US Dollar Weakens - Bitcoin Strengthens

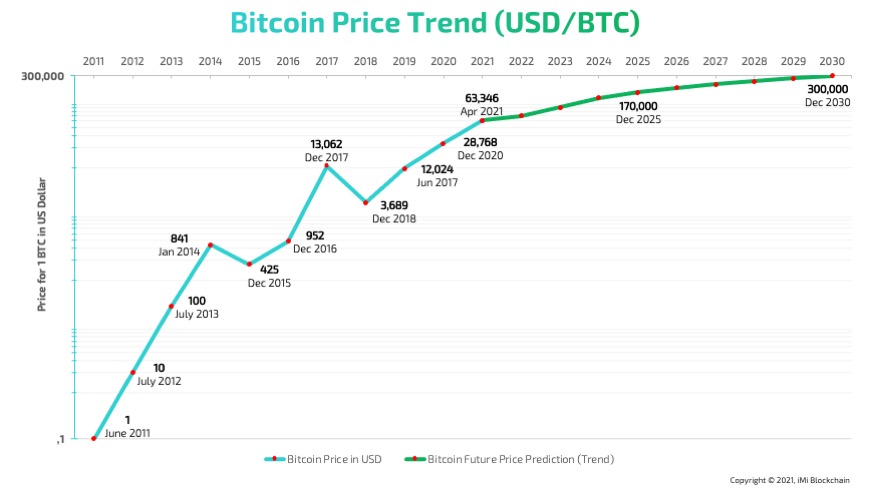

As global financial dynamics continue to evolve, the interplay between traditional currencies and digital assets has become a focal point for investors and analysts. One notable trend is the weakening of the US dollar juxtaposed with the strengthening of Bitcoin. According to BitGo CEO Mike Belshe, Bitcoin ($BTC) is poised to reach between $125,000 and $135,000 by the end of 2024.

As global financial dynamics continue to evolve, the interplay between traditional currencies and digital assets has become a focal point for investors and analysts. One notable trend is the weakening of the US dollar juxtaposed with the strengthening of Bitcoin. According to BitGo CEO Mike Belshe, Bitcoin ($BTC) is poised to reach between $125,000 and $135,000 by the end of 2024.

This projection is influenced by several key factors, including the high level of US government debt and the diminishing role of the US dollar as a global reserve currency due to US foreign policy.

Bitcoin's Projected Growth

Mike Belshe's prediction that Bitcoin could soar to $125,000-$135,000 by the end of 2024 has garnered significant attention. This optimistic outlook is based on various macroeconomic factors and the intrinsic properties of Bitcoin as a decentralized digital asset.

Mike Belshe's prediction that Bitcoin could soar to $125,000-$135,000 by the end of 2024 has garnered significant attention. This optimistic outlook is based on various macroeconomic factors and the intrinsic properties of Bitcoin as a decentralized digital asset.

Bitcoin, often dubbed "digital gold," has demonstrated resilience and growth potential, especially during periods of economic uncertainty. Its limited supply of 21 million coins and increasing acceptance by institutional investors bolster its value proposition as a hedge against inflation and currency devaluation. The growing adoption of Bitcoin by major financial institutions and corporations further validates its potential to achieve significant price appreciation.

Moreover, the advancement of Bitcoin infrastructure, such as improved custodial solutions, regulatory clarity, and the development of decentralized finance (DeFi) platforms, enhances its accessibility and usability. These developments are likely to attract more investors seeking to diversify their portfolios and mitigate risks associated with traditional financial systems.

High Levels of US Government Debt

One of the primary catalysts for Bitcoin's projected growth is the escalating level of US government debt. The US national debt has surpassed $30 trillion, raising concerns about the sustainability of fiscal policies and the long-term stability of the economy. High levels of government debt can lead to increased inflation and currency devaluation, eroding the purchasing power of the US dollar.

Investors are increasingly turning to alternative assets like Bitcoin to protect their wealth from the adverse effects of rising debt levels. Bitcoin's decentralized nature and deflationary characteristics make it an attractive store of value in an environment where traditional currencies are losing their purchasing power.

Furthermore, the Federal Reserve's monetary policies, including low interest rates and quantitative easing, have contributed to the expansion of the money supply, exacerbating inflationary pressures. As confidence in the US dollar wanes, Bitcoin stands to benefit as a viable alternative that offers greater financial sovereignty and protection against inflation.

The US Dollar's Waning Role as a Global Reserve Currency

Another significant factor influencing Bitcoin's rise is the weakening status of the US dollar as the world's primary reserve currency. Historically, the US dollar has been the cornerstone of international trade and finance, underpinned by the strength of the US economy and geopolitical influence. However, recent US foreign policy decisions have contributed to a decline in global confidence in the dollar.

Geopolitical tensions, trade disputes, and sanctions have prompted several countries to seek alternatives to the US dollar for international transactions. Notably, nations like China and Russia are exploring ways to reduce their reliance on the dollar by promoting their currencies in bilateral trade agreements and developing their digital currencies.

The shift away from the US dollar as a global reserve currency could accelerate the adoption of Bitcoin as a neutral and borderless digital asset. Bitcoin's decentralized nature makes it immune to geopolitical risks and government interventions, providing a reliable medium of exchange and store of value for global transactions.

Implications for Investors and the Global Economy

The weakening of the US dollar and the strengthening of Bitcoin have profound implications for investors and the global economy. As traditional financial systems face increasing uncertainty, Bitcoin and other digital assets offer a compelling alternative for wealth preservation and growth.

The weakening of the US dollar and the strengthening of Bitcoin have profound implications for investors and the global economy. As traditional financial systems face increasing uncertainty, Bitcoin and other digital assets offer a compelling alternative for wealth preservation and growth.

For investors, diversifying portfolios to include Bitcoin can mitigate risks associated with fiat currency depreciation and inflation. The growing acceptance of Bitcoin by institutional investors and major corporations signals a shift towards mainstream adoption, further enhancing its legitimacy and potential for long-term growth.

Additionally, the rise of Bitcoin underscores the importance of innovation and technological advancements in the financial sector. The development of blockchain technology and decentralized finance platforms presents new opportunities for financial inclusion, transparency, and efficiency.

However, it is essential for investors to remain vigilant and informed about the regulatory landscape and market dynamics. While Bitcoin offers significant potential, it also comes with inherent risks and volatility. A balanced and informed approach to investing in digital assets can help maximize returns while minimizing exposure to market fluctuations.

Conclusion

The interplay between the weakening US dollar and the strengthening of Bitcoin highlights the evolving dynamics of global finance. Factors such as the high level of US government debt and the diminishing role of the US dollar as a global reserve currency are driving the adoption and appreciation of Bitcoin.

As we move towards the end of 2024, the projected growth of Bitcoin to $125,000-$135,000 by BitGo CEO Mike Belshe reflects the increasing confidence in digital assets as viable alternatives to traditional currencies. Investors and stakeholders must recognize the transformative potential of Bitcoin and other digital assets while navigating the complexities of a rapidly changing financial landscape.

By understanding the macroeconomic factors at play and adopting a strategic approach to investment, individuals and institutions can position themselves to benefit from the opportunities presented by the rise of Bitcoin and the broader digital asset ecosystem.