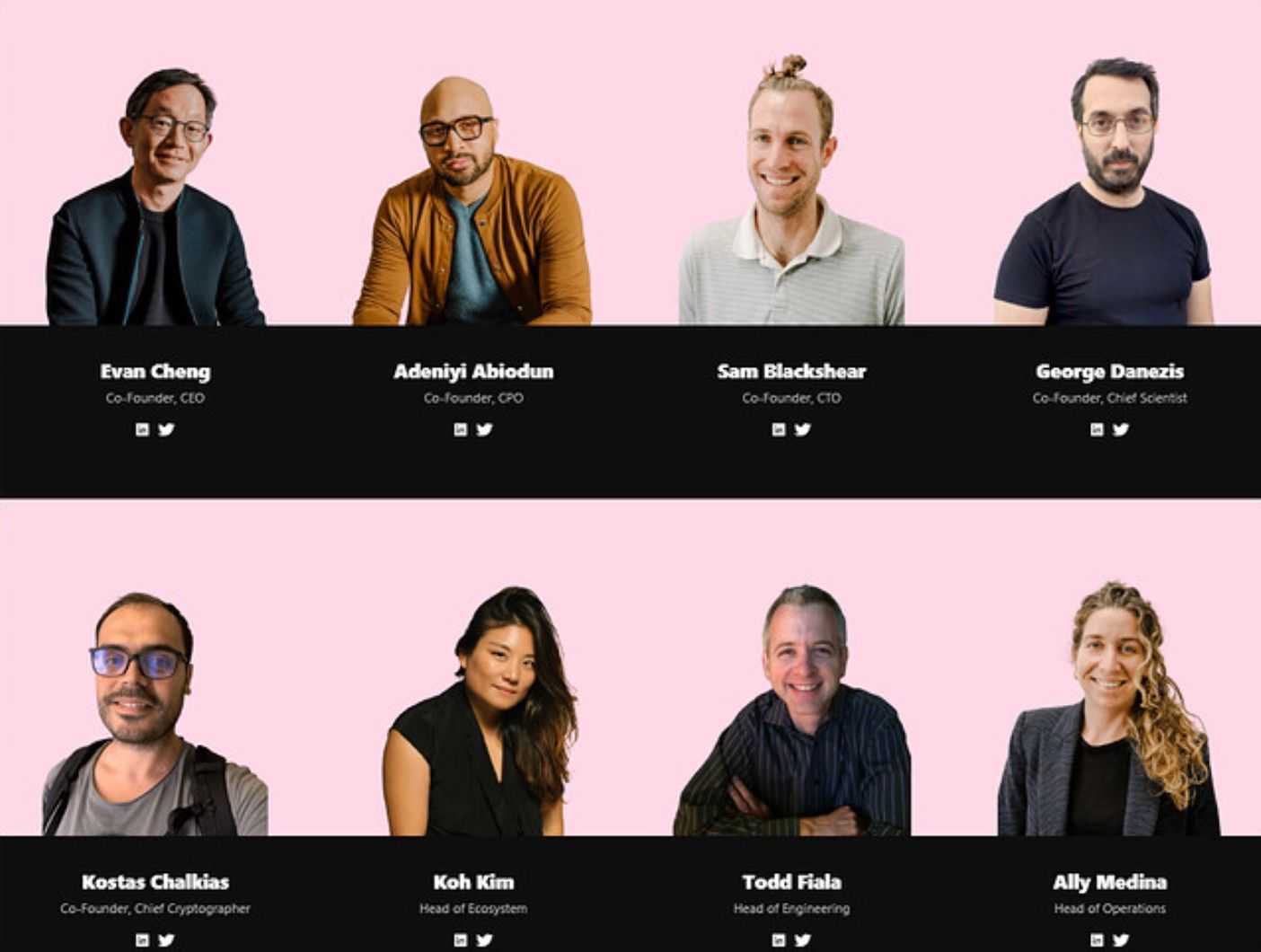

Mysten Labs, the team behind Sui, is made up of an impressive roster of heavy hitters including Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Chalkias. These were the names behind the development of other notable projects such as the Diem blockchain, Novi, the Facebook wallet program and others. While these ventures may have failed to take off for a variety of reasons, the team’s collective experience and history have undoubtedly contributed to the successful launch of Sui. Steering the development and expansion of Sui is the Sui Foundation, an autonomous entity dedicated to bolstering ecosystem developers and creators through grants and other initiatives.

Steering the development and expansion of Sui is the Sui Foundation, an autonomous entity dedicated to bolstering ecosystem developers and creators through grants and other initiatives.

This barely scratches the surface of Sui, the team, and how it works. This article is all about the Sui ecosystem and projects building on the network.

Top Sui Projects

With that bit of background out of the way, in no particular order, let's get into our picks for the most exciting Sui DApps.

SuiNS- Sui Naming Service

Naming services such as the Ethereum Naming Service, Solana Naming Service, and even Bitcoin Naming Service are big business in blockchain.  Think of these as the dotcom domains in traditional Web2 but fuel-injected for Web3. Naming services offer multiple benefits for crypto users such as:

Think of these as the dotcom domains in traditional Web2 but fuel-injected for Web3. Naming services offer multiple benefits for crypto users such as:

Simplification of Wallet Addresses

Blockchain addresses are long, complex strings of letters and numbers, making them prone to errors when typing or sharing. Complex addresses have also led to a significant rise in phishing scams and poisoned wallets, resulting in irrecoverable losses for crypto users.

Naming services like Ethereum Naming Service (ENS) and Sui Naming Service allow users to replace cumbersome addresses that are impossible to memorize with human-readable names. Here is an example, you could ask someone to send Sui to an address that looks like this:

-0x03a212de6a9dfa3a69e22387acfbafbb1a9e591bd9d636e7895dcfc8de05f389

Or simply ask them to send crypto to:

-Bob.sui (please don’t actually send funds to Bob)

This simplification significantly reduces the risk of errors in transactions and reduces successful malicious actions, making the blockchain more accessible and safer for everyday users.

Unified Digital Identity

Naming services offer a unified and portable digital identity across the Web3 ecosystem. A single Naming Service Identifier can point to multiple blockchain addresses and decentralized websites, enabling users to manage their digital footprint more efficiently and reduce the number of wallets a user needs to manage and track.

Decentralization and Ownership

In traditional systems, domain names are managed by centralized entities, giving these organizations control over the domain's fate and even going as far as censoring certain parties. In contrast, blockchain naming services operate on decentralized networks, granting users full ownership and control over their domain names. Once registered, only the domain owner can modify or transfer it, enhancing security and resistance to censorship.

Interoperability and Integration

Blockchain naming services are built to be interoperable across the Web3 ecosystem. A blockchain domain, for example, can be integrated with decentralized applications (DApps), wallets, and other services, facilitating seamless interaction and transaction processes. This level of integration is a significant step up from the siloed nature of traditional online services.

Enhanced Security Features

Blockchain-based naming services often come with enhanced security features such as blockchain-based DNS records, which are more resistant to hacking and tampering compared to traditional DNS records. This provides an added layer of security for users' online presence.

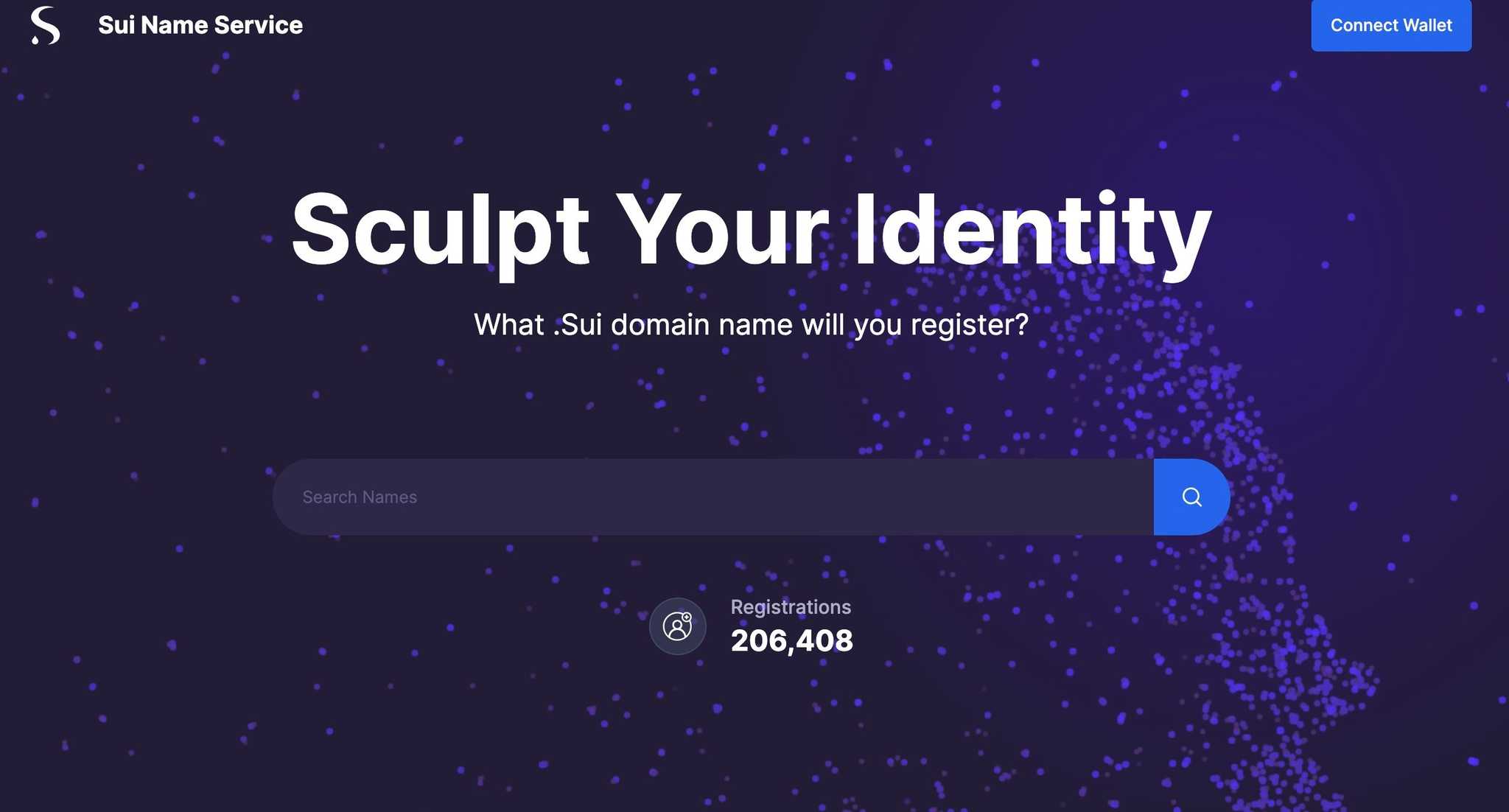

Those are some of the reasons why projects such as the Ethereum Name Service have been among the best-performing projects in recent months. As naming services are likely to stand as the common approach for operating in Web3 and go hand in hand with crypto mass adoption, SuiNS is the current leader in offering this critical service for the Sui Ecosystem.

SuiNS is run by Mysten Labs and allows both users and companies to represent themselves on the Sui blockchain through the use of .sui and .move domain names. SuiNS aims to simplify and secure blockchain interactions for users by providing an easier way to send money, interact with websites, purchase cryptocurrencies, and manage online identities without the need for complex passwords or the hassle of switching between different blockchains.

Scallop Lend

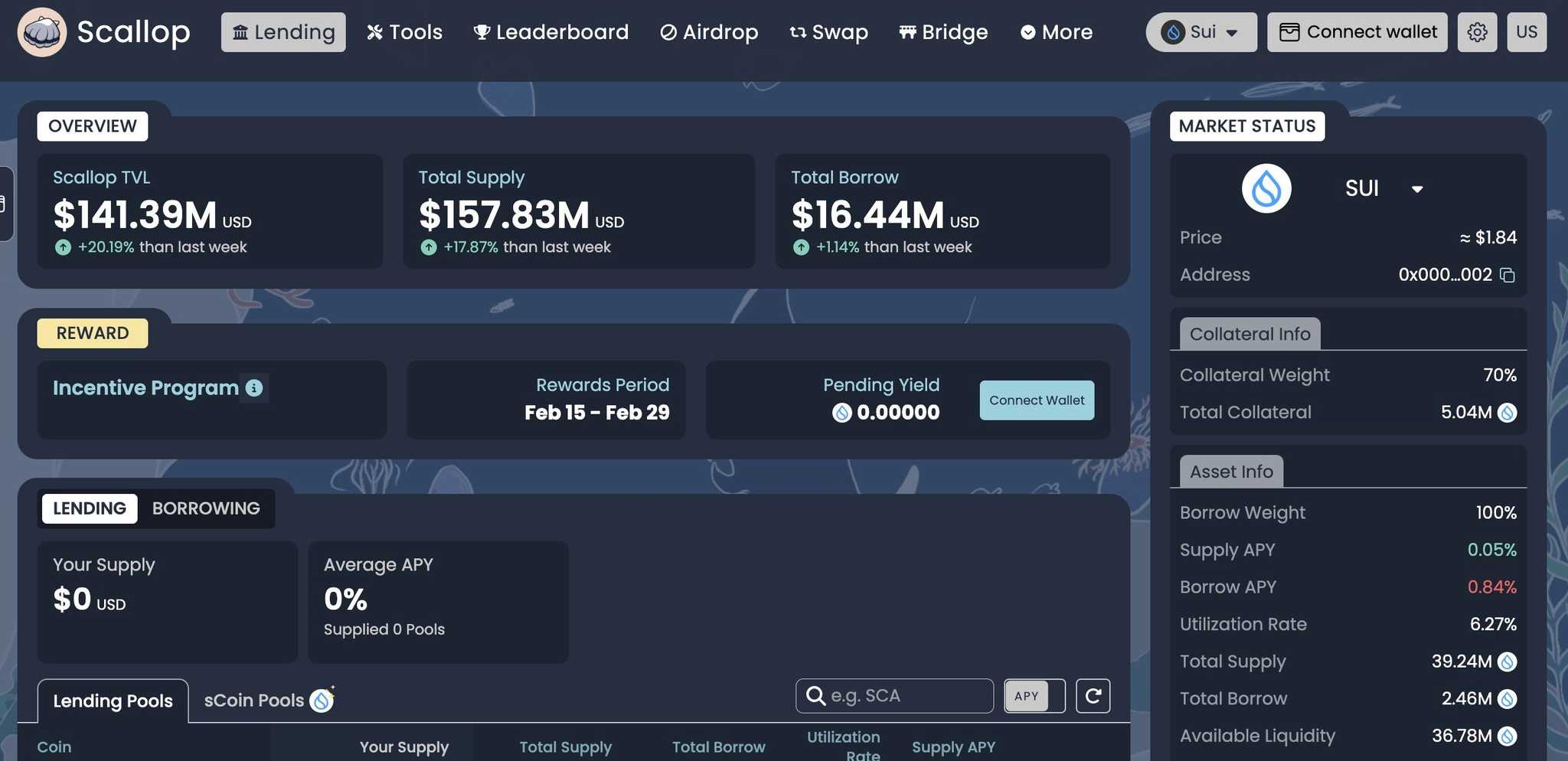

Scallop Lend currently sits as the leading lending platform in the Sui ecosystem by quite a large margin with $141 million TVL at the time of writing. Scallop refers to itself as a next-generation money market which emphasizes institutional-grade quality, enhanced composability and robust security.

Scallop refers to itself as a next-generation money market which emphasizes institutional-grade quality, enhanced composability and robust security.

Scallop Lend was the first DeFi protocol to receive an official grant from the Sui Foundation and plays a significant role in Sui’s blockchain ecosystem. By leveraging its unique architecture which allows for high scalability and low fees, Scallop Lend features a user-friendly platform for lending and borrowing digital assets.

It is great to see some innovation from the Scallop team as it isn’t just another one of the dozens of copy/paste lending protocols already in the space. Scallop is notable for its suite of features catering to both individuals and institutions, such as tools for building Sui Programmable Transaction Blocks (PTxs), a Scallop SDK for interacting with the protocol, and a Sui Kit for leveraging the TypeScript SDK.

Moreover, Scallop offers sCoins (Scallop Market Coins) for facilitating zero-cost flash loans, adding to its appeal among DeFi users seeking flexibility and efficiency in their transactions. Scallop’s efforts aim to further simplify DeFi transactions and improve accessibility for users and the plan is to eventually reward early supporters and active users with its native token, SCA, as part of its commitment to fostering a vibrant community around its protocol.

Scallop’s efforts aim to further simplify DeFi transactions and improve accessibility for users and the plan is to eventually reward early supporters and active users with its native token, SCA, as part of its commitment to fostering a vibrant community around its protocol.

Cetus

Of course, no Top DApps list can be complete without mentioning a good Decentralized Exchange (DEX). Cetus is the current leading DEX on Sui with $105 million TVL at the time of writing.  Cetus is a DEX and concentrated liquidity protocol that focuses on Move-based ecosystems, so it includes Aptos. The project is dedicated to constructing a robust and adaptable liquidity network that aims to simplify trading and liquidity provision for users, fostering an optimal trading and DeFi experience for users.

Cetus is a DEX and concentrated liquidity protocol that focuses on Move-based ecosystems, so it includes Aptos. The project is dedicated to constructing a robust and adaptable liquidity network that aims to simplify trading and liquidity provision for users, fostering an optimal trading and DeFi experience for users.

Like any DEX worth its weight, Cetus is:

Permissionless- All the major tools and functions on Cetus are built with a permissionless standard, allowing other apps to utilize its protocol for their own use cases.

Programmable- Cetus built a highly customizable liquidity protocol based on CLMM. With flexible options for swap, range orders and limit orders, users can perform many different types of trading strategies, mirroring a Centralized Exchange (CEX) experience.

Composable- Leveraging the concept of “Liquidity As A Service” Cetus emphasises the ease of integration when building, allowing developers to easily access liquidity on Cetus for their own projects.

Sustainable- Cetus utilizes a double-token model (CETUS and xCETUS) to create long-term and dynamic incentivization that is sustained by protocol earnings which reward active participation.

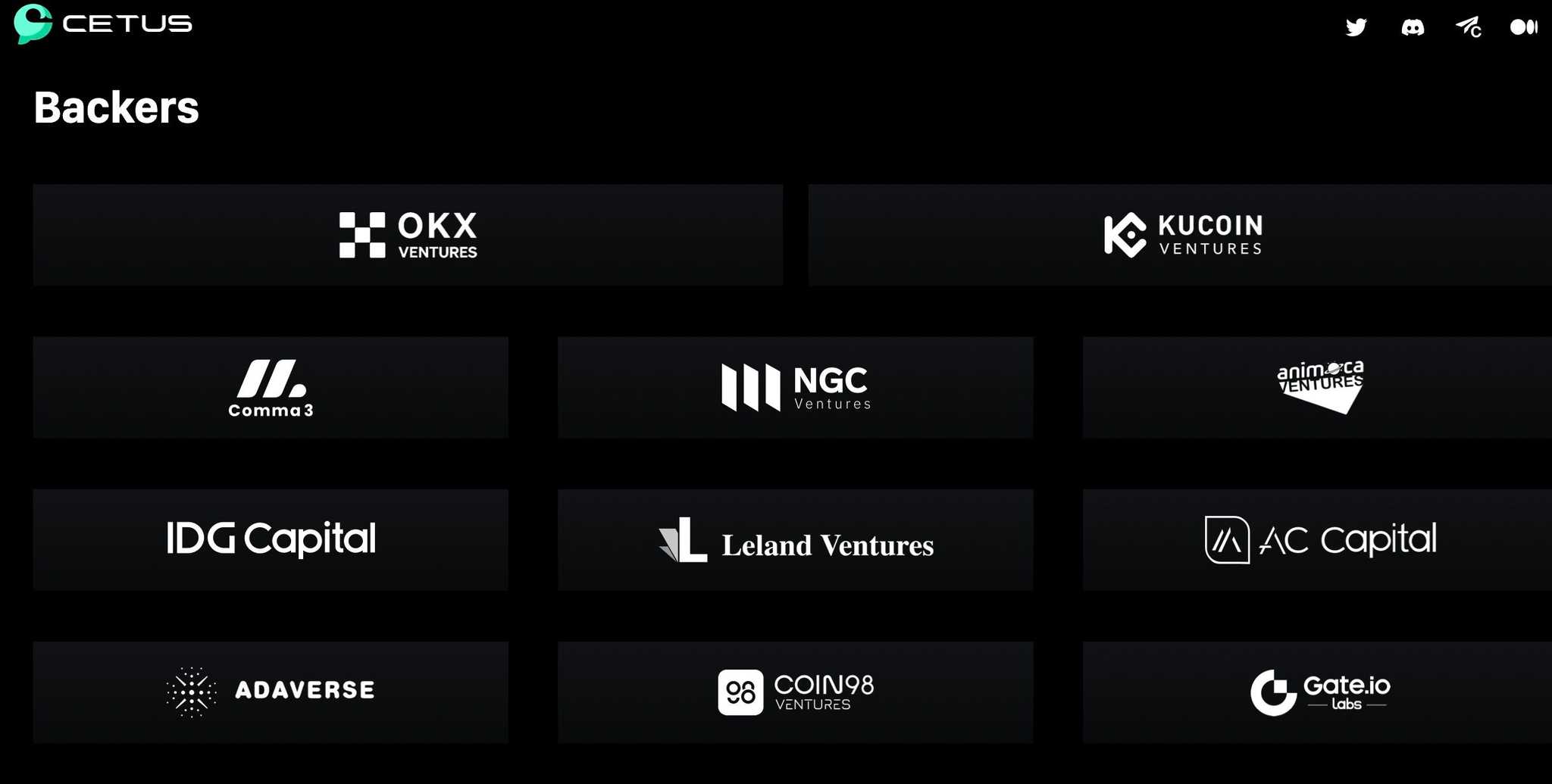

Cetus has also been audited by OtterSec and Movebit, and has an impressive collection of backers: Users of the Cetus platform can currently Swap, utilize Earn Pools and Farms, access a launchpad, buy crypto, and bridge tokens.

Users of the Cetus platform can currently Swap, utilize Earn Pools and Farms, access a launchpad, buy crypto, and bridge tokens.

Aftermath Finance

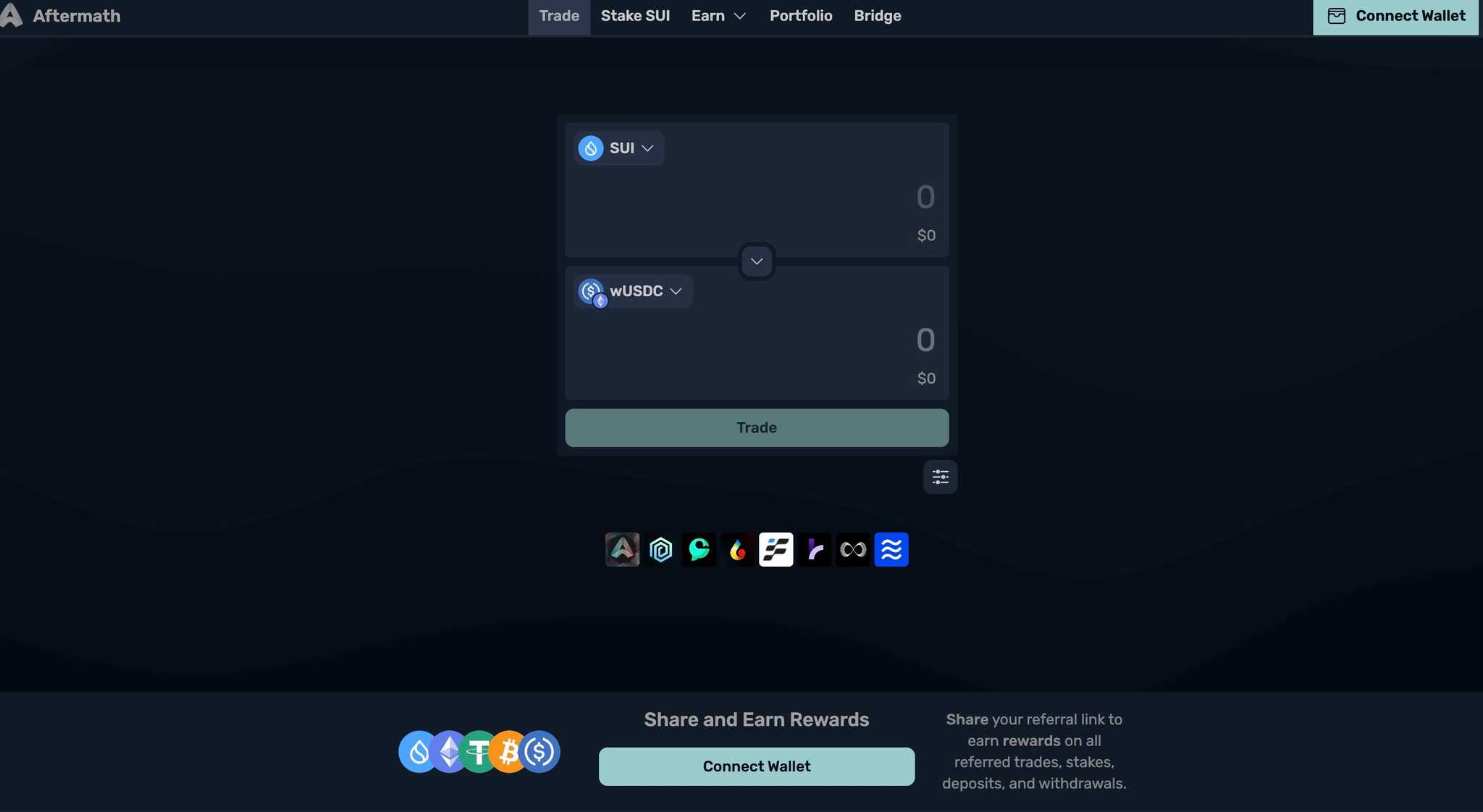

Aftermath Finance is an on-chain CEX. Yes, you read that right, a centralized exchange that operates on-chain, acting as an all-in-one finance hub on Sui.  Aftermath Finance is designed to offer a comprehensive suite of services aimed at revolutionizing how users trade, invest, and earn yield. It is crafted to provide an intuitive and efficient user experience, leveraging the advanced capabilities of the Sui network to facilitate fast, cost-effective, and transparent financial transactions. The platform is being developed by a team of skilled Sui Move developers who are committed to creating an all-encompassing ecosystem for DeFi and GameFi sectors.

Aftermath Finance is designed to offer a comprehensive suite of services aimed at revolutionizing how users trade, invest, and earn yield. It is crafted to provide an intuitive and efficient user experience, leveraging the advanced capabilities of the Sui network to facilitate fast, cost-effective, and transparent financial transactions. The platform is being developed by a team of skilled Sui Move developers who are committed to creating an all-encompassing ecosystem for DeFi and GameFi sectors.

The platform plans to introduce a variety of core products, including indices for portfolio management and yield farming, liquid staking derivatives (LSD) that offer liquidity for staked SUI tokens, perpetual markets with deep liquidity for various assets, and lending services. Additionally, Aftermath Finance aims to explore the NFT and GameFi spaces, anticipating significant growth and activity in these areas as part of the broader Sui ecosystem. Aftermath Finance also supports cross-chain swaps across over 6 networks using Wormhole and Celer bridges.

Aftermath Finance also supports cross-chain swaps across over 6 networks using Wormhole and Celer bridges.

Suia

One area of blockchain that excites many of us here at the Coin Bureau is decentralized social media applications. Imagine a platform where users can speak their minds without having to worry about being censored or de-platformed. Free speech for the win!

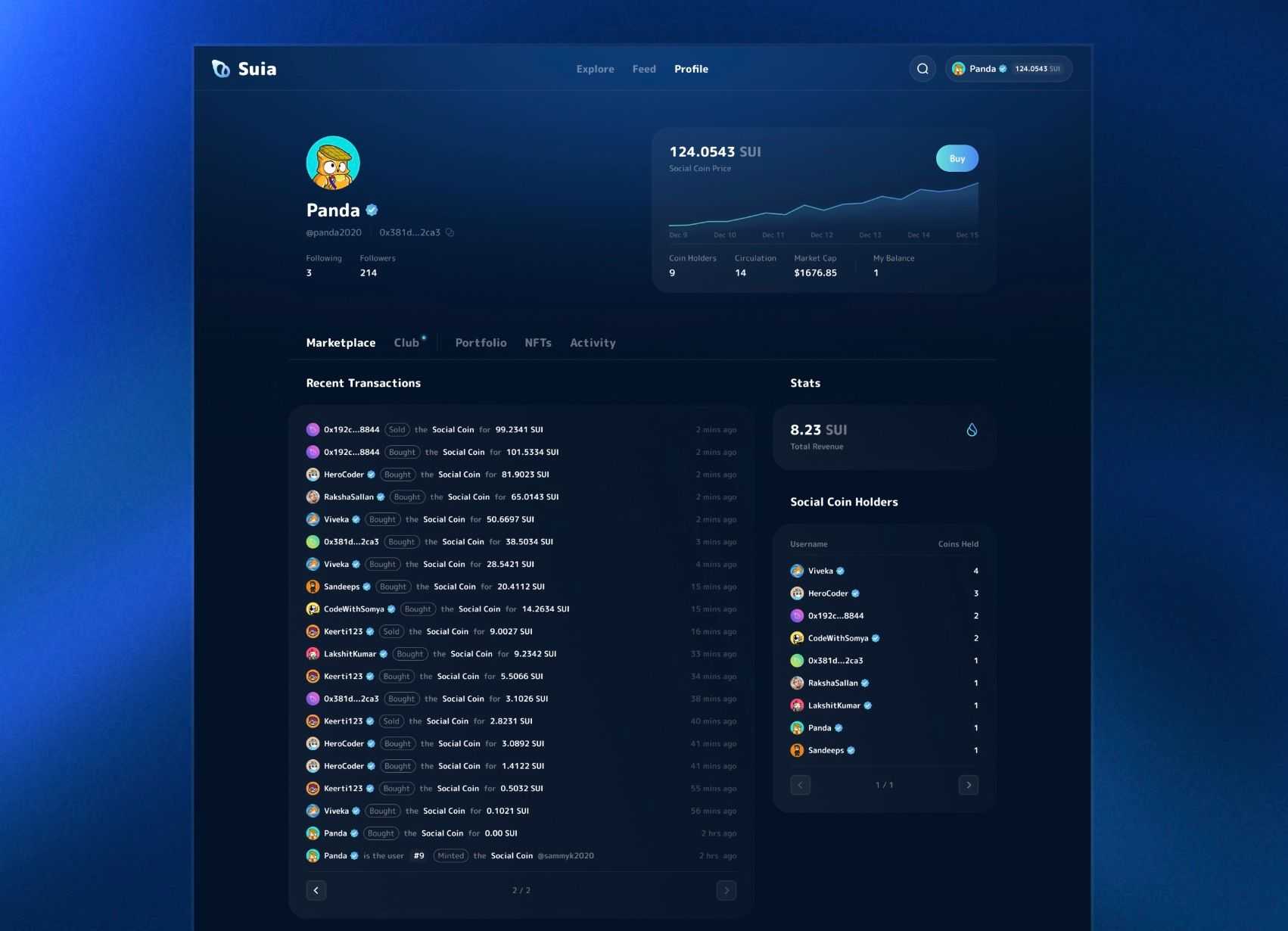

Suia is a social DApp that stands out with its distinct characteristics: personalized NFT recommendations, an on-chain activity feed, brand clubs, and adaptable spaces on Sui. Suia has launched a Social Coin feature and introduced the native cryptographically secure fungible protocol token of Suia.io, denoted by the ticker symbol SUIA. SUIA serves as an interoperable utility token, incentivizing economic participation within the Suia ecosystem and ensuring fair compensation for users' contributions.

Suia has launched a Social Coin feature and introduced the native cryptographically secure fungible protocol token of Suia.io, denoted by the ticker symbol SUIA. SUIA serves as an interoperable utility token, incentivizing economic participation within the Suia ecosystem and ensuring fair compensation for users' contributions.

Here is a brief overview of the primary features of Suia:

Social Coin

Social Coins present an innovative avenue for creators to introduce assets and allocate tokens, providing a platform for fans to invest in creators' future endeavours. This supports a more inclusive environment for interactions between creators and their fans, opening up additional avenues for things like loyalty strategies and fan engagement. Creators also receive a 1% fee from all transactions.

On-Chain Social Feed

Sui Feed is where users stay up-to-date with posts from their favourite creators, brands, traders, whoever!

On-chain Relationship

Suia will launch an on-chain following system. This will allow users to follow other users by sending transactions, and that on-chain behaviour will be presented in the Sui Feed.

This allows Suia to rank the addresses of the Sui Network and identify the most popular addresses followed by users.

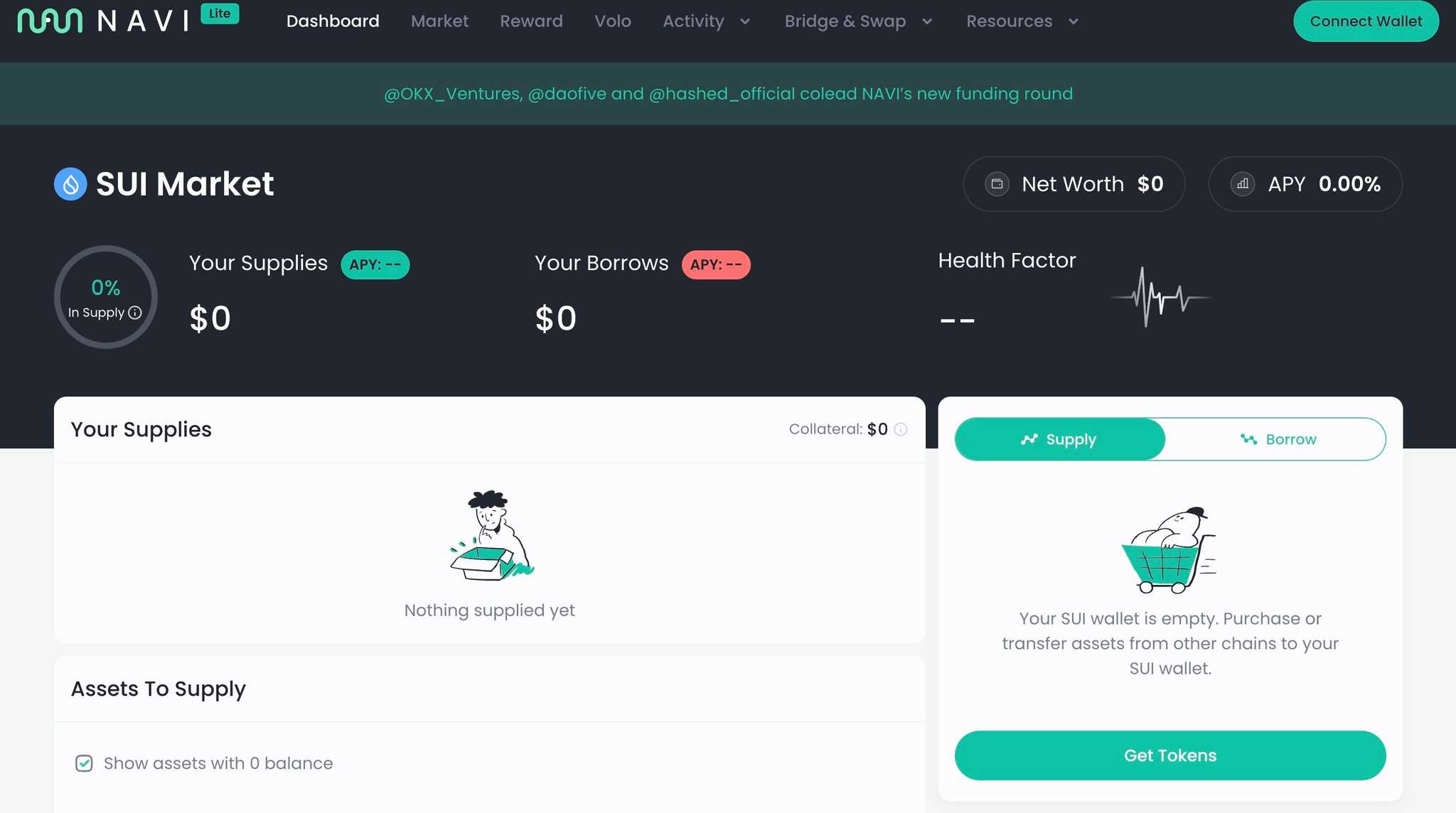

NAVI Protocol

NAVI is a collateralized lending and borrowing platform for SUI, USDC, USDT, wrapped Ethereum and Bitcoin. It has features such as isolated pools, flash loans and cross-chain lending/borrowing.  NAVI Protocol has experienced impressive growth, hitting over $135 million in TVL at the time of writing with no signs of slowing down. I am particularly intrigued by a statement on their site that reads “Inspired by AAVE, Built for the Future.”

NAVI Protocol has experienced impressive growth, hitting over $135 million in TVL at the time of writing with no signs of slowing down. I am particularly intrigued by a statement on their site that reads “Inspired by AAVE, Built for the Future.”

I appreciate the nod to Aave here, recognizing it as a true pioneer in the space for the Ethereum ecosystem. Furthermore, it is nice to see NAVI not just simply clone what Aave has already created, but looks to innovate and enhance upon Aave’s offerings as technology improves with time.

Here are some of NAVI's key offerings:

Leveraged Vaults- Users can access leveraged vaults with low-APR asset borrowing and high farming rewards. There are leveraged strategies on native APY assets such as Liquid Staked Assets and LP Tokens.

Isolation Mode- Secure listing of new assets with no protocol-wide or systematic risks. Novel assets can only collateralize with approval by NAVI Governance.

Versatility- Customizable, extensible interest rate curve and flexible asset support enabled by Sui Oracle partners and TWAP oracles. DeepBook and AMM integrations assure efficient liquidation.

Improved Liquidation Risk Control- By utilizing diverse high-quality price data, NAVI can promptly identify liquidation events. By tapping into the integration with DeepBook, the open liquidation system empowers bot operators to compete in executing liquidations.

Fortified Security and Capital Efficiency- Traders can effortlessly open and close positions with minimal fees and attractive interest rates. NAVI users can achieve higher yields by accessing additional capital through yield-bearing tokens, all within the secure, high-performance Move ecosystem. Looking a little closer into security aspects, NAVI Protocol enables the enforcement of supply limits for each asset, limiting how much of a specific asset can serve as collateral. This helps mitigate exposure to single asset volatility. A partnership with Supra Price Oracles provides secure, reliable and scalable price feeds and debt ceilings restrict total borrow amounts in collateralized markets using underlying tokens. Similar to the supply limits, this enhances risk management by limiting large positions backed by a specific asset.

Looking a little closer into security aspects, NAVI Protocol enables the enforcement of supply limits for each asset, limiting how much of a specific asset can serve as collateral. This helps mitigate exposure to single asset volatility. A partnership with Supra Price Oracles provides secure, reliable and scalable price feeds and debt ceilings restrict total borrow amounts in collateralized markets using underlying tokens. Similar to the supply limits, this enhances risk management by limiting large positions backed by a specific asset.

NAVI Protocol has been audited by both OtterSec and Movebit and is backed by the likes of OKX Ventures, Dao5, BENQi, Gate.io Labs, Coin98 and many others.

Kriya

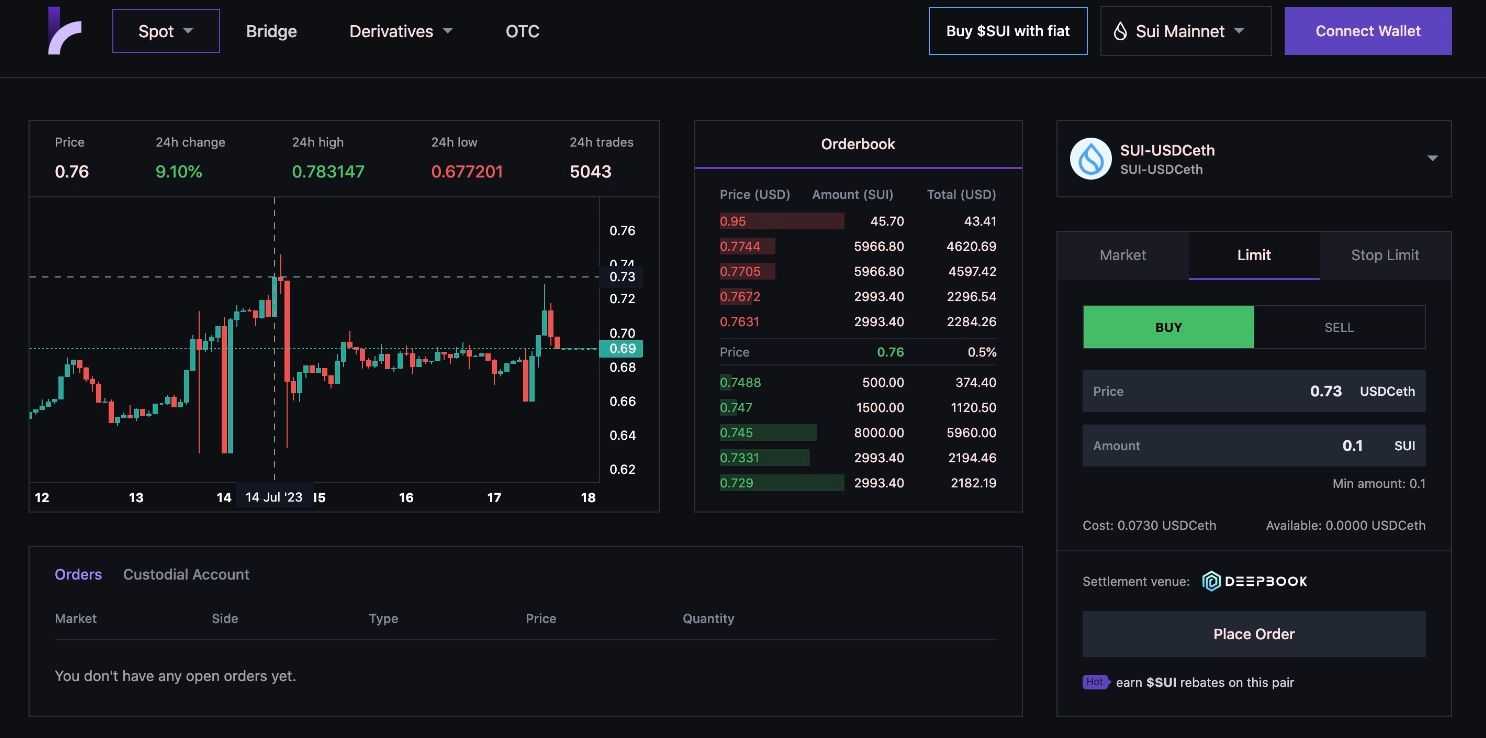

Kriya is a DEX that is developing an institutional-grade infrastructure for on-chain trading. Current offerings are an in-app bridge, an AMM swap and a fully on-chain orderbook that supports perpetual trading with 20x leverage. OTC-RFQ functionality is stated to be coming soon.  Kriya decentralized exchange focuses on providing institutional-grade trading experiences that are every bit as efficient as what traders will find on a Centralized Exchange (CEX), but with all the benefits of decentralization. Traders can take advantage of trading spot, perpetuals, options, access an OTC desk and leverage multiple order types for advanced trading strategies.

Kriya decentralized exchange focuses on providing institutional-grade trading experiences that are every bit as efficient as what traders will find on a Centralized Exchange (CEX), but with all the benefits of decentralization. Traders can take advantage of trading spot, perpetuals, options, access an OTC desk and leverage multiple order types for advanced trading strategies.

Beyond trading, users can bridge funds from various chains and enjoy efficient matching and trading engines for fast trade execution, incentivized liquidity and capital efficiency. Kriya traders can also track and manage open positions, edit open orders, and spread collateral across open positions all from a single dashboard. Kriya has partnered and built with the likes of the Sui Foundation, PYTH, Wormhole, Alpha Wave and others. What is notable is that Kriya taps into TradingView charting functionality, the gold standard for traders worldwide so there are ample tools for even the most hardcore of technical analysts.

Kriya has partnered and built with the likes of the Sui Foundation, PYTH, Wormhole, Alpha Wave and others. What is notable is that Kriya taps into TradingView charting functionality, the gold standard for traders worldwide so there are ample tools for even the most hardcore of technical analysts.

A notable feature Kriya traders can find is the Strategy section. Here traders can find 1-Click Cross Protocol Farming strategies and access various Deepbook LP Vaults, making Kriya a powerful one-stop DeFi platform.

Turbos Finance

Turbos Finance is, as the name implies, a hyper-efficient DEX built on Sui. Launched in June 2022, it is a decentralized exchange that emphasises efficiency and scalability. It aims to democratize DeFi for the next billion Web3 users, bridging the Sui ecosystem with the broader market.  The platform introduces concentrated liquidity AMMs to boost capital efficiency by narrowing the liquidity range. It also offers dynamic asset management for liquidity providers and a streamlined, user-friendly trading experience. Turbos is backed by notable entities like Mysten Labs and Jump, focusing on simplifying DeFi transactions. Here are some of the core talking points:

The platform introduces concentrated liquidity AMMs to boost capital efficiency by narrowing the liquidity range. It also offers dynamic asset management for liquidity providers and a streamlined, user-friendly trading experience. Turbos is backed by notable entities like Mysten Labs and Jump, focusing on simplifying DeFi transactions. Here are some of the core talking points:

Maximizing Capital Efficiency- By utilitizing concentrated liquidity, Turbos Finance achieves a higher degree of capital efficiency by reducing the trading range in which liquidity is provided, leading to the reduction of unused collateral.

Dynamic Asset Management- Liquidity Providers on Turbos have complete autonomy over the trading price range of their assets. With flexible price range management tools, LPs can adjust price range as needed to adapt to the dynamic market conditions that the crypto industry is known for.

Streamlined Trading -The Turbos Finance DApp makes trading simple and intuitive with a minimalist design that is familiar among crypto traders. Though the UX is quite streamlined and minimal, the platform still offers plenty of features and tools to cater to the needs of crypto traders.

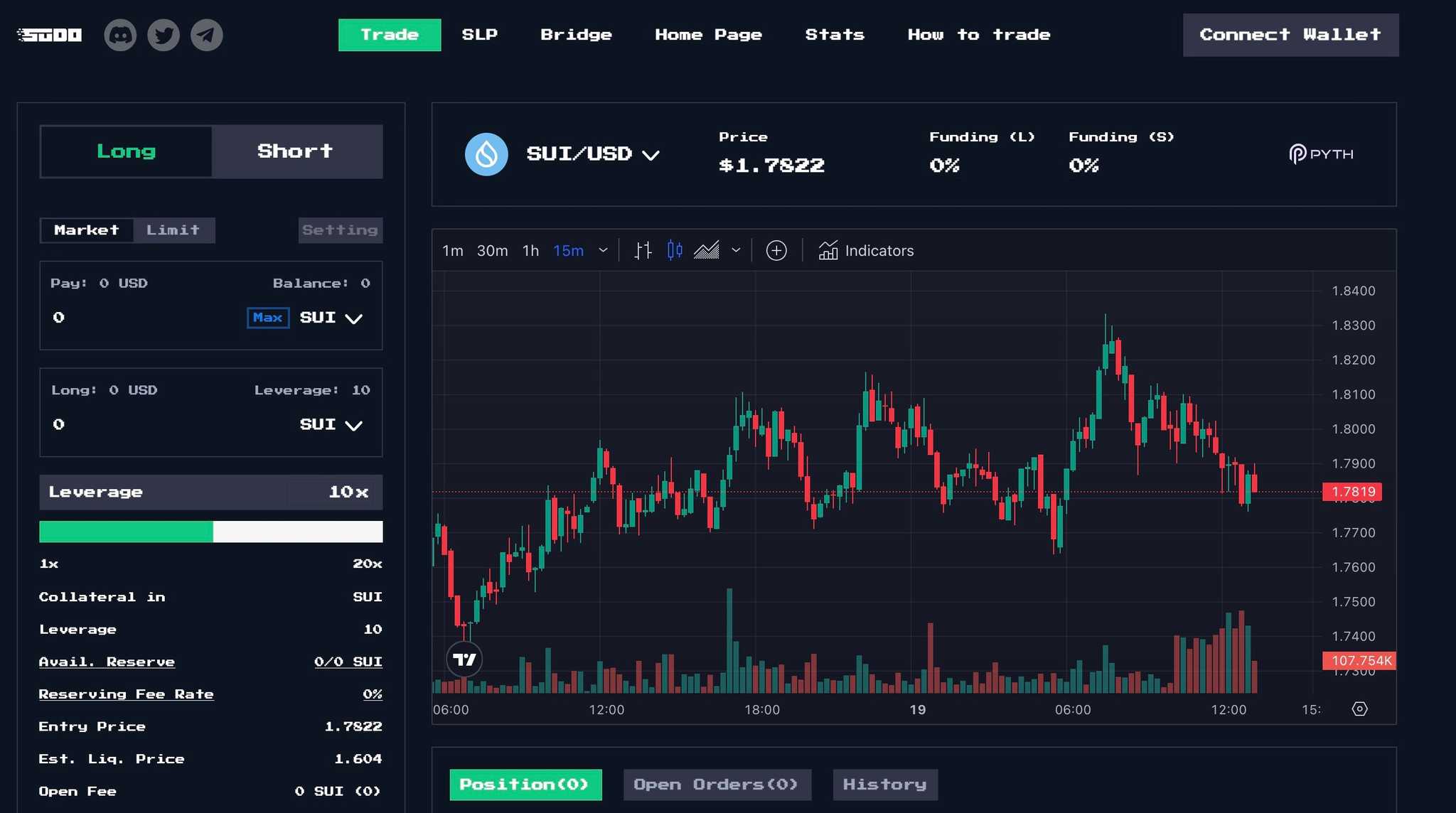

Sudo Finance

Sudo Finance is a synthetic asset trading platform that wraps real-world assets and virtual assets into a synthetic financial product that lives on-chain and offers high-leverage trading.

Sudo's objective is to democratize access to synthetic financial products resembling stocks and/or commodities, making them available to underserved communities worldwide. The name "Sudo" derives from the abbreviation of the sudo command line, symbolizing a hacker ethos and a disruptive approach aimed at challenging the established norms within the global financial ecosystem. The platform provides a highly efficient trading experience where traders can swap tokens and use up to 20x leverage and Liquidity Providers can earn from providing liquidity to Sudo Liquidity Pools. Charting functionality is provided by TradingView, so traders can rest assured it will have all the functions and tools needed.

The platform provides a highly efficient trading experience where traders can swap tokens and use up to 20x leverage and Liquidity Providers can earn from providing liquidity to Sudo Liquidity Pools. Charting functionality is provided by TradingView, so traders can rest assured it will have all the functions and tools needed.

Caution❗️Trading using leverage is considered extremely risky. Leverage can amplify both profits and losses and lead to rapid loss of capital. Be sure to understand the risks of leverage before using it and understand that it is a tool best used conservatively in the hands of experienced traders.

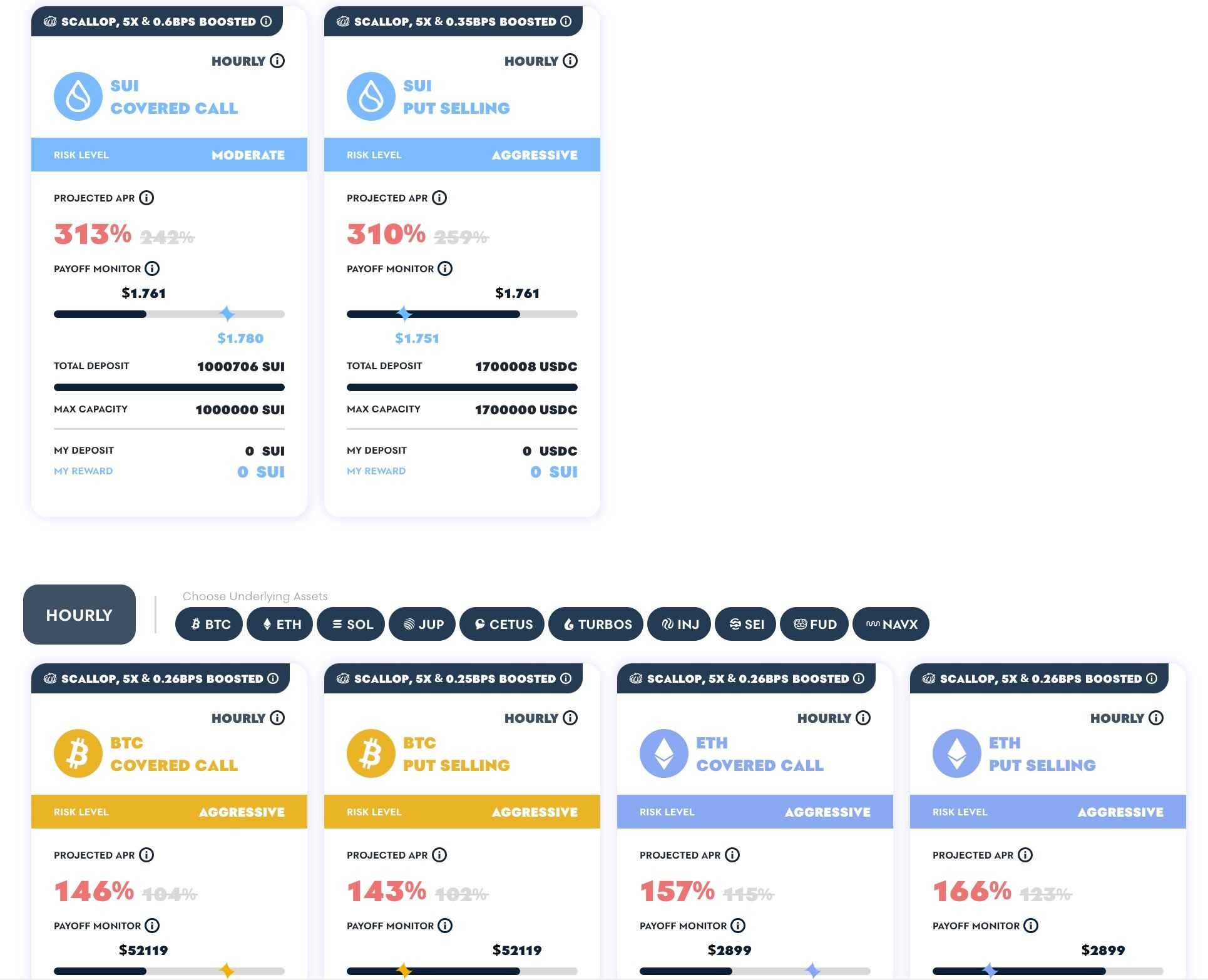

Typus Finance

Typus Finance offers a one-click solution for users seeking high risk-to-reward returns through a real yield infrastructure. It merges swap, lending, and derivatives into an options marketplace for niche assets, enhancing liquidity and risk-adjusted returns for Liquidity Providers in the DeFi sector. Typus separates itself from other DeFi protocols such as Uniswap, Curve and Aave by covering more long-tail assets on-chain and improving the liquidity of such assets. To achieve this end, Liquidity Providers need to transfer part of their risk to those willing to take on the risk. They achieve this through Options.

Typus separates itself from other DeFi protocols such as Uniswap, Curve and Aave by covering more long-tail assets on-chain and improving the liquidity of such assets. To achieve this end, Liquidity Providers need to transfer part of their risk to those willing to take on the risk. They achieve this through Options.

Options are instruments that can be used to hedge and speculate on crypto, but retail users are not playing an excessive role in Crypto Options. To overcome this, Typus is creating a series of retail-oriented, user-friendly and one-click products for Crypto Options that will aim to increase market participation in Crypto Options for retail investors and solve on-chain liquidity issues.

Here are some of the issues and how Typus aims to overcome them:

Lack of Speculation Instruments- Perpetuals and options DEXes struggle to onboard professional market makers that will provide liquidity on-chain. This results in a limited DeFi user base, system integration costs and high gas fees. These difficulties only grow when it comes to market makers providing liquidity for long-tail assets as they are volatile and insufficient historical data is insufficient for market makers to build efficient arbitrage models. Typus overcomes these issues with their innovative Modified Dutch Auction mechanism to discover volatility on-chain.

Unlucrative Risk Rewards for AMM LPs- The model incentivizes market makers to supply liquidity on Orderbook DEXs, often incurring high gas fees, which may drive some towards AMM-based DEXs despite the risk of impermanent loss. Market makers might establish perpetual positions, either on-chain or off-chain, to dynamically hedge and manage risks. Retail investors face challenges like learning programming for dynamic hedging, dealing with high impermanent loss, or withdrawing from liquidity provision, potentially harming the DeFi ecosystem. To address these issues, Typus has developed tools like the Auto Rebalancing Tool and Sharpe Optimizer to enhance LPs' risk-adjusted returns, allowing for easier management of gamma risks and volatility-based rebalancing.

Low LTV Ratio for Long-Tailed Assets- Lending protocols are typically unwilling to accept long-tail assets as collateral as altcoins are very volatile and high risk for lending protocols and inefficient for borrowers. To overcome this, Typus DeFi Options Vaults bundle altcoins with put options as collateral to increase capital efficiency and relieve liquidation risk.

Users can access Covered Call, Put Selling and Call Spread strategies in an attempt to maximize their returns. Typus introduced DeFi Option Vaults (DOVs) with a Dutch Auction feature to streamline the decision-making process for retail users. The platform fosters an options market for niche assets, enhancing rewards for liquidity providers and bolstering DeFi ecosystem liquidity.

Here are a look at some of the current Vaults that Users can tap into: Recognizing the gap in scalable liquidity solutions and risk management tools, Typus aims to differentiate liquidity provision from speculative risks by developing a DeFi-centric mechanism for risk transfer, facilitating smoother liquidity provision by LPs. The platform has also been audited by OtterSec and Movebit.

Recognizing the gap in scalable liquidity solutions and risk management tools, Typus aims to differentiate liquidity provision from speculative risks by developing a DeFi-centric mechanism for risk transfer, facilitating smoother liquidity provision by LPs. The platform has also been audited by OtterSec and Movebit.

Suilend

Suilend is not live just yet but it has already started to garner some excitement and attention. Suilend.io will provide a secure, scalable platform for earning interest and borrowing assets, featuring a decentralized, dynamic interest rate model that will support various collateral types.

Suilend.io will provide a secure, scalable platform for earning interest and borrowing assets, featuring a decentralized, dynamic interest rate model that will support various collateral types.

The platform is going to offer unique functionalities like isolated pools for diverse assets, LP lending, low fees, multi-staking, and an insurance mechanism. Additionally, Suilend will offer referral incentives, a Launchpad for Sui ecosystem projects, and exclusive NFTs for community engagement.

Sui Blockchain Games

For such a new ecosystem, there are already a surprising number of interesting-looking crypto games on Sui. Here are a couple that caught our eye and look like they could be quite fun.

Cosmocadia

Cosmocadia is a community-based farming game where players can build their own utopian farms. The Sui Directory states the game is a mix of Stardew Valley and Animal Crossing with play-to-earn mechanics.  The reasons that this game makes the list are that the graphics are pretty good with a cartoon style that is an improvement over many current blockchain games, this category of game has proven to be popular among players, and the developers behind it are Lucky Kat Studios, a gaming studio with over 200 million downloads, so these guys know what it takes to make a fun game.

The reasons that this game makes the list are that the graphics are pretty good with a cartoon style that is an improvement over many current blockchain games, this category of game has proven to be popular among players, and the developers behind it are Lucky Kat Studios, a gaming studio with over 200 million downloads, so these guys know what it takes to make a fun game.

The object of the game is that players need to work together to turn the wilderness into a utopia by farming, fishing, crafting, decorating, cooking and more. The game has a playable demo available that I found myself getting pretty tied into as I was supposed to be working on this article, it’s pretty entertaining.

Space Mavericks

Space Mavericks offers an engaging real-time multiplayer experience, reminiscent of classic artillery games where players adjust angles and power to aim and shoot. Combining elements from artillery classics like Worms and Angry Birds with the strategic depth of MOBAs. This is a free-to-play and play-to-earn game where players can select from a variety of commanders, each with their own special abilities to create strategies and conquer adversaries.

This is a free-to-play and play-to-earn game where players can select from a variety of commanders, each with their own special abilities to create strategies and conquer adversaries.

Battles can include up to 8 players in competitive battle royale mode or players can team up with up to 4 allies to battle bosses.

Samurai Shodown: The Legend of the Light Moon

In 2023, the Onbuff gaming platform announced that it would be onboarding a suite of Gaming and NFT partnerships onto Sui and launch a Web3 version of SNK's popular game series Samurai Shodown  Introducing popular Web2 games to the world of Web3 is a very exciting concept. We have already seen some developers upgrade their old-school Nintendo consoles to pay Bitcoin while playing Super Mario, adding an even more attractive reason to play beyond nostalgia and entertainment purposes.

Introducing popular Web2 games to the world of Web3 is a very exciting concept. We have already seen some developers upgrade their old-school Nintendo consoles to pay Bitcoin while playing Super Mario, adding an even more attractive reason to play beyond nostalgia and entertainment purposes.

Samurai Shodown is a fighting game series created by gaming studio SNK in Japan, with the first game of the series being released in 1993. There have been over 20 games in the franchise released across various gaming consoles and iOS/Android. The gameplay ranges from the 1v1 fighting style made popular by games like Mortal Kombat and StreetFighter to open-world exploration fighting games like Diablo.

SNK is known for creating popular games such as Metal Slug, The King of Fighters, Fatal Fury and others.

Top Sui NFT Marketplaces

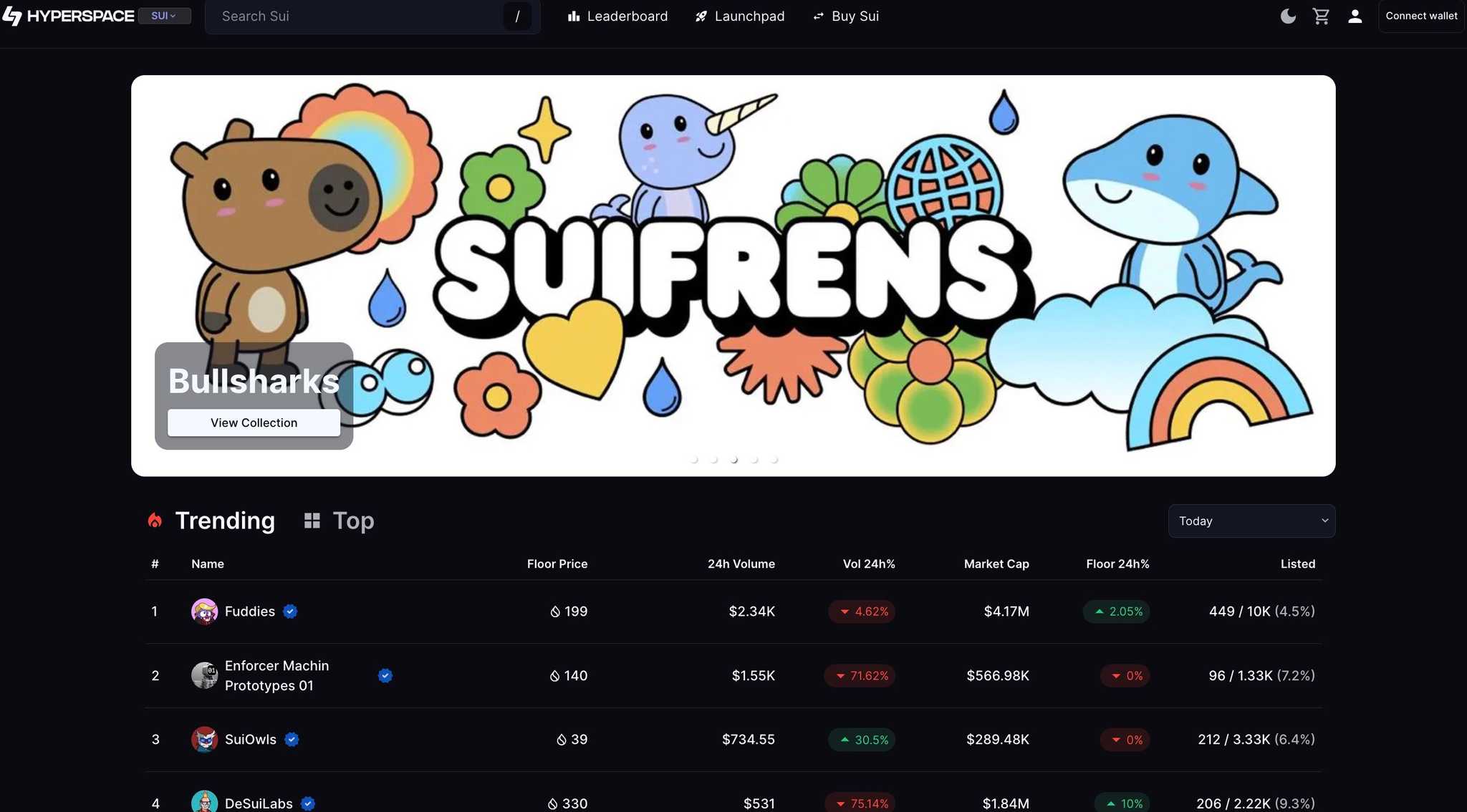

Hyperspace

Hyperspace is a popular multi-chain NFT marketplace that launched on Solana, supports Avalanche, and is quickly becoming a go-to place for Sui NFTs as well. Hyperspace has a simple mission: To enable the best NFT trading and commerce experience for everyone while protecting the openness and composability of web3.

Hyperspace has a simple mission: To enable the best NFT trading and commerce experience for everyone while protecting the openness and composability of web3.

The platform not only has high trading volume for Solana, Avalanche and Sui NFTs, but also acts as an NFT aggregator, hosts a launchpad, and offers SDKs and APIs to empower developers and creators to leverage their tech to integrate with other DApps and platforms.

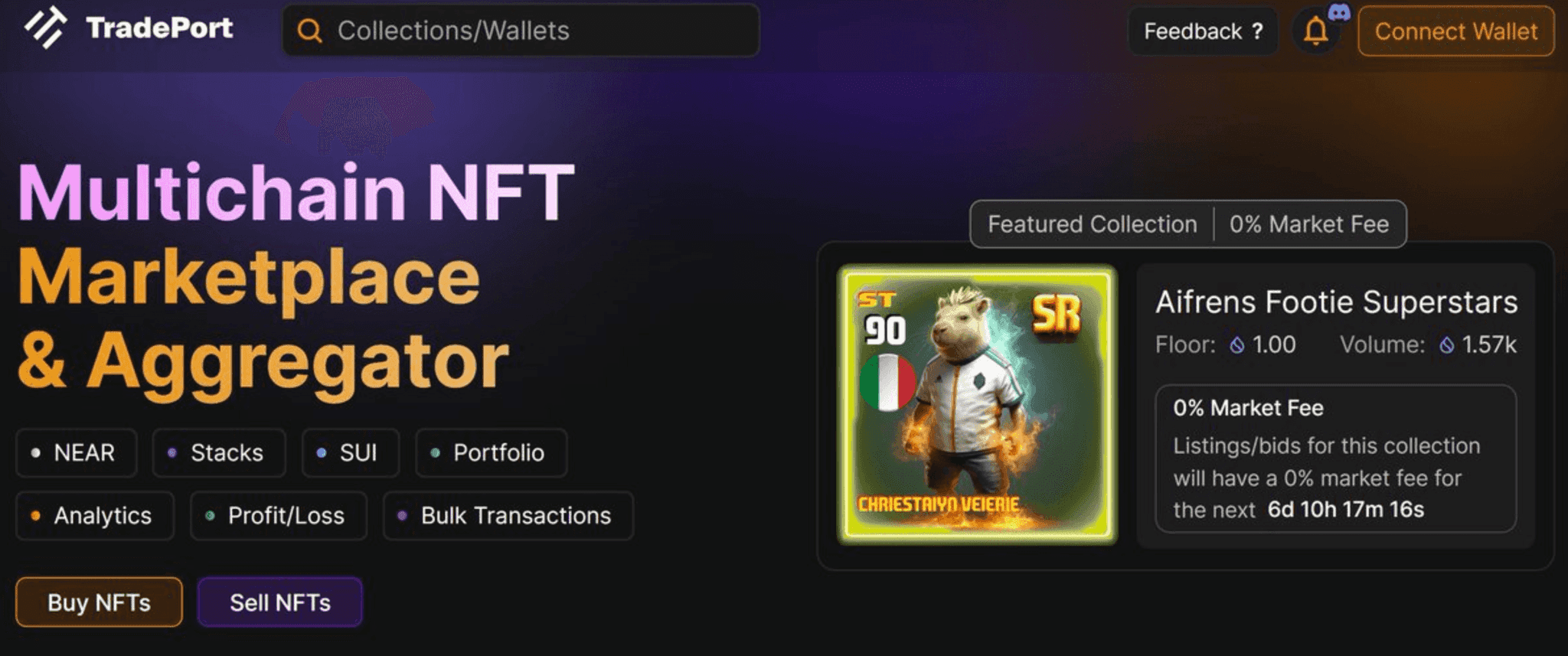

TradePort

Tradeport is another fantastic Multi-chain NFT marketplace for the Sui, NEAR, and, interestingly, Stacks networks. TradePort is known for having healthy trading volumes and featuring some of the top NFT collections on Sui such as Fuddies, DeSuiLabs, and others. This platform not only supports the buying and selling of NFTs but also allows users to see the analytics of their NFT portfolios such as profit and loss, and there are tools to help NFT traders perform analysis before selling and buying digital assets.

TradePort is known for having healthy trading volumes and featuring some of the top NFT collections on Sui such as Fuddies, DeSuiLabs, and others. This platform not only supports the buying and selling of NFTs but also allows users to see the analytics of their NFT portfolios such as profit and loss, and there are tools to help NFT traders perform analysis before selling and buying digital assets.

Best Sui Wallets

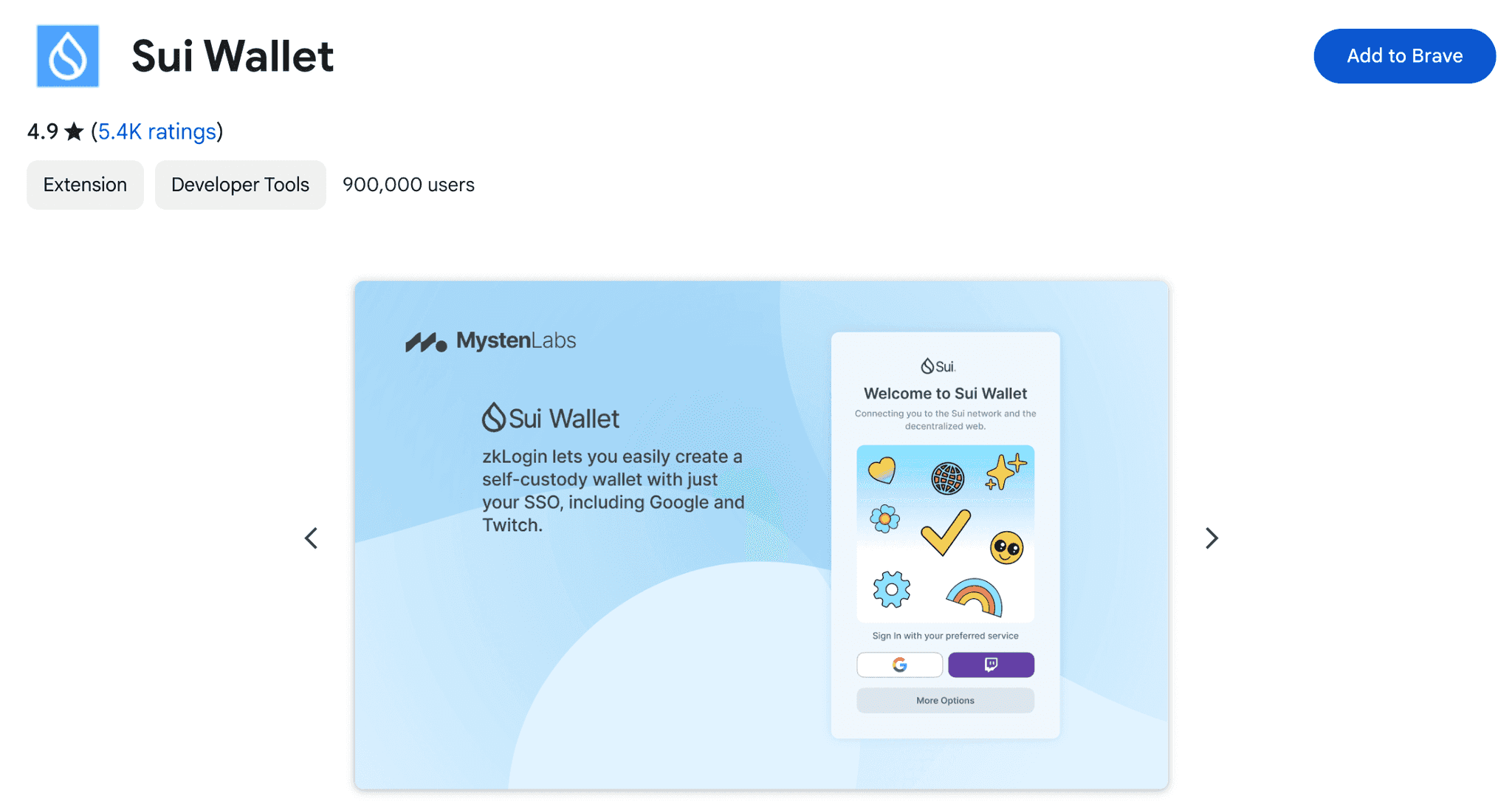

If you are planning on getting involved in the Sui ecosystem, you are going to need a Sui Wallet. There are quite a few Sui wallets to choose from, i recommend Sui Wallet, a browser extension wallet available in the Chrome Web Store. It supports tokens and NFTs and is built by the trusted team over at Mysten Labs.  The wallet has a solid 4.9-star rating and zkLogin allows users to self-custody with SSO wallet creation using Google or Twitch accounts, as well as traditional Mnemonic phrases. Sui Wallet can also integrate with Ledger hardware wallets for additional security.

The wallet has a solid 4.9-star rating and zkLogin allows users to self-custody with SSO wallet creation using Google or Twitch accounts, as well as traditional Mnemonic phrases. Sui Wallet can also integrate with Ledger hardware wallets for additional security.

Surf Wallet is another strong contender along with Ethos Wallet by Nod Labs. Ethos wallet is another browser extension wallet that is beautifully designed and offers a curated home screen that makes DApp and asset management easy. Surf wallet features an on-ramp and utilizes MPC technology to overcome seed-phrase vulnerability risks while still supporting trustless self-custody.

Where to Buy Sui

As Sui was one of the most anticipated L1 launches in 2023, it has pretty solid exchange support so there are plenty of places to buy Sui. I recommend Binance, OKX, and Coinbase if you want to get your hands on some.

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)