The Employment Impact of Fintech Automation

The Fintech Revolution: Its impact on Employment.

The financial technology sector, or Fintech, is rapidly transforming the landscape of finance. From mobile banking apps to blockchain-powered solutions, Fintech disrupts traditional models, offering greater convenience and efficiency.

However, this transformation has a significant impact on employment, wielding a double-edged sword that creates new jobs while potentially displacing others.

Automating Away Jobs: The Threat of Fintech.

One of the most immediate impacts of Fintech is automation. Repetitive and manual tasks traditionally handled by bank tellers, loan processors, and back-office staff are becoming increasingly automated.

Fintech solutions utilize algorithms, machine learning, and robotic process automation (RPA) to streamline processes, reducing the need for human intervention. https://www.worldbank.org/en/publication/globalfindex.

This automation can lead to job losses in several areas:

- Customer Service: Chatbots and AI-powered virtual assistants are replacing human interaction in basic customer service inquiries.

- Data Entry & Processing: Automated systems can handle data entry and processing tasks much faster and with fewer errors than humans.

- Risk Management & Compliance: Algorithmic tools can analyze financial data and make risk assessments, potentially reducing the need for human oversight in some cases.

The Rise of New Roles: Opportunities in Fintech

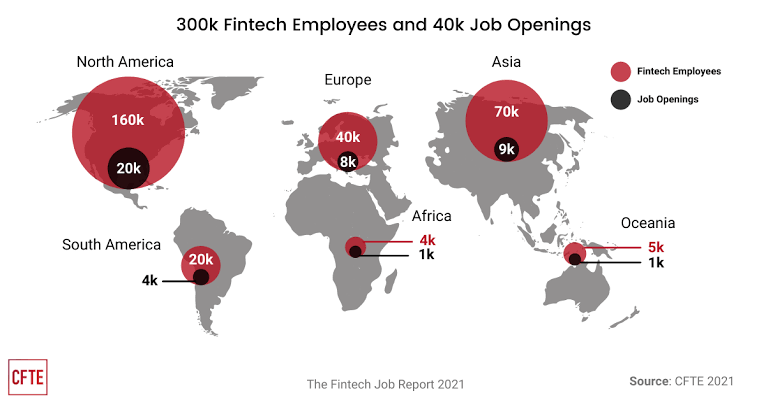

While automation poses a threat to some jobs, Fintech also creates new opportunities. The need for professionals with expertise in these emerging technologies is rapidly growing.

Here are some of the new roles emerging in the Fintech landscape:

- Fintech Developers & Engineers: Building and maintaining Fintech applications requires skilled developers and engineers with knowledge of blockchain, artificial intelligence, and cybersecurity.

- Data Scientists & Analysts: Extracting insights from vast financial datasets is crucial for many Fintech solutions. Data scientists and analysts play a vital role in developing and implementing data-driven strategies.

- User Experience (UX) Designers: As user experience becomes increasingly important in financial services, UX designers are tasked with creating intuitive and user-friendly Fintech interfaces.

- Regulatory Compliance Specialists: The evolving regulatory landscape surrounding Fintech necessitates specialists who ensure compliance with relevant laws and regulations.

- Cybersecurity Experts: As Fintech solutions handle sensitive financial data, robust cybersecurity measures are essential. Cybersecurity experts are in high demand to protect these systems from cyber threats.

The Need for Reskilling and Upskilling

The transition to a more technology-driven financial sector requires existing workers to adapt by reskilling or upskilling.

Here's how this can be achieved:

- Training and Development Programs: Financial institutions can invest in training programs that equip their employees with the necessary skills to thrive in the Fintech era.

- Government Initiatives: Government bodies can provide programs and incentives to support reskilling and upskilling initiatives within the financial sector.

- Individual Initiative: Employees can take the initiative to upskill themselves by pursuing online courses, certifications, or attending workshops relevant to Fintech.

Beyond Job Losses: The Wider Impact on Employment

The impact of Fintech on employment extends beyond direct job displacement. Here are some additional considerations:

- Shifting Skillsets: The skills required for success in the financial sector are changing. Employees with strong analytical, problem-solving, and technological skills will be more in demand.

- Gig Economy: Fintech might contribute to the growth of the gig economy as companies seek specialized skills for short-term projects rather than full-time employees.

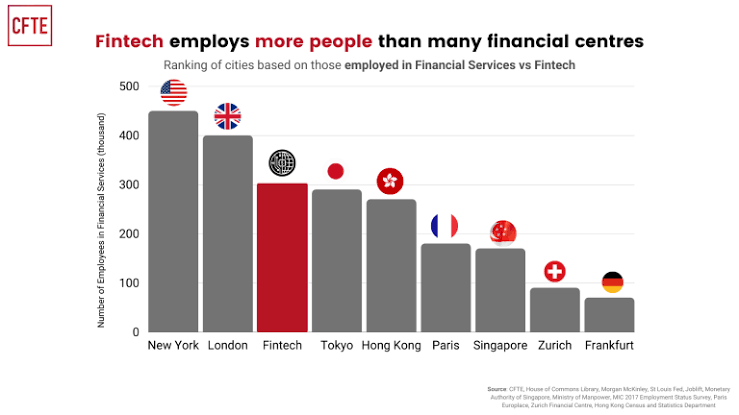

- Geographical Impact: Automation might disproportionately impact jobs in traditional financial centers as tasks become location-independent.

The Human-Machine Collaboration: A Fulfilling Future for Work.

The future of work in the Fintech era is likely to be one of human-machine collaboration. Machines will handle routine tasks, freeing up human employees to focus on higher-order skills like critical thinking, creativity, and complex problem-solving. This collaboration could lead to a more efficient and fulfilling work environment.

Policy and Societal Considerations

The transformation brought about by Fintech requires careful consideration of its broader societal implications. Here are some key areas for discussion:

- Universal Basic Income (UBI): As automation displaces workers, a UBI could provide a safety net and support individuals during periods of transition.

- Education and Training Systems: Educational institutions need to adapt to prepare future generations with the skills needed for the Fintech-driven workplace.

- Social Safety Nets: Social safety nets might need to be strengthened to support those who lose their jobs due to automation.

Conclusion: Fintech: A Catalyst for Change.

The rise of Fintech presents both challenges and opportunities for employment. While job losses are inevitable in some areas, new job roles emerge requiring different skillsets. By embracing continuous learning, investing in reskilling initiatives, and considering broader societal implications, we can ensure a future where the Fintech revolution benefits both businesses and employees.

Looking Ahead: The Future of Fintech and Employment.

The Fintech landscape is constantly evolving, and its impact on employment will likely continue to change over time. Here are some potential future trends to consider:

- The Rise of AI: Artificial intelligence (AI) is poised to play an even greater role in Fintech, further automating tasks and potentially leading to the development of entirely new job roles focused on AI development and management.

- Focus on User Experience: As competition in the Fintech space intensifies, providing a seamless and user-friendly experience will be crucial. This could lead to increased demand for UX designers and user interface (UI) specialists.

- The Decentralized Future: Blockchain technology and decentralized finance (DeFi) have the potential to disrupt traditional financial models further. The impact of DeFi on employment remains to be seen, but it could create new opportunities for developers and specialists in this emerging field.

- Regulation and Oversight: As Fintech becomes more integrated into the financial system, regulatory frameworks will need to adapt to address potential risks and ensure consumer protection. This could lead to the need for more regulatory compliance specialists.

A Call to Action: Preparing for the Future.

By acknowledging the potential impact of Fintech on employment and proactively preparing for the future, we can create a more positive outcome for workers in the financial services sector.

Here's a call to action for various stakeholders:

- Financial Institutions: Invest in reskilling and upskilling programs for your employees, and embrace a culture of continuous learning.

- Governments: Develop policies and initiatives that support retraining and education in the Fintech era. Consider exploring the potential of a UBI or strengthened social safety nets.

- Educational Institutions: Adapt curriculums to equip students with the skills necessary for the Fintech-driven workplace.

- Individuals: Take ownership of your career development by seeking opportunities to learn new skills and stay updated on the latest Fintech trends.

The Fintech revolution is here to stay, and its impact on employment will continue to unfold. By working together and embracing a future of human-machine collaboration, we can ensure that this transformation benefits everyone involved.

Additional Resources:

- The World Bank: Financial Technology and Digital Inclusion https://www.worldbank.org/en/publication/globalfindex.

- The Brookings Institution: The Future of Jobs: Automation and Artificial Intelligence https://www.brookings.edu/topics/future-of-work/

- The World Economic Forum: The Reskilling Revolution https://initiatives.weforum.org/reskilling-revolution/home.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)