AppLovin P6 - The Advertising Ecosystem and the Core Business

Hi everyone,

Apologies for the delay in updates - life has been pretty hectic and I've been struggling to find time. From now on, I'll be posting weekly updates as this seems more sustainable on top of my full-time job and studying for my CFAs, as well as numerous other commitments. This also gives me more time to do deeper research to ensure that updates are more valuable.

That being said, let's dig into today's update.

Platforms - how does the ecosystem work?

As stated on the Q10 by AL's management, Applovin's platforms business is made up of the following:

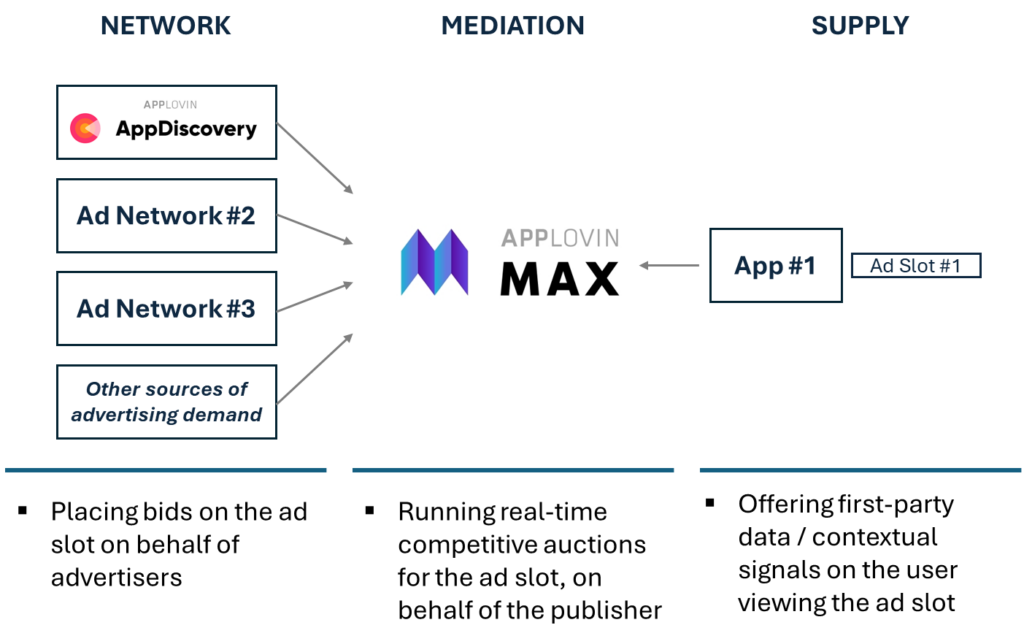

AppDiscovery - AL's user acquisition (UA) platform. This sends your advertising demand to Apps and connected TVs (CTVs) with inventory to drive downloads for your app. This is responsible for likely around 60~80 % of total software revenue (I've yet to find a reliable source for this information, but as it is quite critical to the thesis I will be doing further research into this).

MAX - AL's mediation platform. This is where advertising demand (from people looking to place ads) from different advertising networks (e.g. AppDiscovery) is matched and auctioned against advertising supply (from people looking to sell ad space on apps). This allows app developers to monetise their apps. This is responsible for 30~10% of total software revenue (I've yet to find a reliable source for this information, but as it is quite critical to the thesis I will be doing further research into this).

*AL states here that the vast majority of revenue is being generated through AD, and the majority of software rev is being generated through AD and MAX

Adjust - AL's advertising attribution and analytics suite. This is likely responsible for ~10% of total software revenue. Again, I will update this number once I find a reliable data source.

Wurl - Connects advertising inventory to ad networks for CTVs. Although not explicitly stated, the industry standard is that mediation platforms are used similarly to apps. It is uncertain if Wurl operates as its mediation platform, or if it leverages another mediation platform. The revenue generated from Wurl, alongside other platforms, has been stated as immaterial.

Wurl also provides a service that connects advertisers to demand through ContentDiscovery (think AppDiscovery).

Underlying the platforms is AXON 2.0, AL's proprietary ML algorithm which allocates ads to the inventory most likely to drive downloads and engagement.

How do their different products interact with each other?

In a nutshell, the Max and AD interact with each other as follows Source: Naavik

Source: Naavik

Which markets does AL primarily operate in?

AppLovin has 2 segments on their financial report - US, and the rest of the world.

As of Q1 24:

- US accounts for 634,604,000/1,058,115,000 of revenue, or 59.97% of all revenue.

- The rest of the world accounts for 40.03% of revenue.

But does the geography here actually matter? To understand this we need to look at three things:

- How AL's algorithms can obtain user data, and thus optimise the painting between the network and the ad slot

- Are there differences in what data you can collect from different app stores/platforms

- Are there differences in what data you can collect from users across jurisdictions

To answer the following questions, we have to first understand how the user matching systems work, and what information is required by AL to optimise the performance of their AXON algorithm.

So, how does an ad mediation algorithm work?

On a high level, mediation platforms are intermediaries between the ad network(demand) and the inventory publisher. Ad mediation algorithms try to optimise revenue for the inventory publisher by taking the highest bid. The end-to-end pipeline of an ad would look something like the following:

First, the advertiser sets up the advertising campaign with the ad network(s) of their choice. The ad network then takes the advertiser's requirements and submits a bid to the mediation platform for ad inventory that matches the specified conditions.

On the other side, app developers install ad networks into their SDKs, which tells the mediation platforms when they have advertising inventory available. Alongside their availability, the inventory publisher also sends information about the user (this is key, more on this later) to the mediation platform, which is used to match against the advertiser's specifications received from the ad network.

The mediation platform then matches the different ad networks to the ad inventory and takes bids. The ad inventory is given to the highest bid, and the ad is shown to the end user.

The bids from the ad networks can vary depending on several factors, but ultimately boils down to:

how closely does the person viewing this fit my target demographic, and is therefore likely to purchase my product/service?

A simple way to think about this is a traditional auction, where you have the buyers (advertisers) bidding through their agents (the ad network) at the auction house (the mediation platform) for the auctioned item (the ad inventory). The difference is that instead of this happening over 30 minutes at Sotheby's, it happens in microseconds on a data server.

there are two general models of ad mediation:

- waterfall: Ad networks (and sometimes mediation platforms) are ranked based on historical performance, and the ad inventory is bid for sequentially, with the highest bid being filled, and the remaining inventory being re-offered. this is largely considered obsolete in today's market as it leads to lower revenues for the publisher and remnant inventory.

- Real-time bidding: All ad networks are given the chance to bid concurrently, with the inventory being assigned to the highest bidder. This is usually done through the implementation of a mediation platform, so developers don't have to integrate several ad networks individually and manage their concurrent optimisation. This is what most developers are doing today, and as such will be our focus.

So, what affects the performance of these algorithms?

Well, the simple answer here is Data.

The ad network (AppDiscovery) needs to determine how much it's willing to pay for inventory of a specific characteristic. As we can see in the graph below, the mediation platform sends the availability and contextual data of the user to the ad network, which then comes back with a bid. If the bid is successful, the advertised is charged and receives feedback on the performance of the ad.

Hence, the most critical element for the ad network here is to have an algorithm that can accurately predict the expected performance of an ad from the contextual data provided by the mediation network.

So, what's important here is the volume, accuracy, and recency of the data used by the algorithm at any given time. A better-performing ad network will attract more users, giving it more data to refine its model, and lead to better performance, creating a positive feedback loop.

Although there are diminishing returns on the volume of data being used to train the model, the recency of the data is critical - the model needs a constant feed of up-to-date data to maintain performance.

The implication is that the market lends itself naturally toward an oligopoly structure, as underperforming ad networks will enter a negative feedback loop and quickly die.

On the other side, as the amount of contextual information dwindles, so too does the price of the bids, the revenue driven back to the end user, the number of users on the platform, and the fees that the platform can take as a result. Hence, the amount of contextual information that the mediation platform can provide to ad networks is critical to the revenue generated by the platform. If the data isn't there, platform performance, user base and revenue will snap.

What does the 'supply chain' for these platforms look like?

AppDiscovery: The number of advertising campaigns being requested through the platform, the contextual information being received for each request, conditions of an unsuccessful bid, and the performance data that is received off the back of a successful bid. Demand is one of the multiples that make up supply.

MAX: For the advertising networks, it's the amount of contextual data it receives from apps. For the end publisher, it's the amount of ad networks that are on it's mediation platform.

What are some key factors that can affect growth?

AppDiscovery: The inputs for AD's performance can be summarised as such:

MAX: Here, the amount of contextual data that Max can present breaks down into two parts.

- What is the app collecting?

- What can the app give to Max?

So, what affects the amount of contextual data MAX receives from its apps?

This is where the IDFA (AAID, GAID) comes in. IDFA stands for Identifier For Advertisers and is a device-level tracker that collects data on the user's activity on the device (think a cookie but for your phone). Android and Google still allow advertisers and apps to access the device's IDFA, while Apple now needs apps to obtain consent before they're able to access IDFA to get data from other apps or send the device IDFA data to the mediation platform.

Reading Apple's T&Cs, it seems like if the end user doesn't approve of third-party tracking, their IDFA is not shared with the app. This means that apps are only able to provide the ad networks with whatever data they were able to collect on the user based on their usage of the app. If this is the case why would you care about making first-party apps if the data you're able to get is the same as any other?

The implied answer to the above question, judging from AL's strategic shift seems to be that they don't, and the apps business was only spun up to gather the initial data required to optimise the AXON algorithm, which is now sustained as it is now receiving data from enough third party apps.

So, if only ~35% of all users accept an IDFA, how does AL get contextual data for the remaining 65% of users?

The answer here is a little something called fingerprinting.

Fingerprinting is a technique employed by the applications on your phone. By leveraging other data that they can get from the device, such as OS type, languages on your keyboard, hardware details (do you have a Pixel 6 or an iPhone 12), geographical location, IP address (basically anything they can get their hands on (which is a lot)) to triangulate who you are and assign identification to you. The ad network can then associate and match the traits it receives from one application with another, effectively creating a proxy IDFA.

For example, if the MAX platform received an advertising request from game A installed on a device that is in Wynard, has an iPhone 12 with ios 15, Spanish, Chinese and English keyboards then minutes later receives the same information from game B on a device with the same characteristics, the matching algorithm may infer that these are indeed the same devices and as such assume that the user engages with the game A, see the performance metrics of the previous ad bids, and adjust it's matching accordingly.

This implies that the performance of fingerprinting from the meditation platform can be significantly improved based on the number and variety of apps that send advertising requests.

The final step here is to cover the last question posed earlier:

- Are there differences in the data you can collect from users across jurisdictions?

- What are governments/google/apple looking to implement relating to privacy laws or rules that may affect user tracking?

These questions are critical for the formation of a thesis and will be covered next time.

Other questions that flow naturally from this include:

- How have the IDFA changes affected AL compared to direct competitors?

- What percentage of AL's revenue comes from users on Apple?

- How might market participants react to any new rules/regulations?

- What is AL's current performance in MAX and AD compared to competitors?

- What is AL's market share in the markets in which it operates?

- What do their margins look like and how does this compare to competitors?

- Right now, Foroughi claims that AL has no real sales team, and their sales mostly come organically from WOM. What's stopping competitors from creating their own version of AXON 2.0 (and is AL even fundamentally performing better than competitors)?

Although the layout of this research process has shifted somewhat as expected, we have just about finished looking at the core business (except for some key figures) and will now move into looking at the competitive landscape, with technicals to follow.

Please leave any comments or suggestions you may have, and I'll be sure to take them into account for next time.

Thanks,

Kev

Price at time of writing:

78.58 USD