Is Bitcoin's Negative Funding Rate a Sign of an Upcoming BTC Price Drop?

On April 18, Bitcoin (BTC) futures contracts experienced a notable accumulation of short positions, generating speculation about the possibility of an extension of the bearish momentum. This phenomenon, influenced by the absence of flows into Bitcoin exchange-traded funds (ETFs) in the spot market and expectations of an increase in interest rates in the United States, has contributed to negative market sentiment. .

The Dynamics of the Bitcoin Funding Rate

Retail traders tend to favor perpetual futures, derivatives that closely mirror the price movements of standard spot markets. To maintain a balance in risk exposure, exchanges impose a funding rate every eight hours, known as the funding rate.

This rate becomes positive when buyers (long positions) demand more leverage, and negative when sellers (short positions) seek additional leverage. A negative funding rate, although rare, is considered a highly bearish indicator.

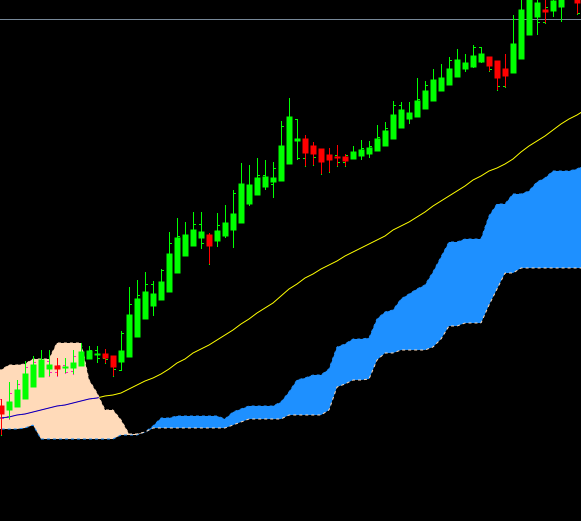

The BTC funding rate showed a notable negative turn on April 15 and again on April 18, reaching its lowest levels in over six months, signaling less willingness toward long positions. This change in market sentiment usually manifests itself after significant price movements, such as the 13.5% drop seen in the price of Bitcoin between April 12 and 18.

Economic Context: External Influences

From a broader economic perspective, recent data from the United States showing higher-than-expected inflation and strong retail sales has reduced risk aversion among investors. The consumer price index rose 3.8% year over year in March, far exceeding the Federal Reserve's 2% target, while retail sales rose 0.7% year over year.

Bitcoin ETF Flows: Key Indicators

Bitcoin spot ETF flows play a crucial role in determining market sentiment. Most recently, a net outflow of $165 million from these funds was recorded on April 17, marking the fourth consecutive day of withdrawals. This shift is in stark contrast to early April, when ETFs attracted $484 million, despite continued outflows from Grayscale's GBTC fund.

Impact on Bitcoin Investors

Market volatility has significantly impacted investor sentiment. During March 2024, seven instances of funding rates above 1.2% weekly led to days of extreme volatility and significant liquidations. Although Bitcoin bulls accurately predicted price movements, sharp fluctuations depleted their margins and triggered forced liquidations.

Future Outlook: An Imminent Correction?

For a deeper understanding of market sentiment, traders are advised to also look at the Bitcoin options markets. The growing demand for puts generally signals a focus on neutral or bearish pricing strategies.

Bitcoin's negative funding rate, coupled with unfavorable economic data and ETF flows, suggest a challenging outlook for bullish investors. Although an imminent correction is not in sight, the market presents signs of caution for those participating in long positions. It is essential that investors conduct extensive research and carefully evaluate their risk tolerance before making investment decisions.

This article does not provide investment advice or recommendations. All investments carry risks, and readers should perform their own due diligence before making any decisions. Investments in crypto assets are unregulated and may not be suitable for all investors.