Deep Review on Carv Protocol

Introduction

CARV Protocol is a decentralized finance (DeFi) project that aims to provide a secure and trustless platform for users to trade and swap digital assets. It operates on the Ethereum blockchain and utilizes smart contracts to automate transactions without the need for intermediaries.

Features

- Decentralized Exchange (DEX): CARV Protocol offers a DEX where users can trade various cryptocurrencies and tokens securely.

- Liquidity Pools: Users can provide liquidity to the platform by depositing their assets into liquidity pools and earn rewards in return.

- Yield Farming: CARV Protocol allows users to stake their tokens and earn additional rewards through yield farming.

- Governance: Token holders can participate in the governance of the protocol by voting on proposals and changes to the platform.

Security

CARV Protocol prioritizes security and employs best practices to ensure the safety of users' funds. The use of smart contracts adds an extra layer of security by automating transactions and reducing the risk of human error.

User Experience

The platform is designed to be user-friendly, with a simple interface that allows for easy navigation and trading. Users can access the platform from their web browser or through compatible wallets.

Tokenomics

CARV Protocol has its native token, which plays a crucial role in the ecosystem. Token holders can use the token for trading, staking, governance, and earning rewards through various activities on the platform.

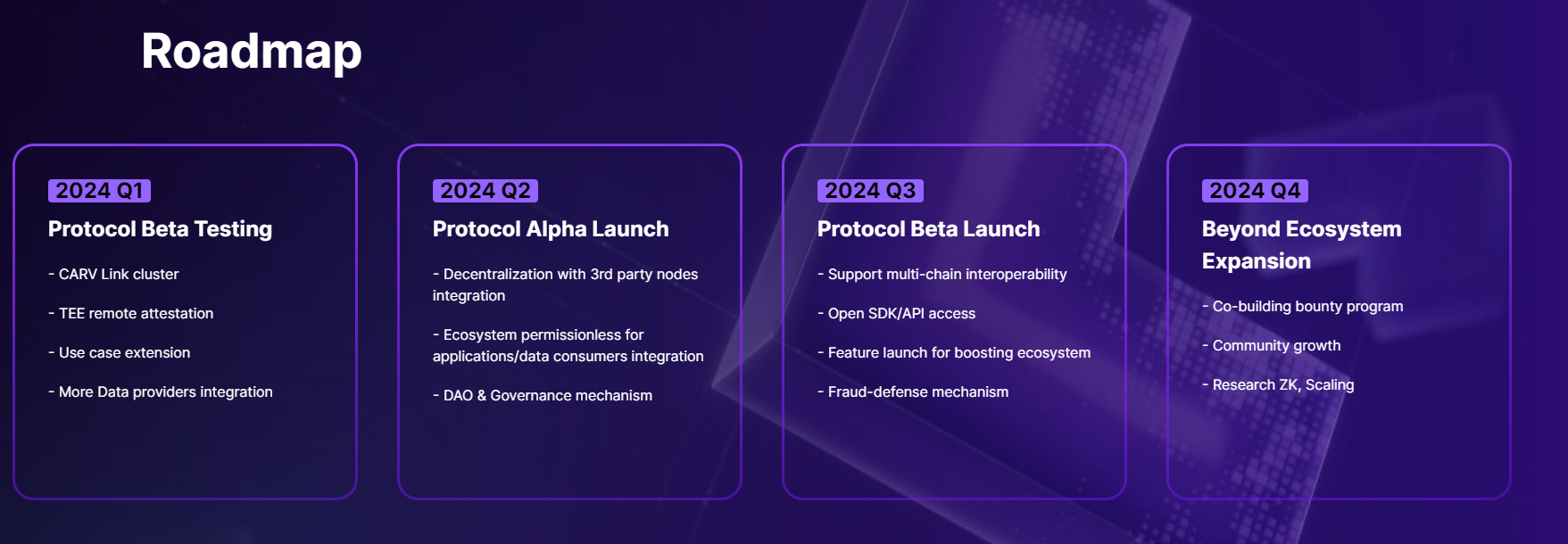

Roadmap

The project's roadmap includes plans for further development, such as expanding the range of supported assets, improving liquidity, enhancing security measures, and introducing new features to enhance the overall user experience.

Benefits of CARV Protocol

- Decentralization: CARV Protocol operates on a decentralized platform, providing users with autonomy over their assets without the need for intermediaries.

- Security: The protocol prioritizes security measures to safeguard users' funds and data against potential threats.

- Liquidity: By supporting a range of assets, CARV Protocol enhances liquidity, making it easier for users to trade and swap tokens.

- User Experience: The platform is designed with user experience in mind, offering a seamless interface for efficient navigation and interaction.

- Community Governance: CARV Protocol allows its community to participate in governance decisions, fostering a sense of ownership and involvement among users.

- Staking Rewards: Users have the opportunity to stake their assets on the platform and earn rewards, providing an additional incentive for engagement.

- Innovative Features: The protocol continues to introduce new features and functionalities to improve the overall user experience and expand its offerings.

Limitations of CARV Protocol

- Smart Contract Risks: As with any decentralized platform, CARV Protocol is susceptible to smart contract vulnerabilities that could potentially lead to financial losses.

- Market Volatility: The value of assets on the platform can be influenced by market volatility, posing risks for users engaging in trading or staking activities.

- Regulatory Uncertainty: The regulatory landscape surrounding decentralized finance is still evolving, and changes in regulations could impact the operation of CARV Protocol.

- Liquidity Constraints: Despite efforts to enhance liquidity, there may be instances where users face challenges in executing trades or swaps due to limited liquidity pools.

- Scalability Issues: With the growing popularity of decentralized finance, scalability could become a concern for CARV Protocol, potentially affecting transaction speeds and costs.

- User Error: Users must be cautious when interacting with the platform to avoid mistakes such as sending assets to the wrong address, which could result in irreversible losses.

- Dependency on Oracles: CARV Protocol may rely on external data sources through oracles, introducing potential risks of data manipulation or inaccuracies.

Partners of CARV Protocol

- Chainlink: CARV Protocol has partnered with Chainlink to leverage their decentralized oracle network for secure and reliable data feeds to support various functionalities within the protocol.

- Uniswap: Collaboration with Uniswap provides users with access to liquidity pools for seamless token swaps and trading activities on the CARV Protocol platform.

- Balancer: By partnering with Balancer, CARV Protocol enhances liquidity management and automated portfolio rebalancing for users engaging in decentralized finance activities.

- Yearn Finance: The partnership with Yearn Finance enables CARV Protocol users to access yield farming strategies and optimize their returns on assets deposited within the platform.

- Aave: Integration with Aave allows users to participate in lending and borrowing activities, utilizing their assets as collateral to earn interest or borrow additional funds on the CARV Protocol platform.

- Synthetix: Collaboration with Synthetix offers users the ability to mint and trade synthetic assets representing real-world assets, expanding the range of financial products available on the CARV Protocol platform.

Future Integrations for CARV Protocol

- Compound: Integrating with Compound will enable users to earn interest on their deposited assets and borrow additional funds based on their collateral within the CARV Protocol platform.

- MakerDAO: Partnership with MakerDAO will provide users with access to decentralized stablecoins and the ability to generate DAI through collateralized debt positions, enhancing the stablecoin offerings on the CARV Protocol platform.

- Curve Finance: Integration with Curve Finance will enhance the efficiency of stablecoin trading and provide users with low-slippage swaps for assets pegged to the same value within the CARV Protocol platform.

- SushiSwap: Collaborating with SushiSwap will offer users access to a decentralized exchange platform with enhanced features like yield farming and staking opportunities on the CARV Protocol platform.

- Synthetix: Further deepening the partnership with Synthetix can bring more synthetic assets and trading options to users, expanding the range of financial products available on the CARV Protocol platform.

- Yearn Finance: Continued collaboration with Yearn Finance can introduce more yield farming strategies and optimization tools for users to maximize their returns on assets within the CARV Protocol platform.

Conclusion

CARV Protocol offers a decentralized and secure platform for users to trade, stake, and earn rewards in the DeFi space. With a focus on security, user experience, and community governance, the project aims to provide a reliable and transparent environment for cryptocurrency enthusiasts.

Benefits make CARV Protocol an attractive option for users looking to engage with decentralized finance in a secure and user-friendly manner.

Understanding the limitations can help users make informed decisions when utilizing CARV Protocol and mitigate associated risks.

Meanwhile, partnerships contribute to the growth and functionality of CARV Protocol, offering users a diverse range of decentralized finance services and opportunities.

Finally, future integrations aim to broaden the range of decentralized finance services available on CARV Protocol, offering users more opportunities to engage in various financial activities and optimize their assets.

For more information, you can visit the https://protocol.carv.io/airdrop?invite_code=JJCQF3 or join their community on social media platforms.

Disclaimer: This review is for informational purposes only and should not be considered as financial advice. Users are encouraged to do their own research before engaging with any DeFi project.

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)