The Impact of Blockchain on Fintech in the Era of Financial Revolution

Introduction

In the digital age, the financial landscape is undergoing a revolution driven by technological innovation and changing consumer expectations. At the forefront of this transformation is blockchain technology, a decentralized and immutable ledger system that promises to disrupt traditional financial services and empower individuals worldwide. In the era of financial revolution, understanding the impact of blockchain on fintech is paramount to navigating the complexities of the modern financial ecosystem.

Blockchain technology, originally conceived as the underlying technology for Bitcoin, has evolved far beyond its cryptocurrency origins. At its core, blockchain enables secure, transparent, and tamper-resistant transactions without the need for intermediaries, revolutionizing how financial assets are managed, traded, and transferred.

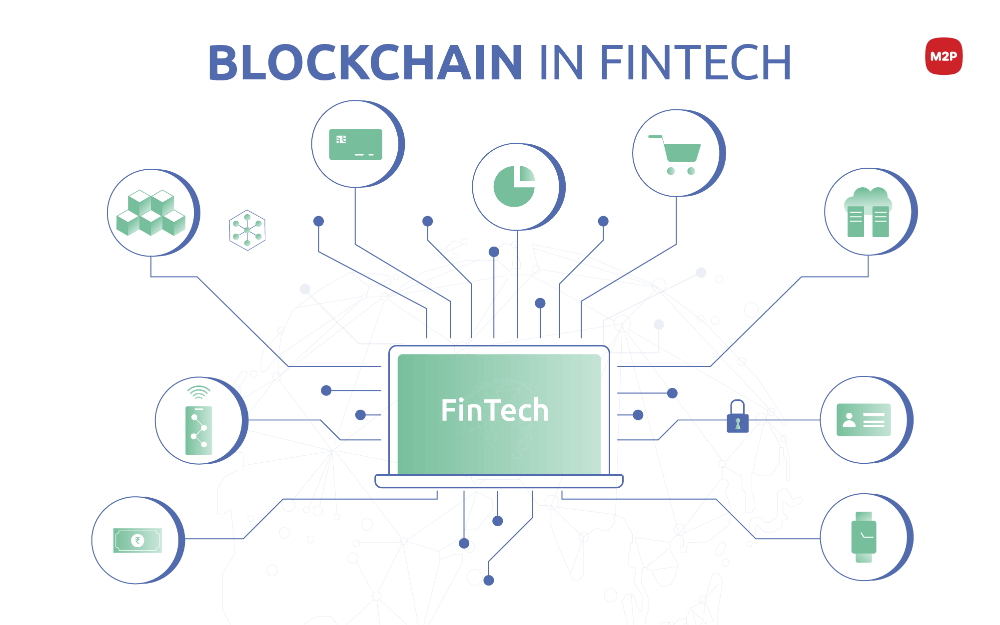

This article aims to explore the profound impact of blockchain on fintech, examining its transformative potential across various sectors of the financial industry. From payments and lending to insurance and asset management, blockchain is reshaping the way we conduct financial transactions, democratizing access to financial services, and fostering greater trust and transparency in the financial ecosystem.

As we delve deeper into the intersection of blockchain and fintech, it becomes evident that we are witnessing a paradigm shift in the way we think about and interact with money and finance. However, this transformation is not without its challenges, including regulatory hurdles, scalability concerns, and interoperability issues. Yet, despite these challenges, the potential benefits of blockchain in fintech are too significant to ignore, offering the promise of greater financial inclusion, efficiency, and security for individuals and businesses worldwide.

On this journey we explore the impact of blockchain on fintech in the era of the financial revolution, uncovering the opportunities, challenges, and implications of this groundbreaking technology for the future of finance.

Understanding Blockchain Technology

- Decentralization:

- Blockchain operates on a decentralized network of computers (nodes), each maintaining a copy of the ledger.

- This decentralized architecture eliminates the need for a central authority or intermediary, allowing for peer-to-peer transactions without reliance on trusted third parties.

- Immutable Ledger:

- Once recorded, data on the blockchain cannot be altered or tampered with due to cryptographic hashing and consensus mechanisms.

- This immutability ensures the integrity and security of transactions, making blockchain a trusted and transparent system for recording and verifying information.

- Consensus Mechanisms:

- Blockchain relies on consensus mechanisms to validate and confirm transactions on the network.

- Common consensus mechanisms include Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS), each with its own advantages and trade-offs in terms of security, scalability, and energy efficiency.

- Smart Contracts:

- Smart contracts are self-executing contracts with predefined rules and conditions encoded on the blockchain.

- These programmable contracts enable automated, trustless transactions and agreements, reducing the need for intermediaries and streamlining business processes.

- Use Cases:

- Blockchain technology has diverse applications beyond cryptocurrency, including supply chain management, healthcare, identity verification, voting systems, and more.

- By providing transparency, security, and decentralization, blockchain has the potential to revolutionize industries and transform how we interact with data and digital assets.

Understanding the fundamentals of blockchain technology is essential for grasping its potential impact on fintech and the broader financial ecosystem.

Fintech Landscape Before Blockchain

Before the advent of blockchain technology, the fintech landscape was characterized by centralized systems, high transaction costs, and limited accessibility to financial services for many individuals and businesses.

- Centralization:

- Traditional financial systems relied heavily on centralized institutions such as banks, payment processors, and clearinghouses to facilitate transactions and manage financial assets.

- This centralized control often resulted in inefficiencies, delays, and high fees, particularly for cross-border transactions and remittances.

- High Transaction Costs:

- The intermediaries involved in traditional financial transactions imposed significant fees, particularly for services such as international money transfers, currency exchange, and remittances.

- These high transaction costs disproportionately affected individuals and businesses in developing countries and underserved communities.

- Limited Accessibility:

- Many individuals and businesses, particularly those in underserved or remote areas, lacked access to basic financial services such as banking, lending, and insurance.

- Barriers such as geographical distance, regulatory constraints, and lack of documentation prevented millions of people from participating in the formal financial system.

- Trust Issues:

- Centralized financial institutions were susceptible to security breaches, fraud, and mismanagement of funds, eroding trust and confidence in the financial system.

- Lack of transparency and accountability in traditional financial transactions raised concerns about data privacy, identity theft, and financial discrimination.

The fintech landscape before blockchain was characterized by inefficiencies, inequalities, and trust issues, highlighting the need for innovation and disruption in the financial industry.

The Role of Blockchain in Fintech

Blockchain technology is revolutionizing various aspects of fintech, offering innovative solutions to longstanding challenges in the financial industry. Its decentralized, transparent, and secure nature enables new possibilities for improving efficiency, reducing costs, and enhancing trust in financial transactions.

- Payments and Remittances:

- Blockchain facilitates fast, secure, and low-cost cross-border payments and remittances by eliminating intermediaries and reducing transaction fees.

- Platforms like Ripple and Stellar enable real-time settlement and instant transfer of funds, enabling individuals and businesses to conduct transactions globally with greater speed and efficiency.

- Lending and Borrowing:

- Blockchain-based lending platforms leverage smart contracts to automate loan origination, underwriting, and repayment processes, reducing the need for traditional intermediaries such as banks.

- Projects like Aave and Compound enable peer-to-peer lending and borrowing, allowing individuals to access credit without relying on traditional financial institutions.

- Asset Tokenization:

- Blockchain enables the fractional ownership and tokenization of real-world assets such as real estate, equities, and commodities, unlocking liquidity and enabling broader access to investment opportunities.

- Platforms like tZERO and Harbor tokenize assets on the blockchain, enabling fractional ownership and secondary trading of previously illiquid assets.

- Identity Verification and KYC:

- Blockchain-based identity verification systems offer a secure and decentralized way to verify user identities and conduct Know Your Customer (KYC) checks, reducing fraud and enhancing security in financial transactions.

- Projects like Civic and uPort enable individuals to control their digital identities and share personal information securely and selectively with trusted parties.

- Supply Chain Finance:

- Blockchain enhances transparency and traceability in supply chains, enabling more efficient supply chain finance solutions such as invoice financing and trade finance.

- Platforms like IBM's Food Trust and VeChain track the provenance and movement of goods on the blockchain, reducing fraud, ensuring product authenticity, and streamlining supply chain financing processes.

Blockchain technology is playing an increasingly integral role in transforming the fintech landscape, offering new opportunities for innovation, efficiency, and inclusivity in the financial industry.

Impact on Financial Inclusion

One of the most significant impacts of blockchain technology in fintech is its potential to promote financial inclusion by democratizing access to financial services for underserved and marginalized populations worldwide. Blockchain's decentralized, borderless nature offers new possibilities for overcoming barriers to financial access and empowering individuals to participate in the global economy.

- Access to Banking Services:

- Blockchain-powered digital wallets and payment platforms enable individuals without access to traditional banking services to store, send, and receive money securely and affordably.

- Projects like M-Pesa in Kenya and BitPesa in Africa provide mobile-based payment solutions, allowing users to conduct financial transactions using their smartphones without the need for a bank account.

- Microfinance and Lending:

- Blockchain enables peer-to-peer lending and microfinance solutions, allowing individuals and small businesses to access credit and financing opportunities without relying on traditional financial institutions.

- Platforms like Kiva and OXIO enable crowdfunding and micro-lending initiatives, providing capital to entrepreneurs and small businesses in underserved communities.

- Remittances and Cross-Border Payments:

- Blockchain-based remittance platforms offer a cheaper, faster, and more transparent alternative to traditional money transfer services, particularly for cross-border payments.

- Projects like BitPesa and Stellar facilitate low-cost remittances, enabling migrant workers to send money home to their families with reduced fees and faster settlement times.

- Access to Investment Opportunities:

- Asset tokenization on the blockchain enables fractional ownership of assets such as real estate, stocks, and commodities, allowing individuals to invest in previously inaccessible asset classes.

- Platforms like RealtyShares and Harbor democratize access to investment opportunities, enabling individuals to diversify their portfolios and build wealth through tokenized assets.

Blockchain technology has the potential to level the playing field in the financial industry, empowering underserved populations with greater access to banking services, credit, and investment opportunities, thereby promoting economic inclusion and empowerment on a global scale.

Challenges and Opportunities

Blockchain technology presents a myriad of challenges and opportunities for the fintech industry, reflecting the transformative nature of this disruptive innovation.

- Scalability:

- Challenge: Blockchain networks face scalability issues, struggling to handle a high volume of transactions efficiently without compromising speed or decentralization.

- Opportunity: Scalability solutions such as sharding, layer 2 protocols, and off-chain scaling solutions offer potential avenues for enhancing the throughput and capacity of blockchain networks.

- Interoperability:

- Challenge: Lack of interoperability between different blockchain networks and protocols hinders seamless data and asset transfer across disparate systems.

- Opportunity: Interoperability protocols and standards enable compatibility and communication between blockchain platforms, facilitating cross-chain transactions and interoperable decentralized applications (dApps).

- Regulatory Uncertainty:

- Challenge: The regulatory landscape surrounding blockchain and cryptocurrencies is complex and rapidly evolving, leading to uncertainty and compliance challenges for businesses and projects operating in the space.

- Opportunity: Collaborative efforts between industry stakeholders, regulators, and policymakers can foster a regulatory framework that balances innovation with consumer protection, ensuring clarity, consistency, and legal certainty for blockchain-based fintech solutions.

- Security and Privacy:

- Challenge: Security vulnerabilities, including smart contract bugs, hacking attacks, and data breaches, pose significant risks to blockchain-based fintech platforms and users.

- Opportunity: Robust security measures such as cryptographic encryption, multi-signature authentication, and secure smart contract development practices mitigate security risks and enhance trust and confidence in blockchain-based financial transactions.

- User Experience:

- Challenge: User interfaces and onboarding processes for blockchain-based fintech platforms are often complex and unfamiliar to non-technical users, hindering mainstream adoption.

- Opportunity: Improvements in user experience design, educational resources, and customer support services can enhance accessibility and usability, making blockchain-based fintech solutions more intuitive and user-friendly for a broader audience.

- Environmental Impact:

- Challenge: Proof of Work (PoW) consensus mechanisms used in many blockchain networks consume significant amounts of energy, raising concerns about their environmental impact and sustainability.

- Opportunity: Transitioning to more energy-efficient consensus mechanisms such as Proof of Stake (PoS) or adopting greener mining practices can mitigate the environmental footprint of blockchain networks and promote sustainability in the fintech industry.

Navigating these challenges requires proactive collaboration, innovation, and adaptive strategies to capitalize on the opportunities presented by blockchain technology in revolutionizing the fintech landscape.

Regulatory Considerations

The regulatory landscape surrounding blockchain and fintech is complex and dynamic, reflecting the need for regulatory clarity, consistency, and adaptability in the face of technological innovation.

- Lack of Uniformity:

- Challenge: Regulatory frameworks for blockchain and cryptocurrencies vary widely across jurisdictions, leading to inconsistencies, regulatory arbitrage, and compliance challenges for businesses operating globally.

- Solution: International cooperation and standardization efforts can promote harmonization and convergence of regulatory approaches, ensuring a level playing field for businesses and fostering cross-border innovation and collaboration.

- Consumer Protection:

- Challenge: Lack of consumer protection regulations in the blockchain and fintech space exposes users to risks such as fraud, scams, and mismanagement of funds.

- Solution: Implementing robust consumer protection measures, including disclosure requirements, risk warnings, and dispute resolution mechanisms, can enhance trust and confidence in blockchain-based financial products and services.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance:

- Challenge: Ensuring compliance with AML and KYC regulations presents challenges for blockchain-based fintech platforms due to the pseudonymous nature of blockchain transactions.

- Solution: Implementing robust AML and KYC procedures, including identity verification checks, transaction monitoring, and reporting obligations, can mitigate the risks of money laundering and terrorist financing while promoting regulatory compliance and accountability.

- Data Privacy and Security:

- Challenge: Blockchain's transparent and immutable nature raises concerns about data privacy and security, particularly regarding the storage and processing of sensitive personal information.

- Solution: Implementing privacy-enhancing technologies such as zero-knowledge proofs, multi-party computation, and data encryption can protect user privacy while maintaining the integrity and transparency of blockchain transactions.

- Innovation and Regulatory Sandboxes:

- Opportunity: Regulatory sandboxes and innovation hubs provide a regulatory framework for experimenting with blockchain-based fintech innovations in a controlled environment, allowing regulators to assess risks and benefits and tailor regulations accordingly.

- Solution: Establishing regulatory sandboxes and innovation hubs can foster innovation, collaboration, and experimentation while ensuring consumer protection and regulatory compliance in the blockchain and fintech space.

Addressing these regulatory considerations requires a balanced approach that promotes innovation and competition while safeguarding consumer interests and maintaining financial stability and integrity in the fintech industry.

Conclusion

As we reach the culmination of our exploration into the impact of blockchain on fintech in the era of the financial revolution, it becomes increasingly evident that we stand at the precipice of a transformative paradigm shift in the financial industry. Blockchain technology, with its decentralized, transparent, and secure characteristics, is reshaping the way we think about and interact with money, finance, and the global economy.

Throughout this journey, we have witnessed the profound role that blockchain plays in revolutionizing various aspects of fintech, from payments and lending to asset tokenization and identity verification. Its disruptive potential to democratize access to financial services, reduce costs, enhance transparency, and foster greater trust in financial transactions is unparalleled, offering new opportunities for innovation, efficiency, and inclusivity in the financial ecosystem.

However, this transformation is not without its challenges. Scalability issues, regulatory uncertainties, interoperability concerns, and security risks pose significant obstacles to the widespread adoption and success of blockchain-based fintech solutions. Addressing these challenges requires proactive collaboration, innovation, and adaptive strategies from industry stakeholders, regulators, and policymakers to ensure a regulatory framework that balances innovation with consumer protection and market integrity.

Despite these challenges, the opportunities presented by blockchain in fintech are too significant to ignore. By embracing the transformative potential of blockchain technology and working together to overcome obstacles, we can unlock a future where financial services are more accessible, efficient, and equitable for individuals and businesses worldwide.

As we look ahead, let us continue to explore, innovate, and collaborate in harnessing the power of blockchain to drive positive change and shape the future of finance. Together, we can build a more inclusive, transparent, and resilient financial ecosystem that empowers individuals, fosters economic growth, and promotes prosperity for all in the era of financial revolution.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)