Top 10 Layer 2 Crypto Projects Set to Shine in 2024

Top 10 Layer 2 Crypto Projects Set to Shine in 2024

Zara Zyana

As the blockchain landscape continues to evolve and adapt to meet the demands of a growing user base, Layer 2 Blockchain Solutions have emerged as a crucial aspect of enhancing scalability and efficiency. These solutions offer a way to alleviate congestion on the main blockchain networks while still maintaining security and decentralization. In 2024, with the maturation of blockchain technology and the increasing adoption of cryptocurrencies, the spotlight is on Layer-2 crypto projects poised to make a significant impact.

In this article, we’ll delve into 10 Layer-2 crypto projects that are primed to shine in 2024. From innovative scaling solutions to novel approaches in interoperability and decentralized finance (DeFi), these projects represent the forefront of blockchain innovation. Join us as we explore the potential of these projects to shape the future of decentralized finance and revolutionize the way we interact with blockchain technology.

What are Layer-2 Scaling Solutions?

Layer-2 scaling solutions are technologies designed to improve the scalability and efficiency of blockchain networks by operating “on top” of the main blockchain layer. These solutions aim to address the inherent limitations of blockchain platforms, such as slow transaction speeds and high fees, by offloading some of the network’s workload onto secondary layers.

One common approach to Layer-2 scaling is through the use of sidechains and off-chain protocols. Sidechains are independent blockchains that are interoperable with the main blockchain but can process transactions more quickly and at lower costs. Off-chain protocols, on the other hand, enable participants to conduct transactions and execute smart contracts off the main blockchain, only settling the final result on the main chain.

Examples of Layer-2 Scaling Techniques

Several Layer-2 scaling techniques are being implemented to address the scalability limitations of blockchain networks. Here are some examples:

✏ State Channels: State channels allow participants to conduct multiple transactions off-chain, updating the state of their interactions privately. These transactions are only settled on the main blockchain when necessary, reducing congestion and increasing throughput. Payment channels, such as the Lightning Network for Bitcoin and Raiden Network for Ethereum, are popular implementations of state channels for enabling fast and cheap micropayments.

✏ Sidechains: Sidechains are independent blockchains that operate alongside the main blockchain but are interoperable with it. They enable specific use cases or applications to run on separate chains, relieving congestion on the main chain. For example, the Liquid Network is a sidechain for Bitcoin that facilitates faster and confidential transactions between participating exchanges and institutions.

✏ Plasma: Plasma is a framework for building scalable blockchain applications by creating nested blockchains (child chains) that can execute smart contracts and handle transactions independently. These child chains periodically submit summarized data to the main chain (root chain), reducing the burden on the main chain while maintaining security. OmiseGO (OMG) is an example of a project utilizing Plasma for scaling Ethereum-based transactions.

✏ Rollups: Rollups are a Layer-2 scaling solution that aggregates multiple transactions into a single data structure, which is then submitted to the main chain for validation. There are two types of rollups: optimistic rollups and zk-rollups. Optimistic rollups assume that transactions are valid unless proven otherwise, while zk-rollups use zero-knowledge proofs to ensure the validity of transactions without revealing their details. Projects like Optimism and zkSync are implementing rollup solutions to scale Ethereum transactions.

✏ State Sharding: Sharding is a technique that partitions the blockchain network into smaller subsets (shards), with each shard responsible for processing a portion of the network’s transactions. State sharding, specifically, focuses on partitioning the state of the blockchain, allowing each shard to process transactions independently. Ethereum 2.0 is implementing state sharding to significantly increase the network’s throughput and scalability.

Top 10 Layer 2 Projects

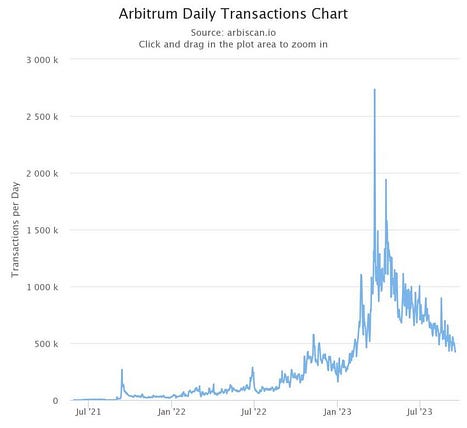

Arbitrum

Arbitrum is a scaling solution for the Ethereum blockchain, aiming to address Ethereum’s limitations in terms of speed and transaction costs. Here’s a breakdown of Arbitrum:

Layer 2 Solution: Arbitrum is an Ethereum Layer 2 (L2) technology, which means it operates on top of the Ethereum mainnet. This design leverages Ethereum’s security while enabling faster and cheaper transactions on Arbitrum.

Optimistic Rollups: Arbitrum utilizes a technique called optimistic rollups to achieve scalability. Transactions are bundled together off-chain, processed on Arbitrum, and then submitted as a single transaction to the Ethereum mainnet. This reduces the load on the Ethereum network, leading to faster transaction speeds and lower fees.

Benefits

- Faster Transactions: Compared to Ethereum, Arbitrum offers significantly faster transaction processing times.

- Lower Costs: Transaction fees on Arbitrum are much cheaper than on the Ethereum mainnet.

- Ethereum Security: Inherits security from the Ethereum blockchain.

Arbitrum boasts an impressive market capitalization of $1 billion, with its native token, ARB, serving as the backbone of the ecosystem. ARB holders wield voting power in protocol development and fund allocation decisions. Facilitating seamless transitions between Ethereum and Arbitrum, users can utilize a bridge to transfer assets and engage in exchanges across various platforms.

At the heart of the ecosystem lies Nitro, powering a range of products. Among them, Arbitrum Orbit empowers users to launch tailored chains, tailored to their project’s specifications. Furthermore, Arbitrum AnyTrust, a variant of Arbitrum Nitro, reduces costs by embracing a moderate trust assumption.

Currently, 12.5% of ARB tokens are in circulation, with a monthly unlocking schedule commencing in March 2024 and extending through 2027.

Polygon (MATIC)

Polygon (MATIC) is a Layer 2 scaling solution for the Ethereum blockchain, aiming to address Ethereum’s limitations in terms of speed and transaction costs. Here’s a breakdown of Polygon (MATIC):

- Sidechains and More: Unlike Arbitrum’s optimistic rollup approach, Polygon utilizes a combination of sidechains and other scaling solutions, offering flexibility for developers.

- Faster Transactions and Lower Fees: Similar to Arbitrum, Polygon offers significantly faster transaction processing times and lower fees compared to the Ethereum mainnet.

Price: MATIC is currently trading around $0.70 with a circulating supply of 9.9 billion and a max supply of 10 billion. It’s down around 4.4% in the last 24 hours.

Market Cap: Around $6.9 billion, ranking it 18th among cryptocurrencies.

The project boasts a Total Value Locked (TVL) of approximately $796 million and recently introduced Polygon zkEVM, fully compatible with the Ethereum Virtual Machine (EVM). This seamless integration into smart contracts and developer tools enhances accessibility and functionality for users.

Optimism (OP)

Optimism (OP) is another Layer 2 scaling solution for the Ethereum blockchain, aiming to solve Ethereum’s scalability issues. Here’s a breakdown of Optimism:

Optimistic Rollups for Scaling: Similar to Arbitrum, Optimism utilizes Optimistic Rollups, a technique that bundles transactions off-chain, processes them on Optimism, and then submits them as a single transaction to the Ethereum mainnet. This approach inherits Ethereum’s security while enabling faster and cheaper transactions on Optimism.

Unique Features of Optimism:

- Optimism Collective: It has a unique governance structure called the Optimism Collective. This collective consists of token holders (Token House) and users with a Soulbound Citizen NFT (Citizens’ House) who work together to steer the network’s development.

- Focus on Public Goods: Optimism is committed to funding public goods that benefit the entire Ethereum ecosystem through a mechanism called Retroactive Public Goods Funding (RetroPGF).

Immutable X

Immutable X is a Layer 2 scaling solution specifically designed for trading and creating non-fungible tokens (NFTs) on the Ethereum blockchain. Here’s a breakdown of Immutable X:

Focus on NFT Market: Unlike Arbitrum and Optimism, which are general-purpose Layer 2 solutions, Immutable X caters particularly to the NFT ecosystem. It aims to address challenges faced by NFTs on the Ethereum mainnet, such as:

- High Gas Fees: Minting and trading NFTs on Ethereum can incur significant gas fees, making it cost-prohibitive for some users. Immutable X offers significantly lower fees.

- Scalability Issues: Ethereum’s network congestion can lead to slow transaction processing times for NFTs. Immutable X provides faster transaction speeds.

Key Features of Immutable X

- StarkEx ZK-Rollups: Utilizes StarkEx, a type of Layer 2 scaling solution that leverages zero-knowledge proofs for efficient transaction processing. This offers significant gas fee reductions and faster settlements compared to the Ethereum mainnet.

- Focus on Security: While operating on Layer 2, Immutable X inherits the security of the Ethereum blockchain through its verification process.

- Immutable X Token (IMX): The native token of the platform with several utilities:

- Fees: A portion of trading fees on the Immutable X marketplace is paid in IMX tokens.

- Staking: Users can stake IMX tokens to earn rewards and participate in network governance.

- Marketplace Access: Some features within the Immutable X marketplace may require holding IMX tokens.

Shiba Inu (SHIB)

Shiba Inu (SHIB) is a decentralized cryptocurrency inspired by the popular Doge meme and its mascot, the Shiba Inu dog breed. Launched in August 2020 by an anonymous person or group using the pseudonym “Ryoshi,” it has gained significant popularity within the meme coin community.

Here’s a breakdown of Shiba Inu:

Key Features:

- Meme Coin Origins: Like Dogecoin, Shiba Inu’s value is largely driven by hype, social media trends, and community sentiment rather than underlying utility.

- Large Token Supply: SHIB has a massive total supply of one quadrillion tokens (that’s 1,000,000,000,000,000), significantly more than most cryptocurrencies. This high supply contributes to its lower per-token price.

- SHIB Ecosystem: Shiba Inu has grown beyond just a meme coin. It has its own ecosystem that includes:

- ShibaSwap: A decentralized exchange (DEX) for swapping and trading cryptocurrencies.

- LEASH and BONE Tokens: Additional tokens within the Shiba Inu ecosystem with specific utilities within Shibaswap.

- Shiboshis: A collection of non-fungible tokens (NFTs).

Mantle

Mantle is a Layer 2 scaling solution for the Ethereum blockchain, aiming to address Ethereum’s limitations in terms of speed and transaction costs. Here’s a breakdown of Mantle:

Modular Design for Efficiency: Unlike some Layer 2 solutions, Mantle utilizes a modular architecture. This means it separates different functionalities of the blockchain (execution, data availability, consensus) into distinct layers, allowing for greater flexibility and optimization.

- Optimistic Rollups: Similar to Arbitrum and Optimism, Mantle leverages optimistic rollups technology to bundle transactions off-chain, process them efficiently, and then submit them to the Ethereum mainnet for final settlement. This reduces the load on the Ethereum network, leading to faster transaction speeds and lower fees.

- EigenDA for Data Availability: A key differentiator of Mantle is its use of EigenDA, a decentralized data availability layer. This layer ensures the immutability and verifiability of transaction data processed on Mantle, even if the primary transaction sequencer goes offline.

Through rollups, the project efficiently shifts both computation and state storage off-chain, significantly reducing the computational load processed on Layer 1 (L1). Notably, its Total Value Locked (TVL) currently stands at $36.78 million.

Since its launch in July 2023, the project has achieved remarkable success, boasting a total market capitalization of $1.3 billion, with 52% of its tokens already in circulation. Looking ahead to 2024, the project’s future appears promising, with a treasury valued at $2 billion and projections to allocate funds towards further ecosystem development.

Loopring

Loopring is a Layer 2 scaling solution for the Ethereum blockchain designed to address the issues of scalability and high transaction fees that Ethereum currently faces. Here’s a deeper dive into Loopring:

Core Functionalities:

- Faster and Cheaper Transactions: Loopring utilizes a technology called zkRollups (zero-knowledge rollups) to bundle multiple transactions off-chain, verify them cryptographically, and then submit them as a single batch to the Ethereum mainnet. This significantly reduces the load on the Ethereum network, leading to faster transaction processing times and lower fees compared to the mainnet.

- Decentralized Exchange Protocol: Loopring also functions as a decentralized exchange (DEX) protocol. Loopring allows users to trade cryptocurrencies in a peer-to-peer manner, without the need for a central intermediary. This can offer greater security and control for users compared to traditional centralized exchanges.

- Order Book and Ring Matching: Unlike some DEXes that rely on automated market makers (AMMs), Loopring uses order book and ring matching systems for efficient trade execution. This can be beneficial for traders who prefer a more familiar trading experience.

dYdX

dYdX is a leading decentralized exchange (DEX) built on the Ethereum blockchain, specifically designed for margin trading of perpetual contracts. Here’s a breakdown of its key features:

Focus on Perpetual Trading:

- Unlike many DEXes that focus on spot trading (immediate exchange of cryptocurrencies), dYdX specializes in perpetual contracts. These are futures contracts without expiry dates, allowing users to speculate on the future price of cryptocurrencies with leverage (borrowing funds to amplify gains or losses).

- Leveraged Trading: dYdX allows users to trade with leverage of up to 20x, which can magnify potential profits but also significantly increase risk.

Key Features of dYdX:

- Layer 2 Scaling: dYdX currently operates on StarkWare, a Layer 2 scaling solution for Ethereum. This enables faster and cheaper transactions compared to the Ethereum mainnet. (dYdX v4 uses its own blockchain, dYdX Chain.)

- Order Book System: dYdX utilizes an order book system for trade matching, similar to traditional centralized exchanges. This can be attractive to users familiar with this trading model.

- Security: While operating on Layer 2, dYdX inherits the security of the underlying Ethereum blockchain through its verification process.

The decentralized exchange (DEX) platform offers users a range of benefits, including low fees, zero gas costs, rapid trades, and swift withdrawals. Its native token, dYdX, plays a pivotal role in staking protocols, governance mechanisms, and providing liquidity.

With a market capitalization of $305 million and a token supply of up to 156,256,174, the platform boasts a Total Value Locked (TVL) of $344 million. Notably, it has garnered support from prominent venture capitalists such as Polychain, Paradigm, and Andreessen Horowitz.

Furthermore, the project has introduced its flagship product, the L2 trading web app. This innovative platform allows users to trade a diverse range of crypto derivatives for various assets, including Bitcoin, Dogecoin, Ethereum, BNB, and many others.

COLLABORATE WITH LAYER 2 BLOCKCHAIN SOLUTIONS

Embrace the future of blockchain technology with Layer 2 solutions! Whether you’re a developer, investor, or enthusiast, now is the time to explore the potential of Layer 2 protocols to revolutionize scalability, interoperability, and decentralized finance. Join the movement towards a more efficient, scalable, and inclusive blockchain ecosystem by diving into Layer 2 projects, contributing to their development, and experiencing the benefits firsthand. Together, let’s build a better, more accessible future for blockchain technology. Take action today and be a part of shaping tomorrow’s decentralized world!

Final Thoughts

In conclusion, the landscape of Layer 2 crypto projects in 2024 is teeming with innovation and potential. We’ve highlighted 10 projects that stand out for their unique approaches to scalability, interoperability, and decentralized finance. These projects are not only addressing the current challenges faced by blockchain networks but also paving the way for a more scalable, efficient, and inclusive decentralized ecosystem. As we move forward, it’s crucial to continue monitoring the progress of these projects and the broader developments in the Layer 2 Blockchain Solutions space. With ongoing advancements and community support, these projects are poised to shine even brighter in the years to come, driving forward the evolution of blockchain technology and reshaping the future of finance and digital infrastructure.