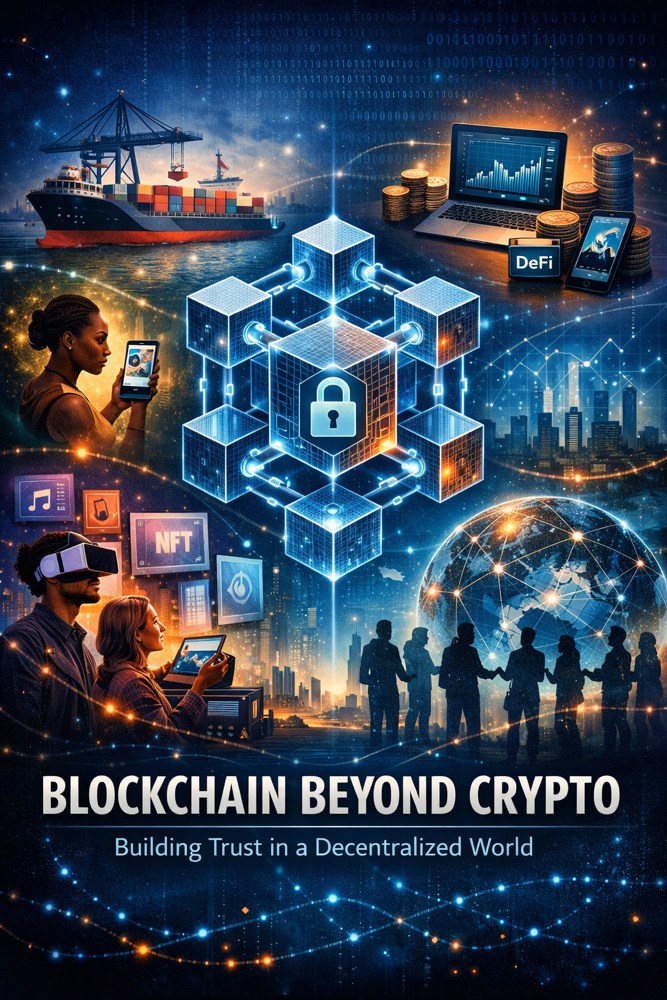

Crypto vs NFT: Unraveling the Differences and Exploring Their Potential

In the ever-evolving landscape of digital assets, two terms have gained immense popularity: cryptocurrency and non-fungible tokens (NFTs). While both fall under the umbrella of blockchain technology, they serve distinct purposes and cater to different markets. In this blog post, we will delve into the details of crypto and NFTs, exploring their unique characteristics, use cases, and potential implications for the future.

Cryptocurrency, such as Bitcoin and Ethereum, is a digital or virtual form of currency that employs cryptographic techniques to secure financial transactions, control the creation of new units, and verify the transfer of assets. The fundamental concept behind cryptocurrencies is decentralization, as they operate on a distributed ledger called a blockchain, which is maintained and validated by a network of computers (nodes) spread across the globe.

- Fungibility: Cryptocurrencies are fungible, meaning one unit can be exchanged for another identical unit. For instance, if you own one Bitcoin, it can be exchanged for another Bitcoin without any distinction.

- Medium of Exchange: Cryptocurrencies primarily serve as a medium of exchange, enabling peer-to-peer transactions without the need for intermediaries, such as banks. They provide a secure and efficient means of transferring value globally, with reduced transaction fees and faster settlement times compared to traditional financial systems.

- Store of Value: Some cryptocurrencies, like Bitcoin, are considered a store of value due to their limited supply and potential for long-term price appreciation. Investors often view cryptocurrencies as a hedge against inflation and a diversification tool for their investment portfolios.

- Programmability: Smart contracts, a feature supported by certain cryptocurrencies like Ethereum, allow developers to create decentralized applications (DApps) and execute automated transactions based on predefined conditions. This programmability expands the utility of cryptocurrencies beyond simple transactions, opening up opportunities for decentralized finance (DeFi), gaming, and more.

Non-Fungible Tokens (NFTs)

Non-fungible tokens, or NFTs, represent a unique type of digital asset that utilize blockchain technology to certify and prove ownership of a specific item, be it artwork, collectibles, music, virtual real estate, or even tweets. Unlike cryptocurrencies, NFTs are indivisible and cannot be exchanged on a one-to-one basis.

- Uniqueness: Each NFT possesses distinct attributes, making it one-of-a-kind. These attributes can include provenance, rarity, ownership history, and metadata that provide additional context and value to the asset.

- Ownership and Authenticity: NFTs leverage blockchain's immutability and transparency to establish verifiable ownership and provenance. This feature has revolutionized the art world, enabling artists to sell their digital creations directly to collectors while ensuring authenticity and traceability.

- Tokenization of Assets: NFTs have unlocked the potential for fractional ownership and liquidity of traditionally illiquid assets. For example, real estate properties or rare collectibles can be tokenized, allowing investors to own a fraction of the asset or trade it on specialized platforms.

- Royalties and Revenue Sharing: NFTs can be programmed to include smart contracts that automatically allocate royalties to the original creators whenever the asset is resold or licensed. This feature empowers artists, musicians, and content creators to receive ongoing financial benefits from the appreciation of their work.

Crypto vs. NFTs: Different but Complementary:

While crypto and NFTs have distinct characteristics, they are not mutually exclusive. In fact, NFTs can be bought and sold using cryptocurrencies, providing an additional layer of utility and liquidity. Cryptocurrencies act as a means of exchange and store of value, while NFTs bring uniqueness, provenance, and ownership

Determining the "best" crypto markets is subjective and can vary depending on factors such as trading volume, market liquidity, regulatory environment, and investor sentiment. However, here are some of the notable cryptocurrency markets that have gained prominence:

- United States: The United States boasts one of the largest and most regulated crypto markets. It is home to major cryptocurrency exchanges like Coinbase and Kraken, and the country has made efforts to provide regulatory clarity for cryptocurrencies and blockchain technology.

- Europe: European countries like the United Kingdom, Switzerland, and Germany have developed crypto-friendly regulations, attracting blockchain startups and fostering cryptocurrency innovation. Crypto exchanges such as Bitstamp and Bitpanda operate in these regions.

- Japan: Japan has been at the forefront of cryptocurrency adoption and regulation, recognizing Bitcoin as a legal form of payment. The country's Financial Services Agency (FSA) has established a licensing framework for crypto exchanges, ensuring consumer protection.

- South Korea: South Korea has a vibrant crypto market, with a significant number of cryptocurrency enthusiasts and active traders. Exchanges like Bithumb and Upbit operate in the country, and the government has been working to establish clearer regulations for the industry.

- Singapore: Known for its supportive regulatory environment, Singapore has become a hub for blockchain and cryptocurrency projects. The country offers a favorable business environment for crypto startups and has attracted major exchanges like Binance and Huobi.

- Hong Kong: Hong Kong serves as an important crypto market in Asia, with a favorable regulatory environment and established exchanges like OKEx and Bitfinex. The city has been a gateway for global investors looking to tap into the Asian crypto market.

- Australia: Australia has seen significant crypto adoption and has established a regulatory framework to govern digital assets. Exchanges such as Independent Reserve and CoinSpot operate in the country, and Australia has been proactive in exploring blockchain technology applications.

- Canada: Canada has a thriving crypto ecosystem, with a supportive regulatory environment and several exchanges like Coinsquare and Bitbuy. The country has been open to blockchain innovation and has seen increased institutional interest in cryptocurrencies.

It's important to note that the cryptocurrency market is global, and trading can take place across various platforms regardless of geographical boundaries. Investors should consider factors such as security, regulatory compliance, trading fees, user experience, and available trading pairs when choosing a crypto exchange or market to engage with. Conducting thorough research and due diligence is essential to ensure the reliability and credibility of the chosen platform.

Determining the "best" NFT marketplace can depend on various factors, including user experience, platform features, fees, popularity, and the type of digital assets being traded. Here are some notable NFT marketplaces that have gained prominence:

- OpenSea: OpenSea is one of the largest and most popular NFT marketplaces, offering a wide range of digital assets across multiple categories, including art, collectibles, virtual land, and more. It supports Ethereum-based NFTs and provides a user-friendly interface for buyers and sellers.

- Rarible: Rarible is a decentralized NFT marketplace that operates on the Ethereum blockchain. It allows users to create, buy, and sell NFTs with a focus on empowering creators. Rarible incorporates governance features that enable token holders to influence platform decisions.

- SuperRare: SuperRare is an invite-only NFT marketplace that specializes in digital art. It curates high-quality, limited-edition artworks from renowned artists and provides a platform for collectors to buy and sell unique pieces. SuperRare has gained a reputation for its focus on exclusivity and artistic curation.

- NBA Top Shot: NBA Top Shot is an NFT marketplace that offers officially licensed basketball collectibles in the form of "moments." These moments are short video highlights of NBA players and have gained significant popularity among sports and NFT enthusiasts.

- Binance NFT: Binance NFT is the NFT marketplace operated by the Binance cryptocurrency exchange. It offers a wide range of digital assets, including artwork, collectibles, and virtual real estate. Binance NFT supports multiple blockchains and provides a seamless experience for users within the Binance ecosystem.

- Foundation: Foundation is an invite-only NFT marketplace known for its focus on digital art and curation. It aims to promote meaningful and innovative artwork and has gained attention for hosting high-profile NFT auctions.

- Mintable: Mintable is a user-friendly NFT marketplace that allows creators to mint, buy, and sell NFTs. It supports both Ethereum-based NFTs and Polygon (formerly Matic) network-based NFTs, offering low gas fees and faster transactions.

- Axie Infinity: While primarily known as a blockchain-based game, Axie Infinity also functions as an NFT marketplace. It allows players to buy, sell, and trade digital pets called Axies, which can be used in gameplay or collected as NFT assets.

When choosing an NFT marketplace, it's crucial to consider factors such as user interface, platform reputation, community engagement, transaction fees, and the specific type of NFTs available. Conducting research and exploring different platforms can help you find the marketplace that best aligns with your needs as a creator or collector.