The Dark Side of Bitcoin

Bitcoin, once hailed as a revolutionary financial technology, has increasingly revealed its darker aspects. While its decentralized nature and potential for financial inclusion have captivated many, the same characteristics have made it a tool for illicit activities, market manipulation, and environmental degradation.

This article delves into the darker facets of Bitcoin, examining its role in criminal enterprises, financial instability, and its environmental impact.

Bitcoin and Criminal Activity

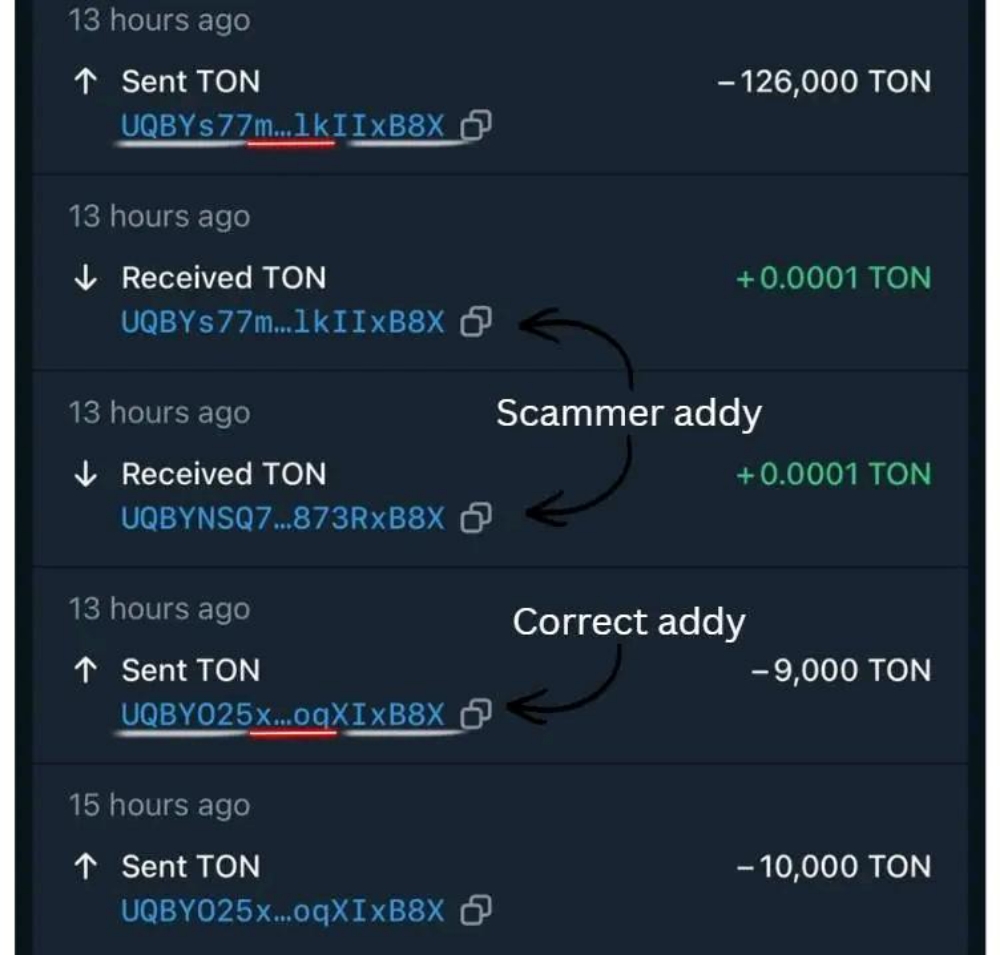

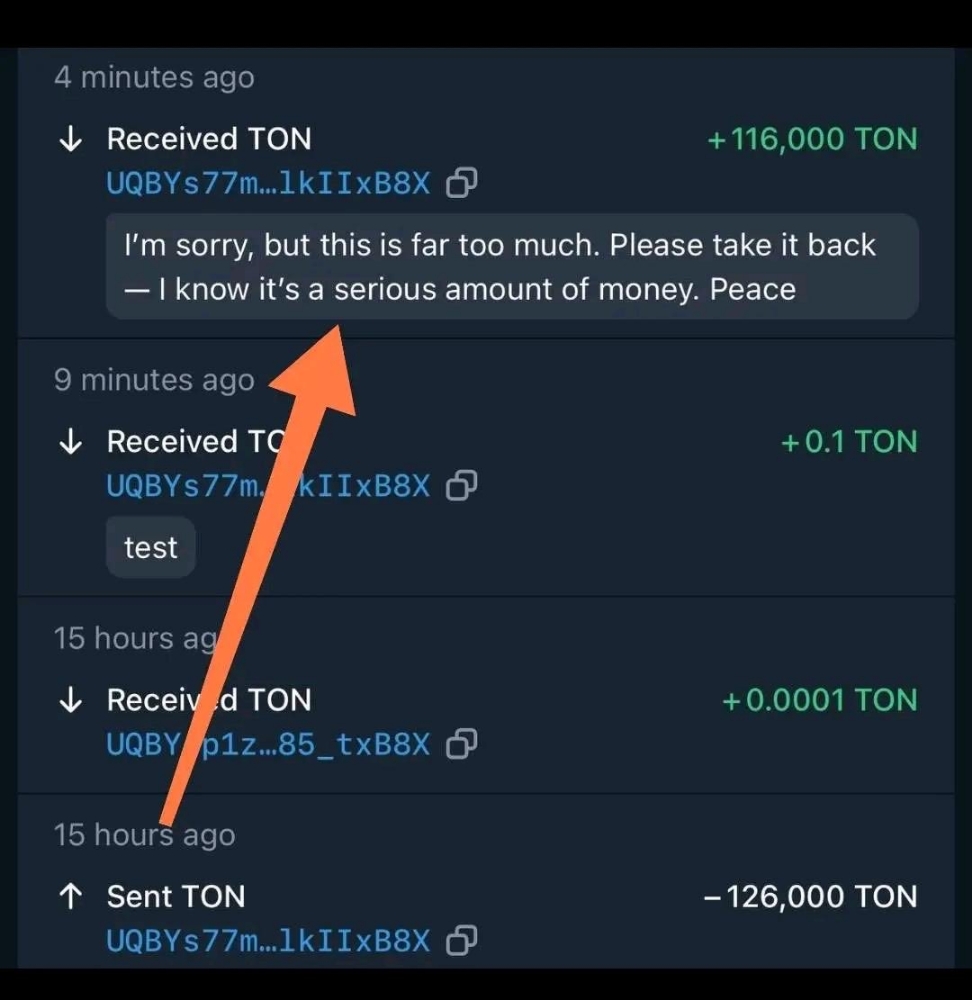

Bitcoin's pseudonymous nature has made it a popular choice among cybercriminals. Despite common misconceptions, Bitcoin transactions are not entirely anonymous; every transaction is recorded on a public ledger known as the blockchain.

However, tracing these transactions back to real-world identities can be challenging, making it an attractive option for money laundering, ransomware, and other illegal activities.

Cybercriminals have increasingly leveraged Bitcoin for ransomware attacks, where they encrypt victims' data and demand Bitcoin as ransom. The cryptocurrency’s use in dark web transactions is also well-documented, with billions of dollars in Bitcoin being funneled through illegal marketplaces.

Even as law enforcement agencies become more adept at tracking these transactions, the rise of privacy coins and decentralized exchanges continues to challenge their efforts.

Market Manipulation and Financial Instability

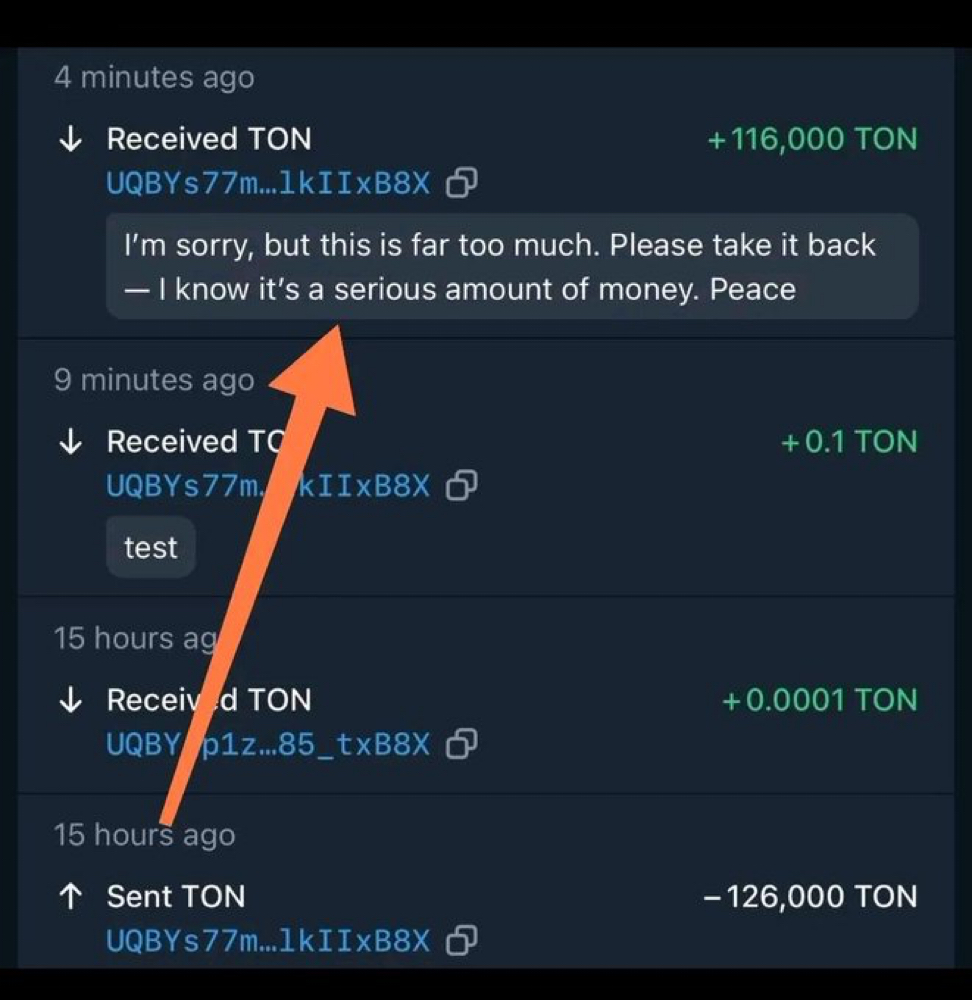

Bitcoin’s market is highly volatile, driven by speculation, manipulation, and the activities of so-called "whales"—individuals or entities holding large quantities of Bitcoin who can influence market prices with significant buy or sell orders.

The lack of regulatory oversight in cryptocurrency markets allows for various forms of market manipulation, including pump-and-dump schemes, where the price of Bitcoin is artificially inflated before being sold off, leaving smaller investors with significant losses.

This volatility not only affects individual investors but also has broader implications for financial stability. Bitcoin's wild price swings can lead to massive losses, undermining confidence in the broader cryptocurrency market. Furthermore, as traditional financial institutions begin to offer Bitcoin-related services, the risks of a Bitcoin crash reverberating through the global financial system increase.

Environmental Impact

The environmental footprint of Bitcoin is another significant concern. Bitcoin mining, the process through which new Bitcoins are created and transactions are verified, is highly energy-intensive. The vast computational power required for mining has led to a surge in electricity consumption, often relying on non-renewable energy sources.

The carbon footprint of Bitcoin mining is comparable to that of some entire nations, exacerbating global climate change. Despite some efforts to shift towards renewable energy, the majority of Bitcoin mining still relies on fossil fuels, particularly in regions with lax environmental regulations.

As Bitcoin's popularity grows, so does its environmental impact, raising questions about the sustainability of the cryptocurrency.

The Future of Bitcoin: Regulation and Innovation

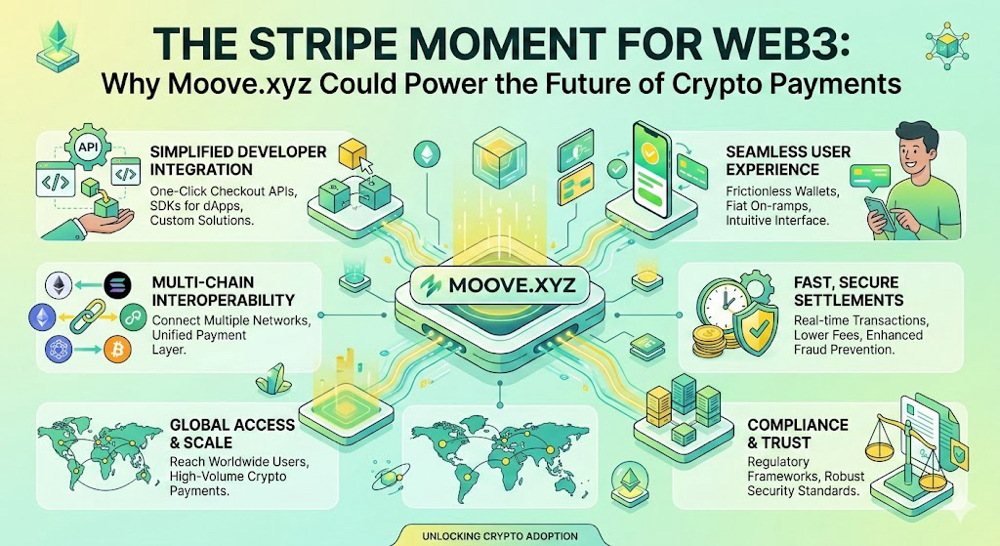

As Bitcoin continues to evolve, so too does the regulatory landscape surrounding it. Governments around the world are grappling with how to regulate Bitcoin without stifling innovation.

In the U.S., there have been calls for stricter regulations to prevent money laundering and other illegal activities, while other countries have taken a more hands-off approach.

However, regulation alone may not be enough to address the dark side of Bitcoin. The development of new technologies, such as privacy coins and decentralized exchanges, poses new challenges for law enforcement and regulators.

These innovations, while advancing the cryptocurrency space, also risk further enabling illicit activities and market instability.

The future of Bitcoin will likely be shaped by a combination of regulation and innovation, as well as the continued push towards sustainability in the face of growing environmental concerns. Whether Bitcoin will overcome its dark side or be overshadowed by it remains to be seen.

Conclusion

Bitcoin’s rise has been nothing short of remarkable, but it has also brought to light significant challenges. From its use in criminal enterprises to its role in financial instability and environmental harm, the dark side of Bitcoin cannot be ignored. As the cryptocurrency continues to grow in prominence, addressing these issues will be crucial for its long-term viability and acceptance.

Sources

- Brookings - Shifting crypto landscape threatens crime investigations and sanctions

- El Pais - Bitcoin: on the rise, but just as volatile and dangerous as ever

- Investopedia - Bitcoin’s environmental impact: Can cryptocurrency go green?

- MIT Technology Review - Why Bitcoin uses so much energy

- Reuters - Explainer: Why is Bitcoin volatile?

- CNBC - Bitcoin and the dark web: How criminals use cryptocurrencies

- The Guardian - Bitcoin and the crypto-whales: How market manipulation harms investors

- The New York Times - The energy cost of Bitcoin and its environmental impact

- BBC News - Bitcoin: The challenge of regulating the unregulated

- The Verge - How the U.S. is cracking down on Bitcoin crimes