Understanding Blockchain: Tokenization of Real World Assets

Introduction to Tokenization

Tokenization is a concept that lies at the heart of blockchain technology. It refers to the process of converting real-world assets into digital tokens, which can be easily traded and exchanged on a blockchain network. By representing physical assets or even intangible assets as tokens, tokenization introduces a new level of fluidity and accessibility to traditional financial markets.

Tokenization offers numerous advantages. Firstly, it enhances liquidity, allowing fractional ownership and the ability to trade assets 24/7. Tokenization also eliminates the need for intermediaries such as brokers or custodians, reducing costs and increasing efficiency. Additionally, it opens up investment opportunities to a wider audience, as it allows for smaller denominations and greater accessibility.

By leveraging blockchain technology, tokenization ensures transparency and immutability of ownership records. Each token represents a unique digital asset, making it easy to track ownership and transfer ownership securely. This brings trust and accountability to the asset ecosystem, fostering a greater level of confidence and reducing the potential for fraud.

The potential applications of tokenization are vast. Anything from real estate and artwork to intellectual property and commodities can be transformed into digital tokens. This has the potential to democratize the investment landscape, enabling individuals to invest in a diverse range of assets that were previously inaccessible or reserved for institutional investors.

Overall, tokenization represents a paradigm shift in asset management and investment. It provides a means to unlock the value of real-world assets and make them more accessible and liquid. With the power of blockchain technology, tokenization has the potential to revolutionize financial markets and reshape traditional notions of ownership and investment.

The Basics of Blockchain Technology

Blockchain technology is a decentralized and transparent digital ledger system that securely records and verifies transactions. It was originally developed for Bitcoin, but its potential applications have since expanded beyond cryptocurrency.

At its core, a blockchain is a continuously growing list of records, called blocks, which contain batches of transactions. Each block is linked to the previous block through a cryptographic hash, forming a chain. This ensures the integrity and immutability of the data stored on the blockchain.

One of the key features of blockchain technology is its decentralization. Instead of relying on a central authority, such as a bank or government, to verify and validate transactions, blockchain networks utilize a consensus mechanism. This means that multiple participants, known as nodes, work together to validate and add new transactions to the blockchain. This distributed approach enhances security, as it becomes extremely difficult for any single entity to manipulate the data on the blockchain.

Another important aspect of blockchain technology is its transparency. Once a transaction is recorded on the blockchain, it becomes visible to all participants in the network. This transparency allows for greater accountability and trust, as every transaction can be traced and verified by anyone with access to the blockchain.

Blockchain technology also incorporates the use of cryptographic algorithms to ensure data security. Transactions on the blockchain are protected through encryption, making it extremely difficult for unauthorized parties to tamper with the data.

Overall, the basics of blockchain technology revolve around decentralization, transparency, security, and immutability. These characteristics make it a promising technology with various potential applications, ranging from financial services to supply chain management and beyond. Real World Assets and Tokenization

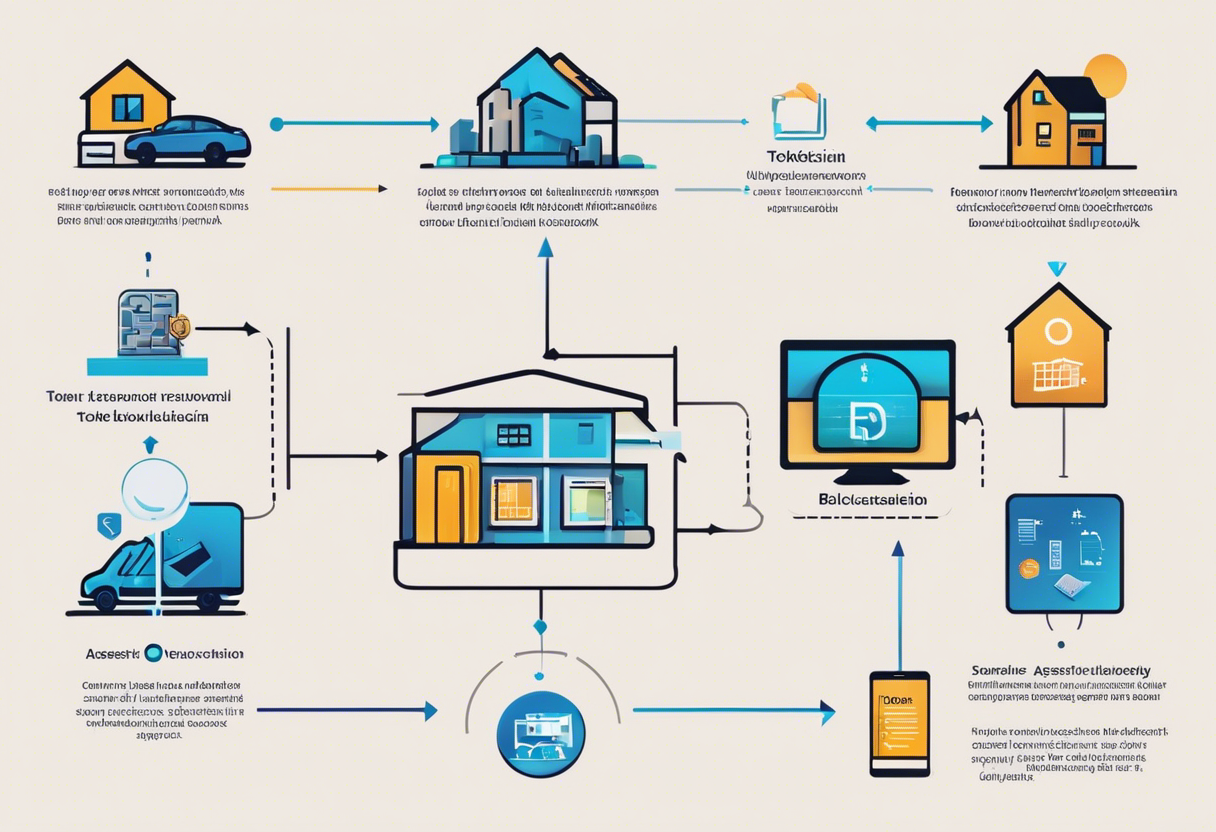

In the context of blockchain, tokenization refers to the process of representing real-world assets as digital tokens. Real-world assets can include a wide range of tangible and intangible assets such as real estate, artwork, commodities, or even intellectual property rights.

Tokenization of real-world assets offers several benefits. Firstly, it allows for the fractional ownership of assets, enabling individuals to invest in assets that may have been out of reach previously. Tokenization also allows for increased liquidity as these digital tokens can be easily traded on blockchain-based platforms.

Through tokenization, ownership and transfer of assets can be recorded on the blockchain, providing a transparent and immutable record of ownership. This creates trust and eliminates the need for intermediaries, reducing transaction costs and increasing efficiency.

Furthermore, by tokenizing real-world assets, the barriers to access and participation in traditionally exclusive markets can be lowered, democratizing the investment landscape. This has the potential to unlock new opportunities for investors and increase market liquidity.

In summary, the tokenization of real-world assets holds significant promise in revolutionizing traditional asset markets. Through increased liquidity, fractional ownership, transparency, and reduced transaction costs, tokenization offers a way to unlock the value of assets, altering the way we perceive and engage with the financial market.

Benefits of Tokenizing Real World Assets

Tokenizing real world assets has several benefits that have the potential to revolutionize traditional financial systems. Here are some key advantages of tokenization:

- Increased liquidity: Tokenization enables fractional ownership of assets, which allows for easier and more efficient trading. This increases liquidity by lowering barriers to entry and facilitating the buying and selling of assets, making it easier for investors to diversify their portfolio.

- 24/7 trading: By utilizing blockchain technology, tokenized real world assets can be traded 24/7, eliminating the need for traditional market hours. This enhances accessibility and provides investors with greater flexibility and opportunities for profit.

- Cost efficiency: Tokenization reduces costs associated with intermediaries, such as brokers and custodians, by automating the process of ownership transfer and eliminating the need for various middlemen. This results in lower transaction fees, making it more cost-effective for investors.

- Fractional ownership: Tokenization allows for the fractional division of assets, meaning that investors can purchase only a portion of an asset rather than the entire asset. This opens up investment opportunities to a wider range of individuals, including those with limited capital.

- Transparency and immutability: Blockchain technology provides transparency and immutability, ensuring that all transactions and ownership records are securely recorded in a decentralized ledger. This transparency reduces the risk of fraud and promotes trust among investors.

- Access to global markets: Tokenization has the potential to democratize access to global markets, allowing investors to participate in opportunities from anywhere in the world. This breaks down geographical barriers and creates a more inclusive financial ecosystem.

- Enhanced security: Blockchain-based tokenization provides enhanced security, as assets are stored on a decentralized network rather than a central server. This makes it difficult for hackers to manipulate or alter ownership records, ensuring the integrity of investments.

- Efficient settlement: Tokenization streamlines the settlement process by automating it through smart contracts. This reduces the time and paperwork required for traditional settlement processes, enabling faster and more efficient transactions.

Overall, tokenizing real world assets has the potential to unlock significant benefits for investors, including increased liquidity, cost efficiency, transparency, and access to global markets. As blockchain technology continues to evolve, tokenization is expected to disrupt traditional financial systems and reshape the way assets are bought, sold, and traded.

Challenges of Tokenizing Real World Assets

When it comes to tokenizing real-world assets using blockchain technology, there are several challenges that need to be considered. These challenges include:

- Legal and regulatory issues: One of the primary challenges is navigating the complex legal and regulatory landscape surrounding tokenization. Different jurisdictions have varying regulations regarding asset ownership, transferability, and compliance. Tokenizing real-world assets requires careful consideration of these regulations to ensure legal and regulatory compliance.

- Liquidity and market acceptance: Tokenized assets may face challenges when it comes to liquidity and market acceptance. The ability to quickly and easily trade tokenized assets is essential for their success. However, if there is limited demand or lack of trust in the market, liquidity can be a significant barrier. Building a robust and trusted marketplace for tokenized assets is crucial for their widespread adoption.

- Valuation and pricing: Assigning a value to tokenized assets can be challenging. Unlike traditional assets, tokenized assets do not have standardized pricing mechanisms. Determining the value of a tokenized asset requires developing reliable methods of valuation, taking into account factors such as underlying asset performance and market conditions.

- Digital security concerns: Tokenization involves converting physical assets into digital tokens. As a result, security becomes a critical concern. Safeguarding digital tokens from theft, hacking, and unauthorized access is crucial to maintain trust and protect investors' interests.

- Interoperability and standardization: Tokenization involves a decentralized system where multiple platforms and protocols may be in use. Ensuring interoperability and standardization across these platforms is essential to facilitate seamless asset transfer and increase market efficiency.

- Trust and transparency: Building trust and ensuring transparency is vital for the success of tokenized assets. Investors need to have confidence in the authenticity and ownership of the tokenized assets. Establishing mechanisms to verify the authenticity of assets and ensuring transparent record-keeping are key challenges.

Overall, while tokenizing real-world assets offers numerous benefits, overcoming these challenges is crucial for widespread adoption. Addressing these challenges will require collaboration between regulators, technology providers, market participants, and legal experts to create a robust ecosystem for tokenization.

Legal and Regulatory Considerations

When considering the tokenization of real-world assets using blockchain technology, there are important legal and regulatory considerations that need to be taken into account. These considerations are crucial for ensuring compliance with existing laws and regulations and addressing potential risks and challenges.

- Securities Laws: Tokenizing assets may trigger securities regulations, as tokens could be classified as securities depending on their characteristics and the jurisdiction in which they are issued. It is crucial to consult with legal experts to determine whether the tokens being created are considered securities and comply with applicable securities laws and regulations.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): To prevent money laundering and ensure regulatory compliance, tokenization platforms need to implement robust AML and KYC procedures. This includes verifying the identity of token holders, monitoring transactions for suspicious activities, and reporting any suspicious transactions to the relevant authorities.

- Data Protection and Privacy: Tokenization involves the storage and transfer of personal data, such as user identities and transaction details. Compliance with data protection and privacy laws, such as the General Data Protection Regulation (GDPR), is crucial to protect individuals' rights and ensure the lawful handling of personal information.

- Consumer Protection: Tokenization platforms should prioritize consumer protection by providing clear and accurate information about the tokens being offered, risks associated with investments, and any potential conflicts of interest. Additionally, mechanisms for resolving disputes and addressing investor complaints should be in place.

- Smart Contract Audits: Smart contracts, which automate the execution of transactions on the blockchain, should be thoroughly audited to identify and address any potential vulnerabilities or coding errors. This ensures the integrity and security of the tokenization process and minimizes the risk of fraudulent activities.

- Jurisdictional Considerations: Blockchain operates across borders, and the legal and regulatory frameworks can vary significantly from one jurisdiction to another. Companies involved in tokenization projects must carefully assess the legal implications in each relevant jurisdiction to ensure compliance with local laws and regulations.

- Ownership and Transfer: Tokenization introduces new challenges regarding ownership and transfer of assets. Clear legal frameworks should be established to define ownership rights, transferability of tokens, and the handling of disputes related to ownership claims.

- Tax Considerations: Tokenization of assets may have tax implications, such as capital gains tax, depending on the jurisdiction. It is important to consult with tax professionals to understand the tax obligations associated with tokenizing assets and ensure compliance with tax regulations.

By considering these legal and regulatory aspects, businesses and organizations can navigate the complexities of tokenizing real-world assets and ensure compliance with applicable laws. The expertise of legal professionals and regulatory bodies is indispensable in addressing these considerations and guiding the development of a secure and legally compliant tokenization ecosystem.

Use Cases of Tokenization

Tokenization has the potential to revolutionize various industries by enabling the digitization and transferability of real-world assets. Here are some prominent use cases of tokenization:

- Real Estate: Tokenization can allow investors to buy and sell fractional ownership of real estate properties, reducing barriers to entry and providing liquidity in the real estate market.

- Art and Collectibles: Tokenizing artwork and collectibles can enable the fractional ownership and trading of these assets, increasing accessibility and introducing new investment opportunities.

- Supply Chain: Tokenizing supply chain assets, such as inventory, enables real-time tracking and can enhance transparency and efficiency by reducing fraud, counterfeiting, and improving inventory management.

- Equity and Investments: Tokenization allows for the fractional ownership and trading of stocks, bonds, and other investment instruments, opening up new opportunities for investors and reducing the need for intermediaries.

- Intellectual Property: Tokenizing intellectual property rights, such as patents and copyrights, can facilitate licensing, royalties, and streamline the process of intellectual property management.

- Luxury Goods: Tokenizing luxury goods like jewelry, watches, or high-end fashion items can establish provenance, authenticity, and traceability, reducing the risks of counterfeit products in the market.

- Commodities: Tokenization can enable the fractional ownership and trading of commodities such as gold, oil, or agricultural products, allowing investors to diversify their portfolios and access previously inaccessible markets.

- Voting and Governance: Tokenization can be implemented in voting systems, enabling secure and transparent voting procedures, enhancing the efficiency and integrity of elections or corporate governance processes.

These use cases illustrate the transformative potential of tokenization across various industries, creating new opportunities for investors, enhancing asset liquidity, improving supply chain processes, and increasing transparency and trust in asset ownership.

The Future of Tokenizing Real World Assets

Tokenization of real-world assets has emerged as a promising trend in the blockchain industry. As technology continues to evolve, the future of tokenizing real world assets is expected to bring about major advancements and disruptions.

- Increased accessibility: Tokenization allows for the fractionalization of assets, enabling individuals to invest in high-value assets that were previously out of reach. This opens up opportunities for a wider range of investors, unlocking liquidity and democratizing the investment landscape.

- Enhanced liquidity: Tokenization digitizes assets, making them more readily tradable and liquid. This can eliminate the need for intermediaries and reduce transaction costs, increasing market efficiency. Real estate, artworks, and even intellectual property can be bought, sold, and traded more efficiently through tokenization.

- Improved transparency and trust: Blockchain technology provides a decentralized and immutable record of transactions, ensuring transparency and eliminating potential fraud. By tokenizing real-world assets, ownership can be easily verified, increasing trust among participants in the market.

- Integration with traditional financial systems: As tokenization gains momentum, we can expect increased integration of blockchain technology with traditional financial systems. This convergence could lead to the creation of new financial instruments, such as asset-backed tokens, that combine the benefits of blockchain technology with familiar investment structures.

- Regulatory framework development: As tokenization expands, regulators worldwide are gradually developing frameworks to govern these new asset classes. This regulatory clarity will provide a solid foundation for tokenization to thrive, attracting institutional investors and fostering widespread adoption.

In conclusion, the future of tokenizing real world assets holds immense potential. As technology advances and regulatory frameworks are established, we can expect increased accessibility, enhanced liquidity, improved transparency, and integration with traditional financial systems. The tokenization of real-world assets is set to redefine the way we invest, trade, and manage assets, ushering in a new era of financial innovation.

Case Studies

Real Estate: Tokenization has become increasingly popular in the real estate industry. For instance, projects in the United States have utilized blockchain technology to enable fractional ownership of properties. This allows investors to own a percentage of a property without the need for large investments. Tokenization ensures the liquidity of real estate assets, enabling seamless transactions and reducing the time and cost associated with traditional property transfers.

- Art and Collectibles: Blockchain has made it possible to tokenize artwork and collectibles, providing provenance and authenticity verification. Art platforms have started using non-fungible tokens (NFTs) to represent unique pieces of art. Ownership of these NFTs can be transferred easily, allowing for a more efficient art market and increased transparency in transactions.

- Supply Chain Management: Blockchain technology offers various benefits for supply chain management. Through tokenization, companies can track and trace the movement of goods across the supply chain, ensuring transparency, accountability, and authenticity. This is particularly useful in industries such as food and pharmaceuticals, where product safety and authenticity are critical.

- Fundraising: Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) have emerged as popular methods for fundraising. By tokenizing assets, companies can offer tokens to investors, representing a share in the company’s assets or future revenue. This allows for a more accessible and efficient fundraising process, enabling global participation and liquidity.

- Commodities: Tokenization has the potential to revolutionize the commodities market by enabling fractional ownership and reducing barriers to entry. Companies are exploring the concept of tokenizing precious metals, oil, and agricultural commodities, providing investors with a more accessible and liquid market for commodity trading.

## Conclusion

In conclusion, the tokenization of real-world assets through blockchain technology has the potential to revolutionize the way we transact and manage assets. By digitizing assets and representing them as tokens on a blockchain, we can enhance liquidity, increase transparency, and reduce friction in asset transactions.

Tokenization allows for fractional ownership, enabling individuals to own a portion of an asset that would otherwise be inaccessible. It also opens up opportunities for new types of investments and financial instruments, creating a more inclusive and efficient financial system.

However, there are also challenges and considerations that need to be addressed. These include regulatory frameworks, investor protection, and ensuring the security and integrity of the blockchain infrastructure. Additionally, the adoption of tokenization will require collaboration between traditional financial institutions and blockchain platforms.

Despite these challenges, the potential benefits of tokenizing real-world assets are significant. It has the potential to unlock trillions of dollars in value and democratize access to investments previously limited to a select few. As the technology continues to mature and regulatory frameworks evolve, we can expect to see increased adoption of asset tokenization and the realization of its transformative potential.

![[LIVE] Engage2Earn: Shayne Neumann MP Blair boost](https://cdn.bulbapp.io/frontend/images/d0ae7174-2ceb-4eed-9844-e1c262a4013e/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)