5 Things you need to do before providing liquidity in pools

This is the next and probably last article regarding liquidity pools. These were the previous posts in this series:

This is the next and probably last article regarding liquidity pools. These were the previous posts in this series:

- Defi is not what it once was... It has become much more professional !

- How do liquidity pools work?

- What is a concentrated liquidity pool

- What are the risks with liquidity pools?

Before you try to provide liquidity in a pool, it's really important that you take the following steps:

Make sure you understand the risks

Providing liquidity comes with several risks. There is the smart contract risk. You can never know how safe a smart contract is and whether it can be hacked. A good idea is to opt for something that hasn't just appeared yesterday but that is battle proven and has a lot of people using it.

Then of course there is the often mentioned but not always understood impermanent loss. I made a video about this that you might want to have a look at.

You really need to understand what you are doing when you invest liquidity in a pool. Take your time to study it before you jump into the water. You might want to read the my post about how these pools work.

Choose the correct pair of tokens

Whenever you want to provide liquidity for a pool you should spend some time to figure out what pair of tokens are most suited for you. To avoid impermanent loss, you should always try to select a pair of token that move in a correlated way. In other words, if token A goes up, token B should go up as well.

The lowest risk ist constituted by pairs of stablecoins. Or pairs that link a token with it's own staked form. For example SOL with mSOL which is Solana in staked form.

These two type of pairs offer a lot of stability but not so much return. A lot of people chose them to provide liquidity and therefore the return is rather low.

If you want to increase your risk, you might want to opt for a token that is more volatile combined with a stable token. A good example here would be a pool that links SOL with USDC for example. SOL is volatile but all the same pretty stable in the long run. There are more risks of impermanent loss but also more potential for bigger yield.

I would avoid in any case to provide liquidity for meme tokens or if you do it, make sure that you try to do it for a very limited time frame. The chances are big that your whole position will be composed of worthless meme tokens if you keep the position open too long.

Set an appropriate range

Especially with concentrated liquidity pools, it's important to set a range that offers the best possible return for you. A good way of doing it is to use a chart like Birdeye. Look at the chart so that it shows you the data for at least the whole previous month. Now you can draw some trend lines on the chart. This will give you an indication of how the token evolves. Now you should look for a situation where the trend channel is as horizontal as possible. Here is an example of the evolution of the last days of the pair SOL – USD and you can see that the trend canal is not horizontal at all. This might not be the best moment to provide liquidity for this pair. There are strategies to use such channel developments but they are a bit complicated to explain.

Here is an example of the evolution of the last days of the pair SOL – USD and you can see that the trend canal is not horizontal at all. This might not be the best moment to provide liquidity for this pair. There are strategies to use such channel developments but they are a bit complicated to explain.

The trend lines give you an indication where you can set the range for your position according to how long you want to keep the position open.

Select the best pool

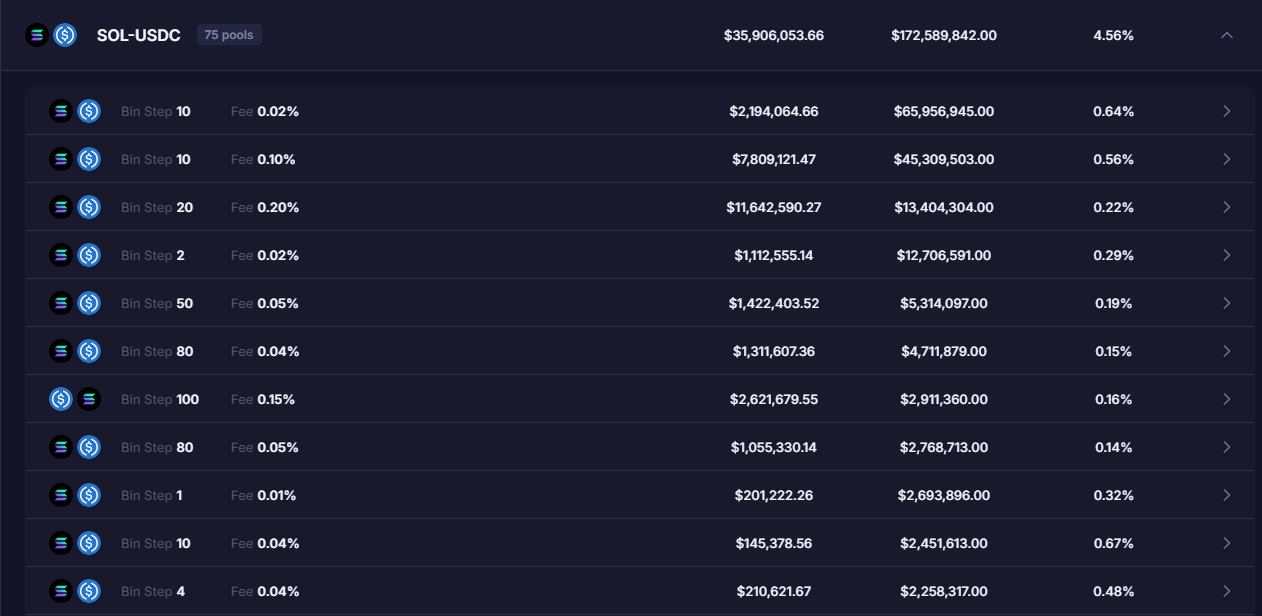

Once you know what tokens you want to pair, it's important to select the best pool for it. Alone on Meteora, you can select among 75 pools for the pair SOL-USDC. The choice is often not that easy to make. The most important aspect in my eyes is that the pool is big enough and has a lot of transactions. You often have an indicator that compares the fees with the amount of liquidity. This could be considered the return for the pool (Fee/TVL). So you want a high Fee/TVL, a lot of transactions and a pool that is not too small. When two pools have similar numbers, I would opt for the pool with lower fees. Such pools generate more organic transactions. More expensive pool generate transactions only in arbitrage conditions.

The choice is often not that easy to make. The most important aspect in my eyes is that the pool is big enough and has a lot of transactions. You often have an indicator that compares the fees with the amount of liquidity. This could be considered the return for the pool (Fee/TVL). So you want a high Fee/TVL, a lot of transactions and a pool that is not too small. When two pools have similar numbers, I would opt for the pool with lower fees. Such pools generate more organic transactions. More expensive pool generate transactions only in arbitrage conditions.

Don't go in too small

When you want to invest into liquidity pools, you will generate some network fees for swapping and providing liquidity and then again for closing the position. It's therefore important that your position isn't too small. The network costs will be more or less the same for a small than for a big position. The network fees are the cost factor of your business together with the impermanent loss. The fees will be your income. To make this whole endeavor profitable, you need to make sure that your income is higher than your costs...

![[LIVE] Engage2Earn: Let's keep Sam delivering for Hawke](https://cdn.bulbapp.io/frontend/images/2c5d8b18-5618-4a2a-9051-89ceddbcdfd5/1)